A growing need for flexibility in power grid operations means greater opportunity for virtual power plants, or VPPs, but maximizing their potential will require new business models and market rules to encourage their development, according to a report published this week by Guidehouse.

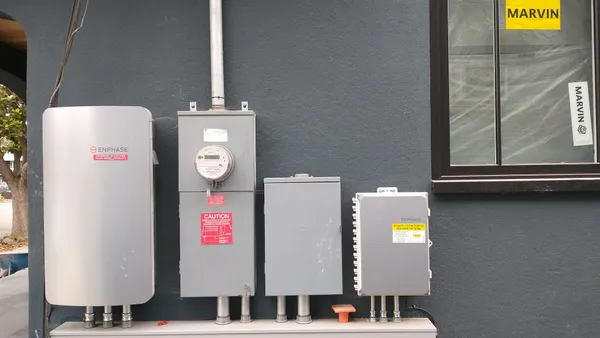

VPPs are aggregations of distributed energy resources, or DERs, that are integrated into the electric grid. They can include heat pumps, electric vehicles, battery storage, renewables and other resources.

“With consumer-sited resources becoming more critical to grid operations, utilities will need to adopt new management technologies and software platforms to maintain grid reliability, while end consumers will need additional assistance in acquiring DER and participating in VPPs,” Dan Power, senior research analyst with Guidehouse Insights, said in a statement.

The largest virtual power plant operators in the United States include CPower, Enel, AutoGrid and Voltus, according to a March analysis by Wood Mackenzie.

VPPs are “an overlooked resource,” according to RMI research. The firm, formerly known as Rockly Mountain Institute, says that by 2030 VPPs could reduce peak U.S. electric demand by 60 GW — potentially growing to more than 200 GW by 2050.

By not building out generation, reducing wholesale energy costs and avoiding or deferring transmission and distribution investments, VPPs can help cut annual power sector spending by $17 billion in 2030, RMI’s report said.

Already, driven by advances in technology and market frameworks, VPP deployments “have started progressing beyond demonstrations and pilot projects to large-scale programs,” Power said.

But to achieve their potential, Guidehouse concluded utilities and consumers “will require more guidance and assistance” from VPP and DER providers. And the firm recommends providers streamline their offerings for end consumers, while system operators and regulators develop market frameworks to encourage the resources.

“With consumer-sited resources becoming more critical to grid operations, utilities will need to adopt new management technologies and software platforms to maintain grid reliability,” according to a summary of the Guidehouse report.

Simultaneously, consumers will need additional assistance in acquiring DER and participating in VPPs, the report said. That presents opportunities for VPP and DER providers “to adjust their business models to facilitate wider market growth.”