Dive Brief:

- Tesla posted mixed fourth quarter earnings this week, reporting its highest revenue ever ($3.3 billion) and a smaller loss than analysts had anticipated—just over $3/share non-GAAP. In a letter to shareholders, CEO Elon Musk said sometime this year the company expects to begin generating positive quarterly operating income on a sustained basis.

- But the company anticipates "major growth" this year in its energy storage deployments as it plans to deploy triple the amount of storage capacity compared to last year. However its solar business appears to be slumping, despite a recent partnership with Home Depot to sell rooftop solar arrays.

- Tesla has yet to turn a profit and production of the Model 3, the company's affordable electric vehicle, has been slow. Capital expenditures were almost $790 in the fourth quarter of last year, with most of that attributable to Model 3 and Gigafactory 1 production capacity, were it produces battery cells for its cars and energy storage products.

Dive Insight:

Tesla this week launched one of its cars into space, but is still waiting for that first quarter of profits. While the company was focused on building cars last year, Musk says Tesla is ready to significantly grow its storage business by tripling the amount of storage capacity it deploys.

In December, Tesla completed a 100 MW/129 MWh battery facility that will help to stabilize the electric grid in South Australia. But even that project is emblematic of the challenges faced: Greentech Media points out that Tesla turned to Samsung for the actual batteries to meet the accelerated project schedule.

The Australian deployment, the result of a high-profile wager where Musk said Tesla would eat the costs if it missed a 100-day deadline, has apparently been good advertising.

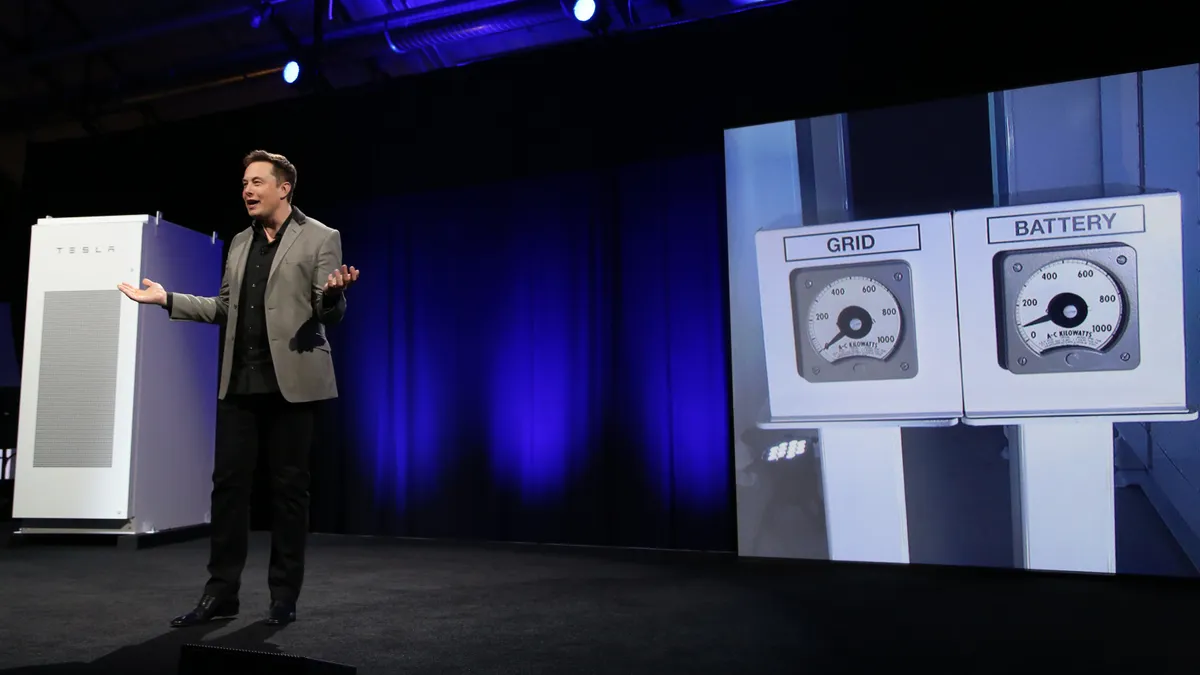

"Due to the success of this project, we're seeing an increase in demand for Powerpack, our commercial energy storage product," Musk told shareholders. "With more electric utilities and governments around the world recognizing the reliability, environmental, and economic benefits of this product, it’s clear that there is a huge opportunity for us in large scale energy storage."

In the fourth quarter of last year, Tesla deployed 143 MWh of energy storage products, growing 45% over Q4 2016. That figure does not include the 129 MWh in Australia, which will be accounted for in the first quarter of this year.

Tesla also deployed 87 MW of energy generation systems in the fourth quarter, a 20% decline from the third quarter of 2017. Solar deployment slowed in part because the company is shifting its focus to profitability and higher-margin-projectsm, Musk added. Deployment was also impacted by a shortage of Powerwalls.

"While volumes may continue to be impacted by these factors over the near-term, we expect growth to

resume later this year," Musk said.

The payment model for residential solar deployments has been changing as well. Musk said the mix of residential solar sales "continues to shift towards cash and loan as compared to leasing." System ownership reached 54% last quarter, up from 25% in 2016.