Dive Brief:

-

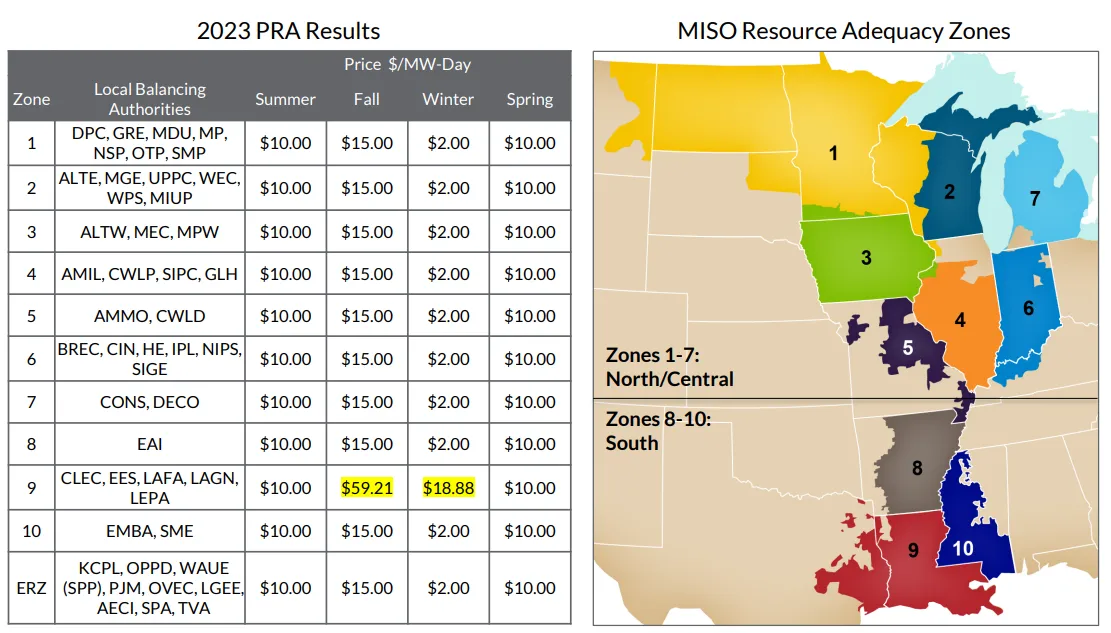

In the Midcontinent Independent System Operator’s first-ever seasonal planning resource auction, or PRA, capacity prices plunged to a range of $2/MW-day to $15/MW-day from $236.66/MW-day a year ago across the grid operator’s central and northern regions, driven by new power supplies and a dip in expected electricity demand.

-

MISO’s northern and central region has a 4,760-MW, or 4.7%, surplus over its reserve margin this summer, up from a 1,231-MW shortfall last year, the grid operator said Thursday.

-

“This year’s results are encouraging and indicate that the new seasonal approach to resource planning is a step in the right direction,” Clair Moeller, MISO president and CEO, said in a statement. “As we navigate an unprecedented transformation of the power system, we must continue to make further enhancements to maintain reliability and send the right pricing signals to the market.”

Dive Insight:

The PRA results mark a sharp turnaround from last year’s auction when prices soared and MISO warned of possible rolling blackouts.

This year, MISO had enough capacity across its footprint, in its two subregions, and in each of its 10 zones.

In a major change, MISO is no longer holding its annual, voluntary PRA, the equivalent of a capacity auction, to meet peak summer load. Finding that grid emergencies are occurring throughout the year, it has shifted to meeting capacity needs for each season.

For almost all MISO’s footprint, capacity prices were $10/MW-day in the summer, $15/MW-day in the fall, $2/MW-day in the winter, and $10/MW-day in the spring. The fall and winter prices in MISO’s zone 9, which includes parts of Louisiana and Texas, were $59/MW-day in the fall and $19/MW-day in the winter, respectively.

Market participants delayed power plant retirements and made additional existing capacity available to the region, helping bolster MISO’s capacity supplies, according to the grid operator.

MISO’s North/Central region was supported by 3,250 MW of new generation and 1,960 MW of increased accreditation for gas, wind, solar and other resources in the summer season. Based on recent events, coal-fired power plants lost 924 MW of accredited capacity and 1,170 MW was retired, according to MISO.

MISO’s North/Central region, especially zones four and six, continue to rely on lower-cost imports from MISO South and external areas, according to Vinay Gupta, senior manager for energy power markets at ICF, a consulting firm. Without the imports, the auction clearing price for the summer season could have been $80/MW-day, he said Friday in an email.

Excess summer capacity in MISO’s southern region fell to 1,723 MW, or 5.1% above its reserve margin, down from 2,811 MW last summer, mainly driven by power plant retirements, the grid operator said.

The auction results don’t reflect long-term risks posed by changes in the power system, according to MISO.

“Reduced load forecasts and actions taken by members such as delayed retirements and increased imports may not be repeatable,” the grid operator said.

Gupta agreed with MISO’s assessment. “The auction does not appear to solve the trend of declining reserve margins,” he said. “The factors this time could be one-off.”

Only a small percentage of MISO load is exposed to the auction prices, so the results do not reflect the value of the grid operator’s underlying reliability needs, according to Gupta.

Power plant retirements, driven by economics, environmental regulations, and state and utility decarbonization goals, will lead to tightening supply, he said.

“These retirements could threaten utilities’ ability to meet the resource adequacy requirements, increasing the value of existing and new firm capacity,” Gupta said.

Looking ahead, MISO said it aims to protect grid reliability by developing transmission lines, enhancing agreements with neighboring grid operators for operations during emergencies and improving coordination between the electric and natural gas sectors.

MISO is also developing a “reliability-based demand curve” to more accurately signal when it needs more capacity.

About 5.1 GW retired in MISO from 2018 to 2022 for economic reasons, according to a MISO presentation. A reliability-based demand curve would have kept some of those resources online through higher capacity prices, MISO said.

MISO had expected to file a demand curve proposal with the Federal Energy Regulatory Commission in June but has pushed that plan to late this year to allow for more discussions. It could take effect for the 2025/26 capacity year at the earliest, according to MISO.