Dive Brief:

-

Lawmakers in South Carolina are pushing back against Dominion Energy’s proposed acquisition of SCANA, raising the odds the deal might not go through.

-

On Wednesday, state senators emerged from a closed door meeting and told local media that they had come up with a plan that would give state regulators until Dec. 21 to decide how to handle customer charges to cover costs associated with the failed V.C. Summer nuclear project.

-

At the end of January, South Carolina’s house passed a bill that would end SCANA’s ability to charge ratepayers for the Summer expansion project.

Dive Insight:

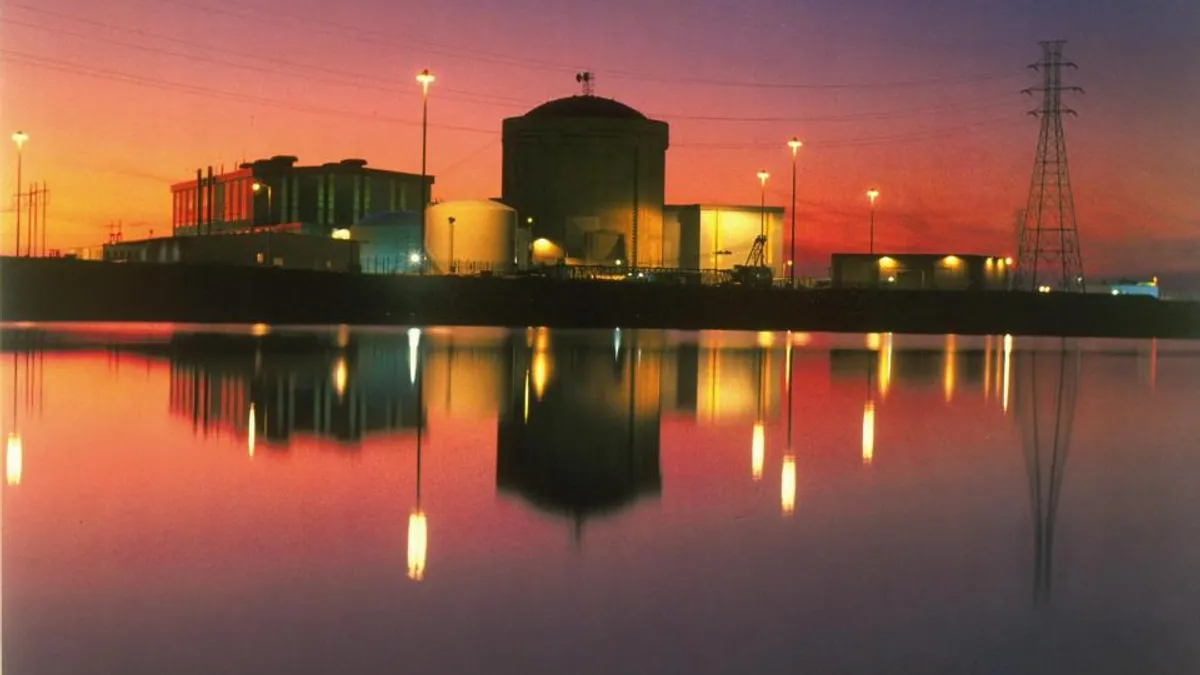

When Dominion made its $14.6 billion offer for SCANA, Dominion CEO Thomas Farrell warned that he would walk away from the offer if SCANA were not allowed to recover costs associated with the failed V.C. Summer nuclear project. But as lawmakers look more closely at the details of Dominion’s offer, they are putting more pressure on Dominion.

Farrell has made several appearances in the legislature and come under questioning about the returns the merged company would earn on about $3 billion in costs associated with the failed nuclear project.

According to local media reports, Senate Majority Leader Shane Massey was incredulous when Farrell told the lawmaker he did not know how much his company would profit from the nuclear-related charges to customers.

SCANA — or Dominion, if the merger goes through — is entitled to those payments under the Baseload Review Act that the legislature passed in 2007. The legislature is now threatening to repeal that law, and Gov. Henry McMaster (R) says he would sign the legislation.

There are concerns that a full repeal would not withstand a legal challenge. But for now, South Carolina's House of Representatives has voted to delay authorization to collect the charges until the Summer project is reviewed by the state’ Public Service Commission, and the state's senate is now looking to give the regulators until close to year end to conduct their review.

“SCANA is facing an unfriendly environment in South Carolina and that is affecting Dominion, as well,” Hugh Wynne, an analyst with investment research firm SSR LLC, told Utility Dive. The legislature and the governor are looking for a way to lessen the impact of the failed nuclear project on ratepayers, he said.

The options facing Dominion include lowering its offer for SCANA or accepting that the deal will take longer and be more complicated. “In my experience, companies do not often walk away from a deal because of complexity,” Wynne said, though he believes “in the long run, the deal will not close.”

Meanwhile, the gap between the share prices of Dominion and SCANA has reached it highest since the merger was announced, a sign that investors are discounting the closing of the deal. SCANA shares were trading at about $37.20 this week compared to $47.65 when the deal was announced. Dominion’s share price has moved from about $77.20 in early January to about $75.40.