From smart meters and cyberattacks to rooftop solar and energy storage, new technologies—and the problems they bring—have the potential to disrupt the utility industry. After remaining relatively unchanged for the last 100 years, the grid is facing a host of new challenges that are evolving utility business models, changing consumer expectations and causing regulatory models to adapt.

These concerns were on every panelists' mind at the National Town Meeting on Demand Response and Smart Grid in Washington, D.C. From July 9-11, utility executives, smart grid technology providers, system operators and regulators convened at the Ronald Reagan Building and International Trade Center to discuss the biggest challenges the industry faces today and in the future.

Here's what some of them had to say.

1. CYBERATTACKS

Blake Young, CEO, Comverge: "I think [cyberattacks have] put a damper on the attractiveness of the cloud for utility CEOs in terms of their trust. To be quite honest with you, there are aspects of the cloud that the security architecture that you’re able to shape and craft outside of the cloud cannot be mimicked or replicated on the cloud. So I think the concerns are valid."

Richard Mora, President and CEO, Landis+Gyr: "I’ll communicate a conversation I had with a CEO, large utility U.S., and he said, ‘Richard, the worst thing I fear is waking up one morning and seeing my name splashed across the Wall Street Journal about some sort of cyberattack. What can you, as a provider, do to prevent that?’"

Donna Nelson, Chairman, Texas Public Utilities Commission (PUC): "Cybersecurity is an issue everywhere and it’s something that I think the commission, ERCOT and all the stakeholders, including the transmission and distribution companies, are very vigilant about. The thing I worry about as a regulator is us talking about it all the time because it just draws attention to it. When I talk to people in the security industry, the worst thing you can do is put a front page article in the Wall Street Journal about it because it just draws attention to it. So I, for one, am glad we’ve moved onto other discussions. We can continue to do our work on cybersecurity and move forward."

Cheryl LaFleur, Commissioner, Federal Energy Regulatory Commission (FERC): "I think, now that I’ve been here a few years, I can say things like this: the Beltway has a very short attention span. And so now all the headlines have moved onto immigration or whatever’s next, but I think cybersecurity is still a front-burner issue at FERC and for the industry. Not necessarily specifically cybersecurity of AMI, but that’s part of cybersecurity in general. We just voted out the proposal to approve the fifth generation of NERC cybersecurity standards, which are really just foundational. They don’t do anything that has to be done. We’re working the President’s Executive Order on voluntary framework and 40% of the hacking attacks are on the electric grid in the country. So I think it’s a top of mind issue. It has to be, it’s not going to go away. All it would take is one incident to put it right back on the front page. I think what’s ebbed a bit is the thought that there will be cybersecurity legislation this year."

2. CUSTOMER EXPECTATIONS

Paul de Martini, Managing Partner, Newport Consulting Group: "We are in a world of personalization. Now, we may not be there in electricity or maybe natural gas but, in almost every service we have in our lives, there’s personalization. And we’re not going to be able to have a different model in the electricity industry than how any of us—we’re all customers—interact with other service providers. So […]these traditional ideas of class averages and uniform pricing, we have to move beyond that.

We have to be able to think about how we evolve to a world where we have differentiated services that involve the ability for the customer [to have], in some cases, at their option, simple choices where they might actually get paid for some service where they are contributing or, in some cases, where they can save money. It really comes down to we’ve tended to overcomplicate because many of us are deep into the weeds on these topics. At the customer level—even me as a customer—am I saving money or am I making money? It’s really that simple as a starting point. If we can reduce things to that level, then I think it becomes more beneficial. Frankly, if you look at the sales pitches that the solar PV industry is using, it’s real simple—you save money. Here’s how much you save, some percentage off their bill, not some price, but here’s the amount on your bill. And it’s very compelling."

David Springe, Consumer Council, Citizens’ Utility Ratepayer Board: "What I would love to have is a clear-cut case to take before customers and say, ‘We spent this money on technology and I saved you this amount of money.’ Because the reality is smart grid is incredibly important, and smart meters are incredibly important, building transmission is incredibly important, retrofitting power plants is incredibly important, the list goes on. If you look at what’s happening at the consumer level, the clamoring from consumers is ‘stop raising my rates.’ This is Kansas but I’m in the middle of a case with our local utility, Westar, who has had 18 rate increases since January 2009. 18 rate increases, $469 million and a 15 kWh consumer bill, which is kind of average ranch house in Kansas in the summer using an air conditioner, has gone up 55%. And we don’t have smart grid and smart meters yet. That’s still on the drawing board.

I’ve yet to have a customer call me and say, ‘I wish I had a meter that I could tell what was going on in the middle of the day,’ but I get a lot of calls about cost. So I think the leadership challenge that you hit on is figuring out how to lead consumers forward, and I will tell you, consumers, at least at the residential level, sort of the bulk consumer base, are not on board with this. They’re not on the train. They’re not reading the book. They don’t know what you’re talking about. They really don’t when you talk about meters and grids and all these things. It’s difficult in the cost challenges and rate challenges that we have to figure out where we can find places to say, ‘look, we can advance the ball, we’ve got technology to do these things’ and do these things in a way that customers are comfortable with. Do it in a way that customers feel protected because there are a lot of consumer protection concerns and a lot of people struggling to their bills. The technology provides a lot of scary, scary things for those customers."

3. DEMAND RESPONSE

Alex Laskey, President and Founder, Opower: "Let me risk doing a quick experiment here. How many people here—show of hands—participate in your own utility’s DR program? [Very few hands go up in the audience] So, roughly, I don’t know, 10% of the audience, and this is a room of people who live, breathe, eat demand response. That’s the problem. We have, in the U.S., roughly 5% of population participates in demand response. And the market is not that everybody should be participating, not everybody has capacity, not everybody has air conditioning, not every part of the grid is congested.

But this is the opportunity [Opower] saw. There are 7 million homes on demand response in the U.S. There are 16 million homes we have in our program with utilities helping them drive efficiency and engage customers. And we saw one of the big challenges, even when the technology exists and even when the regulatory policy exists, one of the big challenges for demand response, particularly residential demand response, is the customer engagement, getting the customer to sign up. Roughly half of the $700 million that’s spent every year on residential demand response by utilities goes to customer incentives. And it’s an incredibly expensive way to do this. If you can transition customer incentives to actual bill savings vis-à-vis energy efficiency, there’s a huge opportunity."

Donna Nelson, Chairman, Texas PUC: "The best demand response product in my mind is when load backs off based on their value and then you have a perfect balance of supply and demand. People pay what they want to pay and don’t pay if the prices are too high."

Blake Young, CEO, Comverge: "A couple years ago on this panel we were talking about the fact that DR is a smart application of the grid, it’s going to add more value—we know that’s true. Brattle put out some very interesting studies here if you look at ConEd recognizing that investing in DR on the heels of AMI would drive another billion dollars of benefits at a cost of roughly $300 million. Same type of study for Ameren Corp: $900 million value if they implement DR on the heels of AMI at the cost of $300-ish million. Remarkable proof that the staying power of DR can drive a lot of value to utilities. [...]

In capacity markets, I think there is probably a view that there is DR saturation in some zones. I mean, if you look at PJM, DR is maybe 20% in some cases. Now, I think there are a lot of arguments on why that shouldn’t be the case but the reality is I think there’s a view that as an emergency resource, you probably top out at some point. The next evolution of this that should stimulate more interest and growth is how do you get DR beyond just the emergency response level and position it as a first call resource operationally?"

4. DYNAMIC PRICING

Paul A. Centolella, Vice President, Analysis Group: "I think there is a potential for there to be a tremendous value, even at the residential level, but I think we’ve approached the residential customer in really the wrong way. We have treated demand response as though it has to be behavioral change. […] What we need to do is give the customer tools that can begin, for example, to automate their response to a dynamic price, to allow them to have a very inexpensive way that their thermostat, their water heater, their refrigerator, their pool pump can know that it’s better for me to operate in this five or fifteen-minute increment or better to operate an hour or two hours from now.

We do this in all other segments of our economy. We rely on Kayak to pick our air fares and our hotels. We have Pandora which matches our preferences for music. Why can’t my thermostat find the lowest price and match my preference for comfort? It’s all a matter of creating the right amount of automated choice engines, the right kind of tools and enabling that residential customer, as well as the commercial and industrial customers, to participate in a meaningful way without having to watch an app on my smartphone to know that I should be turning down my air conditioner. I think we made a fundamental mistake when we look at as, well, all we have to do is give meters and information and behavioral change will happen. Behavioral change is much more difficult than that. [...]

I think it depends on having a more integrated strategy than just rate plans. I think as a commissioner, you get pushback with going to more dynamic pricing, if that’s all you’re doing. But if, at the same time, in a process of making a transition to that, you’ve also made tools available such that consumers can have automated responses to those prices, then a lot of the objections that otherwise would be there can go away.

You have to have this integrated strategy rather than thinking about it as pricing alone. You do have to pay attention to vulnerable customers, but what we saw form the data in our pilots in Ohio was that lower income customers tended to have load shapes that were less peak oriented [and] tended to be winners if we went to some form of time-of-use or dynamic pricing. Saying we’re not going to reflect differences in the times when people use electricity and differences in those costs, was actually a very expensive way to try and 'protect' customers. There are much better ways of doing that, if that’s your concern."

5. SMART GRID

Alex Laskey, President and Founder, Opower: "The EU mandated 80% smart meter roll-out by 2018, which is very fast because, basically, the roll outs have been pretty paltry to date. At the same time, the EU passed an energy efficiency directive requiring each country to reduce consumption by 15% over a 10-year time horizon.

One of the key things, if you read the text of the smart meter roll-out, is there’s an out if the utilities or countries determine that there isn’t a positive business case for rolling out the smart meters. It’s an 80% requirement if there’s a positive business case. The business case is fairly thin without demand response and without energy efficiency. And so the question is, can the people in this room and the businesses represented in this room, whether they be utilities or service providers, help the utilities and national governments in Europe build these business cases in a way that robustly includes demand response because, if it doesn’t, these meters aren’t going to happen."

Robert Ethier, VP of Market Developments, ISO-New England: "How will the smart grid make network operators’ lives easier? It’s not going to change what we do, but it’s going to change how we go about doing it. We’re still going to have all of the same basic functions that we’ve always had, but hopefully we’ll do them in a more efficient way and in a way that gets better outcomes. We’re thinking about, for example, commitment and dispatch—software has improved that greatly over the last several years. When I first started at the ISO, which wasn’t that long ago, we were still calling up generators and demand providers and saying, ‘we want you to do this.’ Now that’s all automated, which seems trivial but it actually took a while to get us to that point.

So I look forward to more smart grid technologies improving the efficiency with which we do the same jobs. We’re still going to have to plan the system, we’re going to—at least for the foreseeable future—have to dispatch the system, we’re still going to have to run the markets everyday. But all that’s going to be better. There are going to be more players, it’s going to be easier for them to interact with us. Look at DR aggregation—the technology has enabled that immensely in the last ten years so that now you have an EnerNOC with thousands of customers or thousands, honestly, for all I know. And they are all dispatched by EnerNOC pretty seamlessly and we just see the results. That is tremendous progress and I think it actually makes us more efficient at what we do, but it’s not actually making it harder for us."

6. CAPITAL INVESTMENTS

Richard Mora, President and CEO, Landis+Gyr: "You’re talking about money. I always wish I had more of it, no doubt. But, listen, I think the industry is strong. If there’s a very strong business case, the utilities I work with are more than willing to make the investments. There’s certainly always a prioritization around that but, if you have the strong analytics and you can prove to the regulators that in fact this is good for their consumers, more often that not you will get the nod. At times there are frustrations around the cycle, in terms of how long it takes necessarily to do that, but the markets are ripe and utilities are willing to make those investments."

Peter Scarpelli, Global Director of Energy and Sustainability, CBRE: "My biggest barrier, and it has nothing to do with meters per se, is probably the cost-benefit to building automation. It’s great to have smart grid and I want that infrastructure, but being able to control the lights in the building simultaneously with that—that’s my biggest challenge. The barrier is the money. I’ve seen business cases that sometimes say the ROI is 6 months and sometimes it’s 50 years. My biggest barrier is access to capital because in some of these buildings, [...] the building automation system may not be up to snuff today."

Steve Kidwell, Vice President of Corporate Planning, Ameren Corp: "Given current business conditions, we have to choose between earning our allowed return, which is what the commission has said we should earn [although] we’re usually under-earning it at this point, or you invest for the long-term. […] You can’t do both really."

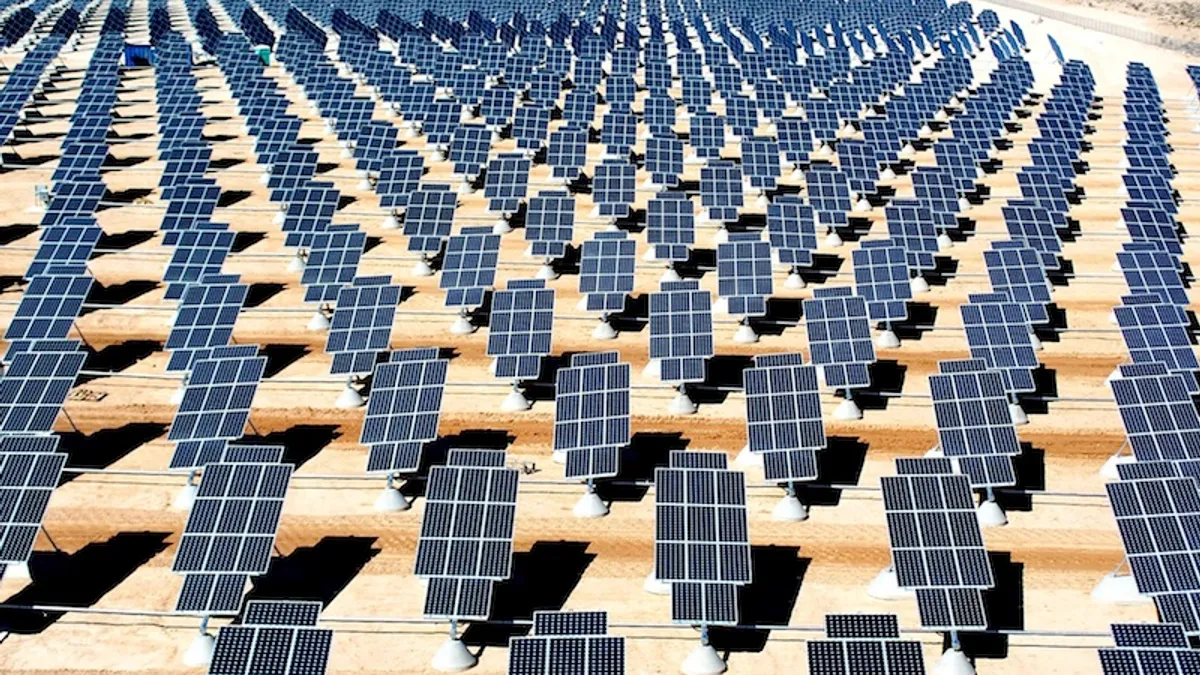

7. DISTRIBUTED ENERGY RESOURCES

Cheryl LaFleur, Commissioner, FERC: "This is something I have pretty strong views about, so I’ll just proselytize. I think that the best thing for this industry is not to present [microgrids and distribution generation] as a destructive force but part of the core business of the people delivering electricity. It’s all about cost to the customer, reliability and reducing environmental impacts. The products you all sell can help on all of those and that’s the core business.

I’m looking at a guy from Southern [Company], the most traditional vertically integrated fossil and nuclear [utility], and they’ve done a ton with smart grid. That helps with their distribution reliability, with their customers. Earlier this week I met with Princeton, the folks who run the microgrid that got a lot of national headlines for staying on during Sandy. They do a lot of very sophisticated things, they use their gas turbines to sell frequency regulation to PJM, but they’re still interconnected. T hey’re still part of the grid. So I hope this discussion is a little bit of a red herring. If we put bike paths and pave the roads in our community, will that mean that nobody uses the state highways anymore? No, because they fulfill different functions. So I’d say the future is integrating into the old way instead of being seen [as a destructive force]."

Russ Feingold, Vice President, Black and Veatch: "Those utilities that maybe don’t have in their DNA, to the same degree as others, the wherewithal to let go of some of the control of transactions may not be as receptive to going after those kinds of value propositions. But I think it’s not that they’re not going to do it all, I think it’s just something where they’re going to be playing catch-up."

Paul A. Centolella, Vice President, Analysis Group: "As a former [commissioner of the Ohio Public Utilities Commission], I try to think of [distributed energy resources] in what’s the value proposition for customers. And I think there are really three. One is it improves asset utilization and reduces the amount of investment that’s ultimately required. Historically, we have, for the last decade, been at 45-50% capacity factors for generation. That’s well below what we see in other capital-intensive industries, which are typically over 75%. We can substantially improve that if we improve load factors.

Secondly, in many areas we need flexibility. Paul [De Martini], you’re familiar with what’s going on in California, Cal ISO is out there saying by 2020 we may have situations where the coincidence between the fall off in distributed PV and the increase in evening peaks means that we may have to change our net load by as much as 50% over a three-hour period. We need a lot of flexibility and, potentially, this can provide that.

Finally, in New England, the Northeast and much of the rest of the country, there is increasing regulatory focus in how do you make the grid more reliable, more resilient. And to the extent that we can have demand or distributed generation that actually responds to the immediate operating conditions on the grid, we can begin to do that in a more reliable and cost-effective way. So I think this plays a very important role but it fundamentally changes the function of a utility. You know, a distribution utility becomes a system operator in much the same way that RTOs are system operators at the transmission level and so it creates a whole new value function, but also a new challenge in terms of investment on the distribution utility side."

Steve Kidwell, Vice President of Corporate Planning, Ameren Corp: "I think, as we look at microgrids, […] we do want the opportunity to see if this is an area that we might be able to invest in, in a way that makes sense—in our case, in a rate-regulated model. If it doesn’t, then that’s something that at least today Ameren is not interested in. But we’d like to figure out if there’s some way of figuring out whether at least some piece of microgrids might be something that we could actually invest in. Other than that, the first thing that comes to mind is safety and just making sure that we’ve done everything we can to make sure line workers are protected in storm situations […], making sure that transfer equipment is in place so that there isn’t an ability to damage our equipment, make sure that when you go into islanding mode, you’re really islanded. Talking about the regulatory dimension, […] there may some ways you want to cooperate and go to the commission with a proposal that might provide some value to the utility."

Mike Carlson, General Manager for Software Solutions, General Electric Digital Energy: "You talk to the military and they’ve got a different concept of a microgrid than community-based energy. I think the [term] distributed energy resource encompasses it from the perspective of what are you trying to do? Is it resiliency, reliability? Is it separation? And one of the things we’ve got to be careful about—speaking from the utilities’ perspective—there’s a lot of infrastructure that gets paid for through utilization.

I’m not aware of any model that says, I’m going to pay a connect convenience fee but I’m never going to use unless all my infrastructure that I didn’t put resiliency into fails. So there’s got to be a model that promotes the value that microgrid and cogeneration can create, but you can’t do it at the expense of the utility or the rest of the consumers who don’t elect to go down this path. And our rate-making models, for the most part, tend to penalize the person who stays connected into a rate structure [and] rewards the guy who stays disconnected. Eventually, the hockey stick occurs in that we see more demand and this becomes a material impact [and] you’re going to have to see a rate-making and regulatory response to it."

8. ENERGY STORAGE

David Owens, Executive VP of Business Operations, Edison Electric Institute: "I would say, probably, if it existed, the most disruptive technology would be storage because it could reduce the need for the wires portion of our business. If customers were able to put on rooftop solar, and if they had constant, reliable storage—I mean battery or some other technology that sustained their use—[they] certainly would still have to use the traditional system as a backup, but that, to me, would the most disruptive technology. Because—even though I don’t believe the word ‘independence’ would exist—there, the customer would believe that they have a level of independence from the utility. It would occur, clearly, with your large industrial customers and your large commercial customers—the customers that pay a substantial part of our revenue requirement. […] I also believe that the energy storage would create a whole new set of opportunities for the industry. […] But, certainly initially, it would be very disruptive."

9. TRANSACTIVE ENERGY

Paul de Martini, Managing Partner, Newport Consulting Group: "Transactive energy captures the idea that for distributed resources, whether it’s demand response or flexible generation or storage as that’s coming or electric vehicles or any customer resources that can respond to economic value or engineering signals, we would be able to engage those resources and managing markets and grid operations, both at the transmission and distribution level. While it sounds very futuristic, really we’ve already been doing this for some time, in terms of how we’ve done price-responsive demand response or other forms of dispatch of on-site generation that customers have had in place, in many cases for some time. What we’re talking about, though, is: as more distributed resources scale up, how do we do this from both an economic but also from a control system standpoint, making sure that this in fact scales and we maintain a reliable grid?"

10. EVOLVING BUSINESS MODELS

David Owens, Executive VP of Business Operations, Edison Electric Institute: "I think the utility should have the opportunity to be a full-service provider. So, yes, I think they should be able to participate in rooftop solar. I also believe […] there are a series of alliances and partnerships—as I view the utility of the future—that utilities have to engage in. We can’t invest in every dimension of the system, so we have to partner with others. But certainly I believe we have to have the ability to be in rooftop solar. I think we need to be able to provide a range of services behind the meter. Traditionally, we haven’t provided services behind the meter [and] I think we should have that opportunity. I’m not saying we’re the experts, but we can partner with others that are.

So, I say, ‘open it up.’ I also believe that that, too, suggests a whole different way of pricing the products. […] There will be those companies that say, ‘I don’t want to be a full-service provider, I just want to be a wires company.’ And even a wires company is going to have a whole set of new challenges because […]we’re going more to variable generation—renewables, things were we don’t have dispatchable generation and forecastable demand. We have a very dynamic system now. So even if you’re just in the wires business now, the wires business has automatic controls, monitors, all types of solid state devices, which is a whole new business opportunity in my view."

Paul de Martini, Managing Partner, Newport Consulting Group: "[…] How do we think about the new business models? […] Is there more money to be made in the way it is now versus the way it could be? I would argue that it’s the way it could be. […] Keeping it the way it is is a losing proposition. […] We need to […] explore how an integrated approach creates more value for everybody in the end run. Now, what does it all look like? There’s a lot of sticky issues that have built up over 100 years. There’s no question about that, but can we stay on the same course, the status quo? I think it’s pretty clear: no. All you have to do is look at some examples. For example, in Germany, […]it’s pretty clear there they’ve gotten past the point of no return and they’re having to make some more draconian changes to get caught back up and on an even keel as an industry. So I think the time is right here in the U.S. to start having these discussions. It’s been talked about, it’s coming faster or slower, depending on where you’re at, but we need to start having the conversation about integration."

Would you like to see more utility and energy news like this in your inbox on a daily basis? Subscribe to our Utility Dive email newsletter! You may also want to read Utility Dive's look at DOE Assistant Secretary Patricia Hoffman's vision for the smart grid.