The PJM Interconnection’s capacity market is generally sound but needs improvements to adapt to a changing power supply mix and extreme weather risks, grid operator officials and stakeholders said Thursday at the Federal Energy Regulatory Commission.

“The capacity market is working,” Joseph Bowring, president of Monitoring Analytics, PJM’s market monitor, said during a forum examining the state of the market.

“We don't think there are major changes needed right now,” said Phil Moeller, Edison Electric Institute’s executive vice president of business operations group and regulatory affairs. “But clearly we need some going forward to address the changing resource mix.”

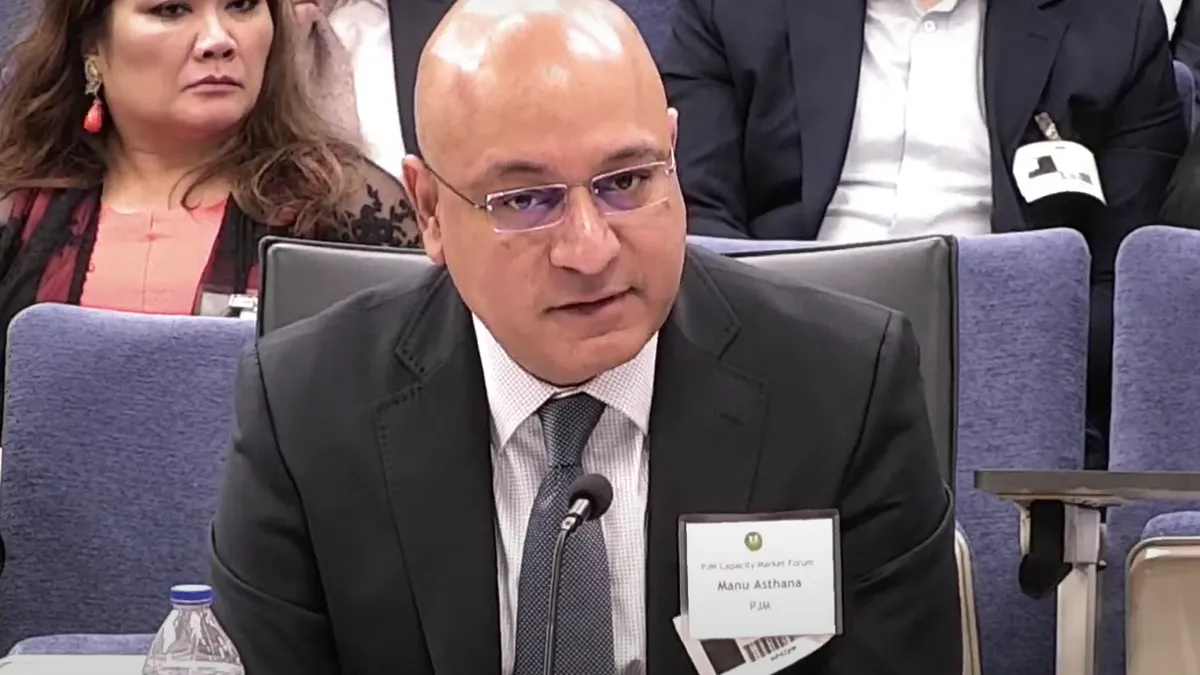

The capacity market is “fundamentally sound,” Manu Asthana, PJM president and CEO, said.

Nonetheless, PJM faces challenges including state and federal policy choices that are chilling investments in dispatchable power plants, a growing fleet of intermittent wind and solar facilities, more extreme weather and a shift in reliability risks from the summer to the winter, he said.

The commission is “keenly aware” that PJM faces a potential supply gap if power plants retire more quickly than they are replaced, FERC acting Chairman Willie Phillips said.

Earlier this year, PJM said in a report that about 40,000 MW, or 21% of its installed capacity, could retire by the end of this decade. In response to the report and the failure of many power plants to run during Winter Storm Elliott, PJM in February launched a fast-track stakeholder process to consider changes to its capacity market.

PJM on June 14 released proposed changes to its capacity market, including a seasonal winter/summer construct.

Three of the most important aspects of the proposal are improved reliability risk modeling, “right-sizing” incentives for power plants to perform when needed, and accreditation to ensure that PJM has resources to provide power for every hour of the day, according to Adam Keech, PJM vice president of market design and economics.

PJM is proposing to use marginal “effective load carrying capability” — a measure of how much resource adequacy a resource provides — to determine the seasonal accredited value of all generation types and demand response.

Marginal accreditation is the “giant decoder ring” to make sure that resources are available to provide electricity every hour, Keech said.

There is broad stakeholder agreement in moving toward a more granular accreditation process, Glen Thomas, PJM Power Providers Group president, said.

In response to a question about how PJM will replace retiring power plants, Thomas said the grid operator’s capacity market helped bring 50,000 MW into PJM, in the face of tightening environmental regulations.

“If the market signals are correct, the new entry can and will come,” he said.

However, the signals aren’t right, according to Marji Philips, LS Power senior vice president for wholesale market policy.

Power plant owners, for example, aren’t compensated for the risks they take to buy natural gas, she said. “Nobody wants to pay for that reliability, but they want us to be there,” Philips said.

While Bowring sees markets as the best way to adapt to a changing resource mix, Monitoring Analytics has proposed a “return to basics” proposal for reforming PJM’s capacity market.

Under the proposal, capacity is paid in the delivery year only when it is able to produce electricity, hour by hour.

But there are some problems markets cannot solve, such as the mismatch between the gas and power sectors, Bowring said.

In a sign of market failure, Bowring said he expects PJM will increasingly use “reliability must-run” contracts to pay retiring power plants to stay online.