Dive Brief:

-

Three Republican senators on Thursday sent a letter to U.S. Department of Treasury Secretary Steven Mnuchin, urging the department to take additional steps to provide aid to the renewable energy industry.

-

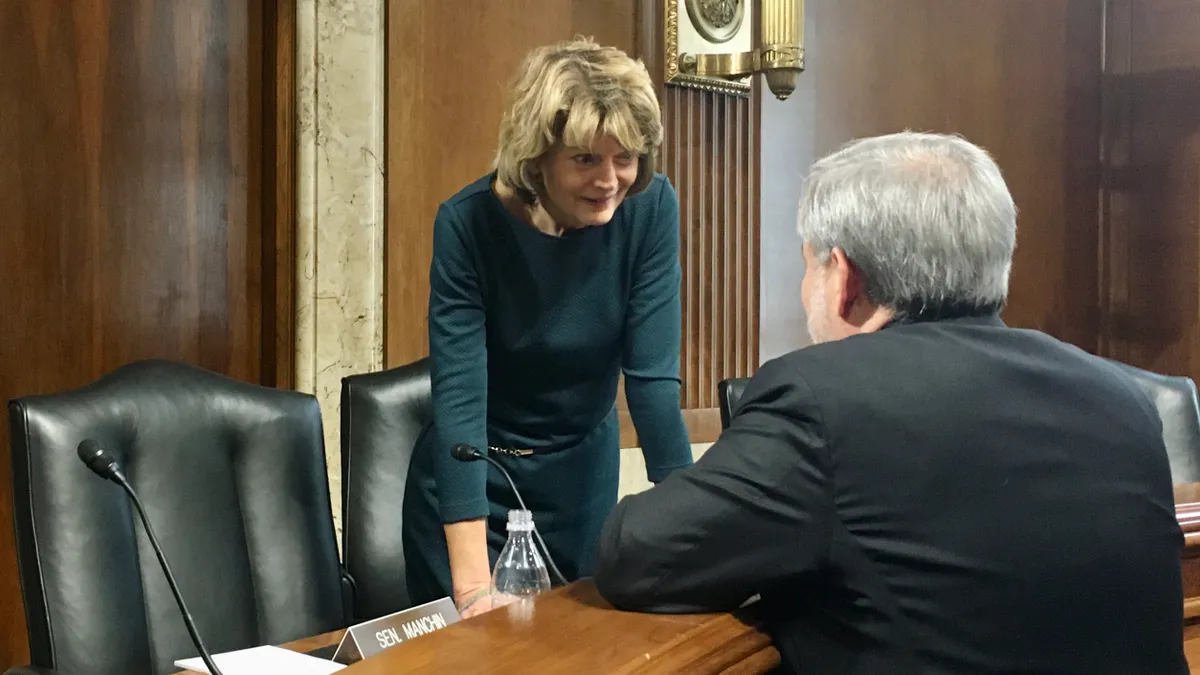

Senate Energy and Natural Resources Committee Chair Lisa Murkowski, R-Alaska, is leading the effort, according to her office, to extend safe harbor requirements for the "start of construction" on renewables projects, as well as modifying the "physical work test" rule, which dictates when significant construction begins for the purposes of determining tax credit elgibility.

- A group of bipartisan senators in April had asked the Treasury Department to extend safe harbor deadlines to ensure renewable energy developers are able to secure the tax credits they need to finance their projects. Treasury officials earlier this month indicated they would move forward with the modifications.

Dive Insight:

The COVID-19 crisis has led to a global economic shutdown, hurting the supply chains and workforces needed to move ahead on major solar and wind projects. For the U.S. renewables sector, the timing is particularly inopportune because of the winding down production tax credit (PTC) and investment tax credit (ITC).

In order for projects to qualify for those credits, developers needed to meet certain deadlines for construction, but due to COVID-19 disruptions, many feared they would not qualify.

The American Wind Energy Association (AWEA) estimates COVID-19-related delays have put 25 GW or $35 billion in wind projects investments at risk, along with 35,000 jobs, while the Solar Energy Industries Association says the solar sector could lose half its 250,000 workers and billions of dollars in solar project investments.

The previous letter sent by six bipartisan senators called for the Treasury Department to extend safe harbor deadlines for the PTC and ITC from four to five years for projects that began construction in 2016 or 2017, in a move largely expected to help the wind industry. But Thursday's letter calls out the solar industry in particular.

The main concern is with projects that began construction at the end of 2019 in order to qualify for the credit, but did not receive the equipment needed to begin the projects within the 105 days needed to qualify for the "start of construction" safe harbor deadline.

"A large number of new renewable energy projects, particularly solar projects, began construction at the end of 2019 in order to qualify for the full 30 percent ITC," the letter reads. "Ongoing uncertainty over equipment delivery in 2020 could lower investment in new projects, as well."

To mitigate the potential harm to industry, Murkowski and Sens. Susan Collins, R-Maine, and Thom Tillis, R-N.C., ask Treasury to treat such delays "as acceptable disruptions," so they may still qualify for the safe harbor deadline "so long as those materials are received by the end of the following year."

The second request is for the Treasury to modify its "Physical Work Test" requirements. Current requirements mandate a minimum level of consistent development once construction has begun, but the three senators asked Treasury to instead require "continuous efforts" to develop the project.

The request is "critical for projects featuring certain technologies that are seeking to maintain a ‘continuous program of construction' but are unable to do so based on permitting requirements or other delays," the letter reads. "Moving to a ‘continuous efforts' requirement would better reflect the full range of activities that are required to begin and complete projects that require some form of federal approval."

Solar and renewable energy leadership applauded the letter.

"Revisions to Treasury's current safe harbor guidance and moving to a ‘continuous efforts' standard for projects that commence construction through 2020 will help provide important relief to America's renewable energy workers who are being hit hard by supply chain disruptions, shelter-in-place orders and other significant pandemic-related delays," Gregory Wetstone, President and CEO of the American Council on Renewable Energy said in a statement.

"Solar energy can add opportunity and economic growth in red states and blue, and the bipartisan support we have seen for this policy tweak by Treasury demonstrates the benefits solar brings to all Americans regardless of their politics," SEIA CEO Abigail Ross Hopper said in a statement. "We look forward to working with Treasury to address problems in the solar market created by this COVID-19 crisis."