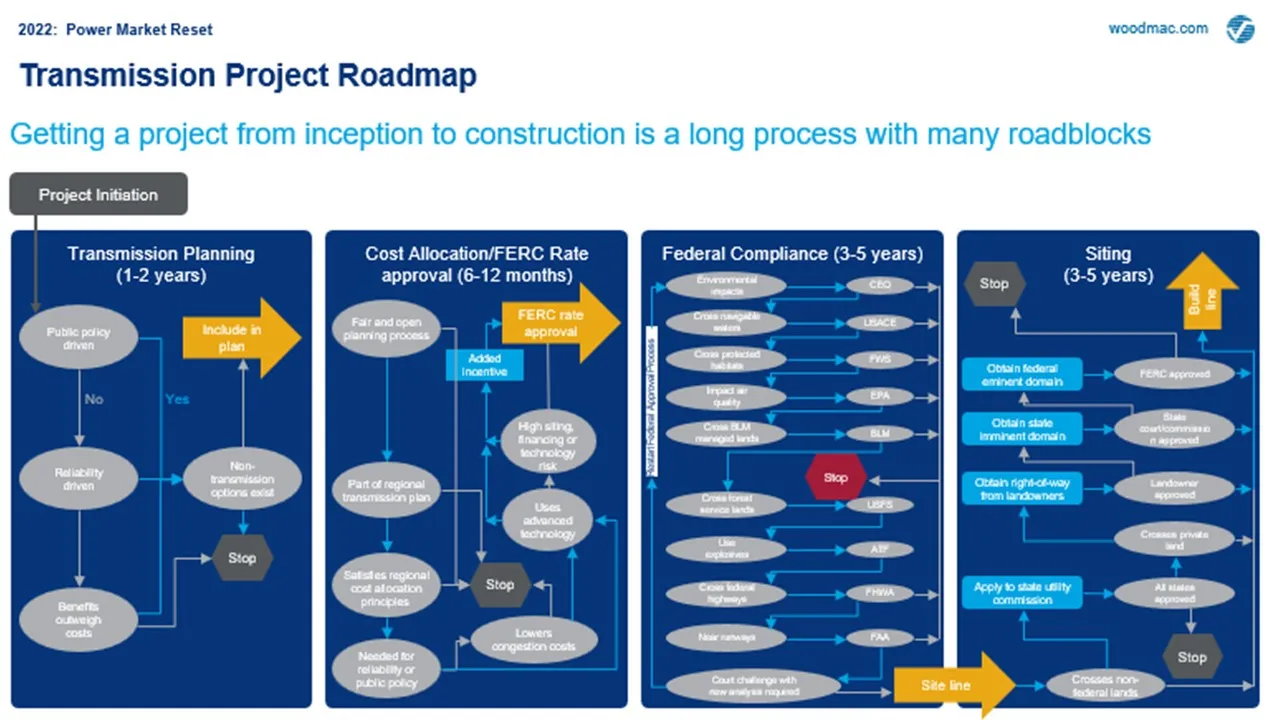

Despite White House and other efforts, new transmission projects to deliver the growing amounts of clean energy in the U.S. to where it’s most needed face what some observers call a permitting “Valley of Death.” But non-transmission solutions can fill the gap, stakeholders agree.

President Biden’s policies and executive orders have initiated many new transmission approval strategies, but permitting remains “the poster child for how things can get held up,” Senior Advisor to the President for Clean Energy Innovation and Implementation John Podesta told a May 23 CleanPower 2023 conference audience.

Policy and regulatory agencies have “many ways to say no” to new development, leaving the potential for streamlined transmission expansion in serious doubt, BloombergNEF Head of Research, North America, Tom Rowlands-Rees told Utility Dive.

Even with historic Inflation Reduction Act funding, U.S. power suppliers “cannot deliver the energy transition” if it continues to take 10 years to permit and build the needed transmission, Berkshire Hathaway Energy Renewables President and CEO Alicia Knapp told the same Cleanpower audience.

But new technologies and materials and new ways to use renewables, batteries and distributed energy resources can get more from existing transmission, analysts, utilities and other stakeholders said. They cannot defer the need for new transmission indefinitely, but the urgency to reduce customer costs and meet clean energy goals mean the time for them has come, they agreed.

The transmission deficit

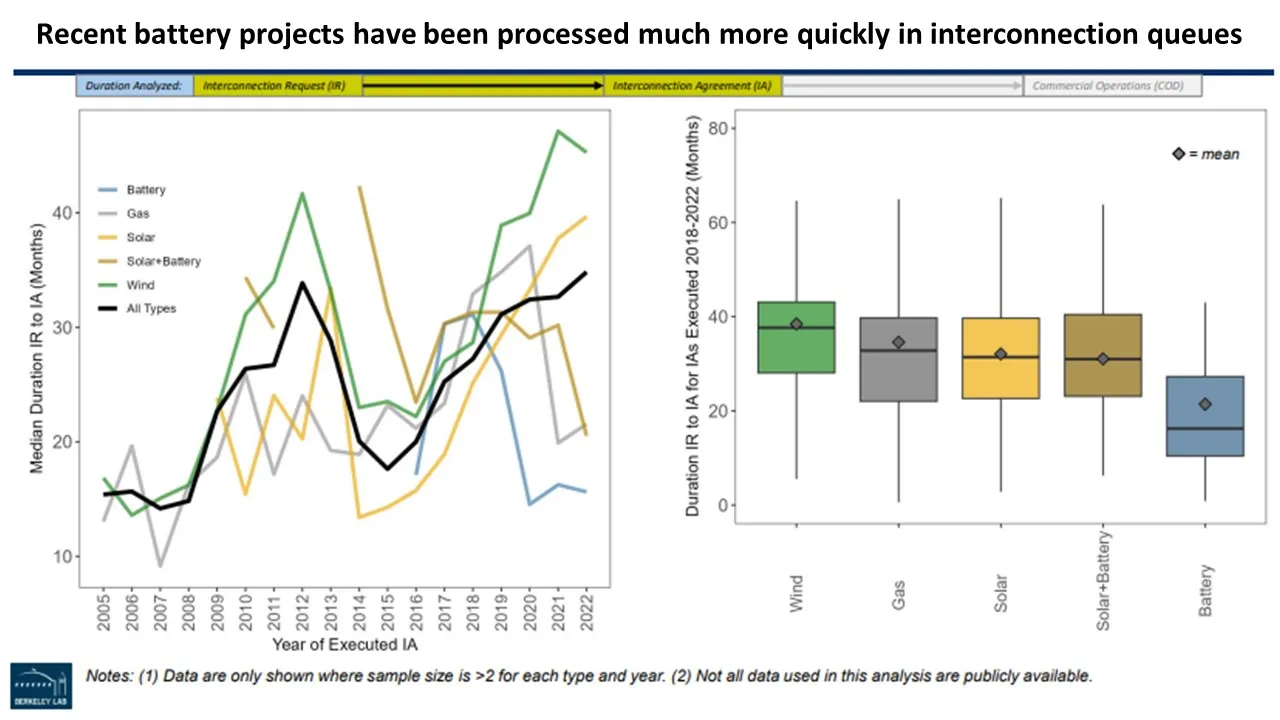

Through 2022, 1,350 GW of generator capacity and 680 GW of storage were actively seeking interconnection to the transmission system, an April Lawrence Berkeley National Laboratory study reported.

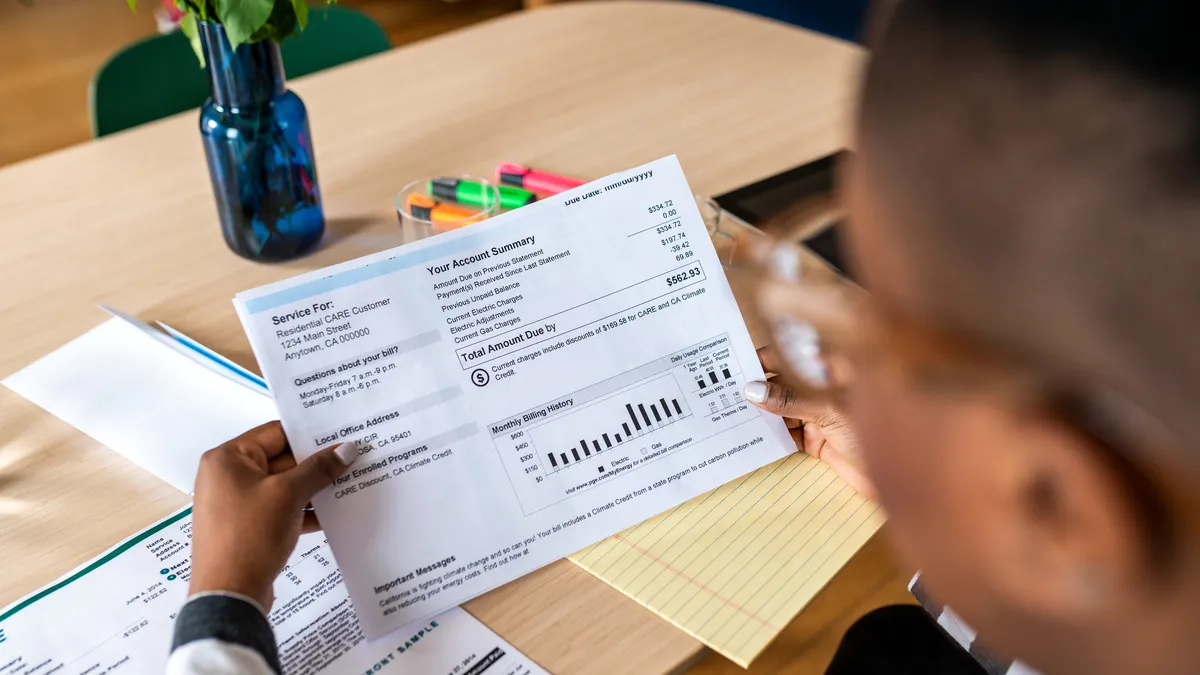

Market congestion costs from insufficient transmission were an estimated $13.4 billion for ratepayers in 2022 and are expected to grow, a March Grid Strategies paper calculated. And much of the U.S. faces an elevated risk of energy shortfalls from extreme heat-induced demand spikes, added the May 17 North American Electric Reliability Corporation 2023 Summer Reliability Assessment.

In response, Biden administration initiatives will prioritize interconnection queue, permitting and cost allocation reforms to expedite transmission deployment, the White House announced May 10. There will also be new emphasis on the economic, reliability and climate benefits of new transmission corridors, inter-regional transmission, grid-enhancing technologies and line upgrades, it added.

The interconnection queues are not the whole story, said New York Independent System Operator Vice President of External Affairs Kevin Lanahan. New York’s “class-year” approach, which identifies the most substantial project proposals, accelerated approval of 27 generation projects totaling 7,452 MW in 2021, and more than 90 class-year generation projects are being studied, he said.

New Southwest Power Pool, or SPP, queue management practices initiated in January 2022 put it on track to eliminate its queue backlog by the end of 2024, added SPP Director, Grid Asset Utilization, Casey Cathey. A consolidated planning process that “merges and optimizes queue requests with regional long-term planning” can eliminate organizational silos, he said.

“There can be no transition without transmission,” but “there are still issue like land permitting outside of SPP’s control,” Cathey added.

“Too many jurisdictions have authority to stop new transmission development,” agreed Dynamic Grid CEO Kay Aikin. Other options can, however, begin increasing the power system’s capacity to meet policy goals, she added.

As battery storage costs continue to fall, it has emerged as a non-transmission solution, though opponents insist it must be located precisely to be cost-effective.

Storage-as-transmission

In 2019, SPP studies of its first storage-as-transmission proposals showed it was a viable alternative to new transmission builds or upgrades but was not cost competitive because batteries were too expensive at the time, SPP’s Cathey said.

Even then, batteries strategically placed at congested nodes where load profiles of limited capacity lines allow energy to be stored when loads ease to offset later demand spikes could defer new transmission builds, Cathey said. SPP’s storage-as-transmission tariff was approved May 26, and costs are now or will soon be low enough to make properly located storage a viable least-cost option to transmission line upgrades, he added.

National Grid’s $50 million, 8-hour, 48-MWh battery which deferred an estimated $250 million transmission line for Nantucket Island is an example of the right kind of use case, said National Grid Clean Energy Development Director Terron Hill. It remains the largest storage-as-transmission project in New England, he added.

Regulators, utilities and system operators must use planning criteria that value optimizing existing transmission with storage, said Long Duration Energy Storage Council CEO Julia Souder. That will require “recognizing that battery project costs might be offset by the ratepayer benefits of reduced [renewable energy] curtailment and deferred capital expenditures for transmission,” she added.

Independent storage providers are concerned about owners of storage-as-transmission assets bidding into energy markets, said Jason Burwen, vice president of policy and strategy at merchant battery provider GridStor. “Owners of storage-as-transmission receive cost recovery through rates and should not compete in markets,” he added.

The locational and regulatory limits on storage-as-transmission make new grid-enhancing technologies, or GETs, and advanced wires materials, which are easier and faster to deploy, the smarter near term choice as a non-transmission upgrade, their advocates insisted.

Grid-enhancing technologies

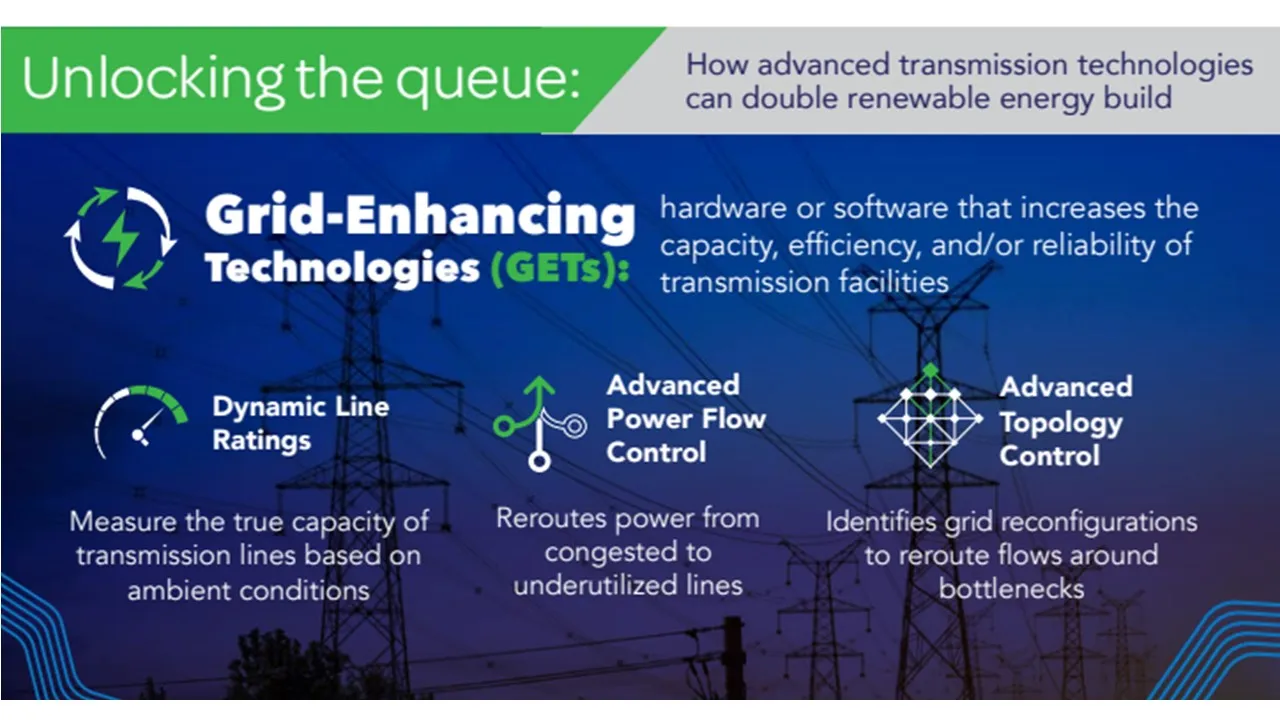

The most often-used GET, Dynamic Line Ratings, or DLR, can expand a transmission line’s carrying capacity in real time based on readings from sensors throughout the system. Advanced Power Flow Control moves electricity away from overloaded lines to streamline energy delivery. And Topology Optimization uses multi-factor awareness to maximize a system’s carrying capacity.

National Grid’s upstate New York DLR deployment and its study of other GETs show they can begin to cost-effectively optimize today’s aging transmission system for a renewable energy future, said National Grid’s Hill. With engineering and deployment expenditures, DLR may cost $100,000 per mile, while new overhead transmission’s per mile costs in the Northeast are from $3 million to $6 million, he added.

Despite efforts at policy reforms, permitting remains the transmission project “Valley of Death” for Los Angeles Department of Water and Power, said its Power Engineer Manager Denis Obiang.

Where building new lines is impeded, LADWP is exploring “reconductoring,” which is replacing traditional line materials with advanced conductor materials, but is not one of the commonly identified GETs, Obiang said. “At a slight increase in cost over traditional steel, the new materials can increase performance 10%,” which is the highest capacity increase of any non-transmission alternative, he added.

But unlike reconductoring, GETs are the quickly deployable “low hanging fruit” for improving existing lines, Obiang added. “For a struggling load dispatcher, bringing marginally more power onto the system in a high demand hour can make a real difference,” he said.

Power provider EDF Renewables North America has helped finance new transmission capacity, its Vice President of Transmission Analytics, Rodica Donaldson said. But EDF has found GETs can be brought online in 16 months to 24 months with a cost in the tens of millions of dollars to defer transmission builds that could take years and billions of dollars, she added.

The data on congestion reduction with GETs are changing the historically conservative mindset of transmission owners, Donaldson said.

“Batteries help resolve the time dimension of congestion by shifting when energy is used, but GETs help resolve congestion’s distance dimension by optimizing the system-wide use of existing wires,” said Hudson Gilmer, CEO of DLR provider LineVision.

GETs can reduce the amount and cost of needed U.S. transmission, reduce some highly congested locations by 40% or more, and relieve the financial risks of transmission expansion, the Department of Energy’s draft “Transmission Needs” study reported in February. And they can potentially double system renewables capacity with a six month payback, an April Brattle Group study found.

It “intuitively makes sense to turn to easier-to-deploy, least cost technologies, but they require utility resources and studies,” SPP’s Cathey cautioned. And “not all transmission owners have an appetite for what they perceive as new technology risks,” he added.

“The industry has a reputation of being slow to adopt new technology,” Gilmer responded. “But many electric utilities are starting to see GETs near-term viability as new transportation and building electrification loads increase the need to protect their systems,” he added.

Duquesne Light’s Pittsburgh region DLR deployment is expected to increase transmission system capacity by an average of 25%, the utility reported in September 2022. It is now studying power flow control and sees topology optimization as “the end goal,” Duquesne Light Director, Advanced Grid Systems and Grid Modernization Elizabeth Cook said.

But deploying new technologies “is a business decision” guided “by regulatory mandates and by the utility business model,” Cook acknowledged. Use of GETs and advanced conductors may be limited by perceived risk as opposed to guaranteed returns through rates with traditional capital expenditures, she added.

Overbuilding strategically located utility-scale generation and batteries might be a more appealing near-term solution for regulated transmission owning utilities, some analysts said.

Economic overbuilding

Building more solar, wind and batteries adjacent to existing transmission and load “is not a silver bullet for the queue problem but a way around it,” suggested Meredith Fowlie, professor of economics and faculty director for the Energy Institute at Haas, University of California, Berkeley.

“If transmission bottlenecks remain formidable, and if the costs of renewables and storage keep falling, overbuilding might be more economic than dealing with queue and permitting obstacles,” Fowlie said. “Instead of building where solar or wind are most productive, building where they can interconnect without additional costs or local objections might be adequate to reduce the need for new transmission,” she added.

Developers are already taking advantage of slightly less ideal renewable resource locations near load and existing transmission, “not because of policy but because of economics,” said SPP’s Cathey. They have realized they can optimize for conditions, costs and the opportunity to address congestion in SPP’s East rather than adding renewables to its backlogged Western queues, he added.

A fourth, and undervalued, non-transmission option is customer-owned distributed energy resources, which can cost-effectively meet demand at the local level, advocates said.

Engaging customers

Engaging customers’ resources is becoming more urgent as loads from transportation and building electrification accelerate, DER advocates said.

Distribution system load flexibility can be a solution to transmission constraints that limit supply by flattening customers’ peak demand during the 5% to 10% of system hours that cause reliability threats, said Astrid Atkinson, CEO and co-founder of software provider Camus Energy. FERC Order 2222 recognizes enabling DER in wholesale markets can be a powerful tool in deferring the need for new transmission, she added.

But regulators must recognize and compensate customers for their resources’ value as energy, capacity, ancillary services and resource adequacy, Atkinson added.

Because of regulators’ resistance to doing that, “it is not possible right now to know how big a role DER can play” in reducing the need for new transmission, the LDES Council’s Souder added.

“DER plays a role, but it does not significantly change transmission needs because the localized transportation and building electrification load growth will be larger than the local DER can meet,” said LADWP’s Obiang. “It will take a comprehensive approach that includes all available options,” he added.

Rethinking transmission

There is no ideal non-transmission alternative to address the challenges facing new transmission development, analysts agreed.

But consideration of the roles of storage-as-transmission, GETs, overbuilding and DER “might force a redesign of the [planning and interconnection] process from the ground up to include modeling that recognizes constraints on building new transmission,” Haas economist Fowlie said.

Many utilities see GETs and other alternatives as a threat to reliability, “like rebuilding the airplane engine while flying it,” said Duquesne Light’s Cook. But non-transmission alternatives “allow rethinking transmission planning with coordination of all options that can defer the need for the many years it will take to bring new transmission online,” she added.

Regional studies of the right subset of technologies could lead policymakers to “a national optimization” of the transmission and distribution systems and the role of all the potential strategies to strengthen them, Dynamic Grid’s Aikin agreed. It should begin with increased use of DER flexibility “to take the burden off transmission,” and then use strategic overbuilding of renewables and storage, and deployment of GETs and reconductoring “until new transmission can be built,” she said.

No non-transmission solution can eliminate the need to expand and renew today’s 100-year old transmission system, added EDF’s Donaldson. “But policymakers and stakeholders need to act proactively to support deployment of alternatives to encourage companies like EDF to keep investing in clean energy development to meet U.S. climate goals,” she warned.