This opinion piece is part of a series from Energy Innovation’s policy experts on advancing an affordable, resilient and clean energy system. It was written by Dan Esposito, senior policy analyst for electricity, energy innovation policy & technology.

The United States Treasury will soon issue guidance defining how to measure greenhouse gas emissions from hydrogen production via electrolysis. These rules will determine which types of projects can qualify for the new 45V clean hydrogen production tax credit, or PTC — with major implications for power prices, grid reliability and climate goals.

Proponents of loose regulations claim Treasury’s guidance should allow electrolyzers to increase GHG emissions. They argue this tradeoff is necessary to support the clean hydrogen industry’s long-term growth, which will be essential for decarbonizing hard- or impossible-to-electrify sectors like industrial feedstocks and aviation.

But new Energy Innovation research shows this is a false dichotomy. Treasury does not need to issue loose rules to ensure high electrolyzer deployment rates. Clean hydrogen is already financially viable today without increasing emissions.

Instead, a loose framework could raise utility rates, make it tougher to meet clean energy targets, and threaten reliability. Loose Treasury guidance could also set the clean hydrogen industry up for failure once 45V expires.

Treasury can avoid this harmful outcome by adopting rules complying with three principles: additionality, deliverability and time-matching. Smart 45V guidance would set the industry up for success while accelerating utilities’ integration of new renewables.

How new electrolyzers affect the grid

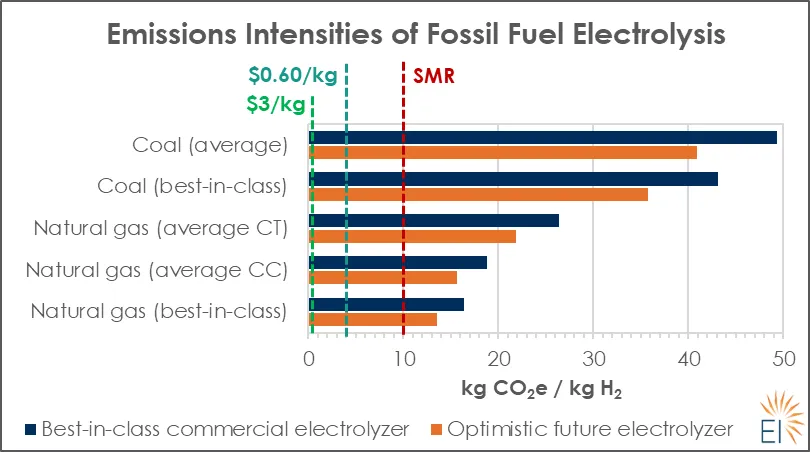

The Inflation Reduction Act’s 45V clean hydrogen PTC is worth up to $3 per kilogram for hydrogen produced with approximately 95% fewer GHG emissions than conventional processes, inclusive of upstream emissions. This is likely only achievable at scale via electrolysis, which uses electricity to split hydrogen from water.

Loose rules would allow electrolyzers to source power from existing clean energy facilities and annually match electricity consumption with clean energy generation, akin to corporate renewable energy certificate, or REC, procurements to offset their grid emissions.

But allowing this practice from existing clean energy sources, including nuclear and hydropower, would almost always cause fossil fuel power plants to ramp up. This would increase hydrogen production’s GHG emissions by as much as five times compared to today’s rates while raising power prices, worsening reliability risks, and slowing power grid decarbonization.

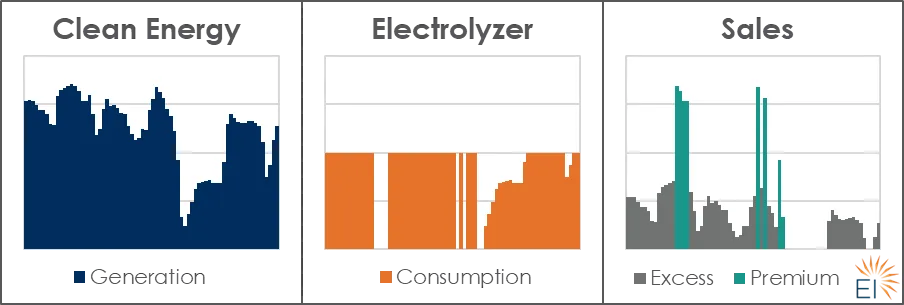

Well-designed rules will build a successful clean hydrogen industry that is self-sustaining after 45V expires. Under smart guidance, flexible electrolyzers will soak up excess wind and solar energy, then ramp down when such power is needed elsewhere. This will help integrate higher shares of variable renewable energy on the grid, helping utilities bolster reliability en route to a decarbonized portfolio. It will also provide heavy industries with access to plentiful competitively-priced clean hydrogen.

In contrast, loose rules would incentivize inflexible systems that consume power indiscriminately and are dependent on rich subsidies. The expiration of 45V would disrupt the new industry, either fueling indefinite tax credit extension demands or causing a wave of stranded assets that threaten job losses.

Loose tax credit rules could derail the industry

Loose Treasury guidance could thwart clean electrolytic hydrogen’s growth in two ways: losing public support for the industry and propping up business models dependent on subsidies.

First, loose rules will cause harmful side-effects from electrolysis, damaging its reputation. For example, if electrolyzers draw from existing clean energy, that demand will be backfilled by fossil fuel power plants increasing output — causing higher air pollution and GHG emissions. Adding much more demand without building new supply will also raise power prices and grid reliability risks.

These negative outcomes will harm hydrogen’s standing as a climate-friendly fuel at a tenuous time when the public is already wary about its transportation and use (consider Glass Onion’s portrayal). These problems could be compounded if utilities blend unsustainably cheap hydrogen into their pipelines for misguided use in buildings and power plants.

Poor guidance design will also complicate utilities building clean energy quickly enough to meet mandates or ensure reliability, jeopardizing the feasibility and popularity of state clean energy targets. For example, PJM is already struggling to interconnect new resources — adding huge new electrolysis loads without new clean energy could quickly worsen the situation.

Second, loose guidance will incentivize inflexible electrolyzer technologies and business models. For example, if electrolyzers can earn $3/kg tax credits from buying enough clean energy to match their operations on an annual basis, operators will run them around-the-clock to maximize revenues from the rich subsidy — equivalent to $60 per megawatt-hour before selling the hydrogen. This dynamic will lead developers to build cheaper, inflexible systems. They will also underinvest in hydrogen transportation and storage solutions since continuous electrolyzer operations will produce a steady stream of fuel for offtakers.

When 45V expires — after 10 years for a qualifying project and for any project beginning construction after 2032 — electrolyzers will need to price-hunt for electricity under $20/MWh to make price-competitive hydrogen. As they will run less often, they will also need to firm their delivery to offtakers via hydrogen storage or pipeline networks.

Yet, the projects spurred by loose guidance won’t have the operational flexibility, midstream systems, or business models in place to adjust to a post-subsidy world. This could create stranded assets and lost jobs, or an indefinite extension of the tax credit — all with higher GHG emissions.

Ultimately, poor tax credit design risks turning clean hydrogen into a policy boondoggle comparable to today’s continued support for ethanol. Congress began requiring ethanol blending in 2005 to cut gasoline emissions and advanced biofuel costs. After nearly 20 years, roughly 40% of U.S. corn production is dedicated to making ethanol, despite the fuel potentially worsening emissions compared to gasoline and doing little to reduce advanced biofuel costs. Yet, with a tiny fraction of this farm land, solar farms could power the equivalent mileage from electric vehicles.

But many farmers have become financially dependent on corn sales needed to meet the federal ethanol blending quota, making the policy politically untouchable. This dynamic was clear when members of Iowa’s congressional delegation removed a provision from the recent debt-ceiling bill that would have slashed support for ethanol production.

Without thoughtful consideration of how 45V will develop the clean hydrogen industry, electrolyzers could face a similar fate: poor business models propped up in perpetuity by tax credit extensions, with distortedly cheap fuel flowing to applications best served by direct electrification.

Three pillars would promote flexible, truly clean electrolysis

Treasury can support sustainable clean hydrogen growth by adopting 45V guidance that accurately measures GHG emissions from electrolysis. This is achievable through a framework that complies with three principles backed by a coalition of renewable energy and electrolyzer developers, midstream companies, think tanks, academics and non-profits:

- Additionality requires electrolyzers to draw power from new sources of clean electricity that were induced as a direct result of the electrolyzer coming online.

- Deliverability requires electrolyzers to use local sources of clean electricity that are physically deliverable to the electrolyzer, accounting for congestion and transmission line losses.

- Time-matching requires electrolyzers to run at the same time as clean electricity generation.

This framework is straightforward to implement: Electrolyzers need a power purchase agreement with recently-built clean energy resources and hourly RECs. The former provides evidence that the electrolyzer was at least in part responsible for the additional clean energy, while the latter contains locational and temporal data to verify compliance with deliverability and time-matching requirements, respectively. Hourly RECs are merely a more granular version of today’s prevalent annual RECs and are scaling across the country and world.

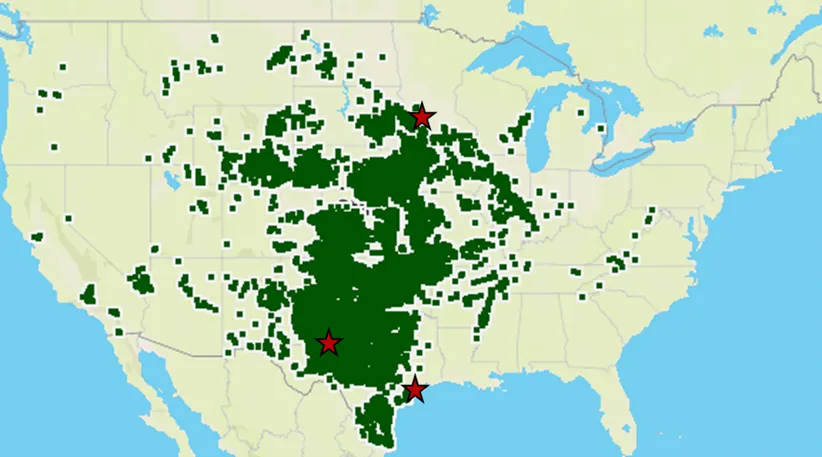

Energy Innovation’s analysis shows compliant projects are already financially viable in much of the U.S., with large profit margins to support investments in hydrogen storage and pipelines after paying down capital, operations, maintenance, financing and tax shield expenses. As clean energy and electrolyzer capital costs fall over time, more sites will become attractive across the country. The profitability of projects meeting these three principles has been verified by a range of analyses from stakeholders, including developers.

Electrolyzers complying with the three principles will produce truly clean hydrogen by ensuring they do not cause fossil fuel power plants to ramp up. These rules would also incentivize flexible technologies and business models that benefit from lower capital costs over time and are capable of price-hunting for cheap power after 45V expires. This includes investment in hydrogen transport and storage infrastructure to smooth gaps in production and provide consistent fuel supply.

Laying the right foundation

While loose rules may please industry stakeholders who would profit enormously from such a framework, they would worsen GHG emissions and derail the industry’s long-term growth. Instead, Treasury should have high confidence that 45V guidance adhering to the principles of additionality, deliverability and hourly matching will ensure a sustainable clean hydrogen industry. This approach will ensure clean hydrogen outlives the 45V tax credit and supports higher shares of renewable energy on the power grid.