Transportation electrification, if not effectively managed, may become the most disruptive new electricity demand on the power system, analysts and utility leaders agree.

Electric vehicle drivers prefer home charging for its low cost and convenience despite the longer charging times, according to a 2023 study by the National Renewable Energy Laboratory. But to keep pace with the growth of EV charging and other customer needs, as of 2021, “utility investments in distribution systems, nationwide, exceeded $60 billion annually,” a 2024 study by NREL found.

That investment is needed to “optimize, visualize and control” new distribution system resources, Pacific Gas and Electric CEO Patti Poppe acknowledged during the RE+ 2024 clean energy conference in September. But revenues from new electricity sales will “offset the infrastructure investment” and “reduce all customers’ bills between 2% and 3%,” she stressed.

And using active managed charging instead of time of use rates to shift charging to the lowest electricity price periods could save another $300 per vehicle per year, according to a just released Smart Electric Power Alliance paper.

“It is becoming clear time of use rates are not enough” and “are creating secondary peaks that cause distribution system congestion,” said report co-author and SEPA Senior Analyst, Research and Industry, Brittany Blair. “Active managed charging” by utilities and third parties “will be needed to unlock EVs’ full potential and decrease distribution system impacts,” she added.

Pilot programs have proven active managed charging is effective and utilities in Maryland and other states are moving programs to scale. But key questions remain about whether state regulators and stakeholders will see the value proposition in distribution system modernization investments and what it will take to get customers to give utilities and third parties control of their charging.

The snapback peak problem

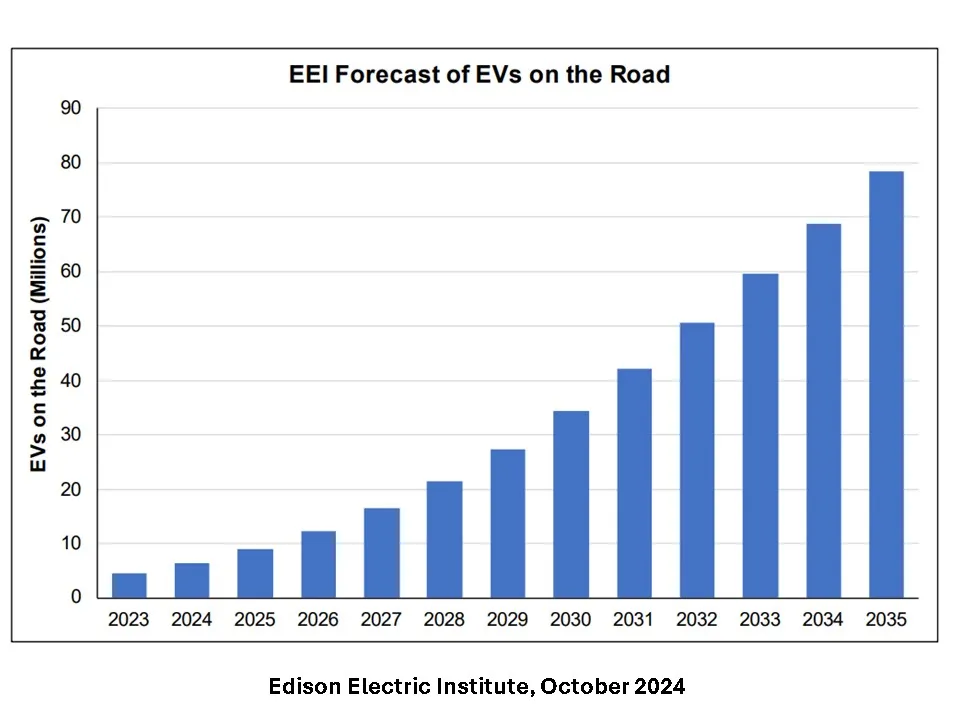

There could be 78.5 million EVs on U.S. roads by 2035, up from 2023’s 4.5 million EVs, according to an October 2024 paper from investor-owned utility trade association Edison Electric Institute.

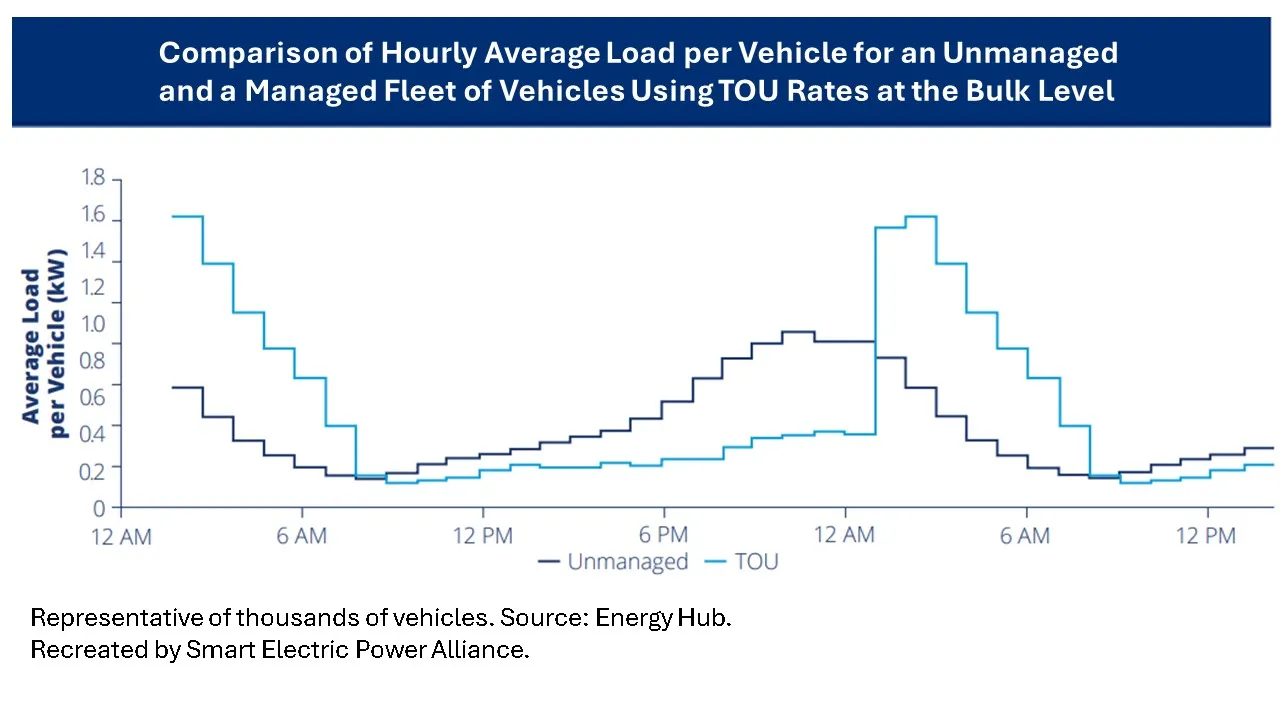

While TOU rates shift residential and business electricity use away from peak demand periods, they are less effective for managing EV charging, a just-released Electric Power Research Institute paper concludes. Charging is too often initiated immediately after the reduced rates begin, causing what many call a secondary, or snapback, peak, the research confirmed.

TOU rates “are definitely helpful” because they limit the system burden “at the primary peak,” said Southern California Edison Director, Clean Energy and Demand Response, Chanel Parson. But there is a secondary peak right after the peak period ends, she acknowledged.

That secondary peak can be managed “to come on gradually” if the utility is allowed to “orchestrate the flexible load to prevent localized distribution system congestion,” Parson said. Active utility managed charging can spread charging over the TOU off-peak period if there are “incentives for customers to participate, either from the utility or third-party aggregators,” she added.

A way “to stage distribution system investment with the growth of EVs” may be in using new accelerated computing capabilities to deliver electricity market price information to local substations, said Kay Aikin, founder and chief product officer of consultant Dynamic Grid. Though not widely tested, that “substation intelligence” could manage charging with “price signals to EV chargers pre-set to owner parameters, eliminating direct utility control,” she added.

Another approach is the smart panel, which is an energy management system that sheds EV charging if it threatens to overload the home’s rated service, said SPAN Director, Homebuilder Services, Stephen Kane.

But if several houses in a neighborhood are charging EVs, the total load could still be an issue at the feeder or transformer, he acknowledged. “The utility has to be responsible for load at the system level,” Kane said.

The proven solution is active management of charging by the utility or a third party, many stakeholders now realize.

The active managed charging solution

With over three million EVs on U.S. roads, managed charging pilots need to be scaled before infrastructure upgrade costs start rising instead, analysts and utility executives agree.

As documented in the SEPA paper, “utilities have done enough active managed charging pilots to understand its value and its effectiveness,” said SEPA’s Blair.

And utilities do not need total control of EV charging, said SEPA Senior Director, Electrification, and paper co-author Garrett Fitzgerald. Many utilities are beginning to understand that third party aggregators with DER management systems at the distribution system level can effectively implement signals from utility control rooms, he said.

An Arizona Salt River Project 2021 study, the Pacific Gas and Electric ChargeForward California program, and National Grid’s Charge Smart plan in New York are examples of such utility progress, according to the SEPA paper.

“The majority of the value that we are quantifying and designing customer compensation around are from system-wide peak energy cost reductions,” Fitzgerald said. But “each customer will have a different value, and managed charging can be optimized to focus on those customers where a shift in charging is needed, rather than on shifting all customers.”

Utilities recognize they can minimize the cost and maximize the benefit of EV charging with active management to put downward pressure on rates and improve system reliability for all customers, agreed EEI Senior Director of Electric Transportation Kellen Schefter.

A January 2024 Synapse Energy Economics study showed “revenues have exceeded the costs of managed charging programs” and offers guidance on “the art of program design,” Schefter continued. “A program design that will change an individual customer's behavior may also require a TOU rate, an upfront bill credit for enrolling, or an ongoing monthly or annual incentive to continue to participate,” he said.

EV advocacy consortium ChargeScape found very different incentives in the Duke Energy Carolinas EV Complete Home Charging Plan and the Xcel Energy Colorado Charging Perks Pilot got good participation, Schefter said.

“Solutions that meet different customer needs and offer different options will likely be needed,” Schefter added. But “programs can now cost-effectively scale,” and Baltimore Gas and Electric, or BGE, is demonstrating that with its just approved plan to serve up to 30,000 EV owners, he said.

BGE’s program has raised the bar, many agree

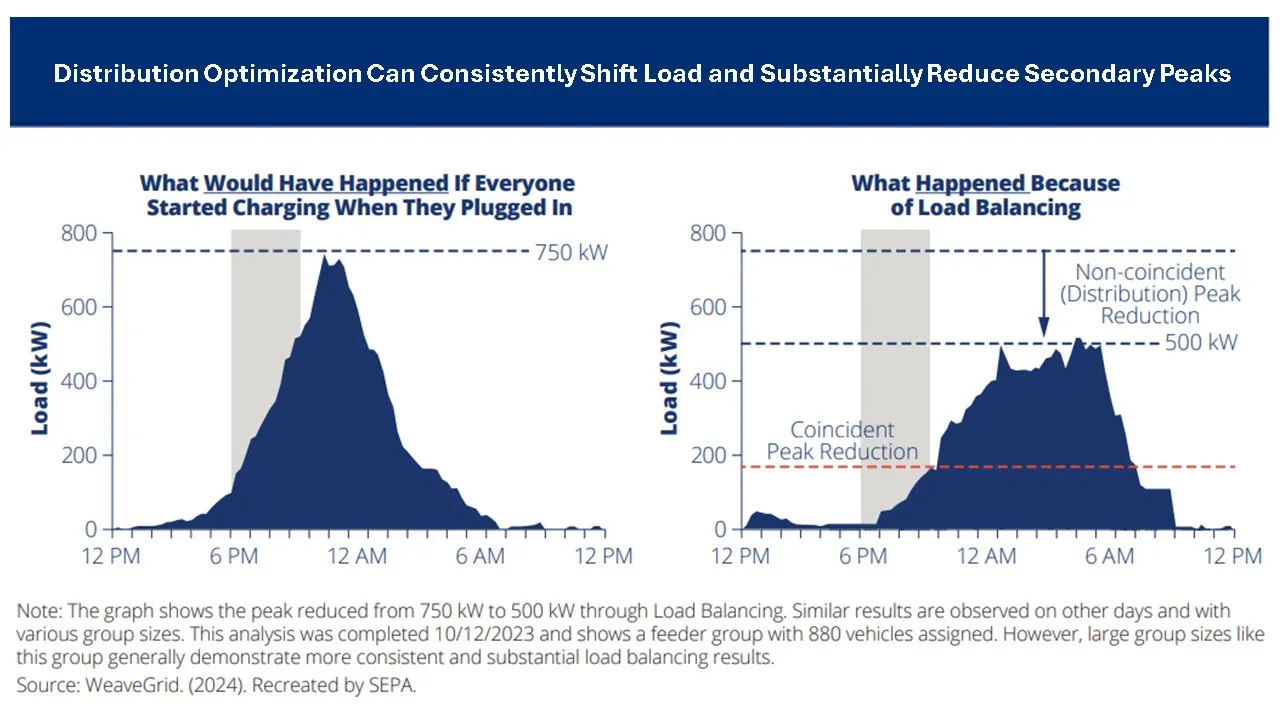

BGE’s passive TOU rate-based charging pilot led to its active EV Smart Charge Management, or SCM, program with third party aggregator WeaveGrid, BGE Manager, Strategic Programs, Stephanie Leach told a Sept, 10 RE+ audience.

“EV charging load is a major concern of almost every major utility now because even where EV adoption is not high, some high adoption neighborhoods may exceed local system capacity,” Leach continued. WeaveGrid uses BGE electricity pricing and system demand information to optimize charging at the grid edge, according to EV owner pre-set preferences, she added.

“We are still working on the benefit-cost analysis by modeling the cost of distribution system upgrades with and without managed charging,” Leach added.

The costs of serving the current and coming EV charging demand will likely be high, analysts generally agree.

But there will also be significant costs for building out the distribution system to enable active managed charging, stakeholders acknowledged.

Managing managed charging

Grid modernization regulatory proceedings and rate cases have shown the potential upward rate pressure from the costs to implement and deploy managed EV charging programs and technologies.

SCE “is developing a large-scale managed charging program that will include a TOU rate, an upfront cash incentive, and other incentives to cover the cost of equipment, Parson said. And an estimated 80%-plus electricity demand growth to meet California’s 2045 net zero emissions goal will require utility DERMS, system-wide hardware and software, and grid edge technologies,” she added.

To avoid imposing costs on non-EV owners, SCE is considering “grant funding and industry partnerships,” Parson said.

The BGE SCM pilot will scale to enroll 30,000 EV owners by 2027, but it will delay or minimize distribution system capital investments for handling EV charging loads, said WeaveGrid VP of Market Development Mathias Bell. WeaveGrid’s EV management system and customer facing DERMS reduces the need for utility investments at the grid edge, Bell said.

“The pilot demonstrated a cost-effectiveness of 1.58 under the required Maryland jurisdiction-specific test, showing a benefit greater than the program’s cost,” Bell said. And “92% of the charging load managed through SCM complied with the charging schedule set by BGE and WeaveGrid,” he added.

WeaveGrid is also working on active EV charging management with Oregon’s Portland General Electric, California’s Pacific Gas and Electric, Colorado’s Xcel Energy, Detroit’s DTE, and Southern Company’s Georgia Power and Alabama Power subsidiaries, Bell said.

Active managed charging is ready to scale, agreed Senior Vice President, Head of Customer Solutions, Erika Diamond of grid-edge DERMs provider EnergyHub.

“There is complexity in managing charging” because utility control rooms expect both “effective load shifting and consumer satisfaction,” Diamond said. But a complete utility control-room DERMS takes time to design and implement, while “a grid-edge DERMS can be deployed as quickly as in weeks,” which is why utility aggregator partnerships are growing, she added.

Adding DERMs to a utility control room can take six to nine months, Schneider Electric Digital Grid Product Marketing Manager Monika Jovic confirmed in a July webinar. And grid edge DERMS deployed and managed by third party aggregators can manage flexible distributed resources like EV charging “to replace traditional resources,” Jovic said.

EnergyHub “has programs involving over 100,000 devices” and “is working with utility planning, operations and demand-side management teams,” Diamond said. Its grid edge DERMs integrates utility control room information with its situational awareness at the distribution system level “to balance supply and demand to match the load shape,” she added.

“Most utilities and aggregators have not yet quantified the full range” of energy, capacity and ancillary services values of managed charging beyond peak reduction, Diamond continued. Determining that full value may “require the value paradigm of distributed resources to evolve,” she said.

Correction: A previous version of this story gave an inaccurate acronym for Baltimore Gas & Electric. It goes by BGE.