Dive Brief:

- NuScale is in “advanced commercial dialogue with major technology and industrial companies, utilities, and national and local governments” on potential small modular reactor deals as it looks forward to U.S. Nuclear Regulatory Commission approval for its 77-MW reactor uprate application later this year, the nuclear technology company said in a Monday earnings release.

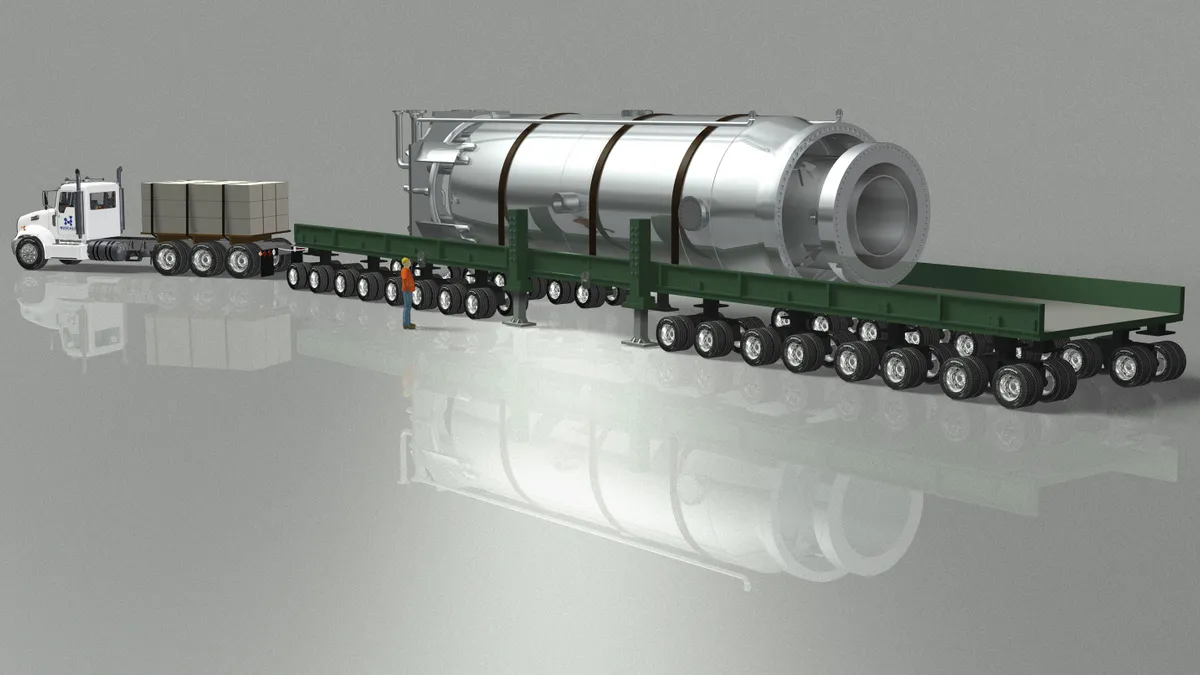

- The company ordered “long-lead materials” for six additional modules from supply chain partner Doosan Enerbility in anticipation of customer orders, and continues to advance a 462-MW power plant project in Romania as a subcontractor to Fluor Corp., CEO John Hopkins said on the company’s Monday earnings call.

- But NuScale has yet to finalize a deal with any U.S. data center operators or other industrial customers due to “the complexity of putting these projects together,” Hopkins said.

Dive Insight:

In a Q4 and full-year 2024 earnings presentation that noted a significant revenue boost toward the end of last year, NuScale detailed “broad customer interest” in its technology, which it said can support multiple industries and grid use cases.

Those grid use cases include resiliency, since reactors like NuScale’s can continue operating through outages and remain available once grid connectivity is restored, and microgrid support for mission-critical facilities like hospitals, the company said. NuScale reactors can also firm an increasingly renewables-heavy grid and replace baseload capacity lost due to coal-fired power plant retirements, the company said.

Last year, a Department of Energy report on coal-to-nuclear transition potential found up to 174 GW of potential nuclear electric-generating capacity at 145 existing U.S. coal sites.

The company presentation also highlighted four industrial opportunities: data centers and AI, carbon capture and sequestration, water desalination and hydrogen production.

New nuclear power capacity is eligible for the maximum $3/kg credit for clean hydrogen production under the Inflation Reduction Act’s Section 45V tax credit, the presentation noted. The U.S. Department of the Treasury released its final guidance for Section 45V in the final weeks of the Biden administration.

Since the November 2023 collapse of the Carbon Free Power Project, which would have provided 462 MW of power to a group of small Utah utilities by the end of the 2020s, NuScale has yet to formalize a deal with a U.S. utility or industrial customer.

In October 2023, “infrastructure as a service” provider Standard Power announced that it had selected NuScale as the SMR technology partner for two planned gigawatt-scale data centers in Pennsylvania and Ohio. The status of the companies’ partnership today is unclear and NuScale executives did not mention it on the call.

“Negotiation and finalization of long-term [power purchase agreements]” is the primary issue in customer negotiations, Hopkins said in response to an analyst question.

“We’ve just ordered [materials for] an additional six modules, so we’re confident that we’re getting closer to landing one of these deals,” Hopkins said.

Those orders are not for reactors themselves but for “long-lead materials … [and] not for a particular customer, but for the first customer that says, ‘We want to buy these modules,’” NuScale Chief Financial Officer Ramsey Hamady added.

NuScale’s long-lead orders would support a 12-module commercial deployment in the early 2030s, it said in the earnings presentation.

Hopkins said prospective customers appreciate the participation of NuScale development partner ENTRA1, which “develops, finances, owns and operates energy production plants,” according to NuScale’s website.

On the call, Hopkins said another partner, “like AEP,” could operate its plants. NuScale is “exploring the feasibility of Xcel Energy serving as a plant operator,” according to its website.

NuScale is seeking NRC approval for an upsized version of its small modular light-water reactor design, which runs on widely available low-enriched uranium rather than supply-restricted high-assay, low-enriched uranium. The technical part of that approval process is largely completed and “[it’s] now about going through the process administratively,” Hopkins said.

“We’re this close … once we get finalization for [the 77-MW design], we’re off to the races,” he added.

Correction: A previous version of this article was published with the incorrect author's name.