The following is a contributed article by Navigant Research Analyst Jessie Mehrhoff.

Rapidly evolving customer expectations and the development of new technologies are creating both opportunity and mystery regarding the next decade of demand response (DR) and energy efficiency programs. Navigant Research’s Demand Side Management Overview finds that customers across all segments are beginning to compare their utility or other energy supplier to the various service providers they interact with on a regular, often near on-demand basis.

In the residential sector, technology early adopters want to optimize energy across a growing number of smart home devices. As the smart home market matures, more gadgets in more homes will serve as potential grid assets. Commercial and industrial (C&I) customers too crave rapid feedback and assistance. What’s more, these customer segments are looking to grow their bottom line through new revenue streams that engage their existing energy assets. Thus, the utility of the future must actively engage customers, something most readily done through demand side management (DSM) programs.

The proliferation of smart, grid-interactive technologies serves as a catalyst for both evolving customer expectations and changing structures of utility DSM programs. Among changes in the DSM market over recent years, two-way communicating devices, advanced data analytics and computation at the grid edge, and the continued rollout of advanced metering infrastructure (AMI) are increasing insights into energy inefficiencies and providing business operators with potential solutions to save on their energy and support their regional grid.

Navigant Research recently identified eight key drivers for evolving energy efficiency and DR programs. These drivers include the following:

- Emerging natural gas DR

- The growth of bring your own device (BYOD) programs

- DR as a tool for distributed energy resources (DER) integration

- DR to support global ancillary services

- Pay-for-performance (P4P) contracting

- Climate change and emissions targets

- Beneficial and strategic electrification

- Normalized metered energy consumption (NMEC)

The applicability of these drivers varies on both intranational and international bases. For example, NMEC is a data metric restricted to California. However, it is expected to help boost the value of energy efficiency programs across the U.S. as the methodology spreads. Climate change and emissions targets will vary more locally as well, applying varying degrees of pressure to expand utility DSM programs.

The following case studies are designed to provide deeper insight into how utilities are operating under some of these common DSM market drivers: natural gas, P4P, DER integration and beneficial electrification. They provide insight into how utilities, technology vendors and program implementers are working together to launch innovative programs that both meet changing customer needs and engage a broader swath of smart home and smart commercial building technologies.

Aquanta explores P4P with two California utilities and natural gas DR with Con Edison

Based in the Washington, DC area, Aquanta develops products that address the inefficiencies and grid integration opportunities inherent in water heating and plumbing systems. Aquanta developed a two-way communicating device to make tank storage water heaters grid-interactive. The company is working with utilities to both launch P4P contracting programs and expand natural gas DR.

In early 2019, Aquanta partnered with ICF and announced the launch of the first residential energy efficiency P4P programs in the country in Southern California Gas and Pacific Gas and Electric territories. Data collected from Aquanta-enabled water heaters and AMI will be used to help measure the effectiveness of energy efficiency spending.

More recently this year, Aquanta launched a 300-unit pilot program with Con Edison to use natural gas water heaters as a DR resource. The program’s enrollment period is through the end of July 2019. If it proves beneficial, natural gas DR could spread throughout the residential sector in regions of the country where gas water heating is prevalent.

Green Mountain Power integrating DER across its DSM programs

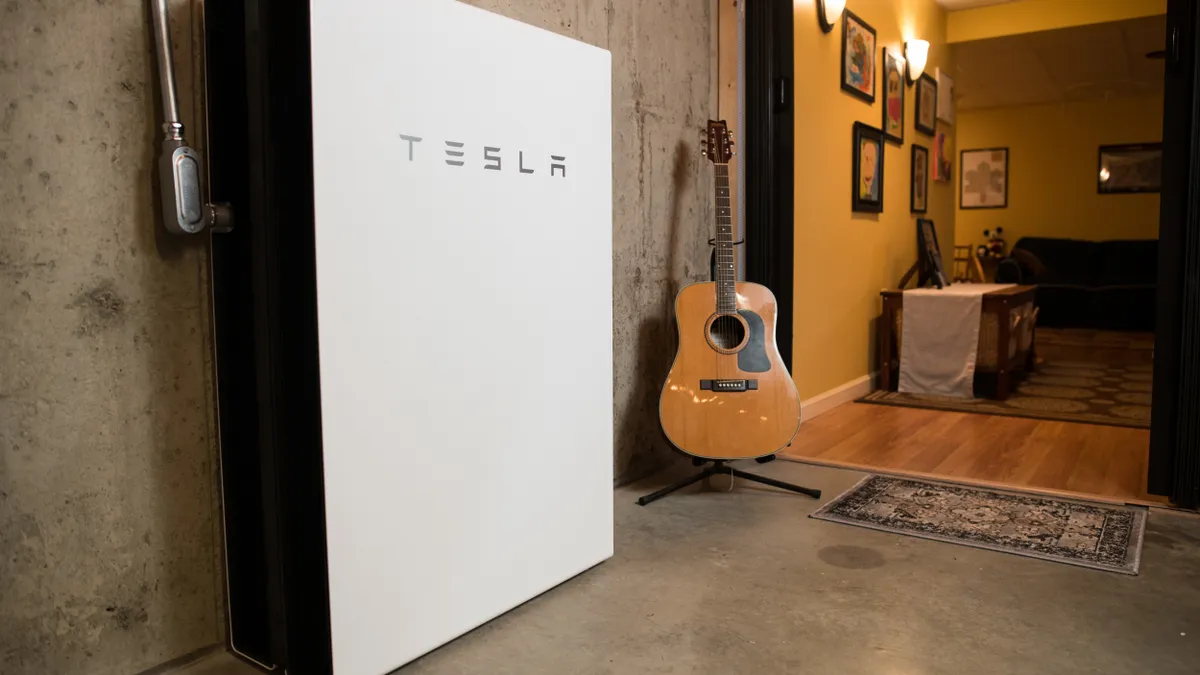

Vermont utility Green Mountain Power (GMP) was the first utility to partner with Tesla, delivering 2,000 Powerwall batteries to customer homes. That grid transformation pilot program is expected to save all GMP customers $2 million over 10 years by reducing the costs of energy during peak demand times. GMP expanded its network of stored energy through a BYOD pilot program, which gives customers financial incentives to share stored energy in a variety of home batteries they can purchase from any Vermont retailer.

GMP also piloted a managed electric vehicle (EV) charging program where vehicle owners could have unlimited charging outside of peak hours for $30 per month. GMP gives customers who purchase or lease an EV a free Level 2 charger as part of its Home Charging program; customers in the pilot allow GMP to turn down power flow during peak demand times.

The managed charging pilot is used for peak curtailment and energy arbitrage, ramping down charging during higher priced times and ramping up when costs are lower. GMP gave customers the choice to opt out of peak events and found that few do.

Austin Energy advances electrification with strategic EV charging

Austin Energy’s Plug-In EVerywhere campaign works to bolster the accessibility of plug-in and other EVs (including bikes, scooters, mopeds and pedicabs) and business models (including electric taxis and ride-hail). The utility is also one of the first to deploy V2G applications, with demonstration partner Pecan Street as part of a larger DER integration program called SHINES.

The Plug-In EVerywhere program allows utility customers to partake in unlimited charging at over 800 public charging stations for $4.17 per month, and rebates are made available to customers to upgrade to Level 2 Chargers in their homes and workplaces.

Austin Energy has learned several challenges must be overcome in the move toward EVs and other beneficial electrification programs. Reaching underserved markets such as multifamily and low income can be particularly challenging, as is finding sustainable business models that support DC fast charging. The critical component is partnering early with customers in making the vehicle electrification transition work for everyone.

DSM drivers outweigh barriers to market growth

Where the California utilities, Con Edison, GMP and Austin Energy are embracing the integration of DER technologies into their DSM programs, it is important to note that barriers beyond those anecdotally mentioned currently hinder DSM market growth.

For example, regulatory mandates for energy savings can pose challenges for integrating technologies best suited to help shift load rather than to curtail. While load shifting can result in lower cost and cleaner electricity, shifting does not equate to saving and has resulted in the regulatory rejection of several DER technology-based programs. On the efficiency side of the market, environmentally beneficial stringent building codes and standards will continue to challenge program providers’ ability to claim additional efficiency savings.

Other challenges identified include the growing stringency of capacity performance requirements in regional markets like PJM; cybersecurity and data privacy threats, which will cause program providers to take greater care and expense into ensuring the safe handling of data; and the continued implementation of proof-of-concept and pilot-scale programs that will increase as new technologies come online in the coming decade.

Despite these challenges, the inclusion of new technologies and customer desire to engage with their utility beyond just traditional power-supply relationships may help to modernize the utility industry over the coming decade. Benefits of DER inclusion will outweigh the challenges and Navigant Research predicts that by 2028, DSM market aggregate spending will exceed $63 billion.