This opinion piece is part of a series from Energy Innovation’s policy experts on advancing an affordable, resilient and clean energy system. It was written by Michelle Solomon, policy analyst and Mike O’Boyle, electricity director.

Festus, Missouri. Sheboygan, Wisconsin. Omaha, Nebraska. Millsboro, Delaware. These communities all have something in common — a coal plant slated for retirement. From high fuel costs to required upgrades to limit pollution to greenhouse gas reduction policies, the operators decided running the plants no longer made sense.

Those communities, and hundreds more across the country, face an existential question. What comes after coal?

Even considering recent supply chain hiccups, new wind and solar have gotten remarkably cheap as coal costs continue increasing. New Inflation Reduction Act clean energy incentives and financing and potential strengthened U.S. Environmental Protection Agency pollution standards mean the economic risks for existing coal — and the communities that depend upon them economically — will only get worse.

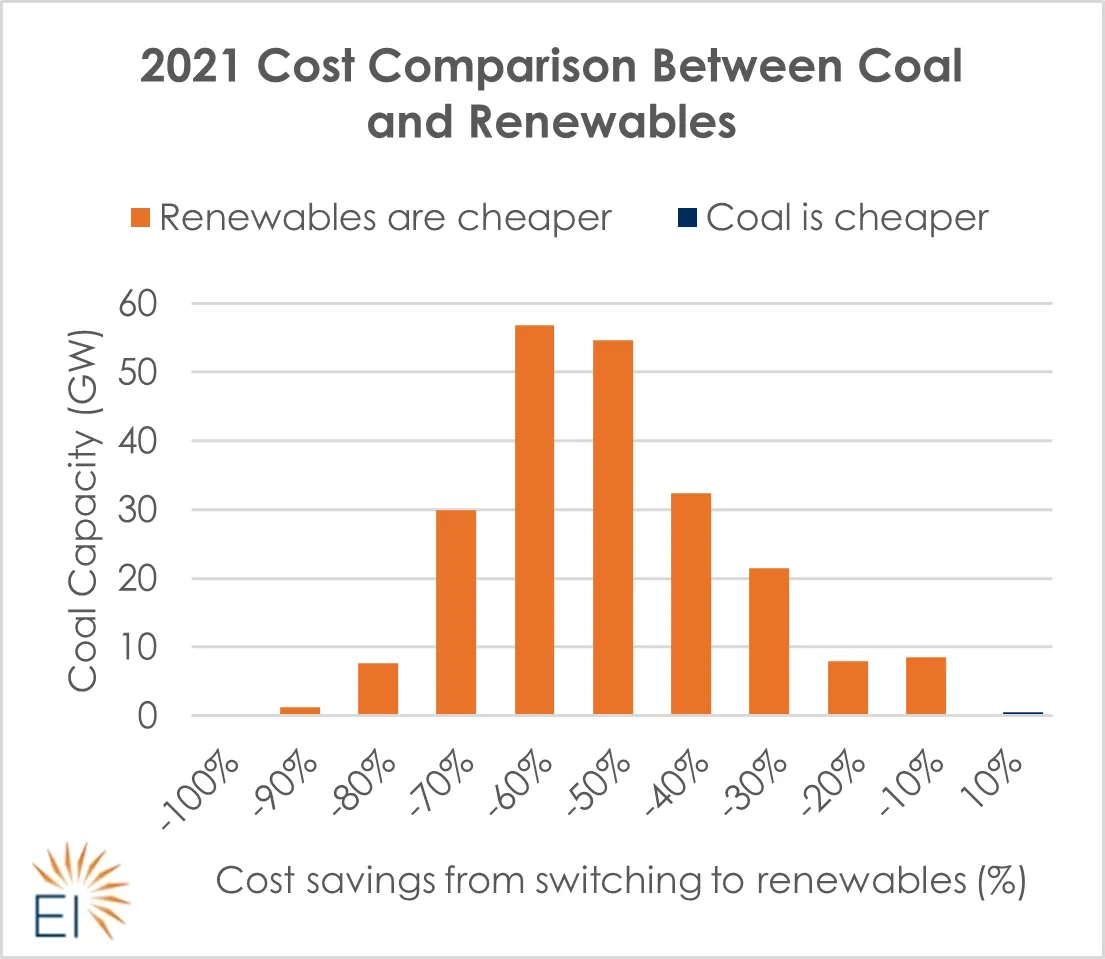

To better understand these risks and the economic upside of a coal-to-clean transition, Energy Innovation Policy & Technology analyzed the cost of new renewable energy and battery resources compared to coal generation. We found 99% of coal plants are more expensive to run than the all-in cost of new wind or solar resources in the same region. And 97% of plants are more expensive than wind or solar within a 30-mile radius.

The margins are not even close. For 80% of coal plants, renewable generation costs are at least 30% lower than the marginal cost of continuing to operate the plant, excluding capital costs of the coal plants. Even though renewables and coal play different roles in the power system, this stark “coal cost crossover” means billions in savings can shore up reliability and transmission needs.

Investment in lower cost wind and solar resources is an economic opportunity worth up to $589 billion, providing jobs and tax base to coal communities. New projects can be even cheaper if utilities access the Department of Energy Loan Program Office's new government-backed loan authority to reinvest in clean energy projects, available through 2026.

Any utility integrated resource plan finalized before August 2022 is now outdated. Regulators and utilities must act quickly to secure potential savings and investments by reevaluating any resource plans made prior to the IRA’s passage and enabling competitive procurement practices.

Aligning least cost with a community transition

Communities have faced barriers to a just, affordable transition away from coal. Consider a joint proposal by Native American Tribes and Arizona Public Service to reinvest $144 million in communities affected by the 2019 closure of Navajo Generating station, which along with the Kayenta Coal Mine, employed nearly 1,000 workers. Although hailed as a potential model for other communities, last September the Arizona Corporation Commission staff recommended against putting this proposal into rates, and one commissioner questioned the regulators’ authority to charge ratepayers for community investment funding.

The case, still in investigation, embodies how traditional ratemaking principles of placing only costs of service into utility rates can restrict utility investments in rural communities that have provided low-cost energy to city dwellers for decades.

The IRA changes this dynamic by providing a 10% bonus on top of extended investment and production tax credits for projects sited within “energy communities” — regions that have depended on the extraction, processing and concentrated use — for example, at power plants — of coal, oil and natural gas.

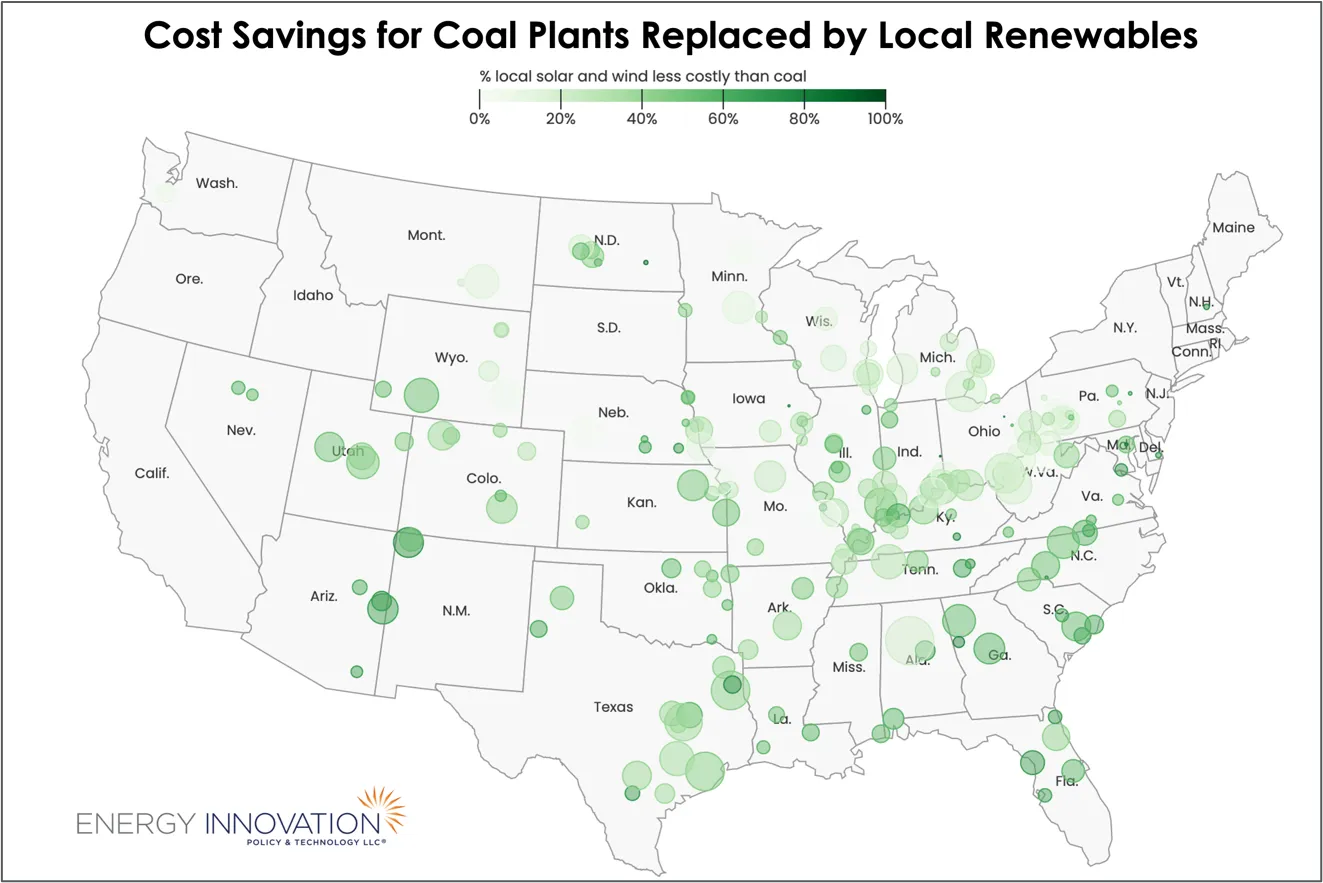

Least-cost resource planning is now aligned with what the reinvestment communities need. For about half the coal capacity in the U.S., our analysis finds the cheapest replacement renewable resource would be local solar within 30 miles of the power plant, which could leverage the energy community bonus credit.

Local replacement could also qualify for financing and funding available through two IRA programs. $250 billion in loan guarantees are now available through the U.S. Department of Energy to “retool, repower, repurpose or replace energy infrastructure that has ceased operations, or enable operating energy infrastructure to avoid, reduce, utilize, or sequester air pollutants or . . . greenhouse gases.” In our current high-interest rate environment, utilities can access this low-cost capital to make a down payment on carbon goals and save consumers even more.

The IRA also allocated $9.7 billion for rural electric cooperatives to replace fossil generation with clean energy through the U.S. Department of Agriculture. The 18 gigawatts of coal primarily owned by cooperatives are excellent candidates for this funding, generating a huge reinvestment opportunity in rural communities that have economically depended on coal plants but borne the brunt of their pollution. New clean energy projects can diversify economies and anchor re-industrialization of the site’s infrastructure, even as coal generation declines.

What about grid reliability?

Coal still plays an important role in system reliability today. Wind and solar will not replicate this role alone, but reliability can improve as coal phases down if planners embrace a portfolio approach that includes existing dispatchable resources, new clean energy resources, storage, expanded transmission, and demand-side management. Our reliability paradigm will change, but electrical engineers are ready to tackle these new challenges.

Building new wind and solar resources fast enough will be key to addressing resource adequacy challenges and meeting consumer demand for renewable energy. As coal gets more expensive and riskier, market opportunities for cheap renewables abound — but we’re not building sufficient new clean energy to keep up with market potential.

The North American Electric Reliability Corporation’s 2023 reliability assessments show much of the electric grid faces risk of resource shortfall through 2027, with 7 of 13 U.S. assessment regions at elevated or high risk of shortfall. Even with great need, transmission bottlenecks and interconnection queues can take five years or more to get new projects online.

This means coal plants that would otherwise retire are being kept around. The Rush Island Generating Station in Missouri and Indian River Generating Station in Delaware were both required to upgrade transmission to ensure grid stability near each plants’ location before they could retire. The Federal Energy Regulatory Commission is now granting cost recovery to keep these plants online until those upgrades can be completed. Meanwhile, interconnection delays for new resources have kept Wisconsin’s Edgewater Power Station and Nebraska’s North Omaha Power Station running.

Siting cheaper renewables close to retiring coal plants can reduce interconnection approval time by using the plant’s existing interconnection rights. With interconnection delays getting longer and costs increasing, local replacement could overcome one of the main hurdles to adding new, clean capacity and transitioning plants like Edgewater and North Omaha.

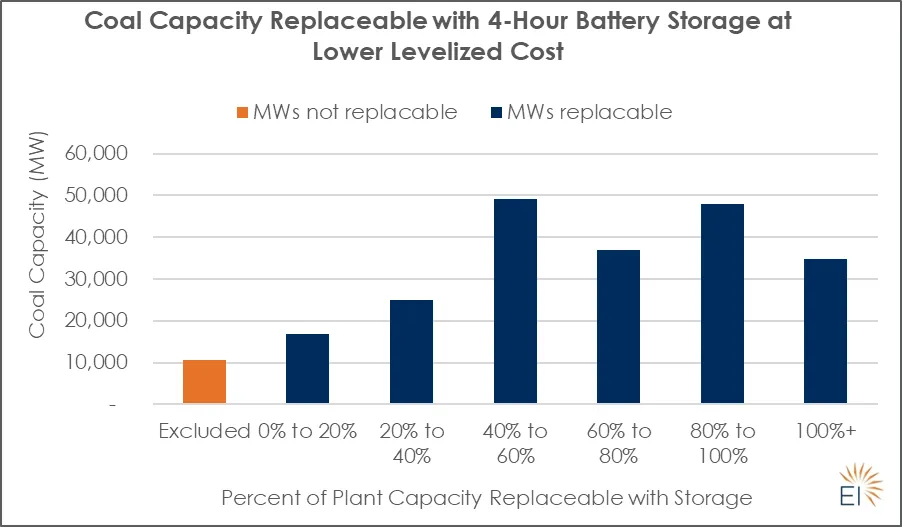

Our analysis finds the savings of switching to local clean energy would be enough to pay for 137 GW of four-hour battery storage across the U.S., equal to 62% of the coal fleet capacity we studied. The potential to add not only energy, but capacity, at plant sites could bolster reliability value and reduce the need for transmission upgrades, such as those identified for Rush Island and Indian River.

Priorities for utilities and their regulators

For a variety of reasons including utility ratemaking, outdated and non-transparent cost assumptions, lack of political will, transmission availability and reliability concerns, many utilities operating coal are not taking advantage of lower-cost renewable energy.

Policymakers and utilities should act now to ensure customers are not saddled with higher prices by accounting for all the IRA has to offer.

First, regulators and system operators should reform methods to assess reliability and resource adequacy, so they fairly reflect the reliability value of new resources. Emerging research from the Energy Systems Integration Group recommends how to credit the resource adequacy value of all resources without discriminating, including newer resources like wind, solar and storage. ISO/RTOs also need to assess opportunities to streamline the process for new resources to leverage coal plant interconnection rights and avoid high costs and long delays.

Second, utilities must update any integrated resource plan or investment strategy enacted before IRA passage to reflect the new costs of renewable energy. In addition to requiring re-evaluation of potential investments, regulators should encourage utilities to use IRA loan programs to pay for clean resources, and, as Hawaii has done, enable competitive procurement so renewable resources can fairly compete against fossil fuels.

Finally, state energy offices and legislatures should follow Colorado’s example by planning and funding a coal-community centered transition, including establishing a centralized body to engage communities and disburse funds.

The economic case for replacing highly polluting and expensive coal-fired generation with clean energy is stronger than ever. Utilities have a generational opportunity to accelerate the transition. Moving slowly risks leaving consumer savings, improved public health and climate benefits on the table.