The last few days have been mixed for energy storage with Xtreme Power filing for bankruptcy and AES Energy Storage reaching the 1.5 million MWh milestone for delivered energy. But looking at the big picture, the energy storage appears poised for take off, in part due to state and federal policies.

Here's what you need to know:

A primer on storage

Energy storage will play a key role in lowering greenhouse gas emissions by helping integrate renewables and making grid operations more efficient.

“Energy storage can play a significant role in meeting these challenges by improving the operating capabilities of the grid, lowering cost and ensuring high reliability, as well as deferring and reducing infrastructure investments,” the Department of Energy (DOE) said in a December report.

The U.S. has about 24,600 MW of energy storage capacity, with about 95% of the capacity coming from pumped storage hydroelectric projects, according to the DOE report.

Besides pumped storage, energy storage technologies include batteries, fuel cells, flywheels, compressed air, molten salt and ice. Each technology has its own characteristics that make them useful for different ways. Flywheels, for example, can provide regulation services by continually speeding up and slowing down to help balance supply and demand on the grid.

According to DOE, energy storage faces four main challenges: cost, validated reliability and safety, fair regulatory treatment and industry acceptance. We expect those challenges to be met in the next few years, partly because new storage technologies are maturing and the market for them is growing.

The promise of energy storage

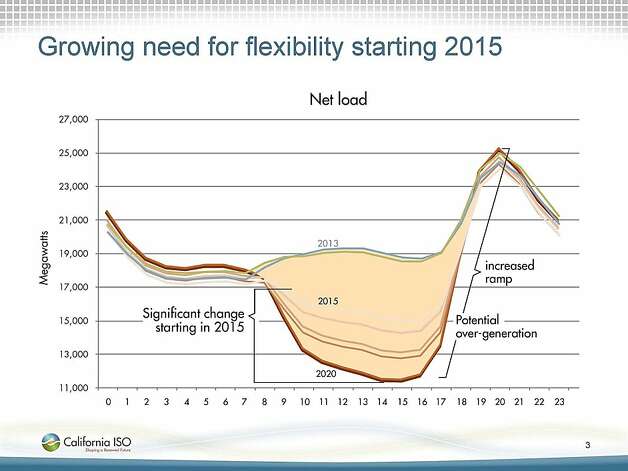

Let's take a look at the well-known “duck chart” to see why storage could be so valuable.

Looking ahead a few years, the California Independent System Operator expects rooftop solar to lead the state to produce more energy than it needs during the middle of the day. But once the sun starts to dip and air conditioners are cranking, there will be a surge in demand just as solar production drops. This is where storage can step in. Storage could absorb the extra production during the day and deliver it in the early evening hours, avoiding a massive ramp up by natural gas-fired power plants.

Energy storage has many advantages over natural gas-fired peaking plants in meeting grid needs, according to the California Energy Storage Association (CESA). Energy storage can respond more quickly than gas plants, operate more flexibly and for more hours while helping lower carbon emissions, according to CESA.

How fast could storage grow? IHS, a research firm, expects the storage market to soar to 40,000 MW worldwide by 2023, with about 43% of the new capacity being added in the U.S. through 2017, according to a December report. Lux Research expects that grid storage will grow to $10.4 billion in 2017 from about $220 million in 2012, according to a report.

California drives the storage market

California is helping drive the energy storage market. California's investor-owned utilities must acquire 1,325 MW of energy storage resources by 2020 under a landmark decision by the California Public Utilities Commission (PUC). The target would more than double the amount of non-hydro storage capacity in the U.S. today.

California's storage requirements will likely have a similar effect as state renewable portfolio standards. Energy storage companies will ramp up production, gain experience and, hopefully, lower their costs. Utilities and grid operators will gain experience with the technology, which will help expand the market.

Under the PUC's order, Pacific Gas & Electric (PG&E) and Southern California Edison (SCE) are each required to obtain 580 MW of energy storage capacity while San Diego Gas & Electric (SDG&E) must acquire 165 MW of energy storage by 2020. The utilities can own up to half of the capacity and can count existing storage projects towards the targets. The PUC excluded pumped storage larger than 50 MW from the procurement process.

The storage resources will be acquired through requests for offers starting in December, with three additional solicitations following at two-year intervals. In the first year, PG&E and SCE are expected to acquire 90 MW apiece and SDG&E will obtain 20 MW. The acquisitions will increase by about 33% in the additional biennial solicitations.

In a sign of stirrings in the storage market, unrelated to the PUC's procurement plan, the Imperial Irrigation District in Southern California this month issued a request for proposals for up to 40 MW of storage.

Other states looking at storage

California isn't alone in setting up favorable policies for storage. New York is “next up at the plate as a hot, receptive market for energy storage in North America,” according to Bill Radvak, American Vanadium president and CEO. As an example, Long Island Power Authority this fall issued a solicitation for 150 MW of storage.

Minnesota is also taking a close look at storage's potential. A study released this month found that utility controlled, customer-sited storage may be cost effective in Minnesota. The report calls for launching pilot projects and supporting utilities in installing storage together with solar photovoltaic resources to defer high cost distribution upgrades.

State regulators are paying attention. Next month, the National Association of Regulatory Utility Commissioners will hear about how new Federal Energy Regulatory Commission rules create opportunities for storage during its winter meeting. Storage will also be discussed as part of potential new utility business models.

So, yes, California is leading the way on energy storage. But other states are following, and the storage market looks ready to take off.