Utilities are on a mission to decarbonize their operations, and utility leaders know they can’t go it alone. SMUD’s Paul Lau said it well: “If we don’t bring our customers along as we pursue our zero carbon goals, we will all fail. Our customers are incredibly important partners on this journey.” To meet their net zero goals, utilities need to influence customer action at incredible scale.

In fact, a recent Brattle Group study found that by 2040, utility customer action can reduce nearly 2X more greenhouse gas emissions than clean energy supply alone. Brattle also found that right now, in this decade, energy efficiency programs provide the vast majority of that emissions reduction potential. So how should utilities invest in energy efficiency? According to a report from The Analysis Group, behavioral energy efficiency programs deliver emissions reductions 5X faster, at a fourth of the cost, and 10X more equitably than any other type of efficiency program. The research is clear: behavioral energy efficiency programs are vital to fast, affordable, equitable utility decarbonization.

The critical question now is implementation. How can utilities set these programs up to deliver the results the industry so urgently needs? ILLUME Advising, an independent program evaluation and research firm, recently looked under the hood of these programs. They examined the current state of behavioral energy efficiency and the factors impacting program effectiveness.

Behavioral programs deconstructed

ILLUME conducted a meta-analysis (study of studies) of behavioral program performance across the U.S. based on publicly available data over the past five years. Their analysis included rigorous screening of data from 111 behavioral program evaluations and reports. The report itself explores how factors such as program duration, communication channel, and vendor impact program performance. The research was peer-reviewed and presented at ACEEE Summer Study this year. Their work shows enduring results from behavioral programs and stark differences in performance among vendors. ILLUME’s findings include:

Behavioral programs generate strong savings that grow over time

The report states “HER programs continue to generate strong electric savings, and these savings increase the longer customers are exposed to the reports.” In ILLUME’s analysis, cohorts treated for 2-5 years showed an average electric savings rate nearly two times higher than cohorts treated for one year. Looking across program durations, behavioral programs saved on average 88 kWh of electricity use and 4.4 Therms of gas annually per household.

Those numbers may look small, but across millions of people, they add up to massive impact. To date, Opower behavioral programs have reduced utility emissions by 16.2 million metric tons. ILLUME’s analysis adds important detail to the body of research showing behavioral programs are foundational components of utility efficiency portfolios and net zero plans.

Opower is the only vendor identified that consistently met and exceeded program savings targets

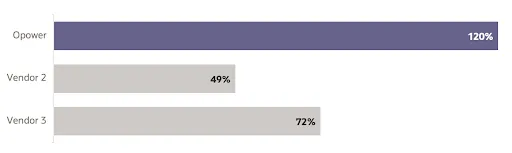

Opower is Vendor 1 in ILLUME’s report, which shows Opower delivered on average 120% of electric savings targets in the past five years. No other vendor in the study met program targets on average. The next two vendors with the most studies included in the report delivered on average only 72% and 49% of their electric targets.

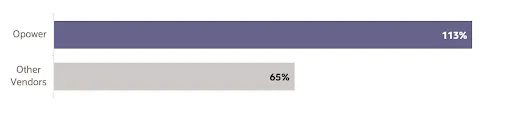

The report also shows Opower was the only vendor that has consistently met gas program targets. Opower delivered on average 113% of gas savings targets, and the average across all other vendors was 65%.

The report states “Savings can vary by vendor for a variety of reasons, including the types of components included in the reports, the content and visual characteristics of those components, the quality of the data and the algorithms used to make comparisons, and the energy saving behaviors recommended to customers.” The report then states one simple point from a subset of studies: “A weighted average of unadjusted electric savings by vendor shows higher average savings for Opower cohorts (1.18%) than other vendors (0.84%).” That is a 40% higher average savings rate from Opower.

Taken together, these are stark differences in performance among behavioral program vendors. We believe ILLUME’s research shows that implementing an effective behavioral program starts with selecting a qualified vendor based on independently-verified, publicly available program performance. The stakes of getting it right are high: ineffective and failed behavioral programs can result in thousands of metric tons of emissions we will never again get the chance to keep out of the atmosphere.

Email-only programs may miss opportunities for cost-effective savings and emissions reduction

Among the programs ILLUME studied, relatively few offered email-only reports. Customers in email-only HER programs saved less energy than customers in multichannel behavioral programs. Multichannel electric programs delivered two times more savings per household than email-only electric programs. Multichannel gas programs delivered 50% more Therm savings per household than email-only gas programs. The limited data suggest we have more to learn about email-only programs.

Behavioral program vendors, administrators, and evaluators have long sought to maximize the cost-effectiveness of these programs, including reducing the use of paper. For example, Opower created the paper HER years ago, and in the past year nearly two-thirds of all Opower HERs delivered were digital. Today, behavioral programs are among the most cost-effective, scalable resources in utility efficiency portfolios. We think the research shows multichannel programs deliver what the industry needs most right now: as much cost-effective energy savings and emissions reduction we can get, as fast as we can get it.

Looking forward

Thanks to ILLUME’s research, utility leaders and efficiency practitioners can make better decisions about their portfolios and programs: we now know behavioral programs are vital, increasingly valuable resources. Assessing any potential vendor’s public track record is critical. Multichannel behavioral programs deliver significantly more value than email-only programs. ILLUME’s research also provided valuable insights for the independent firms who evaluate, measure, and verify the results of these programs: with a few tweaks, greater standardization in program evaluations can make a big impact on the industry’s understanding of behavioral programs.

That understanding will be critical in the years ahead, because behavioral programs are in the throes of a rapid evolution. Utilities of all kinds are leveraging behavioral programs to deliver much more than energy savings. National Grid recently used its Opower behavioral program to nearly triple its pace of weatherization projects and reduce peak EV charging by nearly 10%. SMECO leveraged its Opower program to get 5X faster adoption of their in-home energy improvement program. Exelon tailored its program to help LMI customers reduce their energy burden.

Utilities need these programs to be more in the years ahead in order to deliver on their net zero plans quickly, affordably, and equitably. As the Inflation Reduction Act moves into implementation, the federal government will also need utilities and behavioral programs to play a critical role in influencing millions of people to act on opportunities to collectively save billions on upgrades to their homes and buildings.

Researchers from ILLUME and The Brattle Group (Sergici et al. 2021) agree: “While supply-side clean energy policies can take years or decades to realize GHG reductions, demand-side program offerings like HERs can be deployed rapidly to achieve decarbonization gains more quickly. Securing cost-effective energy savings and GHG reductions remains a critical challenge.” Opower is ready for that challenge.