Dive Brief:

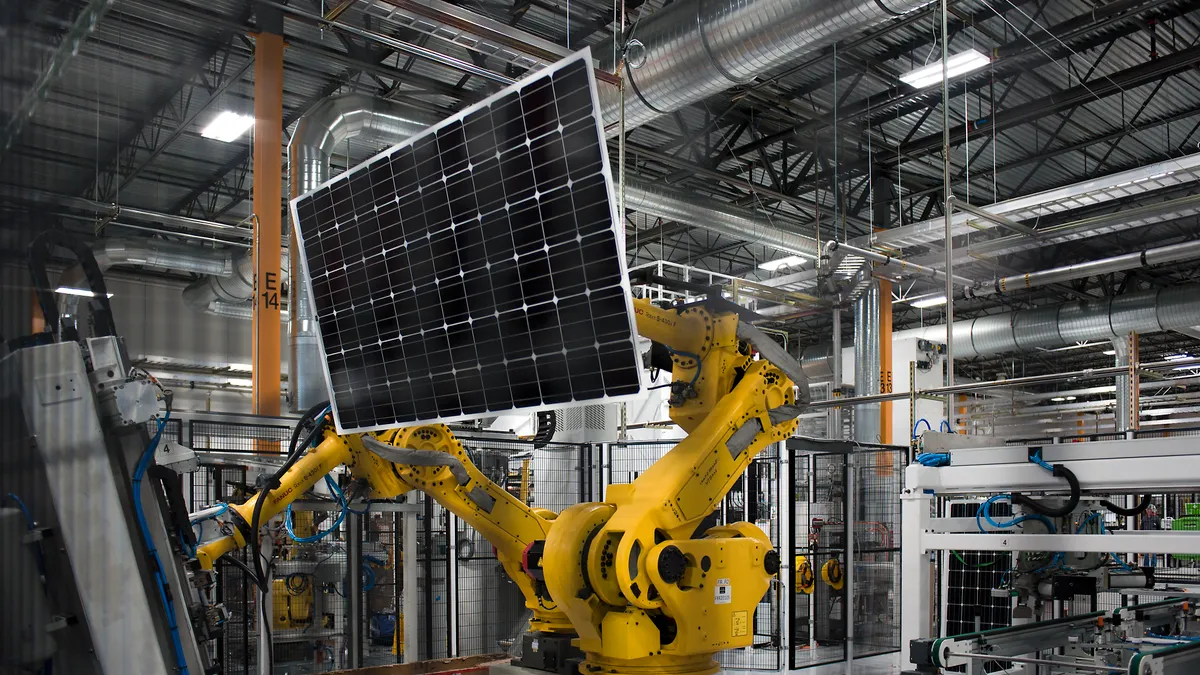

- SQN Capital Management last week announced that it has acquired the technology, licenses and manufacturing capacity of bankrupt solar manufacturer Suniva and intends to "revitalize" the company and its production of panels.

- Last year, Suniva and SolarWorld petitioned for import relief from cheap Chinese solar panels. Both companies went under, even though President Donald Trump ultimately approved a 30% tariff.

- With the tariffs now in place, it appears both companies are coming back into the market. In April, SunPower announced it would purchase SolarWorld and promised investments in domestic manufacturing.

Dive Insight:

It's unclear what impact the solar tariffs will have on installed capacity in the United States. The Trump Administration's decision injected uncertainty into the market, but falling costs overall may mute the impacts — particularly when it comes to utility-scale projects.

Suniva filed for bankruptcy just before the tariff petition, and SolarWorld's German-parent filed for insolvency shortly afterwards. But the two companies seem to be regaining their footing. A pair of second quarter announcements indicate production restarts, and SQN Capital says the company now has "multiple options" available to it.

Suniva's technology, licenses and manufacturing capacity were acquired by SQN and have been released from the bankruptcy process. The firm said "plans are in process to restart operations as soon as possible."

"It has been a long year but a fight worth fighting. We are pleased now to have multiple attractive options as we look toward Suniva's future," SQN CEO Jeremiah Silkowski said in a statement. The company said it is close to determining a partner to provide the "best path to revitalizing the company."

The announcement follows the SunPower-SolarWorld deal from April. That deal will allow SunPower to avoid the tariffs it would have to pay on some of its foreign-made panels.

The companies did not disclose a purchase price but the deal calls for SunPower to acquire 100% of SolarWorld Americas. Regulators in the United States, as well as in Germany where SolarWorld's parent company is based, will need to sign off on the deal, which would make SunPower the largest panel manufacturer in the U.S.