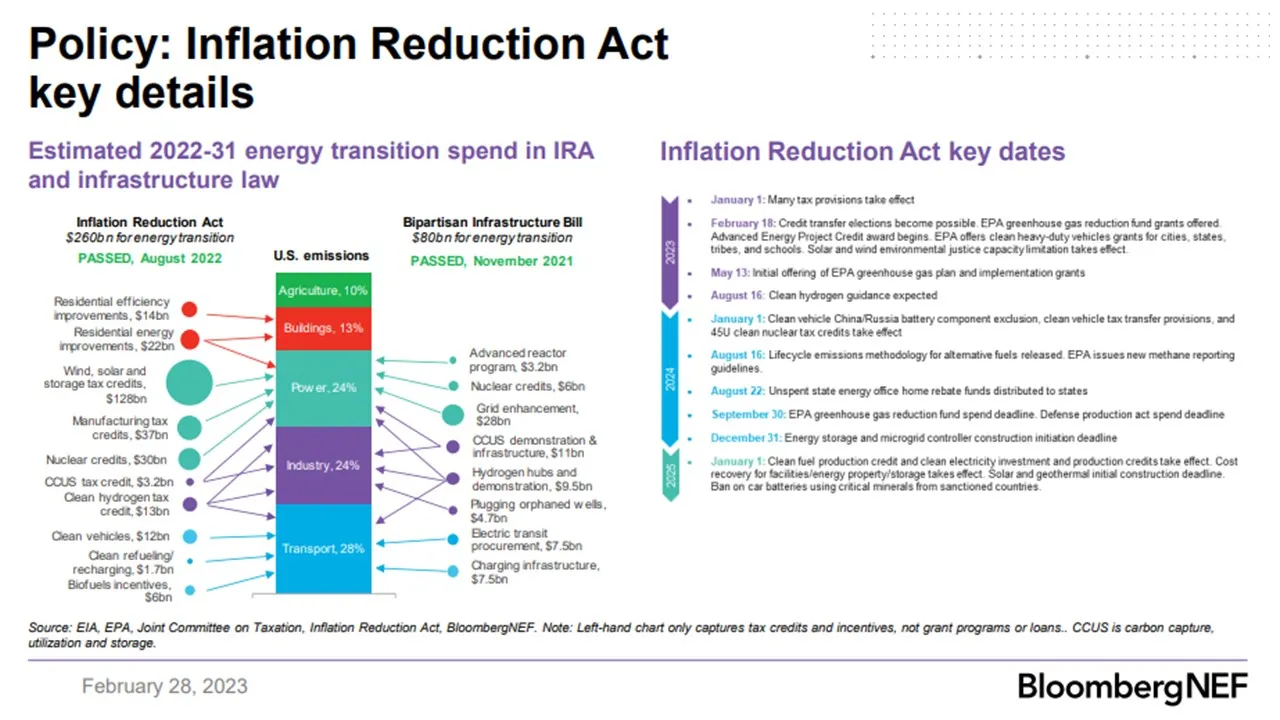

Federal clean energy supports in the August 2022 Inflation Reduction Act, or IRA, could transform the U.S. economy, analysts widely agree.

By December, announcements for “over $40 billion” in new capital were committed to over 13 GW of new clean energy, and 20 manufacturing facilities representing over 6,850 new jobs, the American Clean Power Association, or ACP, reported in December.

But by March 1, nearly 4,000 comments submitted to the U.S. Treasury Department by clean energy advocates and analysts had requested clarification on how investors can be certain of qualifying for the IRA’s new and extended tax credits, grants, and programs.

Many of the IRA’s boldest programs are “far from prescriptive,” and federal agencies, other regulators and utilities “will ultimately shape” them, Regulatory Affairs and Market Development Manager Erica Larson and Senior Director, Energy Business Development Justin Rodgers, both with global business consulting firm ICF, wrote in October.

A major hurdle remains. “The big job in front of us is implementing the laws we passed,” President Biden told House Democrats March 1. That will require Treasury Department rulings, expected in the first half of 2023, on IRA terms like prevailing wages, qualifying apprenticeships, energy communities, domestic content, and direct pay of tax credits, people preparing to do the implementation said.

But the IRA’s potential to drive game-changing energy sector transformation remains clear.

With the IRA added to 2022’s record-breaking generation from clean energy sources, the clean energy sector will be “hard-wired into the U.S. economy,” Amy Farrell, senior vice president of government and public affairs for clean energy advocate CRES Forum, said March 6.

Hard-wiring clean energy

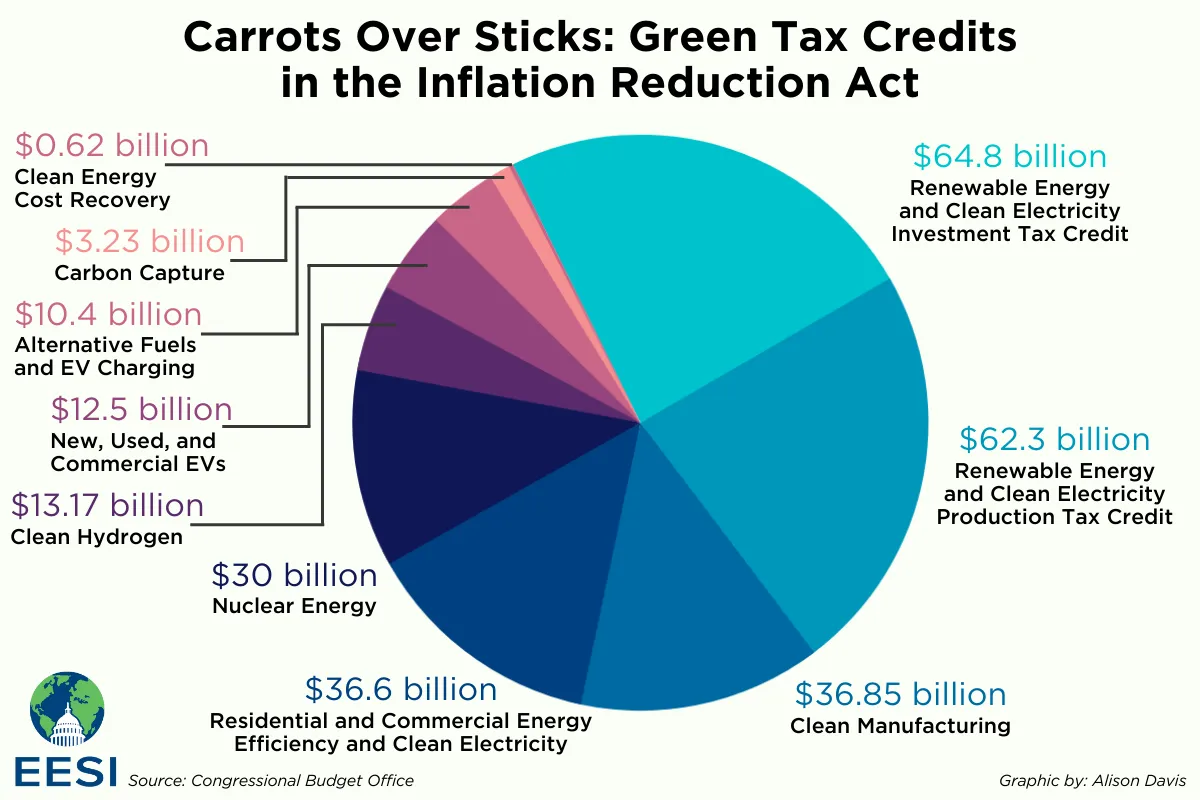

The expanded tax credits and funding for rebates and research in the IRA, valued at $369 billion, represent “the boldest action Congress has taken on climate,” the Environmental and Energy Study Institute, or EESI, reported in August 2022.

The IRA could improve projected U.S. emissions reductions through 2030 by 10% and increase clean energy’s estimated 40% share of U.S. electric generation in 2021 to as high as 81% in 2030, a 2022 Rhodium Group study found. Overall “household energy costs will decrease by between $717 and $1,146 in 2030, relative to 2021 levels” as a result of greater use of lower cost renewables, Rhodium added.

The nearly 4,000 stakeholder comments to Treasury were filed in eight IRA dockets, many in response to Requests for Information, or RFIs, by Treasury’s Internal Revenue Service. IRS responses issued to date have provided few answers, analysts and energy attorneys said.

Revised clean energy investment tax credits, or ITCs, and production tax credits, or PTCs, and an option to expand clean energy use by non-taxable entities are the IRA’s major focus, ICF said.

The IRA’s projected $62.3 billion for wind’s PTC extends the credit through 2032. And the PTC’s $0.003/kWh base increases to the current $0.015/kWh for meeting new wage and apprenticeship requirements, according to multinational energy law firm Norton Rose Fulbright, or NRF. It also increases for projects meeting other IRA requirements or built at IRA-specified locations, NRF said.

The IRA’s projected $64.8 billion for solar’s ITC extends the credit through 2032. The IRA also extends the ITC to standalone battery storage projects, NRF said. The new ITC base tax credit is 6% of both those types of projects’ cost after one year of operation, but it can increase to the existing 30% ITC or higher by meeting the same IRA requirements as those for the PTC, NRF said.

The ITC will accelerate the energy storage market and a new allowed use of the PTC for solar may benefit high production solar projects, but will add negotiating complications for developers and tax equity investors, said Keith Martin, NRF partner and co-head of U.S. projects, and Kevin Pearson, a partner at the law firm Stoel Rives.

Important new questions will emerge in 2025 when the new tax credits are replaced by a “technology-neutral clean energy” credit for zero-emissions electricity production, Martin said. “That will require Treasury to determine what technologies and carbon reductions qualify,” added Pearson.

“Treasury has time for the many details on technology neutral credits,” American Council on Renewable Energy, or ACORE, Vice President of Government Affairs Allison Nyholm said. But the IRA may face criticism if its new tax credits become “a wasted opportunity to meet climate goals,” she added.

Verifying Nyholm’s concern, major utilities including Consolidated Edison, Arizona Public Service and Southern California Edison told Utility Dive they are looking expectantly to the IRA, but awaiting IRS guidance.

The labor questions

The IRA is “a gold mine of opportunity,” but “people are still digging” to understand how to be certain of meeting key requirements, NRF’s Martin told a Feb. 14 Intersolar North America audience.

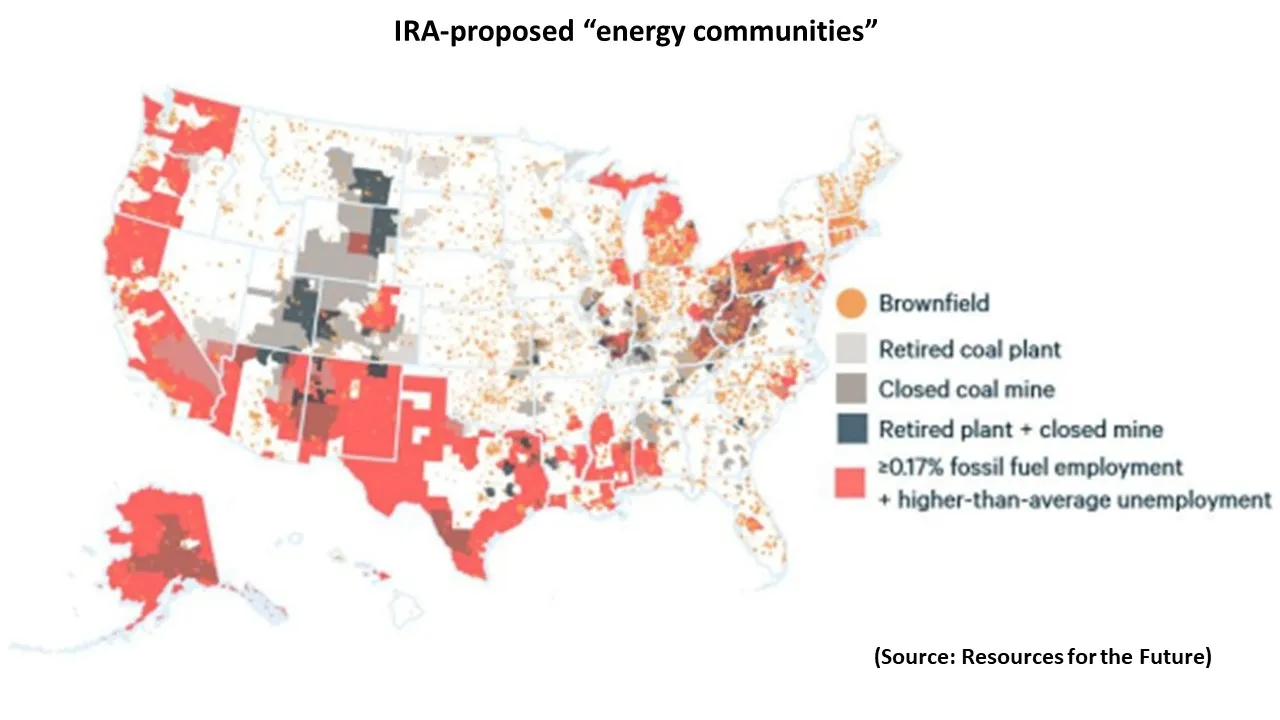

Tax credits could be “as much as 70%” of a new project’s cost and clean energy manufacturers “will also receive significant subsidies,” he said. That is because the base 30% ITC and $0.015/kWh PTC values increase 10% for meeting IRA domestic content requirements, 10% for “energy community” locations and 10% to 20% for serving low-income customers, once the IRS clarifies those terms, he added.

“Almost every new concept in the IRA has at least one provision requiring IRS guidance,” said Stoel Rives’ Pearson. But it must first clarify wage and apprenticeship requirements because initial IRS guidance in November 2022, based on existing Labor Department practices, “may be too broad,” limiting access to the base ITC and PTC values and keeping projects from “penciling out,” he added.

The initial guidance allowed a “good faith exemption” for a publicly issued but unanswered request for apprentices, said Daniel Wolf, ACORE manager, policy. “But it did not make clear how the request must be made, how to document it, or what the developer must ultimately do to actually comply,” he added.

Developers are starting projects without certainty on the tax credits in anticipation of the IRS providing final rules that meet the law’s intent to support a clean energy economy, Martin, Pearson and others agreed.

One solution to sustain a tax equity market projected to reach over $20 billion in 2023 has already emerged, Martin said. Tax equity investors’ initial 20% investments assume “a continued workable level of tax credits” but may change when the 80% balance is paid, he said.

Energy communities and domestic content

Developers want to qualify for the higher tax credits, but “confidence levels about accurately applying them vary,” Martin said.

There are three IRA “energy communities” where projects will qualify for higher credits, according to a Charles River Associates, or CRA, December study: In areas with relatively recent coal mine or power plant retirements, in areas likely to see relatively high fossil fuel-related job losses, and on brownfields, which are lands potentially contaminated by hazardous substances.

Clarifications are needed because misused definitions for retired coal units or fossil fuel-related jobs “could affect 10% to 20% of the total extent” of energy communities, the CRA analysis concluded.

For domestic content, structural materials made from steel or iron like rebar or foundation posts must be “100% U.S.-made,” Pearson said. In 2023, 40% of manufactured product content must be “U.S.-made” and not “merely assembled at a U.S. factory,” and that rises to 55% by 2032, he added.

Those are “simplistic” percentages of the total project cost, ACORE’s Nyholm said.

More precise domestic content rules are critical for publicly-owned utilities, electric cooperatives and non-profit groups because they must meet them to use new IRA funding for tax exempt entities, said American Public Power Association, or APPA, Senior Government Relations Director John Godfrey.

Rules must be “completely clear but simple to implement,” or small tax-exempt electricity providers and non-profits may find it onerous to prove sourcing of solar racking steel or electrical equipment transistors, Godfrey added.

A potential solution to identifying sourcing is IRS approval of taxpayers using written certification that materials were sourced domestically, with substantiating records if necessary, adequate, an ACORE Treasury filing suggested.

The IRA’s support for clean energy domestic manufacturers has already led to at least 40 new manufacturing investments totaling $77 billion, Barron’s reported February 24. Clarified domestic content rules will likely drive more investment, said Lindsay Cherry, market intelligence and policy manager for Qcells, which announced a $2.5 billion U.S. solar manufacturing expansion Jan. 11.

But that will only happen when IRA details are less complicated and more certain, stakeholders agreed.

Three vital clarifications

In addition to domestic content and labor provisions, Treasury clarification is vital on provisions allowing taxpayers to substitute upfront cash payment for the tax credits, on the definition of clean hydrogen, and on energy efficiency, many stakeholders said.

Direct pay allows project owners “to be paid the cash value of tax credits on their projects,” said NRF’s Martin.

The manufacturing tax credits can be transferred for five years, which could lead to “large cash infusions” for major renewables manufacturers, Martin said. But developer interest in transferability is limited because competition for transfers could lead to less certain value of traded credits and more financial market and taxpayer uncertainty, he said.

Public power utilities, rural electric cooperatives and not-for-profit organizations from Habitat for Humanity to small municipalities can also now qualify for direct pay through 2032, said APPA’s Godfrey. That eliminates complicated contract negotiations with tax equity investors and allows public power utilities and electric cooperatives to own and operate renewables, he added.

But direct pay and credit transferability are “new innovations that have not been in the tax code before” and clarifications are needed before deals can be completed, said attorney Hunter Johnston of multinational policy and business legal advisors Steptoe and Johnson.

If IRS rules fulfill “congressional intent” on direct pay, it will be an exciting opportunity for co-ops “to leverage new tools,” said Stephen Bell, spokesperson for the National Rural Electric Cooperative Association.

Energy efficiency’s IRA funding will have its biggest impacts in the $4.3 billion Home Energy Performance-Based Whole-House Rebate program and the $4.3 billion High-Efficiency Electric Home Rebate Program, according to EESI.

But “low income consumers making financial decisions about home improvement investments need protections,” said Jenifer Bosco, staff attorney at the National Consumer Law Center. Contractor certifications, information accessibility, a restitution fund and a complaint process are important, she added.

Clean Hydrogen production has an estimated $13.17 billion in IRA support, according to EESI. A PTC of up to $3/kg for the first 10 years of a clean hydrogen facility’s operation is available, with added credits for meeting the labor standards. But Treasury faces decisions about ensuring the hydrogen is clean.

“Electrolysis with electricity generated by clean sources can create zero carbon hydrogen,” said Daniel Esposito, senior policy analyst at the Energy Innovation Electricity Program. Inadequate Treasury guidance could lead to “a worst-case scenario” that adds fossil fuel generation to produce hydrogen “and increases power system emissions,” he said.

Adherence to the three principles of additionality, deliverability and time matching can ensure that hydrogen production is done with clean electricity, Esposito said. Requiring hydrogen producers to add new clean generation and transmission to deliver it when their hydrogen facilities are producing would meet the intent of the legislation, but “hydrogen hype” could lead to more permissive IRS guidance, he said.

There are “billions of dollars of investment and a lot of plans awaiting Treasury guidance” on the use of hydrogen tax credits, but “substantial uncertainty has prevented projects from reaching financial close,” said Steptoe’s Johnston.

The “legislative intent seems to have been to verify the hydrogen was produced with clean energy,” but rules requiring costly deliverability and time matching could impact “the economics of the industry,” he added. “We need rules that meet the law’s intent to provide incentives for investing,” and “a compromise might be less stringent rules in early years which tighten in later years,” he suggested.

“Treasury is in a brave new world and, for the first time, is in the risk management business,” said ACORE’s Nyholm. “It wants to expand investment, but it is still working to understand how to do that most effectively, and it will provide guidance when it has that clarity.”