Residential energy storage is a niche market now, but it is going to build momentum over the next 10 years, according to a new report from Navigant Consulting, opening opportunities for utilities to harness the technology.

The report’s authors see residential energy storage growing to a 3,773 MW market by 2025 from nearly 95 MW today. In that same time frame, they see the North American residential storage market rising 55%, hitting 800 MW from the current 15 MW.

Most of the growth will occur in Australia, Germany, Japan and the United States, said the authors, Alex Eller, research analyst, and Anissa Dehamna, principal research analyst at Navigant.

The growth will follow a slow gradual path and then shoot up in a “hockey stick pattern” after about 2020, Eller said.

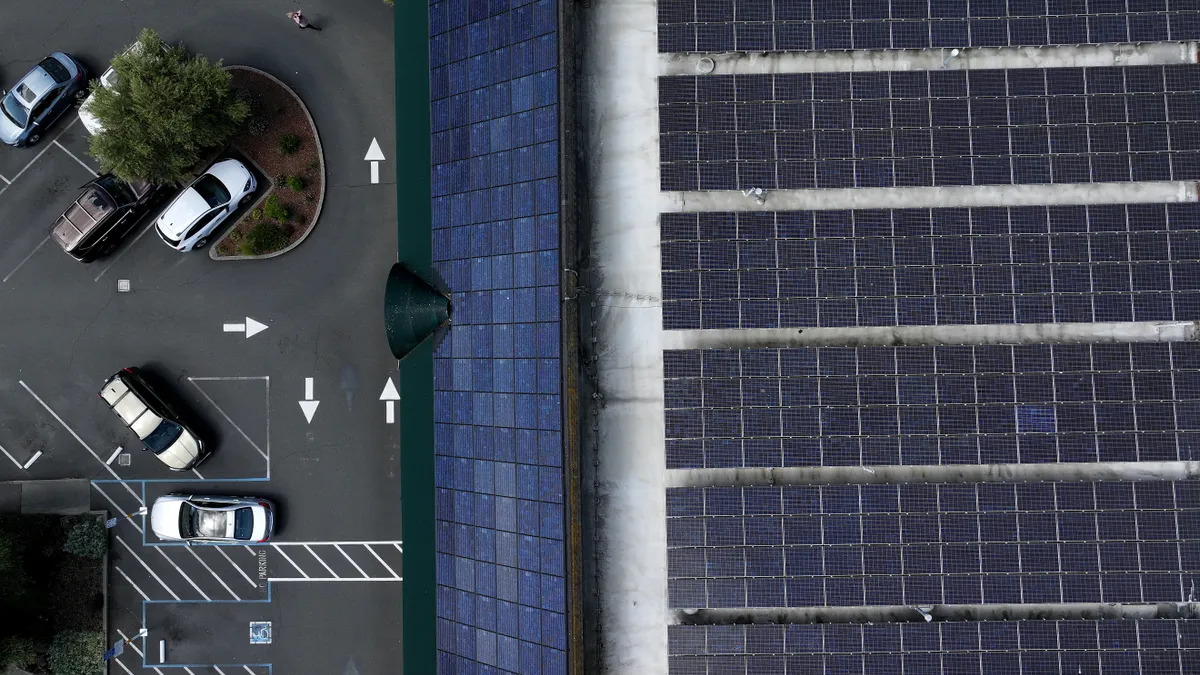

The key factors driving the timing of that growth are utility practices and the growth of rooftop solar installations.

The residential storage industry mirrors the residential solar industry in many ways, said Eller, and the storage market is also reliant on the growth of rooftop solar. The economics of both technologies “can be greatly improved when the two systems are tied together,” he said.

With residential solar, however, utilities largely ignored its growth, viewing it as a flash in the pan or a challenge to their market position. But as residential solar penetration reached higher levels, utilities began to experience voltage issues, as well as contentious disputes with customers and regulators.

Until recently, residential energy storage has been mostly “ignored by utilities as a niche product for clean energy connoisseurs,” the authors said. But utilities are wary of repeating those mistakes and are waking up to the potential of residential storage, said Eller. Among the potential benefits is the ability of residential storage to reduce congestion on the network and limit the need for new peak capacity resources.

Some are finding ways to derive value directly from residential storage, as well as means of limiting opportunities for third parties to come between them and their customers, according to the report.

Opportunities for utilities in residential storage

That is where utility practices come in. Some recent utility practices have been designed to slow the growth of rooftop solar, but that also can have the effect of speeding the adoption of residential solar, said Eller.

Reducing or eliminating net metering practices, for example, can slow residential solar penetration, but customers seeking to replace those benefits are increasingly looking to storage systems that can store unused solar power that can be deployed later in the day when rates are higher.

That is an example of a utility practice that has an indirect or inadvertent effect on the growth of residential storage, but utilities can also play a more active role by designing rates that promote the adoption of storage, such as time-of-use rates.

Utilities are less concerned about grid related problems when solar and storage are combined and the homeowner is not exporting power back to the grid, said Eller.

That approach is being taken by some utilities in Germany where both solar penetration and power prices are high. If the utility encourages residential storage, they can avoid some solar-caused grid and voltage problems, said Eller.

It is also an approach being used by Hawaiian Electric in its self supply program, which has separate rates for customers who do not export solar power to the grid. That program, in turn, created an opportunity for SolarCity, which in February launched a product that combines solar panels, batteries, and control systems and is aimed self-supply customers.

One of the benefits residential storage offers utilities is the ability to reduce congestion and limit the need for peak capacity resources, the authors say. They note that residential storage can improve the overall stability of the grid despite the growth of rooftop solar.

Some utilities also see residential storage as a way to improve their relationship with customers at a time when new technologies are presenting a risk of load defection. Utilities are eager to have new products and services to offer customers, and residential storage can provide that, said Eller.

The report notes that utilities around the world have been launching pilot programs to deploy and test residential storage on their networks. The programs use a variety of ownership models, but the report said, “it is becoming clear that capturing value for both the grid and consumers appears to be the key to success for residential energy storage.”

Eller cited San Diego Gas & Electric’s “bring your own battery” program in which customers can buy – or contract with a third party – for a residential storage system and receive a reduced electricity rate that allows the utility to draw on the electricity stored in their behind-the-meter batteries at certain, pre-agreed peak demand periods.

Eller noted that there is more value in a residential storage system for a utility if they control the system. “It gives them more visibility” into customer behavior, especially below the substation level, which otherwise is largely opaque to utilities, said Eller.

Those kinds of arrangements allow utilities and distributed resources to become “friends” and could represent the “future of energy storage,” according to the Environmental Defense Fund.

“That is an approach we expect to see, utility rates that promote peak shaving and help align usage with solar output,” said Eller. Particularly, he added, when net metering programs begin to expire as they are eventually designed to do.

He cited initiatives such as the virtual power plant program in New York and programs being conducted at utilities in Kentucky and Hawaii by Sunverge Energy. Eller see more of those types of relationships in the future as utilities and utility customers come to see the complementary benefits residential storage can bring to rooftop solar.

Right now the economics of residential storage make sense only in certain markets, but the involvement of utilities opens significant opportunities for growth, said Eller.