Dive Brief:

-

PJM Interconnection's independent market monitor called for penalties for generators that fail to provide grid flexibility when required at a Federal Energy Regulatory Commission technical conference on Tuesday.

-

Power plant owners argued incentives offer a more effective way to make the grid more nimble in the face of a generating fleet that includes growing amounts of variable wind farms and solar fields.

-

Generally, panelists in the conference's morning sessions agreed regional transmission organization and independent system operator (RTO/ISO) market rules need to change to give grid operators new tools to handle the evolving grid. "Today's rules were written for yesterday's resources," Joseph Daniel, manager of electricity markets for the Union of Concerned Scientists (UCS), said.

Dive Insight:

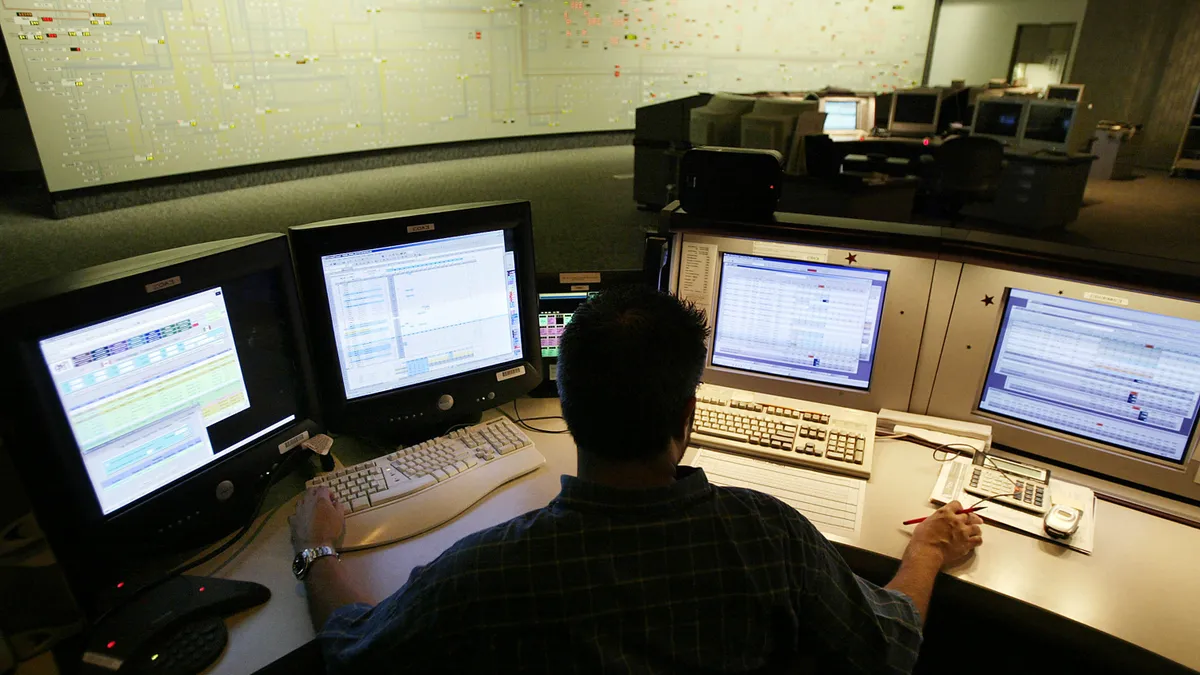

The day-long technical conference was the fourth FERC event focused on modernizing electric market design (AD21-10). The conference explored ways to make the nation's electricity grid more flexible as it shifts away from fossil-fueled generation.

There is broad industry consensus that RTOs and ISOs will need more operational flexibility from resources as the generating mix evolves to include more variable energy resources that are affected by weather and as electrified transportation and building sectors change load patterns, FERC staff said in a white paper released last month that teed up conferences on how energy and ancillary services market rules could support grid flexibility.

During the meeting, FERC Commissioner Allison Clements asked about carrot-and-stick approaches to increasing grid flexibility.

Generally, incentives are more effective at spurring changes by generators than penalties for failing to meet specific standards, according to Sherman Knight, Competitive Power Ventures (CPV) president, and Tom Kaslow, FirstLight Power vice president for market policy.

"We're going to end up with a lot of generators that are only meeting that minimum standard, and that's where I think it's more important to set it up such that there's an incentive to get the maximum out of each of the generation assets," Knight said.

With incentives, the owners of power plants, energy storage and demand response resources can figure out the most effective, economic way to create grid flexibility, according to Knight.

"Carrots are certainly more effective in markets," Kaslow said. "If we don't have revenues to reinvest in facilities and provide flexibility, that would be a very inefficient loss of flexibility."

Catherine Tyler, deputy market monitor for Monitoring Analytics, PJM's market monitor, said there's "plenty of flexibility on paper," but a lack of accountability to perform flexibly in the market.

"The flexibility is offered, but it doesn't always translate into real-time performance," Tyler said. "The logical solution ... is penalties based on the capacity market prices, which are paid for meeting certain performance standards."

In PJM, market changes that increase flexibility, such as capacity performance, fast-start pricing and an extended operating reserve demand curve, provide more revenue for flexible resources, but in all cases, they also create higher revenue streams for inflexible resources, Tyler said.

Also, PJM's rules accommodate inflexibility caused by gas scheduling restrictions, which are becoming more common, according to Tyler.

Capacity resources should be required to have dual fuel or firm gas contracts with provisions offering flexibility, according to Tyler.

"The accommodations for the inflexibility on the gas side are all being pushed from the gas business to the electric business," Tyler said. "Reforms are needed, not just on the electric side but also to get more flexibility and accountability from the fuel suppliers, as well."

Some rules, including ones governing resource commitment and scheduling, are biased towards inflexible power plants and against newer, more flexible technologies, according to UCS's Daniel.

CPV's Knight said market rules fail to reward generators that can ramp up more quickly than other resources in some RTOs.

"Why would a new investor, considering adding resource flexibility, want to do so if their outcome is only to be paid the same capacity price as the resource that is extremely inflexible, and rarely or never run?" Kaslow asked.

Betsy Beck, Enel North America regulatory affairs director, said "on paper" market rules don't keep emerging technologies such as solar and energy storage from participating in wholesale power markets.

Even so, with markets based on conventional power plants, "there is a need to re-evaluate certain market processes and procedures to ensure that they're enabling robust participation of new and flexible resources and sending efficient price signals," Beck said.