Dive Brief:

- The first small modular reactor developer to go public in the U.S. has reported a higher net loss for the first quarter of 2022 compared to the first quarter of 2021, but NuScale Power officials say there is enough cash on hand to stay afloat through 2024.

- NuScale received a $341 million increase in cash-on-hand after going public on May 3, well above the $200 million needed for the next two years, CFO Chris Colbert said during the company’s business update call on Friday.

- President and CEO John Hopkins told financial analysts about growing commercial prospects for the company’s reactors, with new and hoped for partnerships in and outside the U.S. “We are a first mover in a largely global and untapped market,” he said.

Dive Insight:

Nearly a month after it went public, NuScale, a leading SMR developer in the U.S., announced it had incurred a net loss of $23.4 million in the first quarter of 2022. This unaudited loss, which occurred before the company began trading on the New York Stock Exchange, compares to a net loss of $22.7million in the first quarter of the previous year.

Colbert told financial analysts that because the company has generated little revenue, “our focus has been on effectively managing the cost side of the equation.”

He attributed the increased loss to higher costs of marketing, adding workers, and higher administrative and professional fees.

When questioned about interest from U.S. investor-owned utilities, Colbert said utilities are starting to put SMRs into their integrated resource plans, including Duke Energy, Dominion Energy and PacifiCorp.

“It is not a question of ‘if,’ but ‘when,’” he said.

NuScale has one anchor tenant, Utah Associated Municipal Power Systems, or UAMPS, and the 462 MW SMR project is projected to come online in 2029. The company recently signed agreements to work towards deploying its SMR technology at Wisconsin’s Dairyland Power Cooperative, which serves half a million people in four Midwestern states, as well as with Romania and Poland, Hopkins said.

As the first SMR developer to pass the Nuclear Regulatory Commission’s safety evaluation, NuScale needs substantial financing to stay afloat for the next several years until its UAMPS modules come online, according to proponents and critics. During the business update call, officials noted the company’s projected $200 million in cash needs until the end of 2024 and highlighted that it raised far more: $341 million from its public offering following its merger with a Special Purpose Acquisition Company, Spring Valley Acquisition. It also had $42.7 million cash on hand before it went public. The total $384 million in cash includes cost-sharing funds from the Department of Energy, which said back in 2018 that it would support the project with $1.4 billion, though its current annual allocation is $40 million.

NuScale’s Hopkins said growing confidence in the company was reflected in several factors, including a $15 million private investment in April by Nucor Corporation, the largest steel company in the U.S.

“As America’s largest steel producer and a significant energy consumer, we are looking for safe and reliable sources of power generation that are consistent with our sustainability goals,” Nucor CEO Leon Topalian said in a statement at the time.

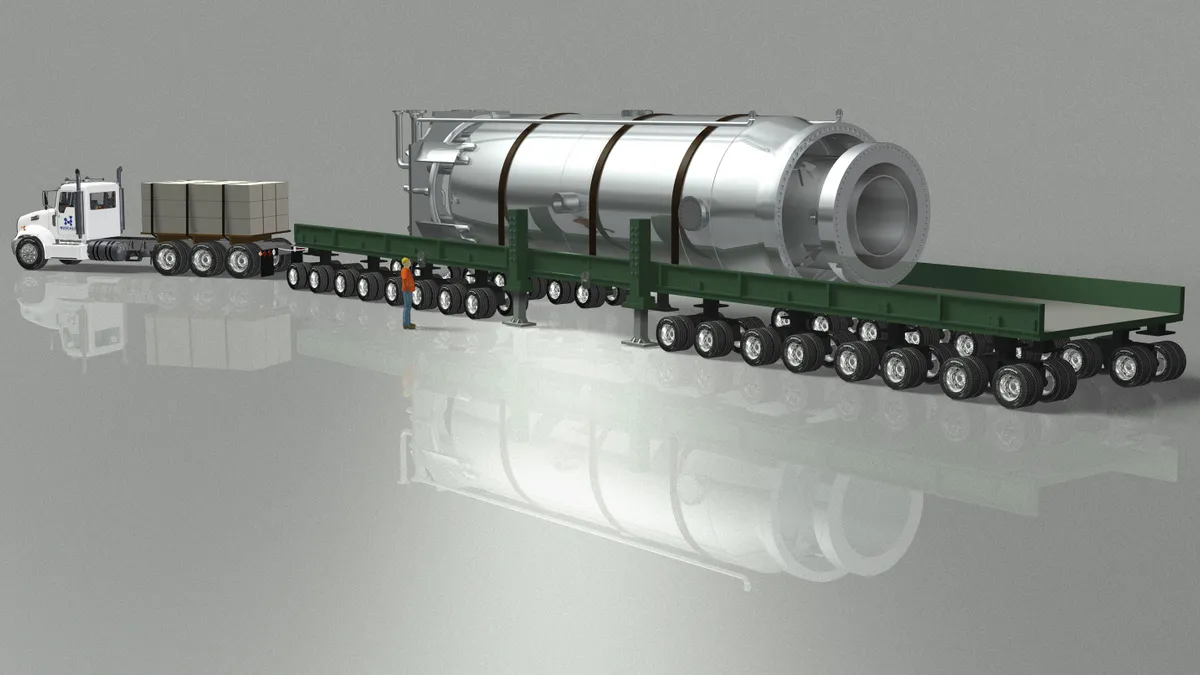

Hopkins also touted the company’s ordering of long-lead equipment, including pressure vessel forgings to be used in its SMRs, giving it “a significant competitive advantage.”

One issue issue not raised during Friday’s call was the potential increase in nuclear waste from NuScale’s and other emerging SMRs, according to a Proceedings of the National Academy of Sciences May 31 report. It concludes that “SMRs will produce more voluminous and chemically/physically reactive waste than large [light water reactors], which will impact options for the management and disposal of this waste.”

NuScale’s initial UAMPS SMR project, which entailed twelve 50 MW reactors and is to use light water as a coolant, will result in a “1.7-fold greater increase” in spent nuclear fuel discharged per energy equivalent, compared to a gigawatt-scale reactor, according to co-author Lindsay Krall. As far as long-lived decommissioning low- and intermediate-level waste needing disposal, its SMRs will increase the energy-equivalent volume by a factor of 9 to 17 compared to conventional light water reactors, the study found.

NuScale rejected the study saying it “uses outdated design information for the energy capacity of the NuScale fuel design and wrong assumptions for the material used in the reactor reflector, and on burnup of the fuel.” The UAMPS project was revamped from twelve 50 MW SMR to six 77 MW reactors. “NuScale’s design compares favorably with current large, pressurized water reactors on spent fuel waste created per unit of energy,” company spokesperson Diane Hughes said.