Dive Brief:

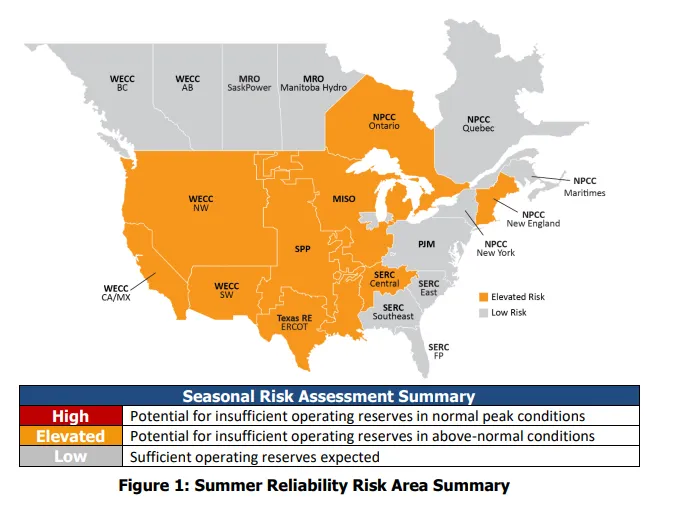

- Most of the United States will face an elevated risk of blackouts should summer weather turn extreme, the North American Electric Reliability Corp. said Wednesday in its 2023 Summer Reliability Assessment.

- Resources should be adequate to meet normal summer peak demand, but “if summer temperatures spike and become more widespread, the U.S. West, Midwest, Texas and Southeast United States, New England and Ontario may experience resource shortfalls,” NERC concluded.

- Recovery times following hurricanes or severe storms could be slowed by low inventories of replacement distribution transformers, NERC warned. Supply chain constraints may also lead to maintenance issues this summer with delays for some new resource additions, NERC added.

Dive Insight:

NERC officials on Wednesday issued a sober assessment of the U.S. grid, ahead of the year’s hottest months and highest electricity demand. Demand for cooling and the performance of renewable energy assets will be key factors in the grid’s performance. The situation has been exacerbated by demand growth and generation retirements, officials said.

”We are facing an absolute step-change,” NERC’s Director of Reliability Assessment and Performance Analysis John Moura said in a call with reporters. Over the past five years, NERC has seen a “steady deterioration in the risk profile of the grid.”

"The system is close to its edge ... managing the pace of retirements is critical,” he said.

NERC’s assessment examines generation resources, transmission capacity and energy sufficiency for June through September.

“All areas are assessed as having adequate anticipated resources for normal summer peak load and conditions,” NERC said in its report. But most of the country will “face risks of electricity supply shortfalls during periods of more extreme summer conditions.”

“This report is an especially dire warning that America’s ability to keep the lights on has been jeopardized,” National Rural Electric Cooperative Association CEO Jim Matheson said in a statement.

In the Midcontinent ISO territory, “wind generator performance during periods of high demand is a key factor in determining whether there is sufficient electricity supply on the system to maintain reliability,” NERC said.

In the Southwest Power Pool, if wind output falls below normal, the grid operator “can face energy challenges in meeting extreme peak demand or managing periods of thermal or hydro generator outages.”

In Texas, “dispatchable generation may not be sufficient to meet reserves during an extreme heat wave that is accompanied by low winds.”

In the Western Interconnection, NERC said wide-area heat events can expose some assessment areas to a risk of energy supply shortfalls “as each area relies on regional transfers to meet demand at peak and the late afternoon to evening hours when energy output from the area’s vast solar PV resources are diminished.”

“Wildfire risks to the transmission network, which often accompany these wide-area heat events, can limit electricity transfers and result in localized load shedding,” NERC added.

Supply chain issues slow recovery times, maintenance

Not all areas will face elevated risks. PJM Interconnection “expects no resource problems over the entire 2023 summer peak season,” NERC noted. In the New York ISO, “adequate capacity margins are anticipated and existing operating procedures are sufficient to handle any issues that may occur.”

Most of the SERC Reliability Corp. is well positioned for the summer but in SERC-Central forecasted peak demand has risen by over 950 MW relative to last summer “while growth in anticipated resources has been flat.” The area includes all of Tennessee and portions of Alabama, Georgia, Kentucky, Missouri and Mississippi.

NERC’s report examines other reliability risks including fuel supplies.

Stored gas and coal “are at high levels, but industry is monitoring for potential generator fuel delivery risks,” NERC said. “Fuel supply and delivery infrastructure must be capable of meeting the ramp rates of natural-gas-fired generators as they balance the system when solar generation output declines.”

Some coal-fired generators in the Southeast have reported “challenges in arranging coal replenishment due to mine closures and transport delays,” the report added.

And new environmental rules restricting power plant emissions will complicate grid operations, NERC said.

The U.S. Environmental Protection Agency’s Good Neighbor Plan, which requires states to reduce downwind pollution impacts, was finalized in March, likely requiring generators in some states to meet tighter emissions restrictions. As a result, grid operators and balancing authorities “will need to be vigilant for emissions rule constraints that affect generator dispatchability and the potential need for emission allowance trades or waivers to meet high demand or low resource conditions,” NERC said.

Supply chain issues are a continuing problem for the power industry. Along with a shortage of transformers, NERC said “difficulties in obtaining sufficient labor, material and equipment as a result of broad economic factors has affected preseason maintenance of transmission and generation facilities in North America.”

“Many utilities have relatively low inventories [of transformers],” said Mark Olson, NERC manager of reliability assessments. “The industry is using asset-sharing programs to mitigate those impacts.”