In a report released early this year, the PJM Interconnection may have overstated the risk it will face a power supply shortfall later this decade, potentially turning state policymakers against competitive power markets, according to the Ohio Manufacturers' Association, or OMA.

PJM's Resource Retirements, Replacements and Risks, or 4Rs, report released in February “has created predictable worry amongst Ohio policymakers, regulators, and stakeholders,” Ryan Augsburger, OMA president, said in a Thursday letter to PJM. “This concern is powering arguments against competitive markets, against the competency of PJM to manage reliability, and for support of wires-only, monopoly solutions without a transparent demonstration of need.”

Ohio is still dealing with the House Bill 6 scandal, “a criminal conspiracy to defraud customers of billions of dollars in the name of base-load power” as well as a roughly $500 million "distribution modernization" program that created no reliability improvements and rolling blackouts in June 2022, Augsburger said.

“These experiences have created distrust that is yet to be rebuilt between electric utilities and regulators and the customers they serve,” he said.

In a memo attached to the letter, RunnerStone, a consulting firm hired by OMA, said PJM’s 4Rs report effectively overstates the resource adequacy risks facing the grid operator by focusing on a worst-case scenario.

In the report, PJM said about 40 GW was at risk of retiring by the end of this decade and new generation may not come online in time to replace the retiring capacity. The 40 GW estimate is likely “conservative,” especially if the Environmental Protection Agency’s proposal to limit greenhouse gas emissions from power plants is put in place as proposed, Manu Asthana, PJM president and CEO, said last month at a National Association of Regulatory Utility Commissioners meeting.

PJM’s focus on the worst-case scenario may tempt state policymakers to abandon competitive power markets and subsidize coal-fired and nuclear power plants, according to RunnerStone.

In a flaw, PJM failed to model the market’s response to any emerging capacity shortfalls, which should drive up capacity prices, the consulting firm said.

“This price increase would attract new generators into the market, now having sufficient revenue to pay for construction, as well as attract existing load-side customers to participate in PJM's capacity market as a demand response resource,” RunnerStone said.

Further, PJM's report included a “reasonable” scenario that successfully meets 2030's power needs through additional renewable energy and 9 GW of new gas-fired generation, the consulting firm said, noting the grid operator has 14 GW of gas plants in its interconnection queue, including 12 GW with interconnection agreements.

OMA hopes its letter will start a dialogue with PJM, with the goal of educating Ohio's policymakers on the benefits of competitive markets to address reliability issues and integrate new technologies at the least cost, Augsburger said.

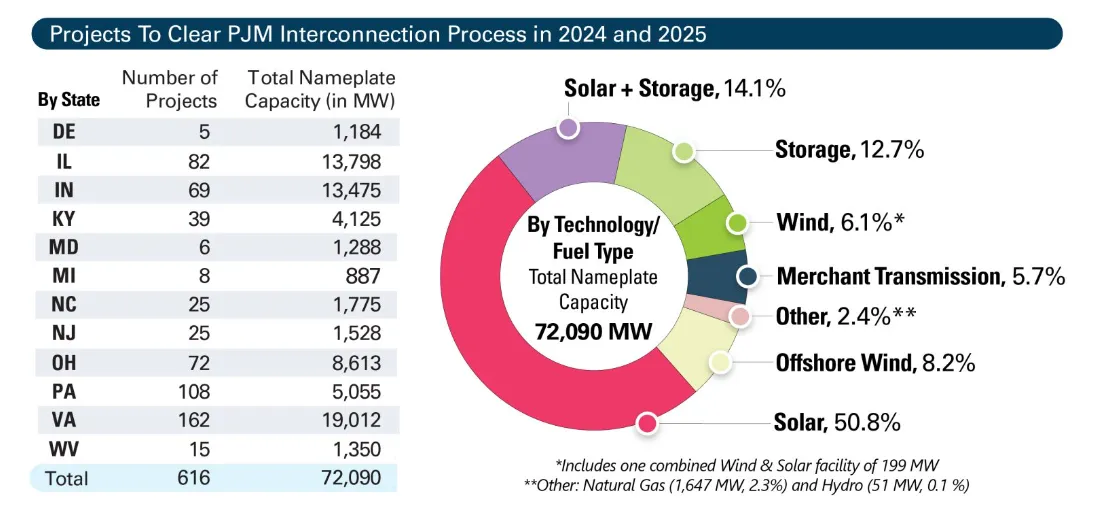

Meanwhile, PJM on Thursday said it expects generating projects totaling 26,000 MW in nameplate capacity to clear its recently reformed interconnection process next year and another 46,000 MW to clear the process by mid-2025.

However, the grid operator noted that about 40,000 MW of projects that have completed the interconnection study process have yet to begin construction, due to siting, supply chain, financing and other issues.

Without lengthy interconnection queues, many of the projects would have been built, according to Carrie Zalewski, American Clean Power Association’s vice president of markets and transmission. “When projects get hung up in lengthy interconnection queues, over time, other issues — e.g., siting, supply chain, financial — usually arise,” she said in an email. “The length of the wait in the queue time is the common denominator for the reason that that these projects don’t ultimately get built.”

PJM said it expects to study interconnection requests for more than 260,000 MW of mostly renewable projects in the next three years.

PJM runs the grid and wholesale power markets in 13 Mid-Atlantic and Midwest states and the District of Columbia.