Dive Brief:

- The Ohio Consumers Office wants state regulators to reject a modified proposal put forth by FirstEnergy which could wind up costing ratepayers more than $550 million each year for modernization, and another similar amount tied to the value of maintaining its headquarters in Akron.

- Critics of the proposal say consumers could be on the hook for more than $1.12 billion annually for a span of eight years.

- This is the latest twist in FirstEnergy's attempt to win support for several aging coal and nuclear plants. Federal regulators blocked an initial arrangement, sending the utility back to the state to re-evaluate their proposal for income guarantees for aging plants.

Dive Insight:

FirstEnergy is not giving up on its attempts to win support for Ohio generation, but critics say the utility's logic is getting more extreme.

In July, staff of the Public Utility Commission of Ohio proposed a new rider for FirstEnergy, possibly charging customers $131 million annually for grid modernization efforts. That proposal followed the utility's initial bid for above-market power contracts for its generation, which the Public Utilities Commission of Ohio approved before the Federal Energy Regulatory Commission nixed.

Opponents pointed out that say the utility has not proposed any modernization projects, and they argue the new fees would simply amount of a bailout of the company's older generation.

Bloomberg reports the utility countered staff's proposal with a larger proposal of its own, and now consumer advocates are opposing the new plan. In total, the Ohio Consumers Office says FirstEnergy is proposing annual amounts of $558 million for grid modernization and another $568 million related to the value of maintaining its headquarters in Akron.

"When they first told me that was in there, I thought it was a joke," Ohio Manufacturers’ Association President Eric Burkland told Bloomberg. "From a manufacturing ratepayer’s perspective, it’s just bizarre."

"Together, the two components of FirstEnergy’s modifications to Staff’s Proposal total a staggering $1.126 billion per year – more than eight times the value of Staff’s Proposal—over a much longer period of time (nearly eight years)," the consumer advocate said in its mid-August filing. "When all is said and done, consumers could be charged up to nearly $8.9 billion to support the financial integrity of FirstEnergy."

Similar to criticisms of the grid modernization rider, consumer advocates point out FirstEnergy has not indicated any interest in moving its headquarters. Last year, the company inked an 8.5-year lease to remain in the location through June of 2025.

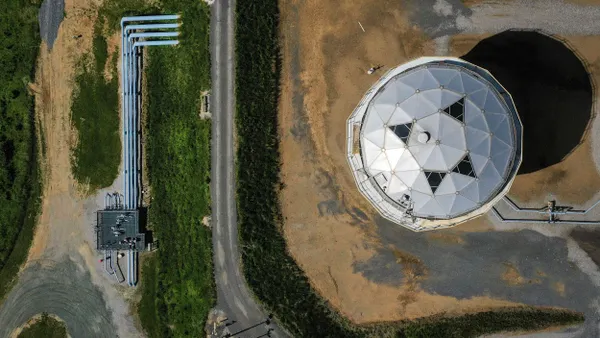

First Energy's original deal covered the utility's Davis-Besse Nuclear Power Station in Oak Harbor and the W.H. Sammis coal-fired plant in Stratton. The utility's rider proposal also included a portion of the output of Ohio Valley Electric Corporation units in Gallipolis, Ohio, and Madison, Indiana.