Dive Brief:

- Lawmakers in the South Carolina House of Representatives yesterday overwhelmingly passed a bill to restrict, at least temporarily, SCE&G from billing customers for the failed VC Summer nuclear development.

- The utility is currently billing customers up to $27/month for the project, according to The State newspaper. The state Senate could hold its first hearing on the measure last week; there is reportedly bipartisan support in the upper chamber as well.

- However, if the measure is passed into law, it will likely scuttle Dominion Energy's propsoed takeover of SCE&G parent company SCANA Corp. since that deal turns heavily on the utility recovering the nuclear expansion's costs.

Dive Insight:

According to the Charleston Post & Courier, lawmakers in the South Carolina House yesterday acknowledged that the Dominion-SCANA merger may lay in the balance, but said their responsibility is to ratepayers first.

House Speaker Jay Lucas in a speech from the floor told other lawmakers, "we need to protect the ratepayer. That is our job. That is what we were elected to do. ... There are business decisions being made. I can’t impact that."

The House ultimately approved the measure in a 119-1 vote.

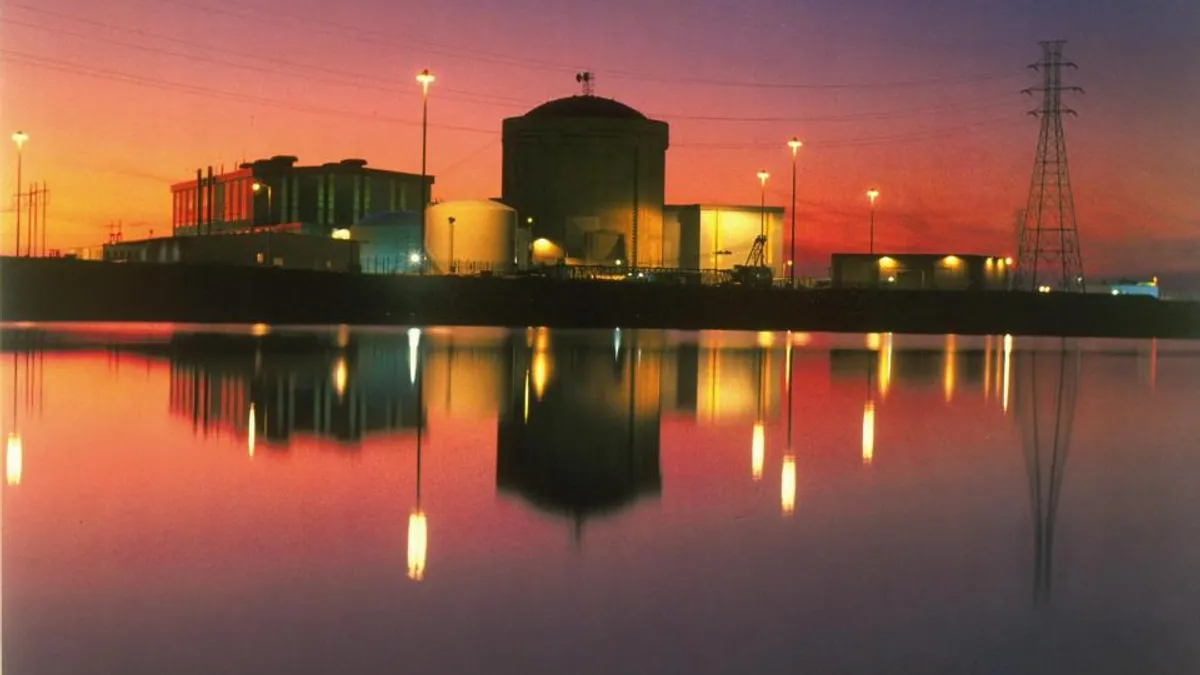

SCANA announced it would abandon construction of the V.C. Summer nuclear plant last year after sinking $9 billion in ratepayer funds into the project. Customers are currently paying $37 million a month for the project, thanks to a controversial 2007 law, the Base Load Review Act, which allowed the utility to begin recovering its investment in the nuclear project.

While there have been calls to repeal that law, the measure considered by lawmakers now would simply halt the utility from charging customers until a final decision has been made. If SCANA is not allowed to recover those costs, there is a significant chance the company will file for bankruptcy. Dominion has also indicated its $14.6 billion all-stock merger proposal would be off the table.

An audit by the state's Office of Regulatory Staff concluded there is only a 35% chance SCANA will file for bankruptcy if it is forced to stop charging customers for development of the nuclear project. But SCANA has said there are fundamental errors in the ORS report, and last week filed supporting testimony with state regulators to bolster its case.

SCANA has filed testimony from Angela Nagy, the executive director at Ernst & Young, backing up the utility company's claims that it would have little choice but to file for bankruptcy if it is not allowed to recover the costs. The ORS analysis concluded that whether to write down the value of the assets is "a management decision of SCANA and SCE&G," but SCANA has said that is incorrect.

"Very much to the contrary, if the Commission were to change the rate structure as the ORS has requested, it would not be a management decision but a requirement under generally accepted accounting principles for SCANA and SCE&G to analyze recoverability of the recorded regulatory asset," Nagy said. "GAAP requires that a loss be recognized unless the expected revenues are sufficient to cover the costs and a return on those costs that is at least equal to the company's incremental borrowing rate."