Dive Brief:

- Pennsylvania state Rep. Thomas Mehaffie, R, introduced a bipartisan bill on Monday to provide subsidies for nuclear generators, similar to a draft version leaked in February.

- House Bill 11 seeks to the Alternative Energy Portfolio Standard (AEPS), to include all carbon-free generators of electricity. Mehaffie told Utility Dive he unveiled the bill after Department of Energy (DOE) staffers told him to prioritize state solutions to nuclear retirements, rather than wait for federal action.

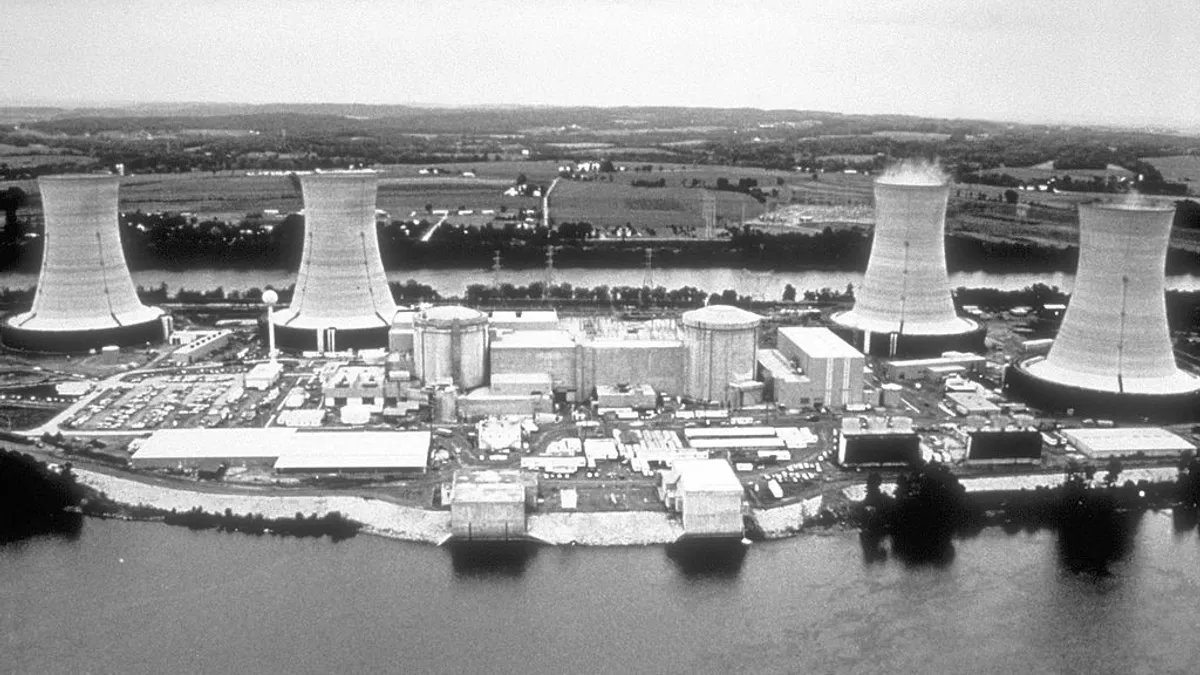

- The push to support nuclear comes ahead of a June deadline for Exelon's Three Mile Island (TMI) to decide whether to move ahead with the next round of refueling. Plant owners indicated that TMI would close in September 2019, and could begin shutdown procedures this summer if no support bill is passed.

Dive Insight:

Mehaffie's bill is part of a continuing trend of states taking the lead on nuclear retirements in the face of inaction from the federal government. New York, Illinois and New Jersey all have similar policies for their in-state nukes.

Last year, the Federal Energy Regulatory Commission rejected a proposal from DOE that would have provided cost recovery for at-risk coal and nuclear plants, like those in Pennsylvania. A subsequent plan to use the DOE's emergency authority to keep the plants open stalled at the White House due to legal concerns.

Now, a main sponsor of Pennsylvania's nuclear support effort says DOE staff told him states should not wait for action from Washington.

Pennsylvania's bicameral Nuclear Energy Caucus met with staff from the DOE throughout the year, according to Mehaffie, a co-chairman of the caucus.

"My question to them was, 'Do we have to act as a state or is the federal government going to do anything?" Mehaffie recalled. "They said, 'No, you have to act as a state."

The DOE did not responded to requests for comment by publication time.

"This isn't just a problem in Pennsylvania, this is a national problem in deregulated areas, that they have deregulated electricity rates," Mehaffie told Utility Dive.

Structure of the subsidies

HB 11 would amend the 2004 Alternative Energy Portfolio Standard (AEPS) to direct utilities to purchase power from all carbon-free generators, including nuclear, wind, solar and other zero-carbon sources.

Unlike the Zero Emission Credit programs in other states, the bill would amend an existing subsidy program, creating an additional layer (Tier III) to the AEPS.

The Pennsylvania legislature formed a bipartisan, bicameral caucus on nuclear energy last year, issuing a report in November on the state's nine nuclear plants, five of which are at risk of retirement.

"We need to have the legislation passed before [June] to give TMI the indication that it needs from the state that they're wanting to preserve their nuclear assets," said Christine Csizmadia, director of state government affairs at the Nuclear Energy Institute, an industry lobbying organization.

Besides TMI, FirstEnergy said last year it would retire its Beaver Valley plant early in 2021. Nuclear energy accounts for 42% of the state's electricity production and over 93% of its clean energy, according to the legislative report.

The third tier's value is estimated at $499 million per year, according to Timothy Fox, vice president of ClearView Energy Partners.

"While much discussion will occur in the coming months about costs, the cost of doing nothing is $4.6 billion, including $788 million annually in higher electricity costs to consumers, whereas the cost of this bill is approximately $500 million," Mehaffie said in a statement.

The "bulk of that total," about $287 million, could be earned annually by Exelon, Fox told Utility Dive via email. FirstEnergy might earn $88 million and Talen Energy, the owner of the Susquehanna nuclear plant, might earn $123 million annually.

The credits paid to nuclear plants would be determined by the Pennsylvania Public Utilities Commission.

Objections to the nuclear subsidies

If the state legislature moves expediently on the bill, the policy is likely to face the same legal pushback as other subsidy programs. In September, federal courts separately upheld the nuclear subsidies in Illinois and New York. FERC regulators and the Department of Justice had jointly filed a brief on their support for the Illinois subsidy program last spring.

Industry consumers already stated their disapproval of the bill and other groups are likely to join as well.

"Nuclear assistance proposals face incremental headwinds in states with a significant natural gas production industry such as Pennsylvania," Fox said.

While the other states with nuclear assistance programs have "near-zero oil and natural gas production activity" contributing to their respective economies, "oil and natural gas production represents 1.42% of Pennsylvania's gross domestic product," Fox said.

HB 11 may also face pushback from representatives and senators who are focused on climate policy, according to Andrew Williams, regulatory and legislative affairs director at the Environmental Defense Fund. Rather than subsidizing nuclear, some state legislators prioritizing climate issues support market-based policies imposing declining limits on carbon emissions, particularly in the power sector.

"There's a whole host of legislators in both the Pennsylvania state House of Representatives and state Senate that are part of a broad climate caucus that are pushing for bigger reformations of the AEPS for renewable energy though, for a more durable solution that actually puts a declining and binding limit on carbon pollution from the power sector," Williams told Utility Dive.