Dive Brief:

- Declining lithium-ion (li-ion) battery prices will facilitate the global growth of commercial energy storage installations, according to a new report from consulting firm IHS Inc.

- Average li-ion battery prices fell 53% between 2012 and 2015, and by 2019 IHS forecasts they will decline by half again.

- Between 2013 and 2019, more than 60% of the total reduction in the cost of storage installations will come from the balance-of-plant equipment, rather than from batteries alone.

Dive Insight:

South Korea, Japan and the United States are each poised to exceed 100 MW in annual energy storage installations in 2015, and by 2016 those three countries will account for 59% of global installations, according to a report by consultancy IHS Inc.

But while “most other global markets currently remain firmly in the test, pilot and demonstration phases” of energy storage, that also will change over the next five years, said Sam Wilkinson, the author of the report.

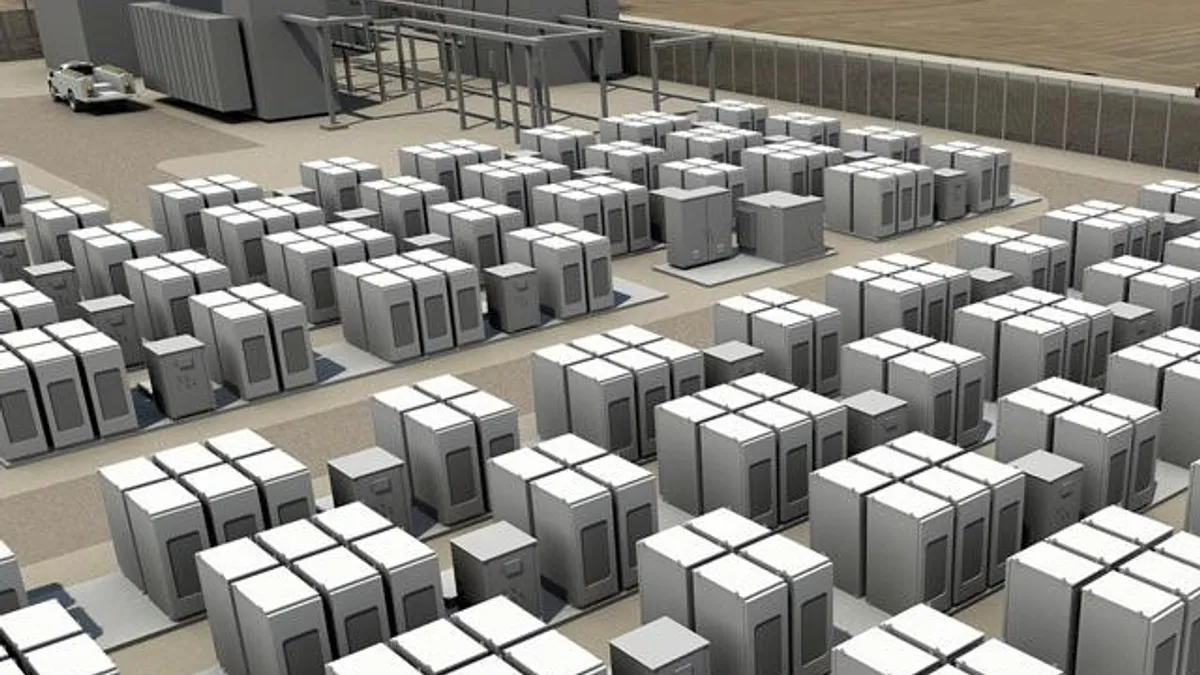

The report focuses on large, commercial energy storage installations, rather than residential installations.

The changes in the global energy storage market are being propelled by price declines in lithium ion (li-ion) batteries. Average li-ion battery prices fell 53% percent, between 2012 and 2015, and are forecast to drop by 50% again by 2019.

Further declines will be driven by price declines for balance of system components such as inverters. For a typical 30-minute duration utility-scale li-ion system, more than 60% of the total reduction in system costs between 2013 and 2019 will come from the balance-of-plant equipment, rather than from batteries alone.

“The breakdown of system costs, and the future evolution of prices, varies significantly depending on whether the system is configured to provide a high-power or high-energy application,” Wilkinson said, “but battery costs will continue to decline over the next five years.”

The next growth markets for commercial energy storage are Australia and United Kingdom, as well as Germany, and longer-term, China could become a major market, Wilkinson said.