Dive Brief:

- Capacity prices across most of the PJM Interconnection market fell for the 2020-2021 delivery year, coming in under expectations, clearing 165,109 MW of unforced capacity in total. Resources cleared at $76.53/MW-day across most of the grid.

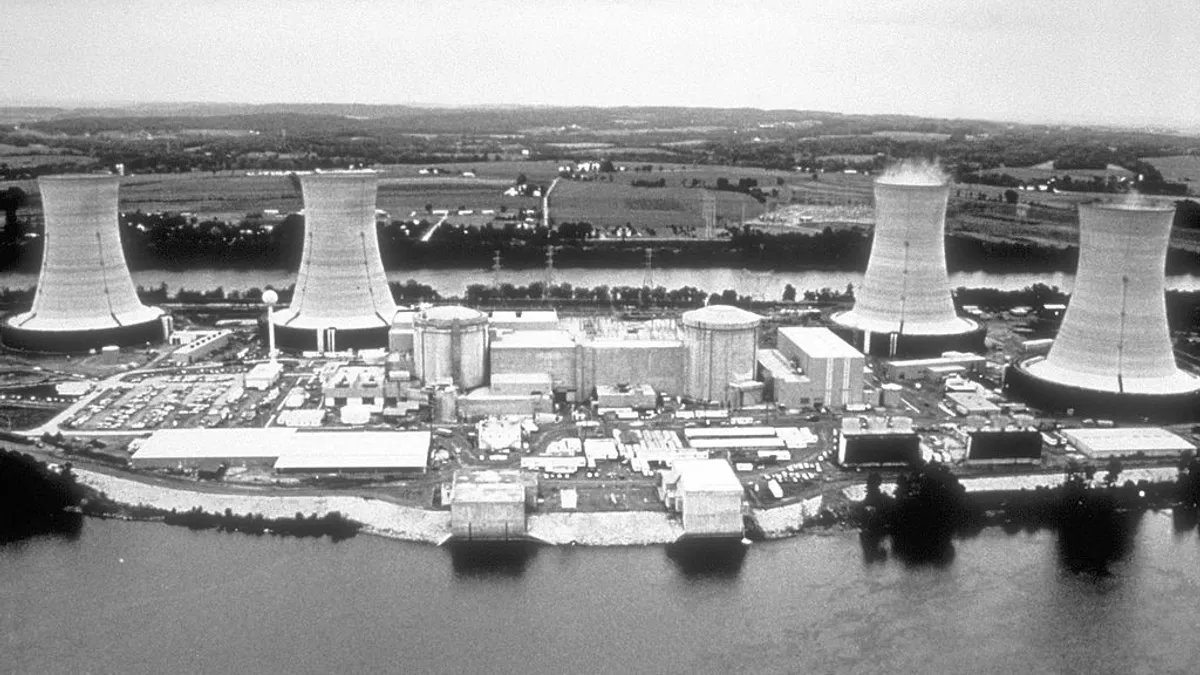

- Exelon's Three Island Mile and Quad Cities nuclear facilities failed to clear the auction, which the utility said stemmed from "the lack of federal or Pennsylvania energy policies that value zero-emissions nuclear energy," and, in the case of Quad Cities, not falling under Illinois ZECs program.

- PJM's Base Residual Auction this year was the first to use the grid's new Capacity Performance standards, which require resources to be capable of sustained operation on an annual basis. The new standards have been a thorn in the side of demand response providers, as most of the resources are seasonal in nature.

Dive Insight:

PJM capacity prices came in below what most analysts had predicted, but some regions still ticked upwards. Most of the grid cleared at $76.53/MW-day, compared with $100/MW-day last year.

Prices in the ComEd region dropped to $188/MW-day, down from $202 last year. MAAC prices dropped from $100/MW-day to $86/MW-day. EMAAC prices jumped from $120/MW-day last year to $188/MW-day.

According to SNL, analysts expectations of the RTO clearing price ranged from $100/MW-day to $125. The auction cleared almost 2,400 MW of new generation and 434 MW from uprates.

Demand response participation in the auction—both in bids and cleared volumes—declined with the new capacity rules now fully in place.

Just 9,846.7 MW of demand response was offered, declining nearly 17% from last year. And of that, 7,820 MW of resources cleared the auction, compared with 10,348 MW last year. Of the 2,242 MW of energy efficiency capacity that was offered, 1,710 MW cleared the auction. Of that, 1,607.4 MW cleared as the Annual Capacity Performance Product and 102.8 MW as summer seasonal capacity.

According to the auction results, "approximately 79.4% of the DR and 76.3% of the EE resources that were offered into the BRA cleared."

Additionally, almost 400 MW of seasonal capacity cleared in an aggregated manner to form a year-round resource.

"Wind generators, whose capacity is greater in the winter, combined through the auction clearing mechanism with demand response and solar resources, whose capacity is greater in the summer," PJM said in a news release.

Demand response provider EnerNOC touted its results yesterday in a series of tweets, saying it had captured 34% of the PJM DR market and its portfolio pricing was up 9%.

The auction was less kind to Exelon, which saw two major nuclear plants fail to clear.

After failing to submit a winning bid last year, Exelon was expected to lower the bid for Quad Cities after the passage of zero-emission credits for nuclear plants in Illinois. But in a release, the company said Quad Cities has not yet been selected to receive credits under the Future Energy Jobs Act, keeping its price too high to clear the auction.

“Exelon remains fully committed to keeping the Quad Cities plant open, provided that FEJA’s Zero Emissions Credit program is implemented as expected and provided that Quad Cities is selected to participate,” said Joe Dominguez, Exelon’s executive vice president of government and regulatory affairs.

The lack of such a policy in Pennsylvania is what kept the Three Mile Island plant out of the auction, the company said. Competition from cheap gas and subsidized renewables continue to challenge the plant, which hasn't turned a profit in five years.

The auction results could put pressure on Pennsylvania lawmakers currently mulling whether to craft a bill to support nuclear generation in the state. Exelon called out those legislators in its auction statement, pegging the nuclear plant's failure to clear firmly on the "lack of federal or Pennsylvania energy policies that value zero-emissions nuclear energy."

Financial support from nuclear plants is under consideration in a number of states after passage in New York and Illinois last year. In addition to Pennsylvania, lawmakers in Ohio, New Jersey and Connecticut are considering supports.

The subsidies are controversial, with independent generators arguing they unfairly disadvantage other plants in the market. In March, PJM's independent market monitor, Monitoring Analytics, filed in federal court opposing the Illinois zero emission credits, and the subsidies were a primary focus of a FERC technical conference earlier this month.