Flaws in the PJM Interconnection’s capacity market suppressed revenue in the grid operator’s most recent auction by $705.1 million, or nearly 25%, according to a report released Friday by the PJM independent market monitor.

The market flaws are the shape of the “variable resource requirement,” or VRR, curve, the overstatement of intermittent capacity offers, the inclusion of demand response in the market and capacity imports, said Monitoring Analytics, PJM’s market monitor. The report analyzed the grid operator’s most recent auction.

PJM bought 144,870 MW of capacity for the capacity year that starts June 1 for about $2.2 billion in the auction held last June.

The auction prices “were the result of both competitive forces and significantly flawed market design,” Monitoring Analytics said.

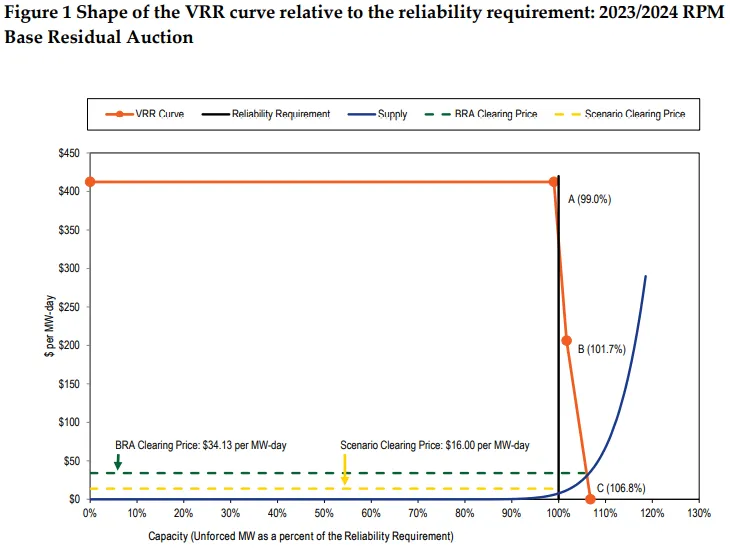

PJM is proposing to change the VRR curve, a demand curve the grid operator uses to help determine how much capacity it purchases and the price it pays in what are usually annual capacity auctions.

The shape of the current curve “very significantly increases the total payments by customers for capacity because PJM is buying too much and buying it at too high a price,” Joseph Bowring, Monitoring Analytics president, said Monday.

PJM has proposed moving the VRR curve by about 25% toward a vertical line representing how much capacity it needs to maintain reliability. Environmental groups and ratepayer advocates support the change, but it’s opposed by the PJM Power Providers Group, a trade group for power plant owners. Shifting the curve towards the reliability requirement line reduces the amount of capacity PJM would buy, lowering consumer costs.

The market monitor contends the curve should move halfway to the vertical reliability requirement line.

If PJM had used the market monitor’s recommended VRR curve in the last auction, the grid operator would have procured about 4,275 MW less capacity and saved about $405.5 million, or 18.5%, according to the report.

Other factors that the market monitor deems to be flawed leads PJM to buy less capacity than it otherwise would, according to the report.

The market monitor, for example, has recommended barring certain demand response products from the capacity auction and eliminating restrictions on the availability of annual DR so they have the same unlimited obligation to provide capacity all year similar to other generation capacity resources, according to the report.

If there had been no DR offers in the last auction, revenue would have been $4.1 billion, or 87.2% more, compared with the actual results, Monitoring Analytics said.

“The demand side has the potential to play a much larger and more significant role in PJM markets,” Bowring said. “But if demand side is going to continue to be treated as a supply-side capacity resource, it should be held to the same standards as all other capacity resources.”

Also, energy efficiency shouldn’t be included in capacity auctions because PJM accounts for those savings in its demand forecasts, according to the market monitor.

Energy efficiency that works is compensated directly through the markets because it reduces energy and capacity use and therefore customer payments for energy and capacity, Bowring said.

“There is no evidence that the energy efficiency programs sold in the capacity market are actually changing anyone’s behavior,” he said.

In a change from previous auction reports, Monitoring Analytics deemed the latest auction to be competitive, driven by changes to a market seller offer cap, or MOSC, the Federal Energy Regulatory Commission approved in September 2021.

The previous offer cap was “ultimately a failed experiment” that added a combined $1.45 billion in capacity costs in the two earlier auctions, according to the market monitor.

“The corrected MSOC rules resulted in competitive offers and prevented noncompetitive offers,” the market monitor said about the latest auction.

Vistra, the Electric Power Supply Association, Constellation Energy, Calpine, LS Power Associates, PJM Power Providers Group and Talen Energy Marketing a year ago asked the U.S. Court of Appeals for the District of Columbia Circuit to overturn FERC’s decision.

PJM supports the generators in the case, saying FERC’s approved rule doesn’t allow generators’ capacity bids to reflect certain financial risks.

Oral arguments are set for Nov. 8.