Dive Brief:

-

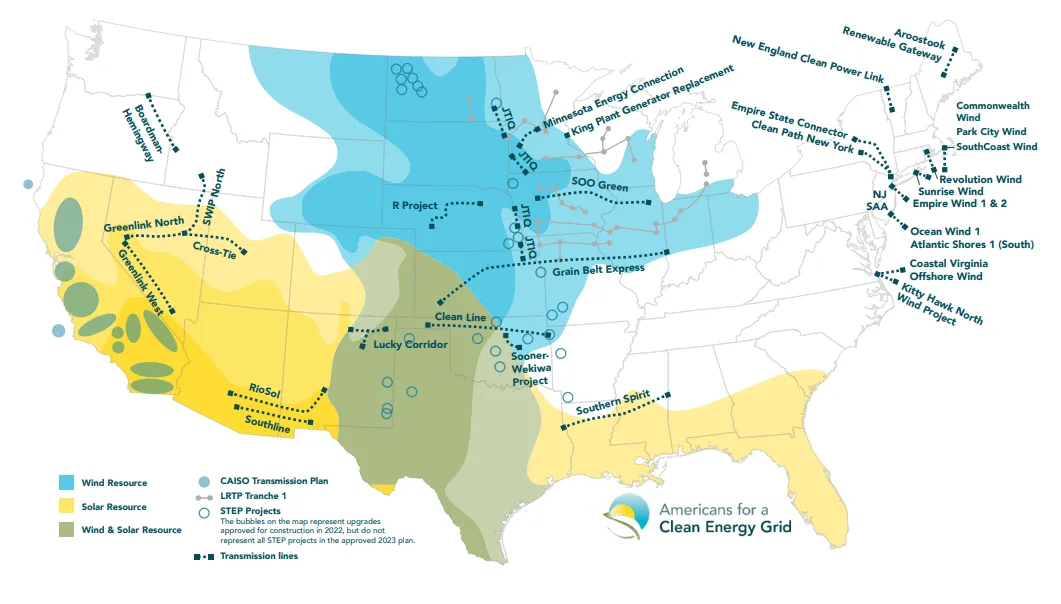

There are 36 “ready-to-go” high-voltage transmission projects in the United States that could interconnect about 187 GW of renewable energy capacity, which would increase U.S. wind and solar generation by 87%, Grid Strategies said in a report released Wednesday.

-

Two years ago, Grid Strategies found 22 shovel-ready projects that could provide access to 60 GW of renewable energy. Much of the increase in ready-to-go transmission projects since the older report reflects plans to connect East Coast offshore wind projects to the grid, the transmission-focused consulting firm said.

-

In part, the report shows that developing major transmission projects is doable, according to Rob Gramlich, president of Grid Strategies. “Too often people get defeatist about how hard it is to build transmission,” he said. “It's beneficial to show that there are real projects that are really viable in the near term that can move forward.”

Dive Insight:

If built, the ready-to-go projects, which count portfolios of lines advanced by grid operators as single projects, would expand existing transmission capacity by about 15%, according to the report, which was written for Americans for a Clean Energy Grid, a group that advocates for transmission development.

Developers behind the ready-to-go projects include a mix of utilities, utility affiliates and renewable energy companies such as Ameren Transmission, Avangrid, Berkshire Hathaway, Invenergy Transmission, LS Power, NV Energy, Ørsted, Pattern Energy Group and Xcel Energy.

Grid Strategies defined “ready-to-go” as projects that have received or are close to getting all needed federal and state permits and ones that are pursuing cost recovery, cost allocation and/or generator subscriptions.

Grid Strategies expects a range of factors will drive a growing need for more transmission capacity.

“Significant load growth, increasing US manufacturing, data center demand (fueled recently by Artificial Intelligence), customer demand for clean generation, and increasingly favorable economics for renewable energy due to market trends as well as the Inflation Reduction Act and other policies, are likely driving greater market interest in transmission,” the consulting firm said.

However, there are major barriers to transmission development, including figuring out who pays for transmission lines, according to Grid Strategies.

The 10 projects from the 2021 report that advanced to construction — such as Transwest Express, Sunzia and PacifiCorp’s Gateway projects — have an easier path to cost recovery because their costs will be paid for by the generators using the lines or were allocated to ratepayers by state regulators, according to Grid Strategies.

“We have this ironic situation where the greater the benefits and the more broadly dispersed they are, the harder it is to find a way to get cost recovery,” Gramlich said.

Many of the advancing projects are gen-tie lines that directly link generating projects to the grid, Grid Strategies noted. Generally, gen-tie lines are “an inefficient, piecemeal” way to build out the grid, the firm said.

Grid Strategies called for “proactive, scenario-based, multi-value planning.” The California Independent System Operator, the Midcontinent Independent System Operator and the Southwest Power Pool have made significant progress in those areas, the firm said.

However, many regions have not established processes for planning and paying for regional network transmission, and planning and cost-allocation frameworks for interregional transmission are even less well-developed, Grid Strategies said.

Grid Strategies warned the U.S. may not be building enough transmission to meet estimated needs to support decarbonization efforts. The ready-to-go projects, combined with those that are being built, meets about 13% of the estimated needed transmission capacity, the firm said.

Even so, the ready-to-projects represent an encouraging step towards meeting U.S. transmission needs, according to Gramlich. “We have some progress and it's real,” he said. “We also know the route for the next few years, we just need to pick up the pace quite a bit.”