Dive Brief:

- U.S. electricity prices rose 3.6% over the last 12 months, outstripping the broader inflation rate of 3.2%, the Bureau of Labor Statistics reported Tuesday. And experts say there is little chance for near-term consumer relief.

- Transmission costs and volatile fuel prices are the primary drivers of higher power bills, according to Tyson Slocum, director of Public Citizen’s Energy Program. While natural gas prices have declined, “I’m not seeing any evidence that today's current low prices are going to result in utilities announcing rate decreases,” he told Utility Dive.

- And federal policies aimed at electrifying end uses and reducing emissions could lead to even higher prices, Travis Fisher, director of energy and environmental policy studies at the Cato Institute, told a House subcommittee Wednesday. Energy and environmental policies “are creating predictable problems with grid reliability and affordability,” he said.

Dive Insight:

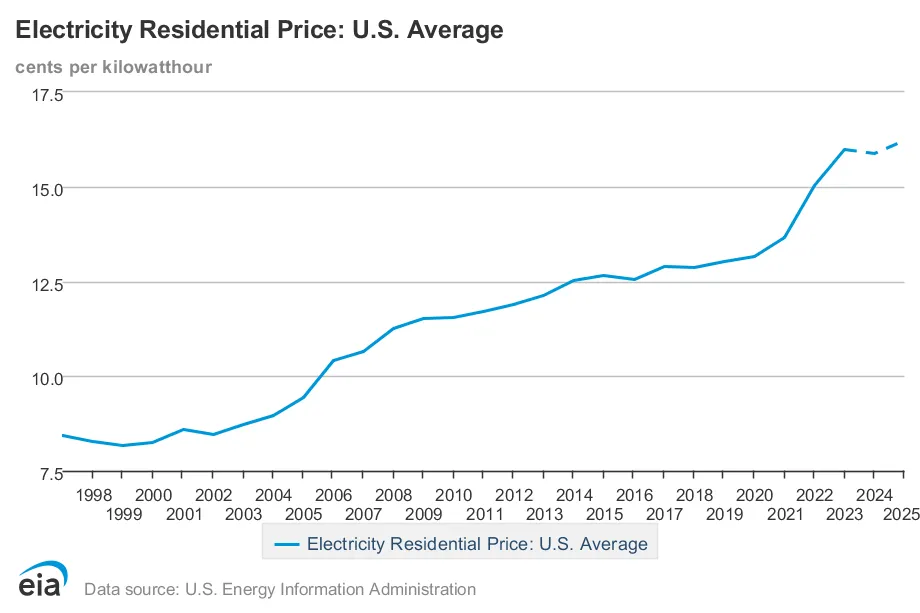

The U.S. Energy Information Administration published the March edition of its Short Term Energy Outlook on Tuesday, forecasting average residential electricity prices next year to reach their highest level in almost three decades.

Residential customers will pay about 16.23 cents/kWh in 2025, up from 15.98 cents/kWh last year, the agency said.

In January, EIA said it expected 2025 residential prices to average 16.11 cents/kWh in 2025. For this year, the government forecaster expects prices to average 15.87 cents/kWh.

The U.S. benchmark Henry Hub daily natural gas price fell to record lows in February, but Slocum said volatility means there will likely be little impact on retail electricity prices. And increased liquefied natural gas exports could send prices higher again.

“So [consumers] don't really see a price decrease,” he said. “What happens is the low [gas] prices sort of give you relief from a price increase. ... It stalls potential rate increases, if the current period is sustained, which I'm not sure it's going to.”

Natural gas tends to set the marginal price of generation because it is the largest fuel source, but that is slowly changing. EIA said it expects the share of U.S. generation fueled by natural gas to fall from 42% in 2023 to 41% in 2025.

On the transmission side of price formation, the Federal Energy Regulatory Commission is considering planning and cost allocation reforms that “could result in much more efficient and cost effective transmission investment,” Slocum said.

The BLS inflation data released yesterday is “especially damning,” said Paul Cicio, chair of the Electricity Transmission Competition Coalition. While electricity generation costs have fallen due to low natural gas prices, “transmission costs continue to accelerate,” he said.

BLS data showed energy service prices, including gas and electricity, rose 0.8% in February; electricity specifically rose 0.3% compared with 0.4% for the broader basket of tracked goods.

“FERC can take an immediate step to reduce inflation and lower prices for consumers,” Cicio said. “The only way to check the power of incumbent monopoly utilities and ensure the cost of electricity is affordable for households and businesses is to enforce Order 1000 and competitively bid large transmission projects.”

FERC’s anticipated transmission rule is expected to increase competition for transmission projects, but former Commissioner James Danly told the House Subcommittee on Economic Growth, Energy Policy, and Regulatory Affairs on Wednesday that he doubts sufficient transmission can be built.

“In order to get hold of the power that would come from the large deployment of renewables that a lot of public policymakers want and expect to have happen, there needs to be a huge build out of transmission. I'm skeptical that level of transmission is even feasible given the costs — it’s an extremely capital intensive proposition.”

Looking ahead, Cato Institute’s Fisher told the subcommittee that the electrification of the transportation sector, along with policies that decrease the availability of dispatchable generation, will ultimately hurt consumers.

Production tax credits in the Inflation Reduction Act “could cost American taxpayers $3 trillion by the year 2050,” Fisher said. “These tax credits reward electricity production from unreliable sources and distort the market signals that keep reliable power plants running.”

Combined with policies designed to increase the number of electric vehicles on U.S. roads, this will “result in increased prices and, unfortunately, a growing number of energy shortfalls,” he said.

New demand is coming online from a range of sectors, as are the resources to meet it, Jonathon Monken, a principal at Converge Strategies, told the subcommittee.

Over the past year grid planners have nearly doubled their five-year load growth forecast, reflecting billions of dollars in investment in manufacturing, industrial, and data center facilities. And there is 2 TW of new generation in interconnection queues across the U.S., more than 94% of which is renewables and battery storage, he said.

“Meeting this demand is essential to domestic economic growth, and requires deliberate action to deploy and

sustain energy resources,” he said. And “the rapid deployment of new resources must be matched with a corresponding investment in electric transmission infrastructure to ensure the grid is prepared.”