Vitol Inc. and one of the company’s traders will pay $2.3 million to settle allegations they manipulated the California Independent System Operator’s power market under an agreement approved Thursday by the Federal Energy Regulatory Commission.

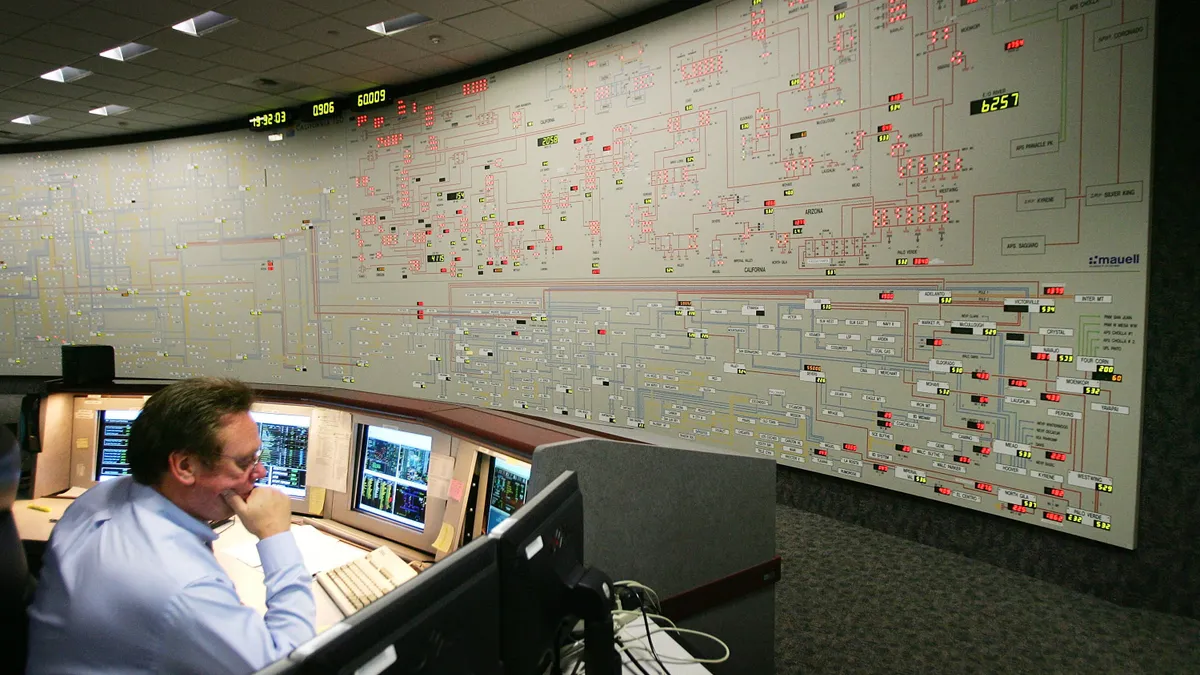

FERC enforcement office staff contend that Vitol and Federico Corteggiano, a Vitol power trader, sold physical power at a loss in CAISO’s day-ahead market in a one-week period in 2013 to eliminate congestion costs they expected would lead to losses on Vitol’s congestion revenue rights. Vitol and Corteggiano deny the allegations.

In 2019, FERC agreed with its staff and assessed civil penalties of $1.5 million for the Houston-based company and $1 million for the trader. The agency also ordered Vitol to disgorge $1.2 million in unjust profits. At the time, FERC staff recommended Vitol pay $6 million and Corteggiano pay $800,000.

FERC in early 2020 asked the U.S. District Court for the Eastern District of California to affirm its penalty order.

Under the agreement resolving the dispute, Vitol will pay $2.225 million and Corteggiano will pay $75,000.

Vitol Inc. is part of the Vitol global commodities trading holding company based in Geneva, Switzerland.

In fiscal year 2023, FERC approved 12 enforcement office settlement agreements totaling about $48.8 million compared with 11 approved agreements totaling $57.5 million in FY22, according to the agency’s most recent enforcement report.

In the report, FERC said market manipulation and fraud cause losses that are passed on to consumers, undermining the agency’s goal of ensuring efficient energy services at a reasonable cost.