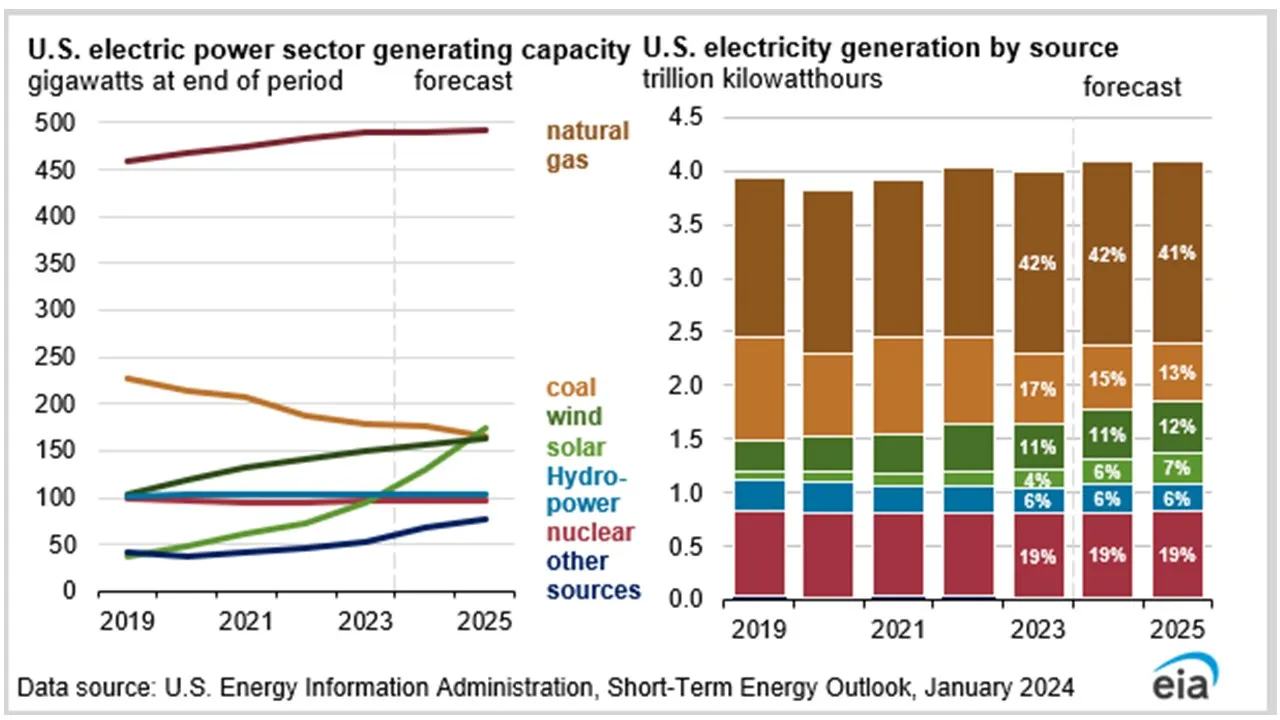

Engineers are readying the U.S. power system for a 2024 boom in clean energy integration propelled by Biden administration goals and funding, utilities and industry analysts report.

As penetrations of variable wind and solar generation rise, sudden and periodic demand spikes and technical fluctuations in current become more of a threat to reliability, researchers and utility sources agree. New ways of managing bulk system clean energy with control room and communications technologies that integrate customer-owned resources to balance supply and demand can alleviate those threats, the sources said.

“Antiquated market-based laws and rules don’t recognize the value” of integrating new technologies and resources, said Association of Edison Illuminating Companies, or AEIC, Vice President, Technical Strategy, Elizabeth Cook. “Unlocking the real capabilities of today’s system requires seeing it as a whole from bulk system resources to customer load and customer-owned resources.”

Some utilities are exploring new technologies and strategies to integrate system-wide operations and dispatch.

“We are actively considering not only which technologies to use, but where and when to deploy them” to optimize “not only the distribution system but ultimately the bulk system as well,” said Xcel Energy Spokesperson Kevin Coss.

Potent new tools and practices, like system enhancing power flow tools, advanced communications, and data analytics on customer behavior, are not yet widely deployed, Cook, Coss and others acknowledged. But Department of Energy research simulations and power provider pilots are beginning to verify a much higher potential to integrate and benefit from bulk and distribution system clean energy, they added.

The emerging system

Despite ongoing supply chain disruptions, clean energy investment in the U.S. reached a record $64 billion in the third quarter of 2023, up 42% over Q3 2022, according to a Dec. 7 Rhodium Group report.

And that investment spike is just the beginning, projections show. Achieving the Biden administration goal of a zero-carbon power sector by 2035 could require a quadrupling of the projected annual growth rates of solar and wind, according to a recent National Renewable Energy Laboratory, or NREL, report. That growth will change the U.S. power system, analysts said.

“There has been more change in the past five years than in the 50 years before and it is accelerating,” said Kevin Schneider, laboratory fellow and manager of a subsector of the Pacific Northwest National Laboratory Office of Electricity. “The emerging system will be more automated and operate under a wider range of conditions with higher customer expectations than ever before,” he added

That means increasing challenges to reliability from variable utility-scale renewables and uncertain customer-owned generation and load, utilities and industry analysts agree.

Smoothing variability

The importance of geographic resource diversity and the need for resource sharing to manage higher clean energy penetrations are well understood, researchers at NREL and the Pacific Northwest National Laboratory, or PNNL, reported. And resource and load forecasting and bulk system ramping capabilities are improving, according to the labs.

Entering 2024, a new emphasis on inter-regional transmission to increase access to lower cost clean energy could reduce the use of more expensive fossil fuel generation, saving customers tens of billions of dollars in generation and transmission costs, according to a November Grid Strategies study.

But new transmission is not being built because of interconnection, permitting, and other regulatory and economic obstacles, Grid Strategies President Rob Gramlich told the Volts podcast Nov. 17. Grid-enhancing technologies that optimize power flows and new high-performance conductors that carry more current can, however, be deployed immediately to “get more throughput from existing transmission,” Gramlich said.

Increasing the efficiency of existing infrastructure to deliver utility-scale clean energy also avoids the need for “new rights of way on undisturbed land,” Gramlich continued. Regulators could consider rewards for deploying the new technologies and penalties for not considering them, he said.

But technologies that integrate more variable and distributed renewables increase the threat of steeper or unexpected demand spikes due to daily resource availability changes or extreme weather conditions, engineers said. Energy management and communications systems and strategies that assimilate and respond to the growing mass of supply-demand data coming to control rooms could be the solution, they said.

Managing demand spikes

Increasingly steep or unexpected customer demand spikes are the immediate challenge from renewables integration because resource availability can be compromised by the setting sun, fading wind, or extreme customer demand from extreme weather, researchers, system operators and utilities agree.

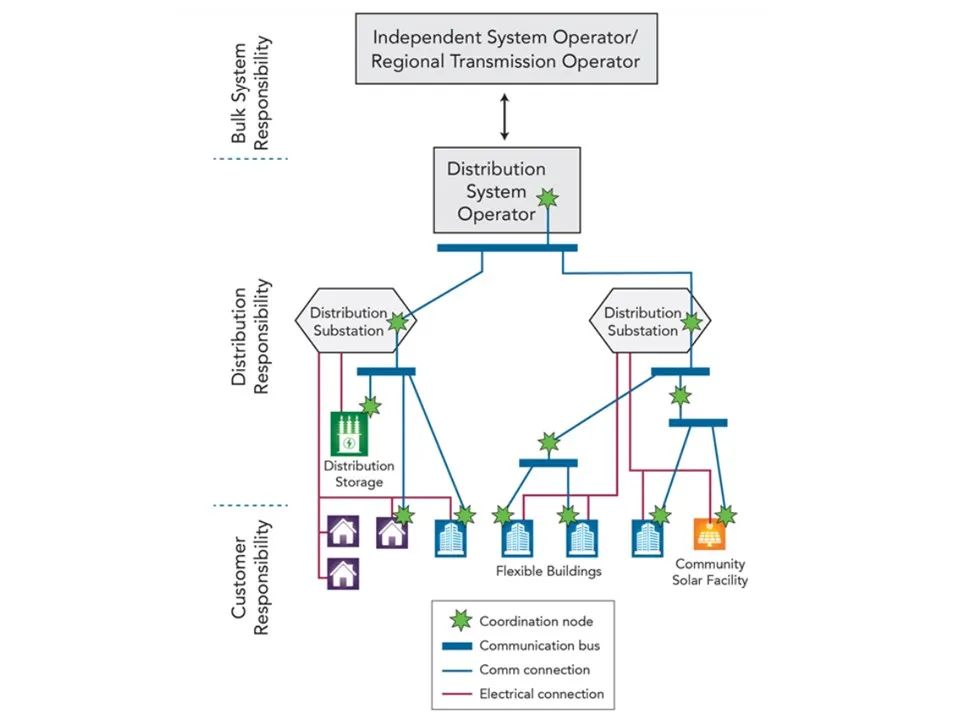

DER Management Systems, or DERMS, technologies available to utilities are not yet capable of optimizing the needed integration of bulk and distribution system resources, Xcel Energy Senior Vice President, System Strategy and Chief Planning Officer, Alice Jackson told Utility Dive last year.

But Xcel continues to invest in and investigate DERMS and other energy management systems, Xcel’s Coss added. The goal is technology that will “benefit not only the distribution system but ultimately the bulk system,” he said.

Eversource Energy is deploying DERMS in its Massachusetts territory to integrate the more than 1 GW of installed distributed energy resources, or DER, and the 1 GW of DER in its interconnection queue, reported Jennifer Schilling, the utility’s vice president of grid modernization. But using DERMs as part of utility operating systems is “emergent” and “dispatching customer-owned DER as a grid asset will require compensation frameworks” approved by regulators, she said.

In 2024, “DERMS is a marketing term” for tools that “provide the ability to dispatch DER,” added PNNL’s Schneider. Utilities may eventually meet 30% or more of their load from distribution-level resources, which means “integrating variable renewables has to be addressed within the entire system to optimize for reliability and resilience and avoid unintended consequences,” he said.

A system “operationally flexible enough” to integrate current and future bulk and distributed system resources may require an independent Distribution System Operator, Schneider continued. But in 2024, “it is not yet clear how that entity would operate, who would operate it, what the extent of its responsibilities would be, or how it would monetize the services it would provide,” he added.

Without a specifc comprehensive tool to manage distribution system flexibility, utilities can enhance multiple capabilities to build system visibility and control, utility engineers agree.

“Advanced technologies, greater computational power, new communication systems, and power flow solutions turned the transmission system into the world’s biggest machine,” said AEIC’s Cook. The failure to evolve new approaches for variable and distribution system resources “is stunting the power industry’s ability to integrate them,” she said.

“A framework for the system as a whole can optimize all the resources on the system, based on their physical capabilities and technical feasibility,” Cook continued. “But dispatch today is being optimized by models based on energy market prices instead of the granular, real-time data that shows the capabilities and values of new assets,” she said.

One key technology solution, already being deployed by some utilities, is private 900 MHz spectrum LTE broadband networks, Cook said. That would increase the control room’s system awareness and speed its responses as conditions change due to renewables variability.

San Diego Gas and Electric is deploying wider-area, lower latency communications and analytics to similarly enhance its network’s capabilities, Humberto Gurmilan, the utility’s communications manager, sustainability projects and initiatives, said.

Duke Energy’s integrated supply and demand planning includes “future deployment of predictive analytics, sensors, and communication with machine learning,” Duke’s Vice President of Integrated Grid Strategy Emily Henson said.

“Advanced communications will be essential for some utilities soon, and some utilities may not need them for a decade or more,” said PNNL’s Schneider. Deployment will depend on decisions made by regulators about the value and high capital cost of networks, but eventually “a secure, reliable, and resilient communication infrastructure will be needed” to manage higher levels of variable renewables, he added.

Advanced communications can also allow utilities to understand “customer impacts at the transformer that could overload or protect that transformer,” Cook noted.

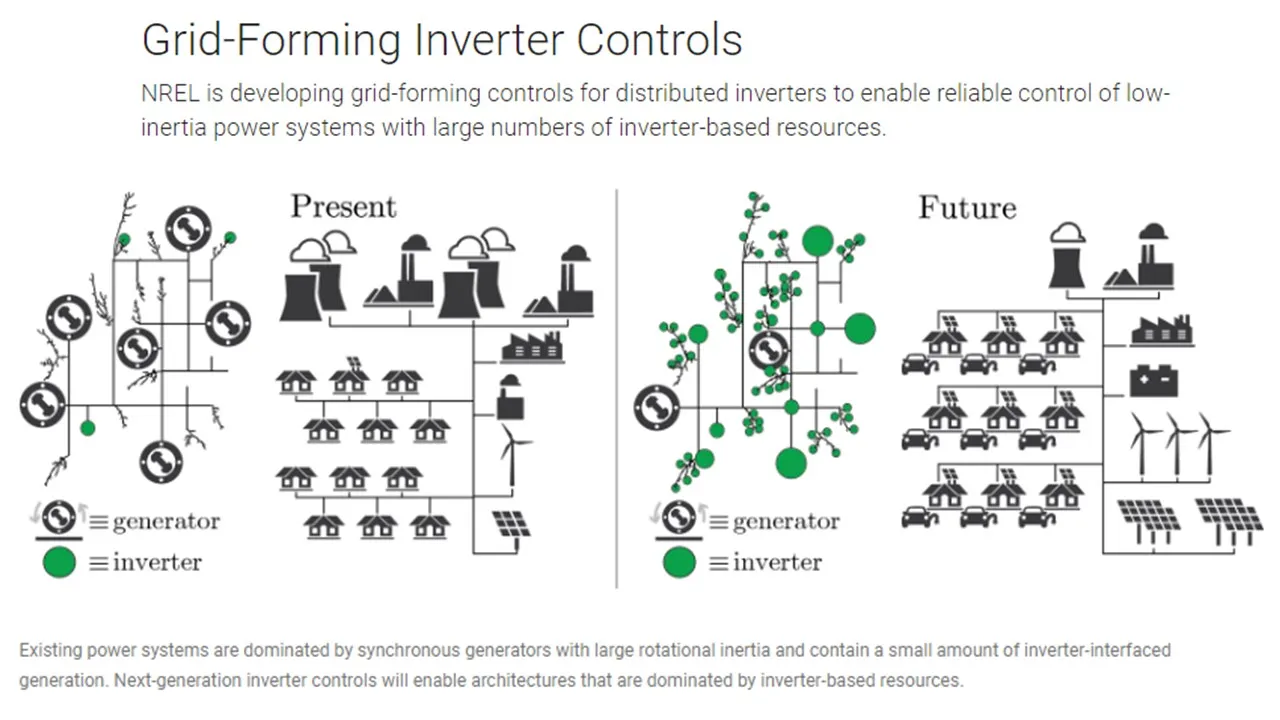

And to protect against overload-induced outages, there is renewed interest in inverters that will allow variable renewables to replace traditional generation in stabilizing the power system, Cook added.

Stabilizing the system

Inverters convert renewables-generated energy into the transmission system’s alternating current, and grid-forming inverters have power electronics that can stabilize frequency fluctuations and voltage changes, engineers with the North American Electric Reliability Corp. and Energy Systems Integration Group, or ESIG, recently told Utility Dive.

Historically, traditional power plants have stabilized frequency and voltage but they are being retired and replaced by utility-scale renewables that, without grid-forming inverters, do not provide stability, a November 2020 NREL paper reported. As the transition to renewables has accelerated, reliability threats have increased, according to NERC.

The recently released NERC three-year plan for developing reliability standards is a response to a Federal Energy Regulatory Commission October decision to address incidences of renewables tripping offline when system conditions caused frequency fluctuations.

System operators can reliably integrate no more than an estimated 75% penetration of variable renewables without grid-forming capabilities, according to ESIG Chief Engineer Julia Matevosyan. But with grid-forming capabilities, the “stability services” can avoid abnormal operating conditions that threaten outages if voltage drops destabilize system frequency, she added.

Deploying utility-scale batteries with grid-forming capabilities “is a low-hanging fruit solution,” to bringing more stability to high renewables systems, Matevosyan said in a March 2023 ESIG paper. A requirement that the over 400 GW of battery capacity in U.S. interconnection queues have grid-forming capabilities could enable variable renewables growth “cheaper and faster than adding new transmission to mitigate stability issues,” she said.

If the state of charge of batteries with grid-forming capabilities can be verified, they are “ideal” for stability and other system services, Xcel’s Coss said. The Electric Reliability Council of Texas will finalize performance requirements for grid-forming capable batteries in 2024, according to Matevosyan.

But “if a system’s grid-forming inverters are not properly coordinated, they could add to the instability,” cautioned PNNL’s Schneider. “The next few years will be about how to evolve the proper integration and control of all the new resources and eliminate resistance to new technologies that will improve the system for all its stakeholders,” he said.

“The system is going through a transformational change,” said AIEC’s Cook. But tools like grid enhancing technologies, high speed communications systems, and grid-forming inverters will alllow utilities to improve reliability and resiliency, and “they will grow in importance as economy-wide electrification increases peak demand and climate-driven extreme weather impacts become more frequent,” she said.