To keep electricity flowing at affordable prices, South Carolina faces difficult choices about its debt-burdened electric utilities.

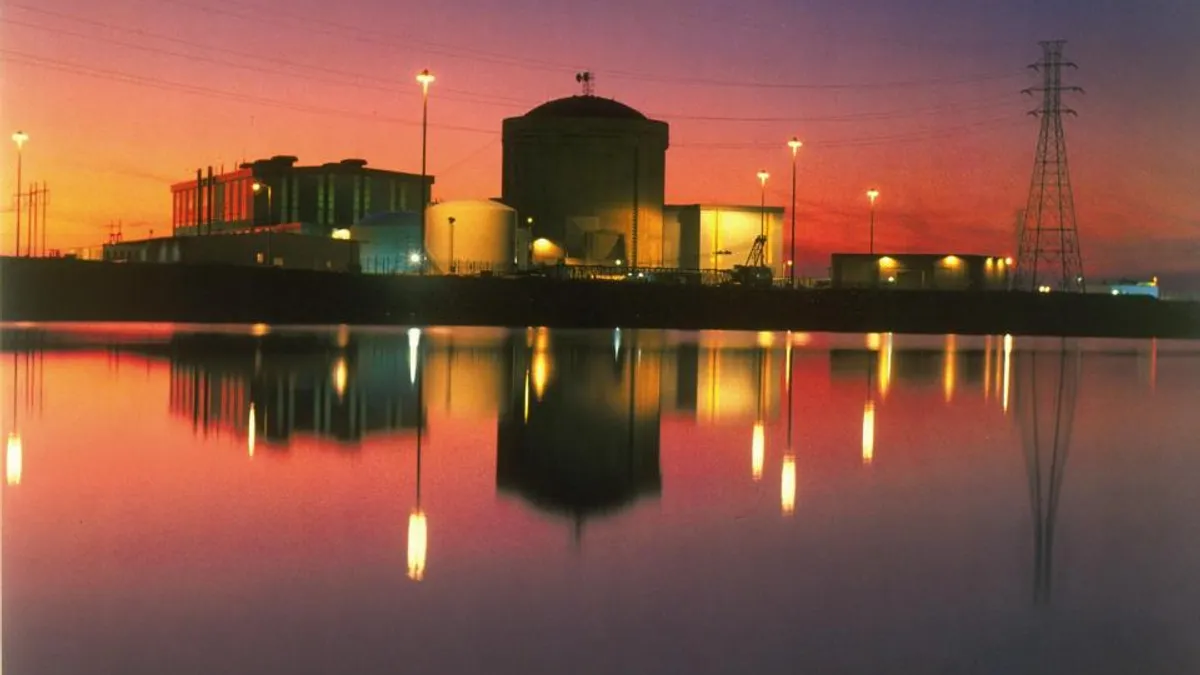

Public power utility Santee Cooper and South Carolina Electric and Gas (SCE&G), the state’s dominant investor-owned electric utility (IOU), have a combined obligation of more than $13 billion. It was incurred when the expected $9.8 billion cost to jointly finance two new units at the V.C. Summer nuclear facility ballooned to more than $20 billion and the project had to be abandoned.

There are five choices for Santee and six for SCE&G, according to new papers. Among the choices, both utilities could attempt to meet their debt by economizing, but the debt is too large for that approach to be effective. They could pass the obligation to customers or taxpayers, but many of the lawmakers responsible for the ultimate decision on the utilities' fates have declared it unacceptable to shift the financial burden to those who did not create it.

A new Palmetto Promise Institute paper says the responsibility should fall on the utilities and investors in the uncompleted nuclear facility.

SCE&G, as an IOU, could aid itself and its customers by cutting dividends to shareholders, according to a study done for the state senate by Bates White, a financial consulting firm. Both utilities could sell out if they can find buyers; Dominion Energy has made an offer for SCANA. but completion of the deal is far from certain. Or both could default on the debt, shifting the burden to bondholders and driving the question to bankruptcy courts.

The dilemma is complicated by the fact that the utilities’ decision to expand the nuclear facility was made in good faith during the “nuclear renaissance” of the early 2000s. Many in South Carolina (SC) believed it was the right decision. But it was a wrong decision and now somebody must take “a haircut" — a financial world euphemism for a loss.

Complicating the matter, the Central Electric Power Cooperative has filed a legal action against Santee. It is intended to legally validate Central’s contractual right to walk away from its obligation to buy 60% of Santee’s generation, should the final decision impose the haircut on customers. That could ruin Santee financially.

The more legislators discuss options for the utilities, the more unlikely a viable way forward that avoids bankruptcy or sale of the utilities seems.

The right decision at the time?

Around 2005, demand for electricity was rising, the price of natural gas hit $16/MMBTU, renewables had barely entered power markets, and there was talk of a “nuclear renaissance.”

Clemson University Economics Professor Emeritus Mike Maloney, a co-author of the Palmetto paper, saw the opportunity in nuclear power then but warned against it. “Nuclear power is very risky because a delay in construction of a few years can double the cost of the plant’s generation,” he told Utility Dive.

“Most people in the nuclear renaissance thought the regulatory hurdles created by the 1970s anti-nuclear movement would not be a problem, Maloney said. “They were. And the plants were delayed.”

Santee Cooper spokesperson Mollie Gore said the decision to build the nuclear units was reasonable at the time. “We had co-owned the first V.C. Summer unit with SCE&G since 1984,” she told Utility Dive. “It had been a reliable, low cost part of our generation.”

Spokesperson Rhonda O’Banion of SCE&G parent SCANA Corp declined Utility Dive’s request for an interview.

New federal regulations for fossil fuel pollutants and transport sector greenhouse gas emissions were imposed in 2007-08, as the utilities' commitments to the nuclear project were being finalized, Gore added. “That is another important reason why nuclear power seemed like the best decision for our customers.”

In 2006, the SC General Assembly passed a resolution endorsing new nuclear development for the state. The next year it passed the Base Load Review Act, which allowed utilities to include in rates the costs of in-construction nuclear plants and allowed cost recovery through rates for uncompleted projects.

The first addition to rates for the project was in 2008. In 2009, construction was scheduled to begin in 2012, the first reactor was scheduled to go online in 2016, and generation from the second reactor was expected by 2019.

The first delay was announced at the end of 2011. A further one-year delay was announced in mid-2013. Late in 2014, a $1.2 billion cost increase was announced. Toshiba/Westinghouse stepped in as contractor in late 2015 and agreed to pay all additional costs above $7.7 billion. At the same time, a third one-year delay was announced.

In early 2016, an independent assessment reported failures by Toshiba/Westinghouse and inadequate oversight by the utilities. Late that year, an $831 million cost increase was added, but further costs became the responsibility of Toshiba/Westinghouse.

In March 2017, Westinghouse filed for bankruptcy. The utilities agreed to continue construction but reassess. In July 2017, the utilities abandoned the project.

In September 2017, the state Attorney General issued an opinion that the Base Load Review Act is “constitutionally suspect.” The AG also indicated lawmakers could prevent further cost recovery by the utilities and require refunds. Serious debate by regulators and lawmakers about the fate of the utilities began then and is ongoing.

"They had to know better"

Santee customers have paid $540 million in rate increases, according to the Palmetto paper. But the utility remains financially sound, retains an A+ credit rating and will not raise rates through 2020, according to Gore.

Mark Cooper, Senior Research Fellow at Vermont Law School’s Institute for Energy and the Environment, an authority on the economics of nuclear power, was an expert witness in several SC regulatory proceedings on the Summer project.

“By 2012, they had to know better,” he told Utility Dive. “In September 2012 testimony, I told them the good business decision was to abandon the project. The loss would have been $1.4 billion, but not $10 billion.”

Proposed utility-led nuclear projects in Florida and North Carolina were abandoned or cancelled at the time, he added. “The new nuclear at Summer was 100% excess capacity for those utilities and there were cheaper alternatives.”

According to Cooper’s 2017 summary of events, “prudent management would have recognized that the project was doomed by mid-2016 and pulled the plug.”

Gore acknowledged that “there were issues,” but insisted the utilities addressed them through the fixed cost increase agreement with Toshiba/Westinghouse. “That shifted the risk to Westinghouse. But it declared bankruptcy.”

Gore said the utilities’ detailed analysis at that point, using “inputs we did not have access to before,” showed a Santee rate increase of 41% would be needed to complete the project. “That is when construction was suspended,” Gore said.

“It was a completely different world back in 2007,” Gore concluded. “And the thing we couldn't fix was Westinghouse's bankruptcy.”

Southern Environmental Law Center Attorney Blan Holman said the argument that the Westinghouse bankruptcy was unforeseeable will be litigated as lawmakers and the courts review this history.

Santee and the co-ops

Electric Cooperatives of South Carolina (ECSC) represents the Central Electric Power Cooperative (Central), which purchases approximately 60% of Santee’s generation at wholesale rates for its 20 member-co-ops.

Central just filed a legal “cross-claim” against a previously filed SC circuit court case concerning the nuclear project. It contains three elements. The first asks the court to rule it cannot be charged by Santee for a nuclear project that is not “used” or “useful.” Charges for a power plant not generating power are “unjust and unreasonable,” according to ECSC.

The second element asks the court to rule Central’s contract with Santee, which runs through 2058, has been breached because the rates are not “just and reasonable.”

In the third element, Central argues that because it covers 70% of Santee’s capital costs, it should be awarded 70% of Santee’s $831.2 millon share of the bankruptcy settlement with Toshiba/Westinghouse.

ECSC spokesperson Lou Green acknowledged that Central’s role as Santee’s dominant customer gives its decision to file this cross-claim “a lot of weight.” But in the ongoing debate about the utilities’ fates, proposals are being made that are economically threatening for Central, he told Utility Dive. “The cross-claim had to be filed, to protect our legal options.”

Central understands its proposals could impose an insurmountable financial burden on Santee, Green added. “We are anxious for guidance from the legislature.”

What now?

The Bates White analysis found that removing the $445 million per year being charged to SCE&G customers to protect shareholder dividends would reduce rates 18%. But eliminating shareholder dividends could cause a stock sell-off. The analysis concluded a 13% rate cut would protect dividends enough to prevent a sell-off. The Senate subsequently voted to impose that rate cut until a long-term solution is found.

As a publicly-owned utility, Santee pays no shareholder dividends. Palmetto’s analysis found a 13.62% rate increase would allow the debt to be repaid over its remaining 38-year term. But it would add $194.49 per year to the average customer bill through 2056.

“Having ratepayers pay the debt would be nearly criminal,” Palmetto added. Therefore, “Santee Cooper must be sold” and it is the legislature’s responsibility to find a “willing” buyer.

SC Republican Governor Henry McMaster wants both utilities sold, to protect ratepayers and taxpayers, according to multiple local reports.

Santee’s Gore said the Palmetto paper overestimates the utility’s financial needs and underestimates its ability to refinance cost effectively. “We will build cost recovery into rates, but our projection is for a total increase for the nuclear debt of 7% to 8% over a period of several years, and not until after 2020.”

Institute for Energy and the Environment's Cooper agreed it is criminal for both utilities to recover costs through rates, but said it is misguided to assume the utilities can be sold. “No private entity will buy them unless somebody takes a haircut,” he said.

Regarding its SCANA offer, Dominion Energy VP Dan Weekley wrote to the SC Senate promising “reduced rates up front” and “no rate increases for at least three years.”

Bankruptcy the best choice?

Clemson’s Maloney argued the best choice is defaulting on the debts. Defaulting would send all the questions to a bankruptcy court, where a judge would consider arguments on how to resolve them, he said.

“Bankruptcy is the right way to fix this because investors financed the project and took on the risk,” Maloney said. “The ratepayers and taxpayers didn't have a say, but investors earn interest for good outcomes, and absolving them of the cost for a bad outcome is giving away money.”

But the sale of the utilities is the most likely outcome because it is the most politically expedient, Maloney acknowledged. It is expedient because legislators could select a buyer, like Dominion, who could “kick the can down the road” by deferring higher rates until they become less politically volatile.

The Central Electric Power Cooperative will be a "pivotal" player “because they seem determined to not be the can that gets kicked down the road,” he added. “If they pull out, it does not seem possible that Santee Cooper can avoid defaulting, and if it defaults, SCE&G will be forced near bankruptcy.”

ECSC’s Green said the decision is up to the legislature. “The co-ops might, under the right circumstances, consider making a bid for Santee Cooper, but we would need to know more about what the legislature wants,” he added.

Southern Environmental Law Center’s Holman said the bleak situation created by this project’s failure “demonstrates the risk of centralized traditional generation, especially when renewables are fast becoming cost-competitive.”

Cooper said nuclear power is “a technology whose time never comes” because “any society that has the technological and economic resources to build a safe reactor has the resources to meet its needs for electricity with much lower cost, less risky, clean resources.”

This story has been updated to remove a quote suggesting that Dominion's offer to purchase SCE&G would cause rates to increase. Although SCE&G customer rates will continue to be higher for some years due to the nuclear facility debt, Dominion's offer includes a promise to bring that nuclear-related rate burden down significantly.