For Elon Musk, it was “kind of an obvious thing to do.”

On Monday, energy storage and electric vehicle provider Tesla announced it has made an offer to buy SolarCity, the largest residential solar installer in the United States.

The move would turn Tesla into a vertically-integrated clean energy company, with operations in the manufacture, sale and operation of products spanning from energy production to storage and consumption.

“We think there's really a huge opportunity here to have a highly-integrated, sustainable energy company that answers the whole sustainable energy question from the generation of power to storage to transport,” Musk, Tesla’s CEO and chairman, said on a press call after the announcement.

To buy the solar installer, Tesla has proposed an exchange of 0.122 to 0.131 shares of Tesla stock for every share of SolarCity stock, valuing the deal between $2.5 billion and $3 billion. That represents a price of $26.50 to $28.50 for SolarCity shares, a 21% to 30% premium over the closing price on Monday ($21.19), before the deal was announced.

While the numbers are still to be finalized, company officials said the structure of the deal may well end up being more important than the valuation. By combining the two companies, Musk and others said the combined company could achieve significant operational efficiencies, reach more customers, and further their partnerships in the electric utility sector. In the end, the aim is to create a company that addresses a fuller spectrum of sustainable energy generation and consumption — if shareholders of both companies will accept the deal.

“Our goal is to accelerate the advent of sustainable energy, so this is, broadly speaking, right in line with that,” Musk said.

The timing of the deal

SolarCity and Tesla have been close since their inception. While holding the top two positions at Tesla, Musk is also a principal at SolarCity and sits on its board. Lyndon Rive, SolarCity’s CEO, is Musk’s cousin and the two companies have already partnered in number of solar-plus-storage ventures, both at the residential and utility scale.

Given that relationship, it surprised few when Musk said the two companies have been considering a merger for “many years.” Now, just over a year after Tesla first introduced its stationary storage products, the company's leadership decided the timing was right.

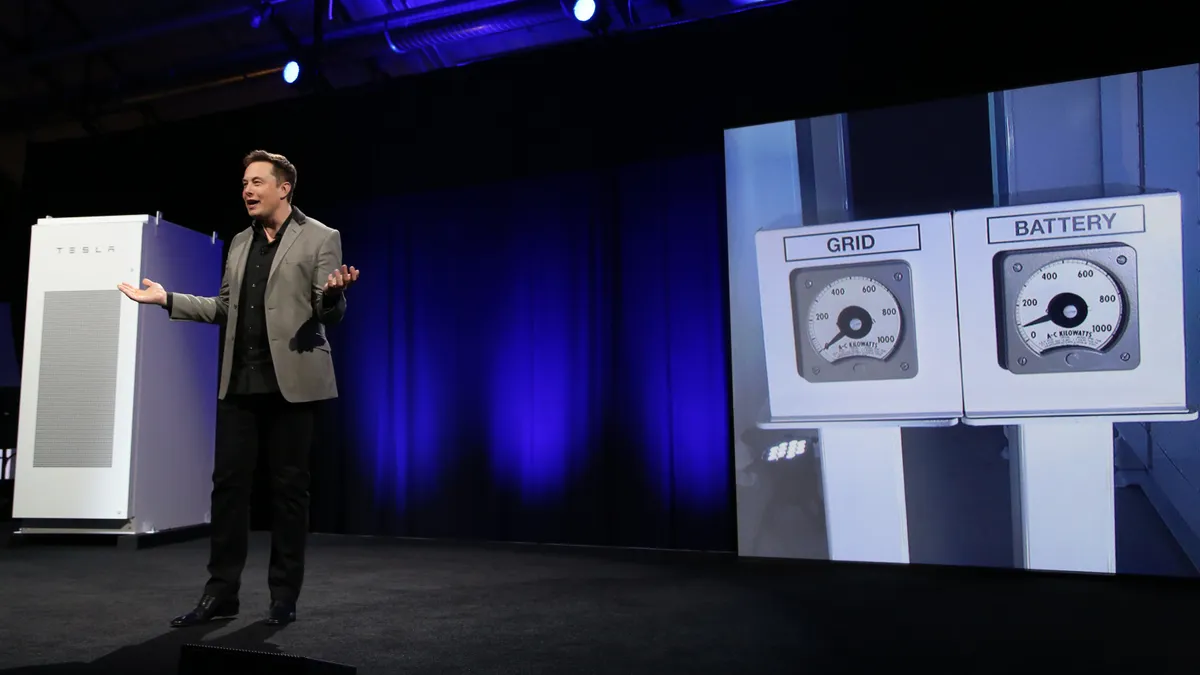

“Tesla's wrapping up its activities with Powerwall and the Powerpack, essentially with energy storage,” Musk said. “SolarCity's got a lot of exciting projects coming out in the future, and just from a product integration standpoint and offering the most compelling experience to consumers and businesses, we really need to achieve a tight integration of the product.”

Rive, on the same call, echoed Musk’s point on integration. “We're going through the phase now where we're becoming a heavy product company,” he said, “and these two products combined can deliver the best product for the consumer.”

But while Musk and Rive espoused the benefits of a unified product, a number of reporters on the press call wondered if there were financial motivations for the deal as well. The deal comes at a time when SolarCity's stock price has slid from about $57 to $21 over the last six months, due to concerns about its debt load and unfriendly regulatory decisions in states like Nevada. Shortly after the company reported disappointing earnings in the last quarter, as well as a weaker-than-expected financial forecast and sluggish installation growth, Elon Musk acquired $10 million worth of SolarCity shares. Musk, the largest shareholder in both Tesla and SolarCity, has made a habit of buying the companies' shares when they are in need of capital.

Asked if those factors influenced the timing of the deal, Musk swatted the notion away. “The timing is really driven by a desire to integrate the products and provide a compelling solution to end customers, and that's really the main reason for it,” he said.

“I think it's very difficult to say that when the market corrects, if it's optimistic or pessimistic,” he added. “The market can vary a great deal from one day to the next. I think in one point in February, Tesla's stock was down like $150, randomly. So I want to take market gyrations with a big grain of salt.”

Another reporter asked Musk if the deal creates more financial risk for Tesla, since SolarCity has about $3 billion in debt. Rive took the opportunity to address his company’s financial health: "When you look at our financials, also look at the recurring revenue the business generates.”

“The recurring revenue the business generates pays back all the debt, all the investors, all the tax equity investors, and then generates essentially cash to the company,” he said. “We're at a roughly $80 million run rate today, and that historically has close to doubled every year.”

When you include those recurring cash flows available to the business and discount it to today’s value, “essentially the company is almost debt free,” Rive said.

While not addressing SolarCity’s debt directly, Musk echoed his cousin’s conclusion. “I don't think this creates additional financial risk for Tesla,” he said. "I think it actually amplifies the opportunities for both companies.”

So far, it’s not clear the markets agree. Tesla’s stock slumped to about $194 in after-hours trading Monday, down from about $219 at the close. SolarCity, however, jumped from about $21 at close to over $24 in after-hours trading.

The new-look Tesla

Many of those amplified opportunities for the two companies will come from integrating their energy products for consumers, Musk said.

Should the deal go through, SolarCity’s products will be rebranded under the Tesla name and sold from the same stores and salespeople. In the future, Musk said, consumers will be able to go into the store and purchase the full spectrum of Tesla products.

“You’d walk into the Tesla store and say: ‘I’d like a great solar solution with a battery and an electric car,’ and in five minutes you’re done,” Musk said. “It’s completely painless, seamless, easy and that’s what the customer wants.”

Integrating the products would allow the companies to cut customer acquisition costs and “increase significantly” the sales per square foot in Tesla stores. It would also cut down on visits to customer homes for each product.

“Instead of having say three trips to a house to put in a car charger and solar panels and a battery pack, you can just integrate that into a single business, and from a consumer standpoint everything will just work together really well,” Musk said.

Offering a fuller spectrum of products may help Tesla sell more of all of them, said Tesla CTO JB Straubel. “Certainly the vast majority of Powerwall customers are interested in solar. There’s a great overlap there.”

While offering no details on those future SolarCity offerings, Musk did say that Tesla customers could expect an electric vehicle charger integrated with home batteries and solar, likely sometime next year.

What the deal means for utilities

Beyond the residential market, there may be even greater value in offering Tesla’s integrated products to the utility sector. Last summer, Musk told the annual convention of the Edison Electric Institute that he anticipates the utility-scale Powerpack storage product will comprise between 90% and 95% of Tesla’s total stationary storage sales.

Since then, Tesla has been working to partner with utilities, both on residential and grid-scale storage. In December, it announced a pilot project with Vermont’s Green Mountain Power where customers can finance Powerwall home battery systems through their utility bill.

Acquiring SolarCity won’t change that strategy, Straubel said.

“The project with Green Mountain Power is an interesting pilot where the utility itself is directly purchasing Powerwalls, then partially subsidizing those and selling them back to their ratepayers and then aggregating their performance for benefits to the utility,” Straubel said. “That's something I think that we definitely see a future in, in any case. It's just a good business model and I don't see that changing.”

Musk highlighted the “tremendous amount of grid services” Tesla could provide by coupling storage with solar.

Just last month, SolarCity introduced a new set of services for utilities and grid operators, including installation, financing and consulting on utility-scale solar and energy storage, as well as new controls for demand response and aggregated distributed resources. SolarCity's software platform, the company said, can turn a utility-scale solar project with energy storage into a dispatchable resource, providing high-return capacity services and helping utilities avoid capacity charges and manage demand peaks more cost-effectively than traditional generation.

One example of this dispatchable solar PV generation is already being installed. Last year, SolarCity selected Tesla to install 13 MW (52 MWh) of Powerpack batteries at a 13 MW solar array on the Hawaiian island of Kauai. Once completed, it will be the first fully-dispatchable photovoltaic plant in the country, allowing the Kauai Island Utility Cooperative to shift its solar generation from mid-day to the peak demand hours in the evening.

Should the SolarCity deal go through, projects like the Kauai plant could become more commonplace. Like bundled rooftop solar and battery options for residential customers, Telsa would also be able to supply utilities with a complete clean energy package, including solar, storage and the software to control it all.

“I think we’ll likely see quite a lot of partnerships with utilities, and we see our business [with them] growing quite significantly,” Musk said on the call.

Shareholder apprehension

Like any merger, the Tesla-SolarCity deal is contingent on approval by the shareholders of both companies, as well as SolarCity's board of directors.

“Until those two votes happen, this is simply what we think make sense,” Musk said, indicating he is recusing himself from voting. (Antonio Gracias, who also sits on both boards, has done the same.)

But while leadership thinks the deal is a good one, the rank and file stockholders may tell a different story. After Tesla’s stock fell 11% following the acquisition announcement, Musk scheduled a second conference call for 4:30 a.m. PST on Wednesday to reassure investors.

“From my standpoint this makes Tesla’s future execution easier, not harder,” Musk said on the Wednesday call, according to Bloomberg. “It’s increasingly unwieldy to work with SolarCity at an arm’s length basis.”

But despite the call, a shareholder struggle could be in the offing. Analysts from Oppenheimer & Co. downgraded Tesla to perform from outperform in a note published after the acquisition announcement, saying they think investors “are likely to view this transaction as a bailout for [SolarCity] and a distraction to Tesla’s own production hurdles,” according to Bloomberg.

Those reactions are unlikely to prove daunting for the Tesla team. Throughout his career, Musk’s rhetoric has positioned his companies’ societal aims ahead of his desire for financial gain and shareholder value. That was no different on the Tuesday press call. When asked how he would think of Tesla post-acquisition, Musk spoke of forming a company that can help humans pivot away from the most dangerous aspects of climate change.

“In order to solve the sustainable energy problem, you need sustainable energy generation, you need storage because of the intermittency of solar and wind, and then you need to have electric transport,” he said. “Those are the three ingredients we need to have a good future, so that's kind of how I think about things — not that we're an automotive company or anything like that.”

On the call Wednesday, he distilled the notion into a proper sound bite:

“We’re trying to have the non-weird future get here as fast as possible,” Musk said.