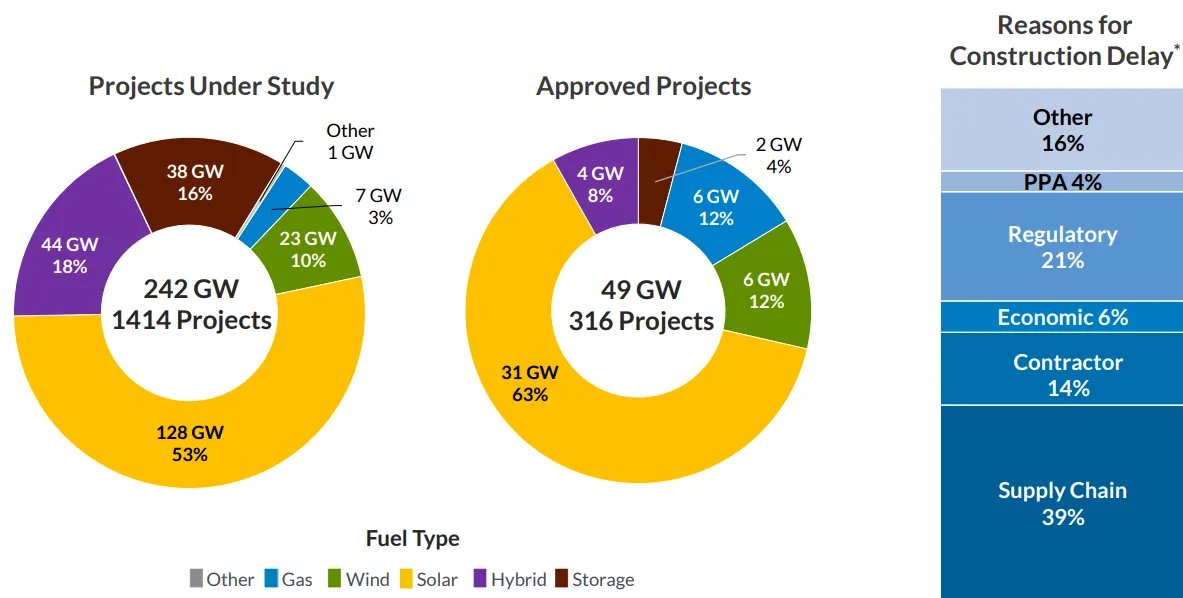

About 49 GW of planned capacity, mostly solar, has cleared the Midcontinent Independent System Operator’s interconnection process, but on average projects face nearly two-year delays in reaching commercial operation, according to Scott Wright, MISO executive director for resource planning.

The delays, which are affecting all types of projects, are mainly caused by supply chain and permitting issues, Wright said Tuesday during a meeting of the MISO Board’s system planning committee.

Projects that have completed the interconnection process and are awaiting construction as of July include 31 GW of solar, 6 GW of gas, 6 GW of wind, 4 GW of generation combined with storage and 2 GW of stand-alone storage, according to Wright's presentation to the committee.

Other grid operators also face project delays amid concerns they may not have enough resources to meet their electricity needs. The PJM Interconnection in June reported that 44 GW of generation had cleared its interconnection process, but was not being built because of siting, financing or supply chain issues.

In MISO, the stalled projects come as the grid operator faces an estimated 2.1 GW capacity shortfall starting in the 2025/26 planning year, according to the annual Organization of MISO State/MISO survey released in July. The potential shortfall grows to 9.5 GW in the 2028/29 planning year.

“We need to get accredited capacity in the ground,” Wright said, noting about 2.5 GW has been added in MISO’s footprint annually in the last five years.

Areas of uncertainty surrounding MISO’s long-term resource adequacy include a potential increase in load growth — current forecasts assume tepid growth — plus a possible acceleration in power plant retirements, evolving risk metrics and capacity accreditation approaches, Wright said.

MISO’s interconnection queue totals about 242 GW, but about 80% of projects typically don’t come to fruition, according to Wright. The grid operator plans to file a queue reform proposal later this year with the Federal Energy Regulatory Commission to reduce speculative projects in the process, he said.

MISO sees signs of load growth

Meanwhile, MISO staff are advancing what could be a record-setting $9.1 billion transmission expansion plan for an annual cycle that doesn’t include multi-value transmission projects, Laura Rauch, MISO executive director for transmission planning, told the committee. MISO’s board approved a $4.3 billion transmission expansion plan last year.

The MISO Transmission Expansion Plan focuses on near-term transmission needs that can be built in one to three years.

There was a surge in expedited project requests this year, a trend MISO expects will continue, Rauch said. The expedited requests are for projects that can’t wait for the normal MTEP review cycle, and are often driven by new load, according to Rauch.

“Listening to our members, we are hearing that there is a continued high likelihood that we will see these larger industrial loads, commercial loads or things like data centers, hydrogen facilities, drive large load additions,” Rauch said.

The expedited project requests are driven by about 21 GW in potential load growth, according to Rauch's presentation to the committee.

Most of the projects in the pending expansion plan respond to reliability needs driven by local load growth, with nearly half the potential spending in MISO’s southern region, according to Rauch.

The four largest projects in the draft expansion plan total about $3 billion and are in MISO’s southern region, according to the presentation.

“We spent a significant amount of time to validate these projects and make sure they align with the possibilities that we see for [long-range transmission planning] tranche three,” Rauch said. The LRTP tranche 3 will focus on regional transmission additions to meet the long-term needs of MISO’s southern region.

“We are confident that the projects that we are moving forward are notionally in line with the needs that we believe we will be tracking down [in the LRTP process] and do not preclude any larger regional solutions,” Rauch said.

MISO staff plan to ask the grid operator’s board to approve an MTEP proposal at a Dec. 7 meeting.