This opinion piece is part of a series from Energy Innovation’s policy experts on advancing an affordable, resilient and clean energy system. It was written by Sara Baldwin, electrification director, and Hadley Tallackson, policy analyst.

Last year’s shocking winter heating prices are back with a vengeance: Natural gas heating costs are expected to rise 28% compared to recent winters. One in six households are already behind on their utility bills, and national utility bill debt doubled from December 2019 to June 2022, according to the National Energy Assistance Directors Association.

While household energy cost price spikes across the United States feel like déjà vu, the overall energy picture has changed drastically since last year. The Inflation Reduction Act’s historic clean energy investments will accelerate deployment of utility-scale renewable energy and energy storage, distributed clean energy resources, and high-efficiency electric technologies.

However, state action is necessary to fully mobilize IRA investments and reduce consumer energy burdens. By acting now, state policymakers and utility regulators can put more consumers and communities on a path to long-term energy affordability and mitigate the impact of future energy price spikes.

Compounding pressures are causing an affordability crisis

Energy market disruptions from Russia’s Ukraine invasion on the heels of the COVID-19 pandemic have led to fuel shortages and surging natural gas prices, while extreme temperatures are raising heating and cooling demand. As a result, more households are experiencing record-high gas and electric utility bills, with average 2022 price increases for natural gas outstripping those for electricity.

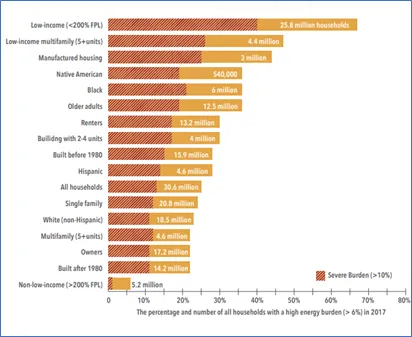

These risks have disproportionate impacts on lower-income households, people of color, renters, older adults, and those living in older housing. According to research from ACEEE, low-income households on average face an energy burden three times larger than that of non-low-income households. As pandemic-related moratoriums on utility shut-offs expire, more energy-burdened households unable to pay rising bills risk service shut-offs.

Meanwhile, the need for utility investments in grid upgrades is growing. An ICF study estimates a $500 billion utility investment gap for resiliency measures to deal with rising temperatures, extreme storms, and wildfires. Utilities will also need to pay for infrastructure expansion and grid modernization to meet new load growth from electrification of buildings, transportation, and industry.

All these factors could make energy costs unmanageable for more households — but federal funding can provide some relief.

The Inflation Reduction Act will help tackle these challenges

Funds do exist to manage rising energy burdens. Congressional funding for the Low Income Home Energy Assistance Program, or LIHEAP, which helps eligible households pay energy bills and avoid shut-offs, has more than doubled in recent years. States and local governments can also draw on COVID-19 relief measures including the Emergency Rental Assistance Program and the Local Fiscal Recovery Funds to alleviate energy burdens.

But short-term and intermittently funded bill payment programs do not address long-term energy affordability and building performance.

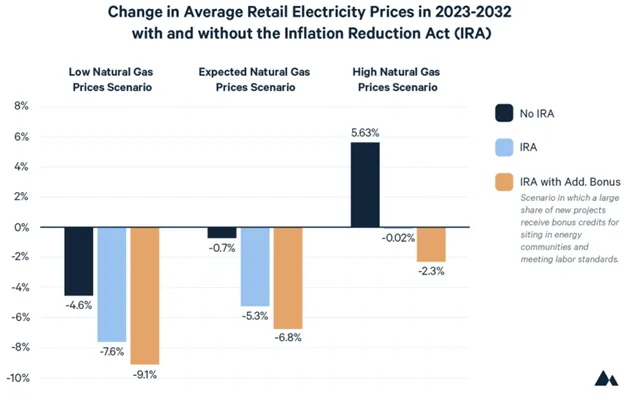

The IRA makes a sizable down payment on long-term energy affordability by investing in cheaper clean energy, home efficiency, and weatherization. Energy Innovation Policy & Technology modeling shows IRA grid decarbonization incentives could achieve a 75% to 85% clean grid by 2030. And Resources for the Future analysis shows a cleaner grid will save U.S. households $170 to $220 on their energy bills every year. These benefits are already showing up — in Florida, Duke customers will receive a $56 million refund on their rates in 2023 thanks to the IRA’s solar incentives.

Consumer-focused provisions for energy efficiency, electrification, and home clean energy generation can further reduce energy bills, including:

- High-Efficiency Electric Homes Rebate Program: High-efficiency electrification upgrade rebates, with up to $14,000 for low-income and moderate-income households

- Home Energy Performance-Based Whole-House Rebates: Rebates for home energy savings, ranging from $2,000 to $8,000 depending on total energy savings and household income

- Residential Energy Efficiency and Clean Energy Tax Credits: Tax credits up to $2,000 for heat pumps, $1,200 for efficiency upgrades, and up to 30 percent for home energy generation including solar panels, geothermal heat, and battery energy storage.

Enduring energy affordability requires sustained state leadership

But to ensure these incentives deliver substantial and equitable savings, states will need to focus on smart coordination and IRA implementation. For their part, utility regulators should center equity and adopt innovative ratemaking to deliver enduring energy affordability through three strategies:

1. State agencies, regulators, utilities, lawmakers, and tribal governments should coordinate to ensure consumers benefit from IRA customer incentives as soon as funds are available.

State agency and tribal government coordination to deploy IRA funds quickly and efficiently will provide relief to consumers struggling with high energy costs. State energy offices and tribal governments should familiarize themselves with the details of various IRA programs and develop strategies to streamline program requirements, such as verification of low- and moderate-income consumer eligibility and demonstration of measured and modeled energy savings. State energy offices should also work closely with the U.S. Department of Energy, which has established a dedicated Office of State and Community Energy Programs to assist with implementation.

Utilities, along with their regulators and governing bodies, should proactively coordinate with State energy offices to determine how utility efficiency programs can complement IRA funding so households receive the maximum possible efficiency and electrification support.

States and utilities that already offer programs targeting low- and moderate-income households should work to increase enrollment, as communication on affordability support programs has been reported to reach only a nominal percentage of eligible households. New outreach strategies, improved information accessibility, and simplified application processes can help. Auto-enrolling households for affordable bill programs if they receive other income-based assistance (such as LIHEAP or the Supplemental Nutrition Assistance Program) can reach more households.

State lawmakers and local governments can address short-term challenges through programs such as arrearage relief and payment plan support for low-income customers and those behind on energy bills.

2. Utility regulators should adopt and implement an energy equity framework to guide decision-making and prioritize those who need it most.

In addition to maximizing IRA incentives, adopting an equity framework can guide regulatory decision-making to relieve energy burdens for low-income ratepayers. For example, California’s affordability framework for rate increases considers three household affordability metrics: energy burden (calculated as an affordability ratio), hours of minimum wage worked, and a measure of community vulnerability. These tools can help utility regulators make informed decisions based on how rate increases impact the most vulnerable households.

Equity frameworks can also bring community voices into regulatory decision-making, generating more equitable outcomes for clean energy access, ratepayer affordability, and pilot projects. For example, extensive community engagement and listening sessions during development of Illinois’ Climate and Equitable Jobs Act resulted in equity-centric programs, including creating a Renewable Energy Access Plan for equitable decarbonization.

3. State utility regulators should consider innovative regulatory mechanisms to advance energy affordability writ large.

Innovative ratemaking can lessen affordability pressures in the context of climate change and decarbonization imperatives. States can tailor various examples of successful policy to fit the unique needs of their utilities and their customers. Three approaches are worth highlighting:

Income-based rates can reduce energy burdens for those most struggling to pay rising energy bills. For example, Connecticut’s newly piloted discounted rates address energy burdens for the most vulnerable consumers. More manageable bills for lower-income customers also leads to lower arrearages, thus avoiding the need for the utility to collect those debts from all customer classes.

Performance-based ratemaking, or PBR, directs utilities to align profit motives with defined performance metrics based on policy and regulatory objectives, rather than rewarding utilities solely for infrastructure and capital investments. For example, Hawaii’s PBR reduced customer rates nearly $70 million through 2025 based on a “customer dividend” in the commission-adopted PBR framework.

Requirements for gas and electric utilities to file joint plans for infrastructure investments can further minimize ratepayer costs, based on changing usage and demand. This novel approach can identify growth assumption incongruencies and planning methodology disparities, avoiding duplicative investments that raise rates for both electric and gas customers (which are often the same customer). In the era of increasing electrification, this strategy merits consideration

States can cut emissions and energy burdens

As we transition to a clean energy grid, state policymakers and utility regulators must give greater attention to energy affordability for all, and especially for lower-income and underserved households. Together, strategic IRA implementation, utilization of existing programs, equitable policy design, and innovative ratemaking will stabilize household energy bills and lower energy burdens.