Behavioral demand management isn't a new concept, but making it actually work is a fairly recent thing.

So, if Navigant's new predictions for growth of behavioral and analytical demand management seem steep, keep in mind that the sector is just getting started. The concepts have been in the works for a decade, but it is the hyper-connected culture of the internet which has unlocked their potential. Consumers now react to a wide range of signals through smart phones – they can track packages, pets, their children and the mail – why not energy, too?

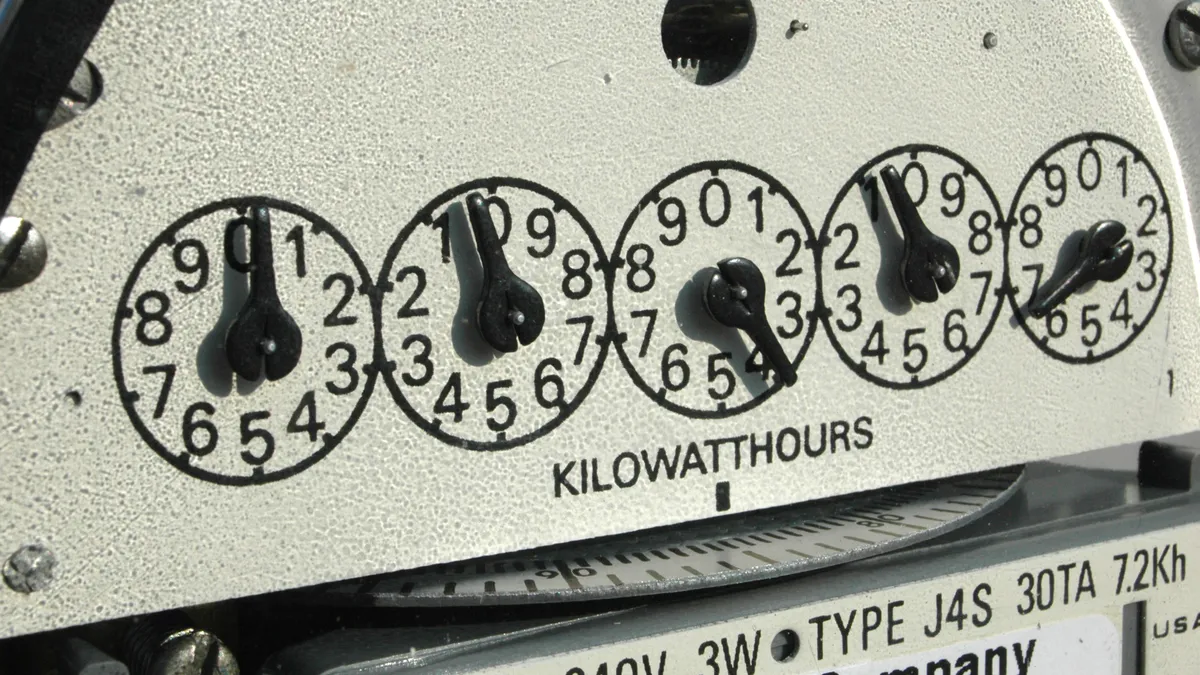

But if the nascent nature of behavioral DSM, which includes behavioral demand response (BDR), is underpinning its potential growth, it is also standing as a near-term barrier. Utilities are slow to change, especially when it comes to adopting experimental or unproven concepts, and it is only recently that evaluation and measurement of energy use — made possible by the widespread adoption of advanced metering infrastructure — has allowed BDR programs to verify how consumers were responding to their prompts. Those new findings are giving utilities the confidence to expand.

According to Navigant, worldwide spending on behavioral and analytical demand management will grow from about $215 million this year to $2.5 billion in 2024. And most of that is the United States. According to the firm's research, about $1.5 billion of that spending will take place domestically.

“It is starting from a very small base, especially internationally, so growth rates can be a little deceiving. Nonetheless, we do expect activity to pick up across the globe,” said Navigant Senior Research Analyst Brett Feldman.

Addressing peak demand is a part of the push, but so is customer satisfaction. Pilot programs have reported positive customer feedback, and Feldman said utilities see it as another way to engage with consumers.

“Ease of deployment is a key factor,” he said, pointing to small capital costs needed to start up a behavioral demand management project. “It is relatively easy for a utility to start a pilot program without much regulatory scrutiny. … It can be a low-cost way to reach a large swath of a utility customer base, on both the residential and [commercial and industrial] sides.”

In addition, the spread of dynamic pricing, smart thermostats and increasing regulatory pressure are all pushing utilities to explore a variety of demand management techniques. So if behavioral and analytic programs are cheap and effective, what's holding them back?

Pushing the market through one barrier at a time

While the growth potential is huge, there are a half dozen barriers to entry that, at least in the short-term, could keep the market from growing.

While states like Hawaii, California and New York have taken proactive approaches to transforming the utility industry, they remain the exceptions. Utilities are slow to embrace change, at least in part because of the regulated nature of their operations in many states, and while the beginnings of a shift to a "service provider" platform may be evident, it is not ubiquitous.

"Traditional utility business models are based on increasing profit by increasing electricity sales," Navigant said in its report. "Therefore, some utilities are resistant to changing roles from a commodity provider to a service provider and embracing technologies that empower customers to reduce their energy consumption, thus reducing electricity demand, decreasing electricity sales for utilities, and threatening profits."

But beyond the persistent existential threat to the utility business model, it is the short history of these programs which often holds them back, which companies are rushing to address.

"Measurement and verification is a very big issue with these programs," Feldman said. "There is a small but growing body of evaluations that have generally shown statistically-significant savings."

That was the takeaway from Opower's announcement last month: That its expanded deployment of behavioral demand response programs had returned consistent results, largely unchanged from the summer before. “In the utility industry, it's important to remember there is a lot of skepticism for things that are new,” Josh Lich, Opower's director of product marketing, told Utility Dive. “The most common question we get is, 'Are you reliable?'"

So far, Opower believes its product and BDR in general are reliable resources. And the ability to return consistent results is not just about predictability. If utilities can count on the results every time, then demand response can participate in wholesale markets and as a capacity resource for planning.

“One of the strongest use cases we're seeing is using this as a resource that is relied on in a wholesale market,” said Nick Payton, Opower's associate director of product marketing and strategy. The company expects its programs to participate in at least one wholesale market next summer, he said.

But even if behavioral and analytical programs worked last year, this and next, there continue to be questions about their future efficacy. At its heart, the BDR concept relies on consumers responding to utility messages regarding conservation. But if customers tire of the message, will they continue to respond?

"Persistence is another issue that will have to be addressed over time. As the programs scale from pilots to full implementation, higher cost-effectiveness and performance metrics will need to be met," Feldman said, looking ahead. "On the other hand, these programs are not always implemented purely for energy savings," he added, but also from a customer engagement and satisfaction perspective.

"The budgets may come out of marketing buckets, in which case the direct energy savings results are not as critical," Feldman said.

The full potential of BDR is not yet known. Highlighting both the potentials and the unknowns, a BDR program run by People Power in Hawaii this year – operating with only a mobile app and a customer's internet connection – helped reduce usage by 10%.

Opower has produced perhaps the largest and most consistent field research when it comes to BDR. The company, in consecutive years, has now shown its programs can reduce peak demand by 3% without any kind of device or corresponding rate – and it can shave peaks down by 5% when a variable rate is also employed.

The company saw that result when it tested BDR with 1 million participants in 2014, finding similar returns as it scaled up by 50% and went international. Opower also announced this week that Hydro Ottawa customers hit that 3% figure over more than a half million personalized communications.

Could utilities go it alone?

Perhaps one of the most surprising wrinkles in the Behavioral DSM market that Navigant identified is the simplicity of behavioral and analytical demand management programs. That is, by no means, to argue that the programs are easy to execute. But they largely rely on analyzing data that utilities already have, and then translating that into a call for action.

A few years down the road, there's a very real chance utilities will pause and think, "Could we do this ourselves?"

Increasingly, third-party energy companies are data companies. They don't own wires and generation, but databases and predictive models which have the potential to act like energy capacity. While right now that's a fairly specific knowledge base, it also presents a very low barrier to entry that utilities may attempt to tackle themselves. But probably not just yet.

"There is still a level of analytics and intellectual property that each individual utility does not have the resources to develop, so it is still easier for them to outsource it," Feldman said. "I would first see competition between more vendors to bring down the cost."

But again, these behavioral and analytical programs are still evolving, and utilities will eventually get the hang of it.

"After the utilities have some experience and some of the system architecture built into its IT infrastructure, they may be able to maintain existing programs," Feldman said. "Finally, they may be able to develop their own capabilities or build onto the platform from the vendor."

Feldman said there is a spectrum of behavioral and analytical DSM programs, beginning with basic and broad calls for conservation. But studies show that the blunt-force and scattershot approaches of demand response are largely ineffective, and that the ability to personalize a call to action is key to engaging consumers.

California's generic Flex Alerts returned no reductions in power demand related to the emergency calls for load shedding, according to a 2013 study. An academic paper last year titled “The Perverse Impact of Calling for Energy Conservation” actually found no peak load reductions — and even some small demand increases — in response to mass media calls for conservation.

"You could have a very simple behavioral message without any analysis, but in reality a lot of behind-the-scenes thought goes into segmenting the data and personalizing messages based on usage and demographic characteristic," Feldman said. "Analytical tools are all good and well if they can provide information for a building owner about its facility, but unless the output is easy to understand and provides actionable outcomes, it won’t get the desired result."