The NextEra Energy “Real Zero” plan announced June 14 by the world’s biggest investor-owned utility could be a game-changing climate goal but comes with unanswered questions, stakeholders said.

Real Zero would eliminate carbon emissions from NEE operations by 2045 without relying on carbon offsets as other U.S. utilities’ net zero plans do, and is “the most ambitious carbon-emissions-reduction goal ever set by an energy producer,” NEE’s June 14 statement said. With it, NEE and subsidiary Florida Power and Light are challenging utilities with net zero climate goals, NEE President and CEO John Ketchum said.

NEE’s business model, based on utility-scale renewables development, has helped to propel it to the highest market capitalization of any electric utility in the world, NEE reported to investors June 14. Real Zero would “transform” over 80% of FPL generation to solar, battery storage, and green hydrogen, while “enhancing reliability, resiliency, affordability and cost certainty,” NEE said.

The Real Zero Blueprint would also leverage NEE’s scale as the biggest U.S. electricity producer to lead the over “$4 trillion market opportunity,” in decarbonizing the U.S. economy, NEE added.

It may be a “paradigm shifting” plan, according to longtime FPL critic Stephen Smith, executive director of the Southern Alliance for Clean Energy, or SACE. “When a private business as successful as NextEra puts this kind of ambition on the table, it moves the needle,” and “it has committed to elements of the blueprint in planning documents, showing it is serious,” Smith said.

FPL is also “on track” to meet its 2025 solar commitments, underscoring that seriousness, SACE, Sierra Club and other stakeholders agreed.

But Real Zero’s 90 GW of solar, 50 GW of battery storage, and yet-to-be-piloted green hydrogen plan will be difficult to reach by 2045 at the promised “zero incremental costs” to customers, those stakeholders also agreed. And it lacks specific demand flexibility and energy efficiency goals likely to be needed to meet accelerating transportation and building electrification loads, they added.

Real Zero

From 2005 to 2021, NEE increased its emissions-free generation 300% and, from 2006 to 2021, its earnings per share had an 8.4% compound annual growth rate and its shareholder returns were 620% higher than the S&P 500 average, it reported June 14. In that period, unregulated subsidiary NextEra Energy Resources built 24 GW of wind and solar, NEE’s statement added.

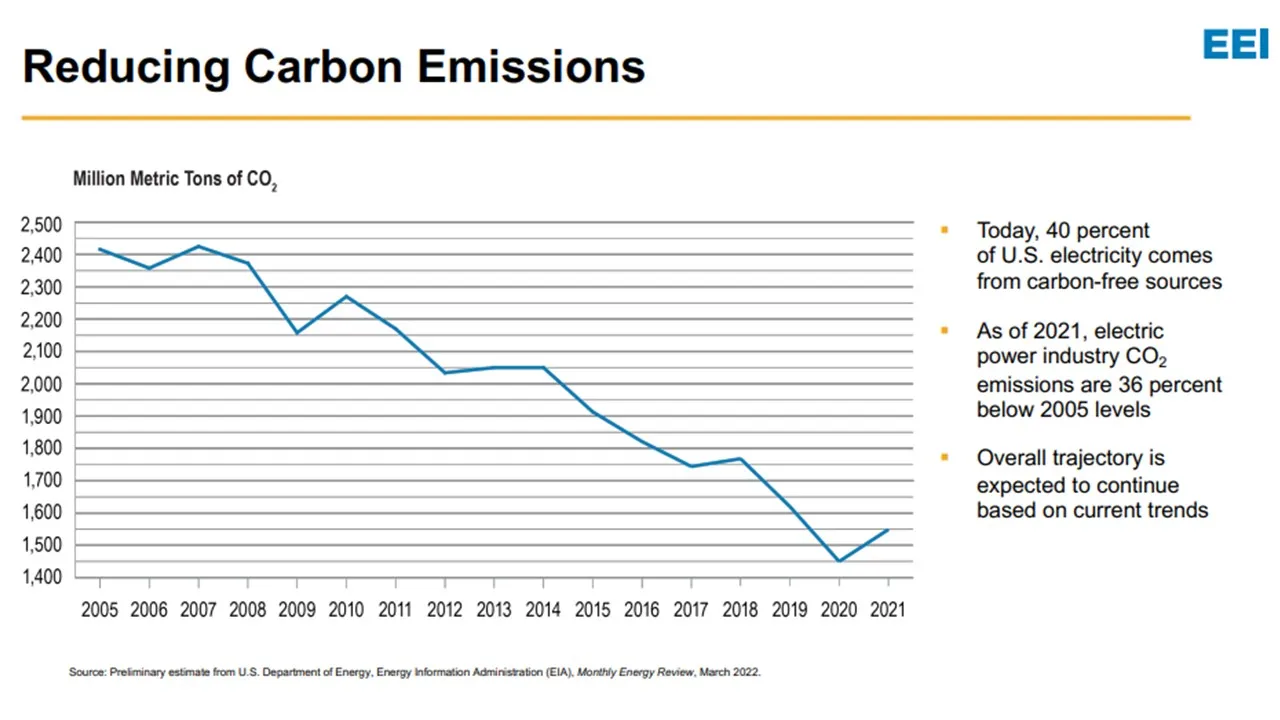

In 2021, U.S. electric utility emissions were “36% below 2005 levels,” according to the Edison Electric Institute and a growing number of utilities have decarbonization commitments. But, unlike Real Zero, those net zero goals will not achieve “a total transformation of our energy infrastructure,” the NEE statement said.

Real Zero will eliminate all direct and indirect carbon emissions with “unprecedented speed and scale,” NEE added. FPL will be 52% decarbonized by 2030, 62% by 2035, 83% by 2040 and 100% “no later than 2045,” NEE committed.

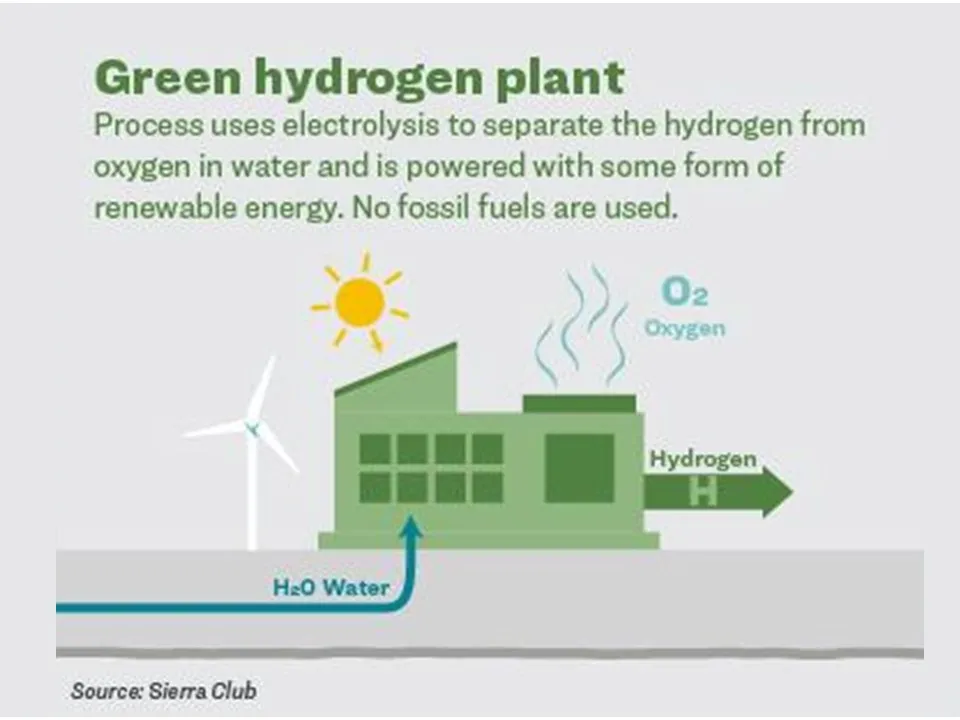

By 2045, FPL’s current 4 GW of utility-scale solar will be over 90 GW, and its 0.5 GW of battery storage will be over 50 GW, the blueprint added. It will also convert 16 GW of existing natural gas generation to run on green hydrogen created from water electrolyzed by solar generation, a transition that avoids stranded assets, the blueprint added.

FPL will maintain its 3.5 GW nuclear capacity and, for added reliability, will develop a 6 GW carbon-neutral renewable natural gas capacity for limited use in its existing natural gas plants, FPL spokesperson Christopher McGrath told Utility Dive.

The blueprint reported past support by FPL for customer-owned demand-side resources like energy efficiency, but neither the blueprint nor McGrath proposed specific expansions of those resources.

Renewables’ accelerating cost competitiveness, largely due to global demand for natural gas that is driving up its price, makes Real Zero feasible, NEE’s investor presentation reported. The levelized cost for existing natural gas generation rose 63% from January 2021 to May 2022, while the cost for new solar rose only 16% and new wind’s cost rose 11%, NEE added.

Though renewables prices are also now rising, largely due to supply chain constraints, they are likely to retain relative cost-competitiveness, according to a June 30 BloombergNEF report.

With continued cost competitiveness, further technology advances, and adequate state and federal policy support, Real Zero is achievable at “zero incremental cost to customers,” NEE said. A zero emissions facility “won’t cost customers more than building a fossil plant to meet that same electricity demand,” McGrath added.

Critics support the ambition

Traditional FPL critics see promise in Real Zero.

SACE “has repeatedly called for a carbon target from FPL, but the scale of the Real Zero ambition has shifted the debate with utilities and we welcome it,” SACE’s Smith said. “It is what the planet needs and what the power sector needs to tackle the climate problem.”

FPL’s “no incremental cost to customers” language qualifies its commitment, but uncertain carbon-related politics and market dynamics require that, he said. SACE “will hold FPL to its word” but is giving the utility “a pass for now because we do not want to make the perfect the enemy of the good.”

Real Zero also shows other utilities that “renewables can be good for business and attract investors,” agreed Institute for Energy Economics and Financial Analysis Energy Data Analyst Seth Feaster.

Sierra Club, which has long fought FPL over coal use and is still fighting it over natural gas infrastructure, sees Real Zero as “a game-changing commitment,” the Club’s Beyond Coal Campaign Senior Campaign Representative in Florida Susannah Randolph wrote June 22. But its viability “will be in the execution.”

“Other Southeastern utilities claim clean energy is a risky financial bet, but FPL is now on the record that it isn’t,” she said. FPL’s proposed investment in green hydrogen, however, includes cost uncertainties for electrolyzers and plant and pipeline retrofits that could undermine its “no incremental cost to customers” claim, she added.

Even advocates for green hydrogen agreed.

About green hydrogen

Studies show green hydrogen’s current high electrolyzer, production and transport costs, and other uncertainties will resolve with scaling, Green Hydrogen Coalition Founder and President Janice Lin said.

And scale will come because some industries as well as long-distance aviation, ocean shipping, and power sector long-duration storage “urgently need renewable hydrogen to become climate neutral,” German consultant Agora Energiewende’s August 21 report said. Like wind and solar, green hydrogen costs will fall “if scale-up occurs,” agreed BloombergNEF’s November 2020 assessment.

Neither study reported deployment levels that are driving costs down, but power plant off-takers like FPL can provide that, which is why Real Zero could be pivotal for the technology, Lin said.

FPL’s green hydrogen pilot, scheduled for late 2023, will use a 5% green hydrogen blend in its Okeechobee natural gas plant, McGrath said. A solar project and five electrolyzers built nearby will complete FPL’s Cavendish NextGen Hydrogen Hub, he added.

But Real Zero overlooks green hydrogen’s many uncertainties, stakeholders said.

The pilot’s unproven-at-scale technology may not work or may be too expensive and could result in FPL continuing to use natural gas blends that create emissions, Sierra Club’s Randolph said.

In addition, there are significant concerns about green hydrogen’s “timeline” because “the turbine and pipeline technologies for 100% green hydrogen are not ready,” IEEFA’s Feaster cautioned.

Hydrogen-natural gas blends of up to 5% are “generally safe” for pipelines and appliances but higher levels “require modifications” to avoid leaks, malfunctions, or even “gas ignition,” a July 18 University of California at Riverside report to the California Public Utilities Commission found.

And green hydrogen has competition, IEEFA’s Feaster said.

“There is a race with battery technologies, which the tech, utility, and auto industries are investing hundreds of billions of dollars in,” he said. Green hydrogen “may be the answer in 10 years,” but “there will likely soon be faster-charging, longer duration batteries, while the cost, complexity, and inefficiency of hydrogen could be obstacles,” he added.

But despite the questions around green hydrogen, some new technology like it “will likely be needed to reach high decarbonization levels,” SACE’s Smith said. FPL’s bet on electrolyzing hydrogen with solar may be the cleanest and most likely, and is worth exploring, because of climate change’s challenge to humanity and the planet, he said.

FPL’s commitment, and its announced interim commitments on carbon emissions reductions, show “real leadership” and “a specific and serious level of planning,” said Smart Electric Power Alliance Senior Manager, Research and Industry Strategy, Lakin Garth. But there is at present “no certain answer to how feasible and cost-effective” all the parts of its annual resource planning filing with regulators in April are, he said.

And to reach Real Zero by 2045, FPL will likely need an all-of-the-above approach that also includes demand- side resources that are not detailed in the blueprint, he and other stakeholders said.

The missing piece

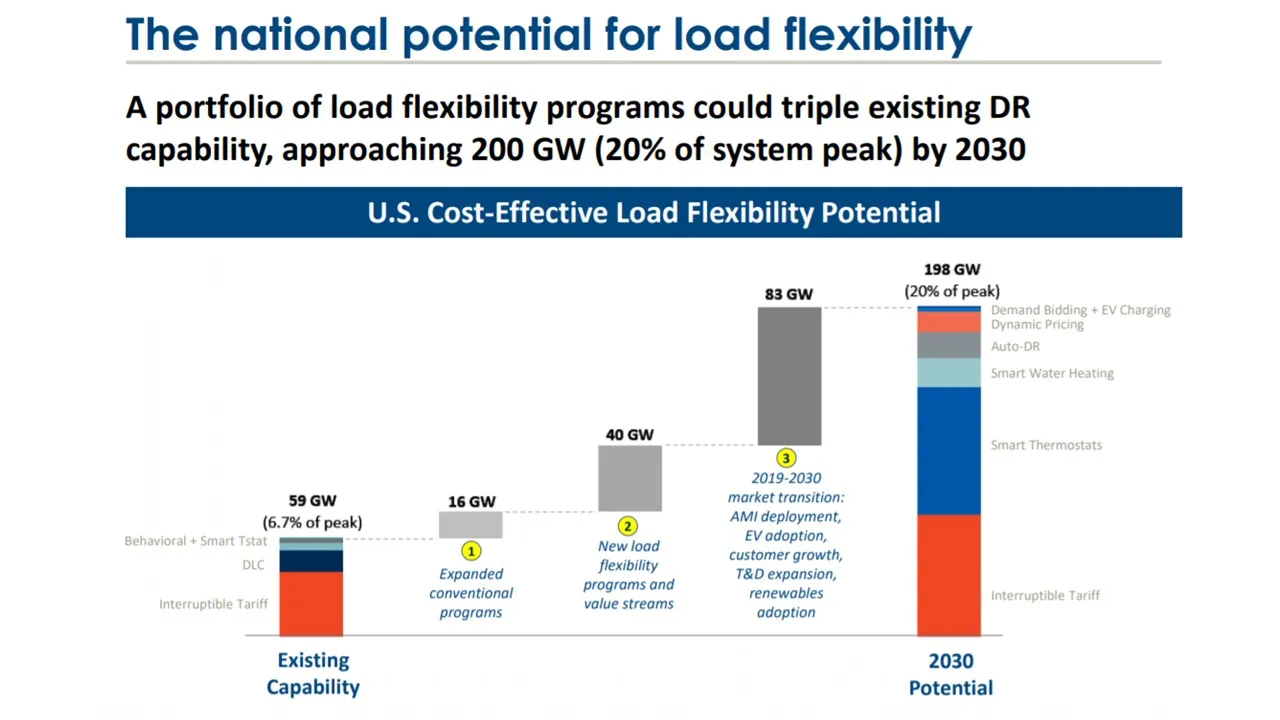

Beyond green hydrogen uncertainties, FPL may have overlooked the benefits of flexible demand-side resources to power systems with high variable renewables penetrations, advocates said.

Through 2021, FPL’s demand-side management has produced a “cumulative summer peak reduction of nearly 5,500 MW” and “cumulative energy savings of approximately 95,000 GWh,” the blueprint reported. But FPL has used regulatory technicalities “to dodge” genuinely supporting energy efficiency, Sierra Club’s Randolph wrote. And “it is no secret FPL was behind the effort to end rooftop solar’s net metering incentive in Florida,” she added.

Real Zero “leans in on innovation,” she said. FPL “could do the same with customer-owned demand-side resources to achieve both system and customer savings instead of using the most expensive approach,” Randolph added.

A zero-carbon power system can benefit from flexible behind-the-meter resources, SEPA’s Garth agreed. And ongoing scenario planning can evolve their role in reducing system costs and customer rates as technologies and economics change, he added.

FPL’s “ambitious initiative” does include a general reference to energy efficiency and demand response in its brief mention of smart grid technologies, California Efficiency + Demand Management Council Executive Director Joe Desmond emailed. And though it does not identify specific targets, the blueprint includes the undetailed observation that FPL is “investing and innovating” in demand-side resources, Desmond added.

FPL has long had “one of the largest demand-side management programs in the country,” and remains “open to the possibility of innovative technologies,” FPL spokesperson McGrath said. But its focus is “generation resources needed to be carbon-free by 2045, keep the lights on 24/7, and keep customer bills below the national average,” he said.

FPL was, however, ranked 51st of the 52 major U.S. investor-owned utilities for energy efficiency performance, program diversity, enabling infrastructure, and policies in the American Council for an Energy-Efficient Economy’s 2020 Utility EE Scorecard.

More effective use of energy efficiency could be one of the keys to managing anticipated loads from transportation and building electrification.

FPL is committed to EV growth and EV charger deployments in one of the fastest-growing state markets, McGrath said. But the blueprint provides no specific plans for addressing the explosive load growth expected from transportation electrification, McGrath acknowledged.

FPL also does not include a strategy for taking advantage of demand-side resources and dynamic loads from building electrification, he said. Addressing building electrification loads with grid-interactive efficient buildings could save the U.S. “between $8 billion and $18 billion annually by 2030,” a May 2021 Department of Energy building electrification roadmap reported. Cumulative benefits through 2040 “could reach $100 billion to $200 billion,” the roadmap added.

NEE and FPL may have omitted specific demand-side resource plans from the blueprint because “there is shareholder value they are planning to take advantage of in the future by owning them,” SACE’s Smith speculated.

Ambitious decarbonization plans like Real Zero will need “all available options,” including “innovative demand-side initiatives,” Ryan Hledik, a Brattle Group principal and co-author of DOE’s electrification roadmap, said. “Regulators will find expanded energy efficiency and load flexibility investments are cost-effective and key to affordable decarbonization for consumers.”

None of the stakeholders contacted by Utility Dive debated McGrath’s assertion that Real Zero is “game-changing” and a “bold goal.” Implementing it “will not be easy, but FPL is not doing it because it will be easy, or to meet a mandate,” McGrath said. It is doing Real Zero because “it is the right thing to do for our customers, for Florida’s economy, and for the environment.”

And there is overall optimism about the chance for success.

FPL “has a track record of following through,” added Sierra Club’s Randolph. “It moved from coal when natural gas became the lower cost option, and it now is moving to solar and green hydrogen for the same reason. But everyone is watching closely to see how it implements the blueprint.”