Samuel Newell is a principal at The Brattle Group.

The U.S. electric system is under more pressure than ever before. In order to meet the challenges of unprecedented growth in electricity demand from data centers, re-shoring and other uses, the U.S. electricity grid will have to expand more than five times faster than in the previous two decades. All regions of the country will need massive amounts of new resources and increased grid capability yet face lagging infrastructure, supply chain issues and slow-moving planning processes.

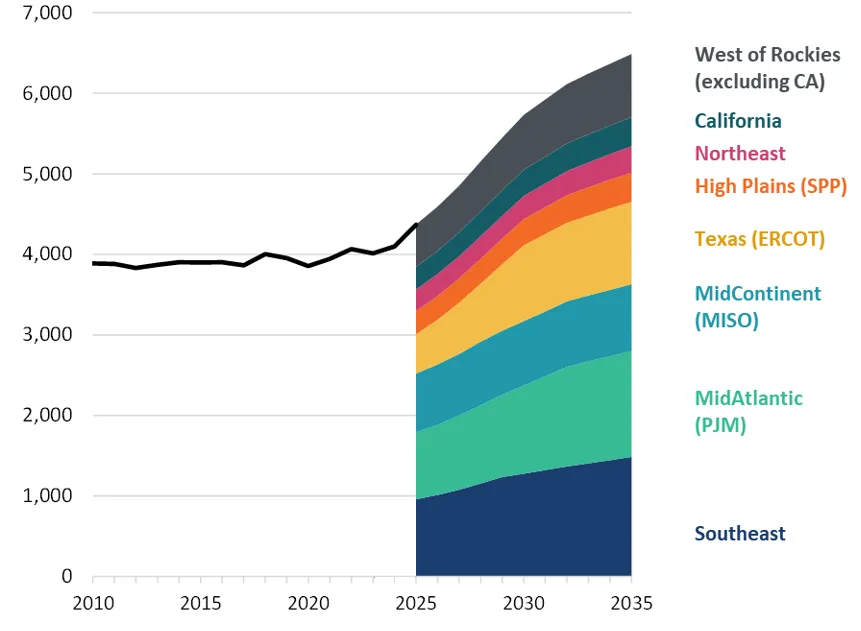

Current forecasts, based on Brattle’s aggregation of most recent RTO and utility forecasts across the country, suggest peak loads will increase by 175 GW by 2030, and 270 GW by 2035 (24% and 36%, respectively) relative to 2024. Annual energy use is projected to grow even faster, adding 53% by 2035, since many of the new loads have higher load factors than existing loads.

These forecasts are uncertain, with wider error bars than in more stable periods. Uncertainties surround the firmness of hyperscalers’ plans for new data centers and their future expansion, as everything about artificial intelligence training, usage and computational efficiencies evolve. There is also uncertainty around whether planned manufacturing plants will proceed with federal incentives that have been depended upon. Perhaps there is more downside than upside if some service requests are tentative or duplicative of requests in other candidate locations. Yet even if only half materializes, the growth rate will still far exceed that experienced in recent decades.

This rate of growth is difficult to meet because of its sheer magnitude and because it is so much higher than anticipated in forecasts from even a mere 1.5 years ago, which were closer to business as usual and exploded only over the past year or so as demand requests proliferated. This is why supply chains and planning mechanisms are behind the curve.

Many new resources will be needed to meet increased load and to replace old coal plants that are retiring primarily because of their costs. Indeed, Hitachi’s Energy Velocity reports 65 GW announced coal retirements by 2030 and another 15 GW by 2035, although some of these plants will opt to extend their lives if they can, and some will convert to natural gas.

But can enough resources be added quickly enough to reliably meet so much load growth and to replace retirements? Each type of resource has limitations, such that a diverse array of approaches will be needed to offer the best opportunity to meet the need and to do so cost-effectively.

Demand-side solutions

Aggressive development of demand-side solutions will be essential, including traditional demand response for peak shaving, emerging virtual power plant applications to provide a range of grid services, energy efficiency, time-varying rates and distributed energy resources. Many demand-side resources can be quick to develop, in part because they do not require lengthy timelines for interconnection to the transmission grid, as supply-side resources often do.

Traditional demand response opportunities remain widespread, as they have been in the past even when capacity was less scarce. Further applications should become economic at higher prices. And even data centers may provide some DR, either through on-site generation or load flexibility. On-site generation that data centers bring can provide DR, especially by using a combination of batteries, solar and gas-fired generation instead of diesel generation in order to address air-quality limitations. This capability could increase as cooling technology advances (cooling load adds to about 40% of a data center’s electric consumption). Additional load flexibility approaches are emerging to distribute electricity-intensive LLM trainings spatially and temporally to reduce electric demand during RA hours. Finally, some new loads will rely entirely on new on-site generation they develop as a bridge until a grid connection is available, although they will compete for a scarce supply of generation units.

VPPs are emerging as a related option to provide a range of grid services through orchestrated aggregations of flexible loads and DERs, and can cost 40-60% less than the net cost of conventional alternatives. States would need to structure incentives to mobilize customer adoption for wide-scale flexible load potential via managed charging, vehicle-to-grid, behind-the-meter battery optimization, integration with building energy management systems, and management of electric heating and cooling load. Brattle’s recent research identified 30 proven strategies for scaling these programs. Similarly, time-varying rates may provide material capacity relief if adopted widely, on a default basis.

Supply-side solutions

Demand-side solutions are unlikely to suffice for meeting projected load growth. Large amounts of new supply will be needed. Since each type of supply resource has its own challenges, a diverse portfolio will be needed to provide enough supply quickly enough and cost-effectively. Supply-side options include the following:

- Solar, wind, and storage dominate development pipelines. Their prevalence is both for economic reasons and in response to corporate, utility, and state clean energy procurements. Although these resource types do not provide as much RA as dispatchable resources, they can be developed quickly while providing significant RA value (particularly when storage is included) and large amounts of low-cost energy. A recently released study Brattle conducted for ConservAmerica showed the major role these resources will play in meeting growing demand as well as the economic importance of supporting their further development by continuing the clean energy tax credits.

- Gas-fired generation will be built to help meet so much load growth in spite of its emissions. Yet gas-fired capacity accounts for only 45 GW in interconnection queues nationally, due to recent history of slow growth and with many states and utilities turning toward cost-effective non-emitting resources. New projects beyond those already in development will be severely limited through approximately 2030 by issues with supply chains for turbines, transformers, and switchgear, correspondingly long construction timelines (44-50 months currently), and sometimes lengthier timing to process and build upgrades for new interconnections. Orders by utilities, developers, and loads themselves will stimulate supply chain expansion, but that will take time. In the meantime, other technologies such as smaller turbines, internal combustion engines, and reciprocating engines may contribute, albeit in smaller magnitudes and with higher emissions.

- Advanced nuclear options will take much longer to develop and expand at scale, but it is worth publicly supporting several approaches now to see if some can become cost-effective at greater scale. Examples like NYSERDA’s Blueprint for Advanced Nuclear Energy Technologies, to which Brattle contributed, can help guide the way.

What will happen if new loads try to enter faster than the resources needed to support them? Vertically integrated utilities can deny requests, whereas the RTOs in restructured markets do not have such authority. There, only transmission owners could deny requests that would overload their transmission systems. From an RA perspective, new entrants can lean on resources already in place and this will tend to increase prices, which should draw in more resources as quickly as supply chains, development and interconnection can allow. In the meantime, there may be some period of sustained high prices and even RA shortfalls in some places.

Transmission interconnection

Closely related to resource adequacy is transmission interconnection, which is a key enabler but has been a bottleneck in two ways. First, it takes many years to study, plan, permit and build new transmission lines. Second, the supply chain for certain types of transmission equipment is highly constrained given rapidly growing worldwide demand for the equipment.

The most frequently discussed improvement opportunity is to streamline generator interconnection processes and standards, including by clustering certain projects, fast-tracking projects that are more ready to add more capacity or are easier to accommodate, or by allowing energy-only injection rights with less stringent standards. All of the RTOs are making progress but still have further to go.

It will be important to prioritize getting more out of existing systems while proactively planning to build more. Grid-enhancing technologies, which include dynamic line ratings, topology control, and flow-control devices, can substantially increase reliable utilization of the existing system quickly and at minimal cost. Remedial Action Schemes (RASs) can similarly enable rapid interconnections of new resources without requiring costly and time-consuming network upgrades. RASs allow for improved grid utilization by managing the risk transmission contingencies through automated relay-controlled responses of new generation, including backup generation at large new loads. When network upgrades are needed, the key is to do it faster and cheaper. Here, too, RTOs are making progress by replacing reactive planning with more proactive planning of processes and upgrades (including reconductoring) ahead of need.

Industry participants will need to evaluate their planning and decision-making processes in order to meet the unprecedented growth in US electricity needs. Massive amounts of new resources and increased grid capability will be required, while facing inadequate infrastructure, supply chain issues and slow planning timelines. Adding sufficient and proper resources fast enough to reliably meet the growth will require an array of demand- and supply-side resources as well as stronger transmission interconnection planning than ever before.