Growing California power system reliability threats made vivid by early September Flex Alerts called by the state’s system operator could be relieved by a price signal based on real-time pricing, or RTP, linked to smart customer-owned resources through new enabling technologies, according to the California Public Utilities Commission Energy Division’s June 22 ”CalFUSE” proposal.

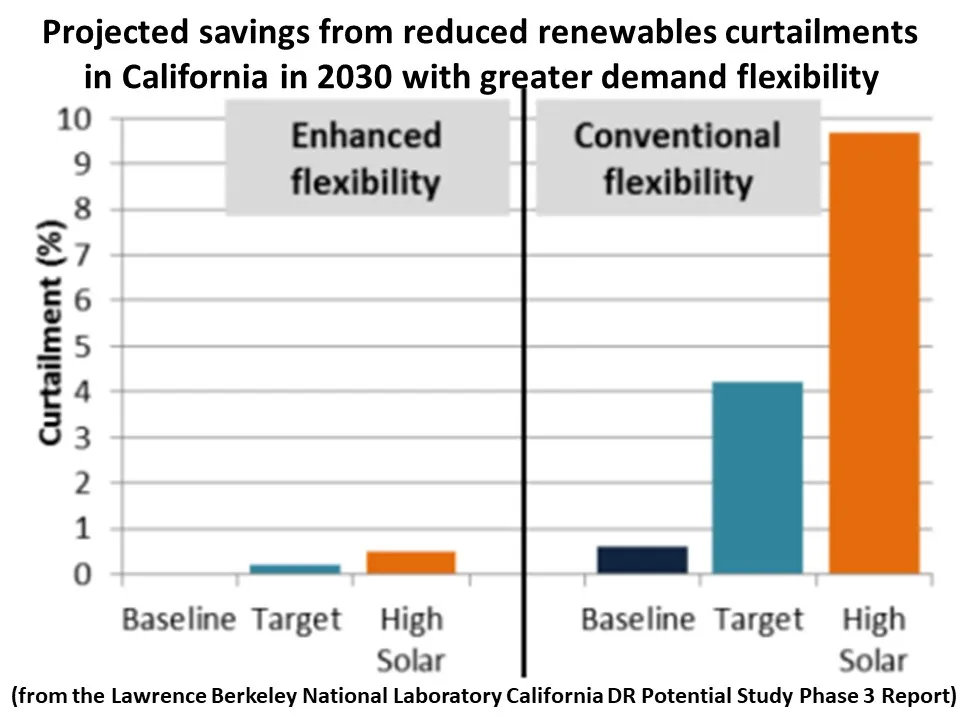

The new approach could transform California’s high penetrations of customer-owned distributed energy resources into a response to electricity market supply and load fluctuations, commissioners agreed in a July 14 order opening a proceeding to investigate the proposal’s potential.

RTP can signal DER owners and aggregators to provide “demand flexibility” by rapidly and cost-effectively responding to rising market prices for electricity by decreasing consumption or exporting stored energy, staff added at a July 21 CalFUSE introductory workshop.

The CalFUSE framework “is complex, but the complexity will be outweighed by the benefits in the long run,” Southern California Edison Director of Pricing Design and Research Robert Thomas said. Customer bill credits “for responding to dynamic price signals” can “add up to significant affordability gains,” he added.

The proposal offers a vision of “a viable dynamic future grid,” and “utilities are critical to that vision, but it will not work without innovative third-party entrepreneurs engaging customers,” customer-owned device aggregator OhmConnect CEO and Founder Cisco DeVries cautioned.

CalFUSE’s rate design and enabling technologies can lower system and customer costs and drive system flexibility if customers participate and it is a solution that could work wherever power markets and RTP enable it, utilities, DER advocates, and other stakeholders agreed. But whether the plan is too complicated to be workable and how quickly it can be implemented remain highly debated.

The need

California faces a “high DER future” that could overstress the state’s distribution system, a March 2022 CPUC-commissioned white paper said. Customer demand, the state’s zero emissions by 2045 goal, evolving technology, and falling prices will continue to drive DER growth, it added. And Senate Bill 846, passed September 1, provides $1 billion to fund a clean energy reliability plan by 2023, which could further accelerate DER growth in the state.

By 2030, California distributed solar will increase from 2022’s 14,048 MW to 24,721 MW and distributed energy storage will increase from 2022’s 740 MW to 2,587 MW, according to California Energy Commission 2021 projections. California’s 1.1 million electric vehicles are projected to reach 5.7 million in that same timeframe, and its smart thermostats are growing exponentially, CEC data also show.

DER growth is already threatening reliability, as evidenced by the growing “ramp” during late afternoon peak demand periods when solar generation falls and other resources need to be quickly brought on, according to the California Independent System Operator demand flexibility proceeding filing.

“The maximum three-hour ramp in 2019 was 15,600 MW,” but the March 11, 2022, three-hour ramp reached “more than 18,000 MW, driven by a rapid decrease in both grid-connected and [distributed] solar,” during peak evening periods, it reported.

DER could quickly fill the gap between availability of solar and other types of generation, advocates said.

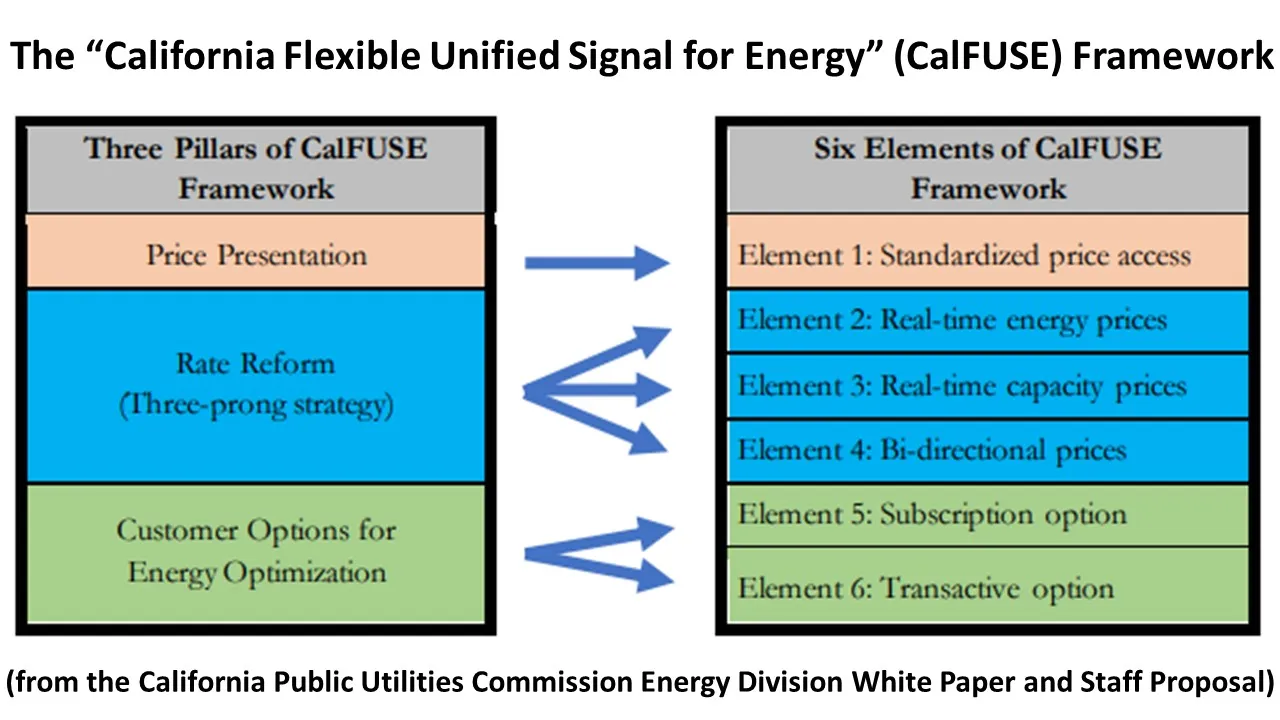

The CalFUSE elements

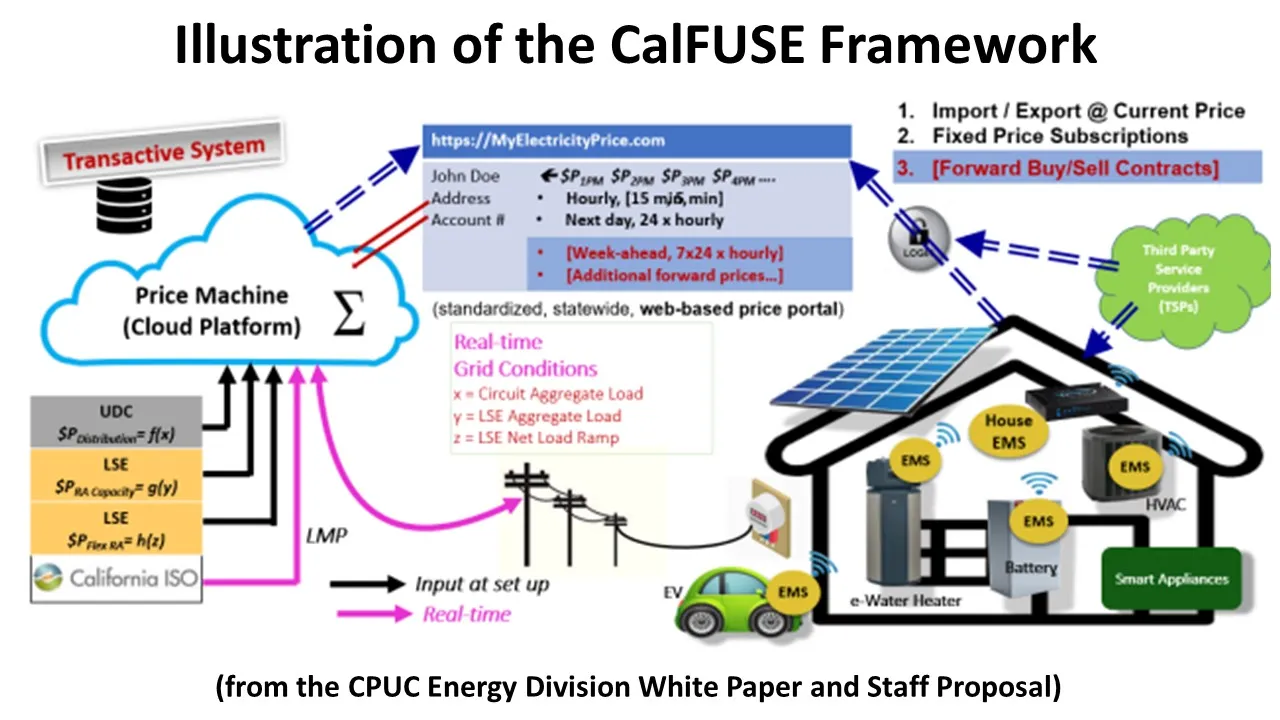

CalFUSE includes universal opt-in access to real-time energy and capacity pricing “specific to each customer at any time” through “a statewide internet-based price portal,” the CPUC CalFUSE proceeding’s opening order said. The proposal also addresses cost recovery for “generation, distribution, and transmission services and other fixed costs,” through individual electricity providers’ rate designs, it added.

A CEC-developed Market Informed Demand Automation Server, or MIDAS, platform or any other “price portal” construct could be the “front end” of what the CPUC described as a “price machine.” The customer-facing price portal would provide utility rate access to customer devices and third parties like aggregators and automation service providers, CPUC staff said in the July 21 workshop.

MIDAS will be a CEC-operated “internet service” with “a centralized, publicly accessible database” to provide “real-time access to time-varying locational electricity prices,” CEC spokesperson Elaine Kahan said in an email. MIDAS data can be used by automation service providers, electricity customers, building owners, and tenants to reduce or shift energy usage to when electricity is less expensive, Kahan added.

Back-end pricing computations will be done by the CPUC’s “price machine,” staff said. Inputs like system load forecasts, distribution circuit load forecasts, and wholesale market prices would be used to generate customer-specific RTP based on their California electricity provider rates.

The price machine’s mathematically derived capacity values for 8,760 hours, or one year, of forecasted demand would meet all Resource Adequacy requirements and recognize the needs and limits of local distribution systems down to circuit or substation levels, the white paper specified.

As tested in the Retail Automated Transactive Energy System, or RATES, pilot, implemented by subcontractor TeMix in SCE territory, the “design principle” is that “fixed cost recovery should be higher when the system utilization is higher,” the white paper stressed. That would ensure electricity provider revenue requirements are met and unintentional cost shifts are avoided, staff added.

Bidirectional pricing will allow customers to import or export electricity at equal dynamic prices, staff said. But third-party aggregation and automation services providers are expected to also “play a major role,” in the “CalFUSE ecosystem” by developing capabilities to make prices more accessible to third parties, optimize system functions, and expand aggregation capabilities, it added.

CalFUSE’s “subscription option” is intended to limit exposure to RTP for customers who choose not to participate, staff said. Those customers would subscribe to a monthly electricity usage based on their consumption history and be billed at a pre-set “predictable” rate, allowing a “transition from legacy rates to the CalFUSE price signal,” staff said.

The subscription would allow them to “buy additional energy” or “sell back any unused or excess energy” and benefit from bill charges or credits at more advantageous dynamic prices, it added.

Finally, proposed “transactive features” would allow forward energy arbitrage by customers or aggregators who “commit to future import or export of energy” at forecasted prices, the white paper said. This could both maximize customer benefits and allow system operators “more visibility for planning and operations,” it added.

But that only adds to the complexity, some stakeholders objected.

Too complicated?

Workshop feedback suggested the plan may be unworkably complicated, but utility and private sector rate design analysts disagreed.

CalFUSE offers “much more dynamic, granular pricing” than today’s time-of-use rates, but rising DER penetrations make that necessary, Regulatory Assistance Project Principal Carl Linvill said. Its RTP for energy addresses short-term marginal costs, its RTP for capacity meets longer-term marginal costs, and the bidirectional export-import price fairly compensates DER output and customer usage, he added.

Implementation will take time, and “most customers are unlikely to actively manage their consumption, especially if it is difficult or limits comfort,” he added. But utility, community choice aggregator and private sector flexible demand service providers “can build successful businesses from handling the complexity” with automated systems that aggregate and operate smart devices in response to price signals, he said.

CalFUSE is a “natural evolution” of rate design and “a fairly elegant solution” to promoting flexible demand, solving renewable over-generation, and dealing with net peak load issues, Tesla Managing Policy Advisor Damon Franz told the workshop.

Replacing demand charges with RTP capacity values could favorably impact Tesla’s EV and EV charger businesses, he said. And the bidirectional import-export pricing could be “critical” to its residential solar and storage businesses because it “will be fairly easy for customers to understand and for aggregators to respond to,” he added.

Brattle Group Principal Sanem Sergici, who often advises utilities and regulators on rate design, agreed with Linvill and Franz.

CalFUSE is “a first step” toward “a future of dynamic pricing and automation,” Sergici said. “Some aggregators will find business models and ways to communicate with customers and orchestrate devices and pricing signals to maximize customer savings because that is how innovation happens,” she added.

California’s 2020 outages were a driver behind development of CalFUSE, the white paper acknowledged. And during that August energy crisis, demand-side aggregator OhmConnect’s customers earned over $1.3 million through 739,000 usage adjustments, 580,000 automated, “without a single failure in dispatch,” DeVries reported.

The CalFUSE “vision” requires much higher levels of “customer adoption of technologies capable of automating customer load,” OhmConnect’s filing said. Much of that will be managed by utilities, but opportunities for “third party customer engagement and energy management should be a critical component,” DeVries added.

Market tests show OhmConnect could reduce customer bills significantly where customer costs are tied to electricity market pricing, which is the objective of the staff proposal, he said. With RTP “throughout the device ecosystem” and adequate access to customer data, third parties can create successful new business models that also reduce customer bills and lower system costs, DeVries said.

Compensation could be a monthly energy management payment or a share of customer savings and is likely to include compensation for critical peak and emergency demand reductions, he added. “There are multiple complexities, but this transition to dynamic pricing is urgently needed and we are way behind schedule,” DeVries said.

Go fast or together?

A major debate about CalFUSE is how quickly it should be implemented, with some urging prudence and others focused on an urgency made undeniable by September’s heat wave-driven wildfires and reliability-threatening power demands.

California’s electricity providers want “a more deliberate or phased” implementation “that takes advantage of the results from current pilots,” like Phase 2 of RATES, SCE’s Thomas said. The RATES Phase 2 report on an opt-in pilot across SCE territory of CalFUSE elements like customer response to RTP, the subscription option, and “automated vendor software,” is due in early 2025, according to SCE’s filing.

San Diego Gas and Electric “is not convinced” that the benefits of dynamic pricing for all customers will outweigh costs because they “have not yet been quantified,” its filing said. “Learnings” from pending RTP pilots will help address those doubts, it added.

Dynamic rate pilots proposed by Pacific Gas and Electric were approved after detailed analysis of customer differences, PG&E’s filing added. Because responses to dynamic rates differ significantly depending on customers’ “real-world circumstances,” moving before 2025 results on utility pilots could produce poor results, the filing said.

The Agricultural Flexible Irrigation Technology, or AgFIT, dynamic rate pilot, jointly implemented by CCA Valley Clean Energy, energy services provider Polaris, TeMix and PG&E, will send price signals to agricultural customers “to shift flexible irrigation pumping load away from daily load peak,” the Valley Clean Energy-Polaris filing said.

Implementing AgFIT showed the challenge of “even a small pilot where novel dynamic rates are being introduced to customers,” the filing said. In an uncommon IOU-CCA agreement, Valley Clean Energy also advocated awaiting “learnings” from “multiple large-scale pilots” on “best practices for scaling implementation of dynamic rates.”

Despite working with electricity providers on the pilots, TeMix somewhat disagreed. “The commission should authorize the CalFUSE tariff as opt-in for all customer classes as soon as possible,” its filing said. But regulators should also support further “demonstration projects” on “the CalFUSE approach,” it acknowledged.

Others urged acting sooner.

“Foundational work” on CalFUSE “needs to be done quickly,” emphasized the filing by the Center for Energy Efficiency and Renewable Technologies, which has long urged more use of demand flexibility. Opt-in CalFUSE rates should be implemented by summer 2023 “to determine what works,” because some rate proposals “may appeal to economists” but “customers may not understand or respond,” it added.

Tesla’s Franz cautioned that pilots may not show CalFUSE’s real appeal. “Limited” pilots can require significant hardware and software development by third-party companies, and they may not choose to participate if they cannot “get more output for that work than the pilot provides,” he told the workshop.

But that reasoning could also justify awaiting pilot results, SCE’s Thomas responded. Moving too quickly could result in a more expensive and slower deployment, because electricity providers could incur similar costs “and only after months or years would the customer response be clear,” he said.

“We don't want to fully implement what is not a fully informed pricing signal, disrupt customer participation, implement again, find out it works only somewhat, and then implement again,” he added. “Small pilots leading to full implementation by 2025 can avoid disruption and potential costs.”

The timeline and monetization mechanisms remain to be defined, and “it may seem complicated until an innovator simplifies the problem and builds a business model,” Brattle Group’s Sergici said. “But that does not mean the proposal is too complicated. It is the problem statement that will lead to solutions” sooner or later, she added.