Energy utilities across the United States are challenged with reducing wildfire risk and increasing their reliability as part of their on-going operations. As droughts and energy demands increase due to climate change, we are seeing that wildfires are not just a “California issue” anymore. Yet, simply knowing the probability of a wildfire does not explain what the possible consequences are – including the possible liability – from an asset-caused ignition. Risk managers at energy utilities have a need for sophisticated risk modeling that can help them quantify both the probability and consequence of utility caused ignitions from their assets. To face this future effectively, energy utilities need to combine both ignition probabilities and consequences, to model their expected risk which can guide asset hardening decisions, and most importantly, identify which asset to prioritize first.

So, how can understanding ignition consequence help? We know that all utility assets in the field have a different probability of failure and ignition due to their varying condition, health, composition (age, type, design, etc.), and environment (fuels, surrounding vegetation, slope, weather, etc.). Energy utilities need to understand the historical probability of a wildfire ignition occurring at any asset point and what the impact of that possible fire would be. This ability is valuable because it enables an in-depth historical risk assessment which provides decision making insight into which mitigation or asset replacement effort they should choose when developing wildfire mitigation plans.

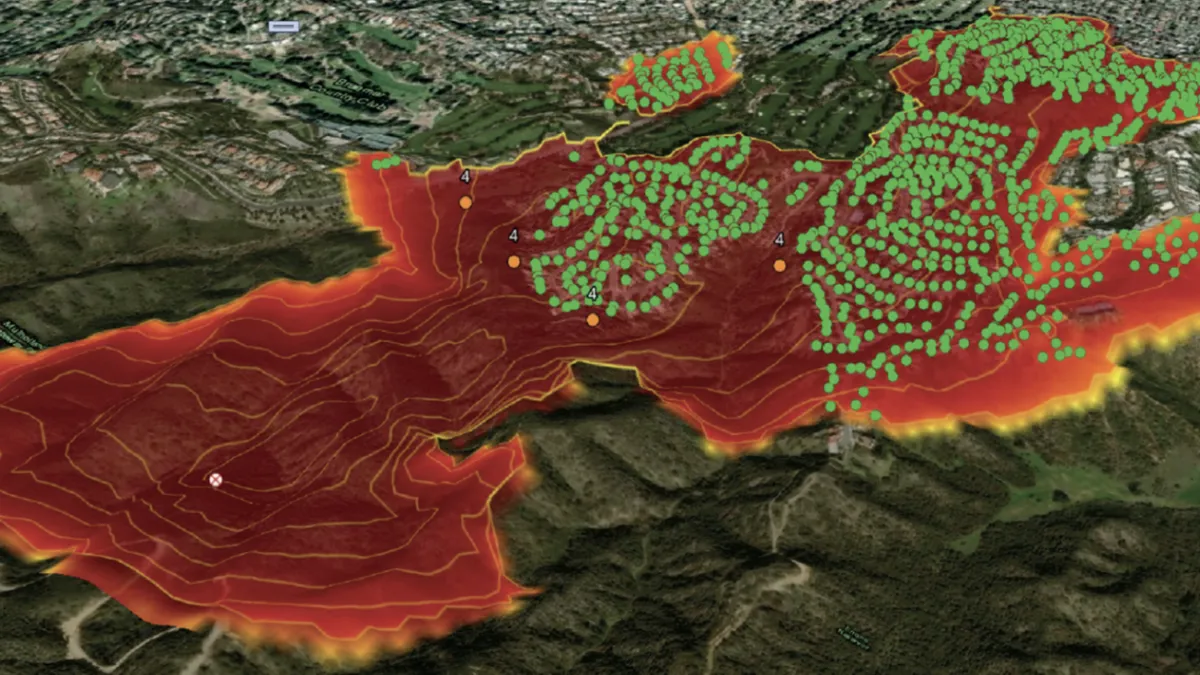

Adding to this data is a desire to integrate advanced fire spread prediction modeling with forecasted weather to determine where fires will spread from asset ignition sources. Most importantly, these spread models quantify the impacts associated with those ignitions. How do you know which ignitions have the most risk though? Typically, a lot of energy company risk managers focus ignition modeling and mitigating those ignitions, but it’s important to differentiate that ignition is not risk. Risk is the possibility of damage, loss, and/or harm occurring from an ignition. Understanding which potential fires would be most destructive is critical.

Understanding the consequence of ignition allows electric utilities to see why one possible wildfire would be a lot worse than another. Not all ignitions are created equal. Not all fires are created equal. So, it's the foundational piece to model and then know what assets are of most concern. To know what de-energization and PSPS decision making may be needed on the most riskiest assets. To see what the impact is going to be across people, potential fatalities, and buildings lost.

But, how do you know which asset to harden first? Risk managers need a longer-term view, leveraging weather and landscape data over 10+ years, so they can identify which assets are consistently the highest liability for consequences from an ignition and then prioritize them for hardening. Risk managers need to know which assets pose catastrophic risks if they fail. With such data, they can qualify the risk and define the most effective mitigation work under limited resources. Effectively, any asset hardening decision will have a quantifiable risk reduction and when the risk reduction is divided by the cost of the mitigation, we arrive at the risk spend efficiency (RSE). The RSE is extremely useful in developing an asset hardening strategy that reduces the overall risk most effectively per dollar invested.

While it is true that California Public Utility Commission regulations are currently driving this need in that state, they are not the only reason to engage in such work. Understanding the importance of asset hardening due to increasing wildfire risk builds in service efficiency and liability from damage Wildfire related regulation is on the move. But wildfire related regulations are also on the move. They are also increasing in complexity for compliance on the operational side for de-energization with Public Safety Power Shutdowns (PSPS) and on the mitigation side with required Wildfire Mitigation Plans.

As wildfires increase in severity and scope, electric utilities need to be able to quantify their risk across their assets both historically and in real time. They need to be able to operationalize this data to make better informed de-energization decisions and to inform asset hardening expenditures through RSE analysis. Learn more about the modeling science behind this work and how that science is put into practice.