Dive Brief:

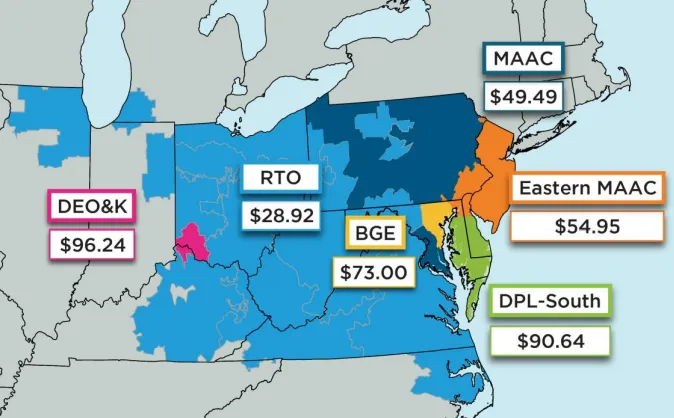

- Capacity prices in the PJM Interconnection’s latest auction fell 15% across most of its footprint to $28.92/MW-day from $34.13/MW-day in the previous auction. But price increases in a growing number of areas kept the auction’s cost at $2.2 billion like the last auction, the grid operator said Monday.

- Ratepayers in five areas, up from three in the previous auction, will pay higher prices because of transmission constraints limiting imports into the area and reduced supply offers from within some of the zones, Stu Bresler, PJM senior vice president of market services, said during a media briefing

- PJM has a “healthy” 20.4% reserve margin, a buffer of capacity above forecast peak load to handle unexpected events. But supply offered in the auction fell for the third year in a row, according to Bresler. If the trend continues, it raises concerns that were highlighted in a report issued Friday, he said.

Dive Insight:

The results were released nearly a week after the Federal Energy Regulatory Commission voted to let PJM change its market rules in mid-auction to address “anomalous” factors that would have led to capacity prices more than quadrupling in a zone that includes parts of Delaware, Maryland and Virginia. Generators may challenge that decision in court.

In the auction, PJM bought 140,416 MW for the capacity year that starts June 1, 2024, according to the grid operator. About 148,946 MW was offered in the auction, not counting energy efficiency resources, a decline from the previous auction of 2,198 MW.

In part, the regional transmission organization-wide clearing price was lower than the previous auction in June because generators are earning more revenue from energy sales, according to Bresler.

The cleared capacity included nearly 330 MW of new generation, down from about 3,330 MW in the last auction.

PJM’s clogged interconnection queue isn’t the sole driver of a lack of new generation in the grid operator’s footprint, according to Bresler. Generating projects totaling more than 40,000 MW have cleared the grid operator’s interconnection process and have interconnection agreements, clearing them for construction, he said. But last year, only one combined-cycle gas-fired power plant, plus other projects totaling only a few hundred MW, started operating, he said.

Supply chain problems and land acquisition challenges are among the difficulties power plant developers face, he said.

“It's safe to say it's not just the queue reform that is holding up development of new resources that will replace what we expect to retire,” Bresler said. “There are a lot of resources that can get started as soon as they possibly can and begin that process.”

Two new areas – a region called Eastern MACC that includes New Jersey and parts of Delaware, Maryland and Pennsylvania, and Duke Energy Ohio and Duke Energy Kentucky – joined the list of constrained regions in PJM.

Capacity in Eastern MAAC cleared at $54.95/MW-day, about 90% higher than the RTO-wide price while capacity in DEOK cleared at $96.24/MW-day, more than triple the PJM-wide price.

MAAC prices remained the same at $49.49/MW-day compared to the last auction while prices in Delmarva Power South jumped to $90.64/MW-day from $69.95/MW-day and Baltimore Gas and Electric prices increased to $73/MW-day from $69.95/MW-day.

PJM typically holds annual capacity auctions, called base residual auctions, to secure capacity three years in advance. The failure to win capacity obligations can be a factor in power plant owners’ decisions to retire those generating units.

The next auction is set for June. An auction planned for December could be delayed, depending on the results of a fast-track stakeholder process that could lead to capacity market changes, Bresler said.

The capacity auction’s results show the need for a clear price signal for capacity resources, according to Todd Snitchler, president and CEO of the Electric Power Supply Association.

“The market must be designed properly and avoid rule changes intended to accommodate specific preferred resources or technologies,” he said in a statement.

Vistra cleared 6,905 MW at a weighted average clearing price of $43.25/ MW-day, equating to about $109 million in capacity revenue for the 2024/2025 planning year, the Irving, Texas-based company said Tuesday. Vistra cleared 6,868 MW in the last auction, garnering about $94 million in revenue.

All of Constellation Energy’s generating fleet cleared the auction, including 16,150 MW of nuclear and 2,575 MW of gas and other fuels, the company said Monday in a U.S. Securities and Exchange Commission report.