Dive Brief:

- Xcel Energy on July 14 filed an alternative to its proposed utility-owned electric vehicle charging network in Colorado, citing market “uncertainty and volatility” regarding which fast charger connector type will eventually become standard.

- The utility’s Colorado 2024-2026 Transportation Electrification Plan, filed in May, proposed 460 direct current fast charger, or DCFC, stations that would be owned and operated by Xcel. The substitute plan would result in the same number of stations at roughly the same $137 million cost, officials said — but with rebates helping non-regulated third parties to install and own the charging equipment.

- A coalition of retailers and other businesses opposes Xcel’s initial plan, arguing that utility ownership of stations will discourage competition in the EV charging sector. The utility says its updated proposal is unrelated to the criticism.

Dive Insight:

Utility ownership of EV charging stations has become a controversial issue, but Xcel says that is not what led to its alternative proposal.

“The public charging market is undergoing rapid changes in real time, and the company believes the market is likely to look materially different in terms of market participants, technologies and equipment configurations, and availability a year from now and beyond,” Deborah Erwin, Xcel’s director of policy and program planning for clean transportation, said in filed testimony describing the utility’s alternative plan.

Erwin’s testimony points to Ford Motor Co.’s May 25 announcement that the manufacturer will adopt Tesla’s North American Charging Standard, or NACS, connector for its vehicles, and General Motor’s June decision to follow suit. Previously, it had appeared the non-proprietary Combined Charging System connector, or CCS, would become the more widely-used standard.

Xcel filed its initial transportation electrification plan with Colorado regulators on May 15.

“It is now uncertain whether charging providers and auto manufacturers will ultimately converge on using the CCS or the NACS charging connector design in the United States, and when NACS will receive certification from an international standards body,” Erwin said.

Despite the alternative proposal, Xcel says it still favors a utility-owned charging network.

“We are committed to supporting public fast charging for electric vehicles in Colorado,” Xcel spokesperson Michelle Aguayo said in an email. “We still support our original proposal but believe stakeholders and the [Public Utilities Commission] will be interested in weighing both options.”

“This alternative was not in response to entities that oppose utility ownership of public charging,” Aguayo said.

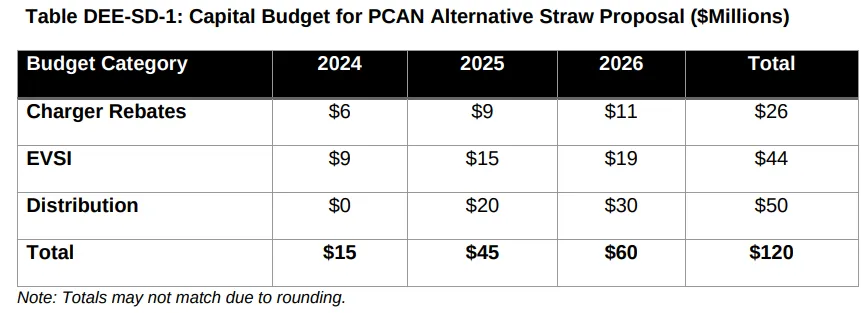

Xcel estimated capital costs of its alternative proposal at $120 million over three years, with another $17 million in operating and maintenance costs over the same period.

Under the alternative plan, Xcel would provide rebates to non-regulated entities “in conjunction with utility investment in [EV supply infrastructure] to lower the cost of DCFC public charging stations, and ... strategic distribution investments to support non-regulated public fast charging investment in a streamlined and efficient manner.”

However, Xcel told regulators it is still working out details around charger rebates.

“Given the rapid state of change in the public fast charging market, the company is still considering definitive proposed rebate amounts, eligibility requirements, and rebate processing plans,” Erwin said.

Xcel’s alternative plan for third-party ownership of charging stations is “mutually exclusive” from its initial proposal to own and operate the network. “The company is not proposing to pursue a combination of these two proposals,” Erwin said.

Opponents of utility-owned charging stations say the Xcel is feeling pressure to address concerns around competition.

“They have gotten massive pushback on their proposals,” said Ryan McKinnon, a spokesperson for the Charge Ahead Partnership which represents businesses that want to expand into the electric vehicle charging space, including convenience stores and gas stations.

Xcel has also faced difficulties in Minnesota, where it filed a similar plan to own DCFC stations. The utility has asked Minnesota regulators to withdraw its plan for more than 700 utility-owned chargers after its rate request was cut in June.