Dive Brief:

- NV Energy on May 31 filed its 2024 integrated resource plan with the Public Utilities Commission of Nevada, proposing more than 1,000 MW of solar and more than 1,000 MW of battery storage across three storage and renewable power purchase agreements, construction of 400 MW of gas-fired peaking capacity at a cost of $573 million, and higher costs associated with its Greenlink transmission projects.

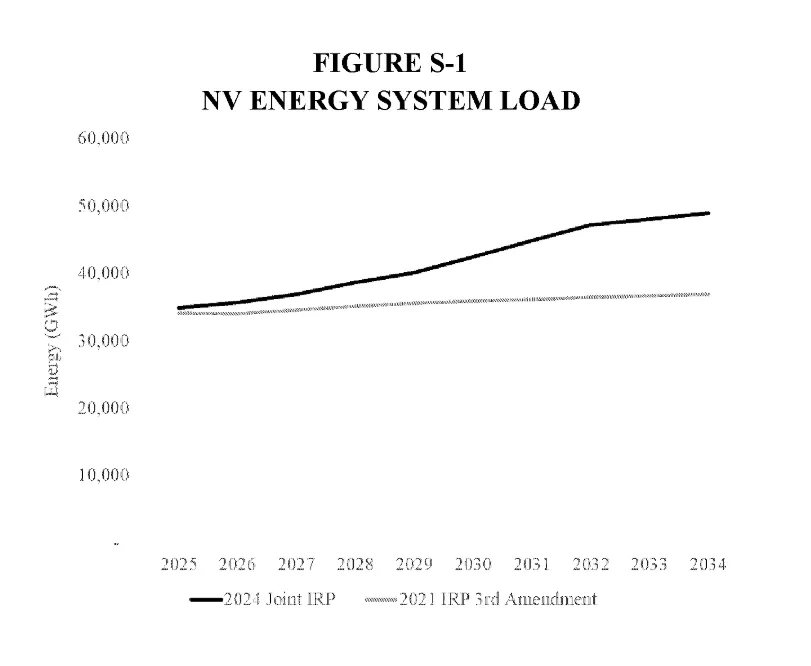

- The Nevada utility company is expecting “considerable load growth in the state through 2034” as a result of rising population, electrification and the development of data centers in its service territory, NV Energy told regulators.

- The IRP is “encouraging” in how it approaches demand and system planning but is “disappointing” in its resource procurement, said Brian Turner, a policy director at Advanced Energy United. The solar and storage resources are “significant,” he said, but “we have good reason to believe that they could do substantially better in their solicitation of bids.”

Dive Insight:

Demand projections have risen significantly since NV Energy filed its 2021 IRP, as it also works to meet a 50% renewable portfolio standard by 2030, the utility said in its planning documents.

“This is our path forward and these are our priority projects to meet the present and long-term needs of our current and future customers,” NV Energy President and CEO Doug Cannon said in a Thursday statement announcing the IRP. “The requested resources present a balanced portfolio that will reduce NV Energy reliance on expensive and unreliable market resources.”

The utility last month said it plans to join the extended day-ahead market being developed by the California Independent System Operator. It will likely file an application to join with the PUC this fall.

NV Energy’s slate of proposed projects includes:

- Approximately 400 MW of gas peaking capacity at the North Valmy generation station, to be online by summer 2028, which the utility said “will be able to utilize hydrogen in the future”;

- A PPA for the Dry Lake East solar + storage facility, expected online in 2026, with 200 MW of solar capacity and 200 MW of 4-hour storage located northeast of Las Vegas in Clark County;

- A PPA for Boulder Solar III, expected online in June 2027, with 128 MW of solar capacity and a 128 MW 4-hour battery in Boulder City;

- A PPA for Libra Solar, expected online by the end of 2027 with 700 MW of solar capacity and a 4-hour 700 MW battery to be located about 20 miles south of the Fort Churchill substation in Yerington.

- Continued approval of NV Energy’s Greenlink transmission project, a 525-kV transmission network in Nevada that the utility says will improve grid reliability and access to renewable energy.

Costs of the Greenlink project have risen to $4.2 billion, from about $2.5 billion, the company said, citing supply chain constraints, labor rates and inflation. “The only practical alternative to the construction of Greenlink is the construction of additional generation closer to the load centers ... similar reliability cannot be achieved at a lower cost without Greenlink,” the utility said in its application.

The Libra solar + storage project is valued at over $2.3 billion, developer Arevia Power said Thursday.

According to the IRP, the Libra PPA is for a 25-year term at a flat energy price of $34.97/MWh and a 20-year term for the battery component at a flat rate of $13,350/MW-month. In years 21-25 of the battery PPA there will be no cost.

“The integration of a large-scale battery storage system with the solar energy project ensures that we can meet our energy demands efficiently while significantly reducing our carbon footprint,” Cannon said.

NV Energy’s IRP has some improvements over past iterations, said AEU’s Turner. The utility has moved to an integrated grid planning perspective, “so their distributed resources are being better integrated into their load and supply needs.” And they have developed an approach to distributed resources that emphasizes the grid value created by those resources rather than focusing only on localized demand reductions, he said.

But Turner also said NV Energy’s approach to project development lags best practices developed in states such as Colorado, where the utility IRP is used to determine resource needs that are then filled through an all-source procurement.

“NV Energy issues occasional RFPs, receives those bids, negotiates privately with the projects that it likes best, and we as stakeholders, and certainly the development community, have no insight into how that process occurs,” Turner said.

“I think they could have done better, and different, on proposing those gas resources if they had a more robust program for renewable procurement,” he said.

The PUC will likely spend about six months reviewing the IRP before issuing a decision, Turner said. “We'll have testimony and cross-testimony and a hearing, and then the commission will make its decision,” he said. “We’ll argue around details, like how they could do more, cheaper, better, with more distributed resources.”