Dive Brief:

-

Toshiba’s nuclear development subsidiary Westinghouse Electric filed for Chapter 11 bankruptcy court protection this morning, the New York Times reports.

-

The company obtained $800 million in third-party financing to help protect its core businesses during its reorganization. Westinghouse has been hurt by cost overruns at two nuclear plants it is building in the United States, as well as challenging economics for new plants in organized power markets.

-

It is unclear at this point if the bankruptcy would have an effect on Southern Company or SCANA, the utility companies for which Westinghouse is building the nuclear plants.

Dive Insight:

Westinghouse Electric's bankruptcy protection filing is another notch against an already struggling U.S. nuclear sector.

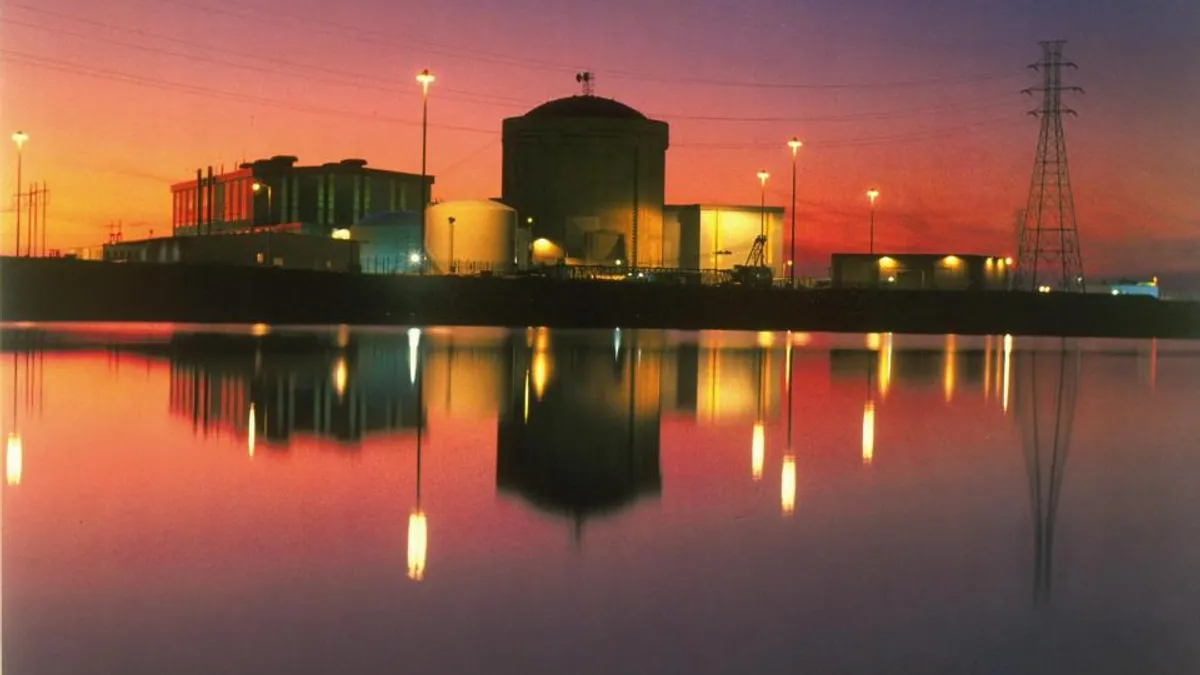

Cost overruns have dogged the two nuclear facilities under construction in the nation — Southern’s Vogtle plant in Georgia and SCANA’s V.C. Summer project in South Carolina. Just this week, the Atlanta Journal Constitution reported Vogtle is likely to miss another deadline in the upcoming months.

Westinghouse took over as the contractor on the Vogtle project in January 2016 and since then delays at both projects have dogged its parent company, Toshiba.

Toshiba acquired a majority stake in Westinghouse in 2006, but last February was forced to take a $6 billion write off because of problems with the projects.

The direct effect on the Vogtle and Summer plants remains unclear, but the MIT Technology Review noted a bankruptcy could thwart new nuclear construction in the U.S., since the company is a chief builder of new plants.

Analysts doubt Toshiba will find a buyer for its stake in Westinghouse, and construction partners could be reluctant to move ahead with the nuclear plants it planned to build.

Toshiba said in a recent financial presentation it intends to "reduce risk at eight plants currently in progress by thoroughly implementing comprehensive cost reduction measures." Earlier this year, the company indicated regrets over purchasing Westinghouse.