Last year was a challenging one for electric utilities: Share prices lagged broader market gains, supply chain constraints added costs and time to renewable energy projects, and electricity prices continued a 3-year rise. What does 2024 have in store for the sector?

“An exceptional level of volatility and opportunity,” is how Bank of America Global Research analysts described the situation for electric utilities and the clean energy sector in its Jan. 9 look ahead.

The U.S. is less than 10 months away from a presidential election that could have significant impacts on energy policy and the implementation of clean energy tax credits and federal loan guarantees. Interest rates may have stabilized, but at higher levels than in the past 15 years that experts say will increase refinancing and debt service risks for renewable energy developers. Higher electricity demand and moderating natural gas prices signal a mixed bag for consumers bills, say market observers.

Investment in new technologies will grow, but not uniformly. Experts say hydrogen near-term expectations may be outsized, and investment in virtual power plants could see rapid expansion. Solar deployments may stabilize after years of supply chain constraints and tariff uncertainty, and batteries could reach “critical mass” as an asset class, said BOA. .

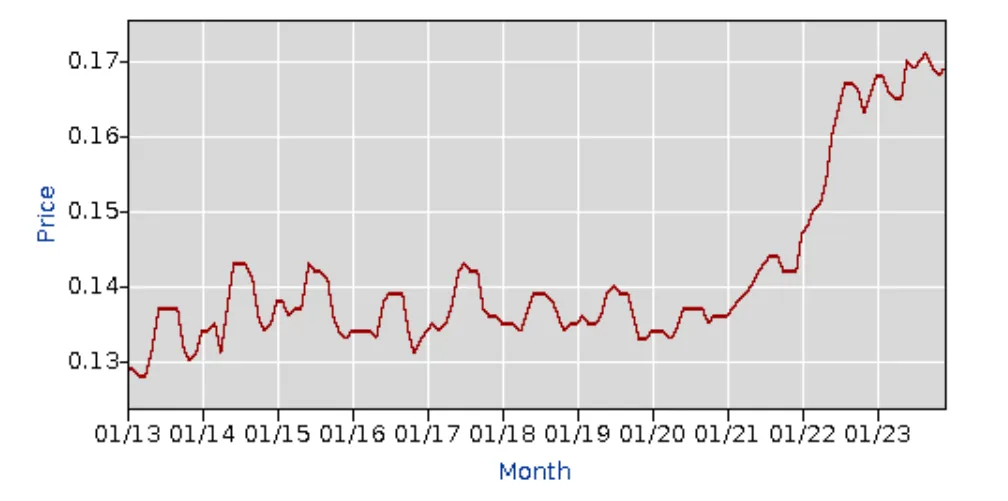

Electricity prices to remain elevated

Residential electricity prices averaged $0.1588/kWh in 2023, completing a rapid runup from $0.1372/kWh in 2021, according to data from the U.S. Energy Information Administration. Prior to that, electricity prices had been relatively stable for years.

EIA expects U.S. retail electricity prices to fall slightly in 2024, to average $0.1573/kWh, before rising again to $0.1611/kWh in 2025. The forecast is based largely on moderating gas prices, which EIA expects to remain near $3/MMBtu through 2025 when liquefied natural gas exports begin to rise.

That level “should keep average wholesale power prices in most regions less than or close to prices last year,” according to the agency’s short-term outlook.

There are regional differences, however: EIA is forecasting wholesale electricity price increases for New York and New England this year.

Moody’s Investors Service in December said it was maintaining a stable outlook on the unregulated utilities and power generation sectors, “based on our expectations for higher power prices.” Increased electricity demand from data centers, industrial activity and weather will be a factor in “driving higher forward power prices across most markets.”

The Electric Reliability Council of Texas market “is the exception,” Moody’s said in its 2024 outlook, “with declining on-peak power prices as solar power is forecast to grow rapidly in Texas over the next 3 to 5 years.”

However, both EIA and Moody’s say Texas could see electricity price spikes under constrained market conditions.

And in California and the West, there is a “shortage of generation, so even if gas prices stay low, power prices could stay high in some areas,” said Moody’s Vice President Toby Shea.

Moody’s expects gas prices this year to range from $2.50/MMBtu to $3.50/MMBtu — a significant decline from 2022 when prices reached almost $9/MMBtu, said Moody’s analyst Jillian Cardona.

Henry Hub spot prices closed out 2023 around $2.50/MMBtu “so that's fairly supportive for credit, for the regulated utilities,” Cardona said. “We don't expect them to have difficulties with excess gas costs.” Moody’s maintains a stable outlook on the regulated utility sector.

But while gas often sets the price of power as the marginal fuel it is not the only factor, said Paul Cicio, president and CEO of the Industrial Energy Consumers of America.

“We have entered into a period of accelerating electricity price inflation for decades to come,” he said, and laid the blame on increasing capital investment in transmission that is built without competitive bidding.

The Federal Energy Regulatory Commission has proposed new transmission planning and cost allocation rules, but it “steps away from requiring competitive bidding of transmission projects instead of embracing it,” Cicio said. “Without competition, monopoly incumbent electric utilities do not have an incentive to reduce costs when building new transmission projects.”

The impact of competitive bidding is “complicated,” said Mark Dyson, managing director of RMI’s Carbon-Free Electricity program. But "if you build the right kind of transmission — for example, the kind that helps you unlock very low cost wind and solar resources that otherwise would not be deliverable to market — that actually lowers the price” of electricity going forward.

But those aren’t the kind of lines utilities have been building recently, he added.

“The kind of lines that we ended up building in this country for the past five years are more regional lines that are not necessarily optimized around bringing low cost resources to market [and] are more justified from a reliability perspective,” Dyson said.

Power demand rises in 2024, flat the next year

Electrification of both the transportation and the building sectors is beginning to add to utility loads, but so far the new demand is showing up mostly at the local level, experts said. Weather and economic growth will drive national increases in power demand in 2024, observers said.

EIA expects U.S. electricity demand to rise 2.6% in 2024, largely based on weather, and then remain stable in 2025.

“US economic growth is also likely to drive higher commercial and industrial demand, including incremental demand requirements for data centers across the country,” Moody’s said.

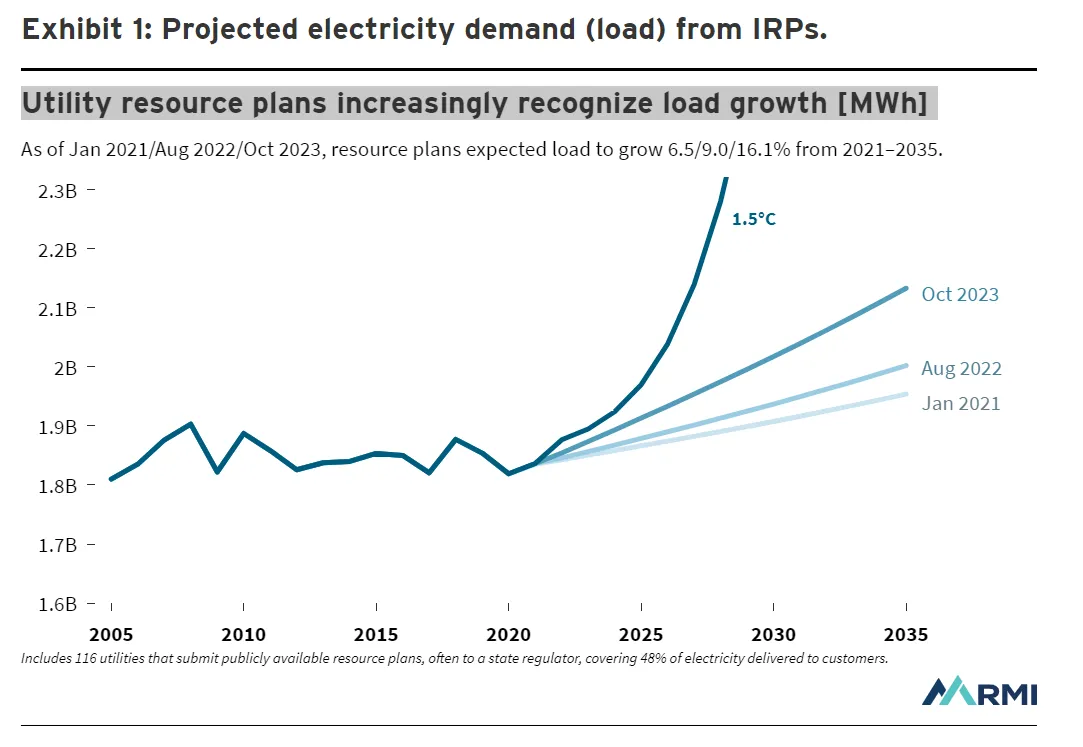

RMI in December looked at utility integrated resource plans to quantify the potential demand impacts of the Inflation Reduction Act, which was passed in 2022 and invests billions of federal dollars in clean energy and electrification.

About half of U.S. utilities file an IRP, said Dyson, and RMI’s analysis showed that in January 2021 those utilities expected demand to increase by 6.5% by 2035. Since the IRA’s passage, expectations for demand growth by 2035 now exceed 16%, RMI found.

“Demand growth projections are ticking up steadily,” Dyson said. “We've had 15 years of flat demand in this country, and now that is no longer the case.”

The industry must cope with higher interest rates

While interest rates have stabilized, they remain high and will be a challenge for some industry segments, debt analysts said.

For unregulated utilities and clean energy developers, “the much higher cost of debt increases both debt service costs and refinancing risk,” Moody’s said. “For new renewable projects, the higher cost of debt raises the levelized cost of power.”

The combination of higher capital costs and elevated inflation “has threatened the viability of some planned renewable power projects especially for offshore wind,” Moody’s said in December in its 2024 outlook for the sector.

On the regulated side, there are bigger impacts on utility holding companies than operating companies since interest expense at operating companies typically flows through to customers, said Cardona.

“The biggest risk is for holding companies that have significant debt maturities coming up within the next year that need to be refinanced, as well as any exposure to floating rate debt,” she said. “There's some potential that interest rates may come down. It seems like the Fed is signaling that that's a possibility for early 2024. But that remains to be seen,” she said.

Impact of the election?

The Republican caucuses and primaries have just begun but former President Donald Trump promised that if reelected he would end the “Green New Deal atrocities” on his first day in office. Observers say the election poses some risk to clean energy incentives funded through the Inflation Reduction Act, including tax credits and Department of Energy loan guarantees.

“To the extent that the various Biden administration agencies do not complete work on carbon emissions (actual emission limitations and disclosures), hydrogen, electric vehicle, and other policy objectives, there is a risk that a Republican administration can stop or overturn many elements,” Bank of America analysts wrote.

The largest risks are tied to changes in “executive interpretation of the IRA, rather than the credits themselves,” they wrote.

BOA analysts also said they are looking for the completion of DOE federal subsidy programs for clean energy in 2024. “Watch for real progress on preliminary awards” early in the year, they said. “We perceive conditional loan approvals need to be established prior to the end of calendar year ’24.”

“There's talk of repealing or changing the IRA if Republicans get in power, but we don't know exactly what they would do,” Moody’s Shea said. “So it's kind of hard to say what the impacts would be. The IRA benefits utilities across the country. So it's not like there's a blue-versus-red kind of issue. They all benefit.”

The Department of the Treasury and the Internal Revenue Service in December released proposed regulations defining criteria hydrogen producers will have to meet to qualify for the 45V clean hydrogen production tax credits created by the Inflation Reduction Act.

The proposed ruleis just one among a series issued by IRS and Treasury on how to qualify for various IRA clean energy and EV tax credits.

There is some pressure on the Biden administration to finalize the rule “expeditiously,” said Alex Piper, senior associate with RMI’s U.S. program. The comment period ends Feb. 26, and even if the rule is finalized “there are certainly other ways in which ... a future administration that's different than this one could could come in and start to hinder the progress.”

Investment in new tech: Hydrogen, VPPs

2024 will be a year of investment in new technologies though some will start with more momentum.

"We see hydrogen prospects as subdued heading into 2024 despite the passage of the IRA,” BOA said. “We stress this is all about expectations where hydrogen expectations around a ‘green new economy’ have appeared meaningfully outsized after IRS released quite stringent new regulations regarding its implementation.

“On balance, we expect 2024 to prove a ‘reset’ year in expectations as hydrogen companies had anticipated meaningfully greater latitude” on hourly matching of emissions and other considerations, BOA said.

Under the proposed rules, hydrogen producers would have to use renewable or zero emission electricity from generators who began operation no more than three years prior to the construction of the hydrogen facility. The electricity would also have to be sourced from within the same geographic region as the hydrogen production facility, and would be subject to hourly matching rules beginning in 2028.

Piper said he doesn’t expect to see big electrolyzer projects deployed this year, “but we will hopefully see announcements and investment decisions made around hydrogen and industrial decarbonization.”

New offtakes for clean hydrogen that can decarbonize steel, fertilizer and aviation fuel “are kind of the big investment decisions and [utility] business trends I think we'll start to see in the later half of this year and into next year,” he said.

Dyson said he also expects investment to increase in virtual power plants which “solve a bunch of problems that are now pressing for utilities across the United States. ... We've seen reliability go down and we've seen costs go up. If you get it right, VPPs can help address both of those challenges.”

Significantly expanding VPP capacity in the United States could save about $10 billion a year in grid costs, DOE concluded in September. There is 30 GW to 60 GW of domestic VPP capacity today, depending on how the resource is defined.

Dyson also said he expects to see more “clean repowering” projects, which are renewables sited at former fossil plants that have grid interconnections. RMI research published Jan. 16 found a 250 GW potential for repowering projects across the country.

“This is going to be a trend this year. We will see more and more utilities take advantage of this opportunity, because of the economics spurred by the IRA and because of the technical capacity of the grid to absorb new renewables at sites of existing interconnection,” he said.