Walmart is known for large stores and low prices.

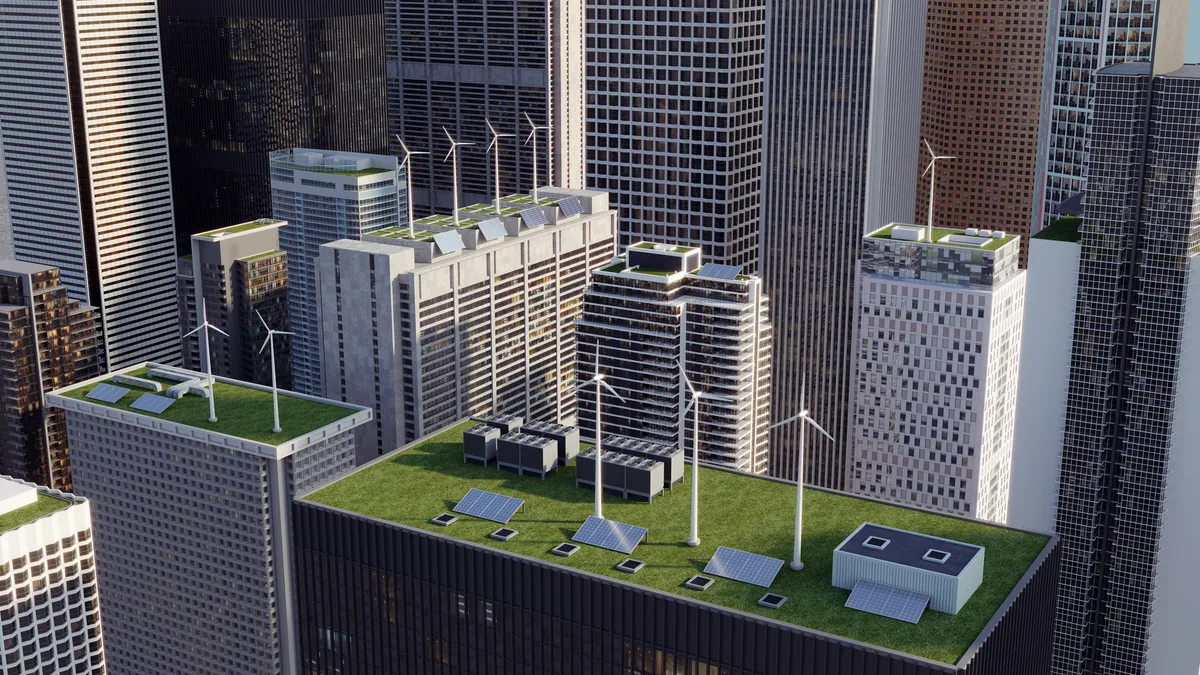

It is also has a strong reputation as one of the largest purchasers of renewable energy in the United States, dethroned by Target for solar consumption only this week. With that as its reputation, it's only a matter of time before more distributed energy resources, including storage, makes its way into Walmart's energy mix.

Since 2005 when the retailing giant announced its aspirational 100% renewable energy target, the company said 25% of its global electricity needs now come from renewable sources.

That includes 470 on-site and off-site projects, mostly wind and solar power projects, under development or in operation in seven countries around the world and in 17 states.

In the United States, that means that until recently, Walmart had earned the distinction of being the leading corporate installer of solar power. Last week, Target inched past Walmart, installing 147.5 MW of solar power compared with Walmart’s 145 MW, according to the Solar Energy Industries Association’s 2016 report. Even so, Walmart has lead the field in solar installations since the SEIA began issuing the report in 2012.

Wind and solar power both play a vital role in Walmart’s renewable energy portfolio, as Mark Vanderhelm, vice president of energy for Walmart, points out. He also notes that the company is committed to doubling the solar energy projects at its Walmart and Sam’s Clubs stores, as well as its distribution centers across the U.S. That commitment has started spurring investments in energy storage as the company continues to gobble renewable energy projects.

Policy, price make corporate DERs attractive

In markets like California, which offers incentives for energy storage, Walmart has combined rooftop solar installations with storage. Walmart was a pilot customer for SolarCity’s energy storage system for businesses. Walmart now has 17 energy storage projects in California, including six 200 kW, 400 kWh solar-tied batteries.

“Storage is a way to enable renewables,” said Vanderhelm. Typically the company uses storage for peak shaving. “That is the first value stream,” he said. Then the company looks to savings from energy shifting.

The systems are also sized to provide backup refrigeration in case of outages, until a diesel generator can be put in place, which usually takes us about four hours.

“Key for storage,” Vanderhelm said, “is that we continue to see prices come down.”

The storage systems use Tesla batteries and are owned by SolarCity, which has a pay-for-performance model with Walmart. In all, SolarCity has installed or is installing solar systems for Walmart at over 200 stores in seven states and in Puerto Rico.

And, as the SEIA report notes, there is still a lot of low hanging fruit for Walmart in terms of traditional rooftop space. The report noted that only 7% of Walmart’s more than 5,000 facilities have gone solar.

Solar power is only a part of Walmart’s renewable energy strategy, and energy is only part of the company’s wider sustainability efforts, which also includes waste reduction and energy efficiency.

Walmart has set a target to reduce the energy intensity per square foot required to power its buildings around the world by 20% by 2021, as measured from its 2010 power usage. “It all works in concert,” Vanderhelm said.

In terms of energy, Walmart’s near-term target is to produce or drive the production of 7 billion kWh by 2020. At the end of 2015, Walmart said it had over 2 billion kWh of renewable energy contracted on an annualized basis.

The 2015 total is more than double Walmart’s total in 2012, but less than the company reported last year. Walmart said the decline is the result of changes in policy and certification of renewable energy sources, particularly in the U.K., the timing of projects coming online and varying production from a few large wind projects, including wind farms in Mexico. And in the United States, Walmart discontinued a renewable contract because it plans to replace it with a larger wind project that did not come online until late in 2015.

Wind as well

The wind project was the 200 MW Logan’s Gap wind farm in Comanche County, Texas, that was developed by Pattern Energy Group and came online in September 2015. Walmart has a 10-year power purchase agreement to acquire 58% of the output from the facility.

When the project came online, Vanderhelm called it “a significant leap forward on our renewable energy journey." He said the energy Walmart buys from Logan’s Gap represents nearly 20% of the U.S. portion of the company’s 7 billion kWh target.

“To the extent we can, we leverage our commitment to the amount of renewable energy that is produced,” Vanderhelm said. There are a lot of wind farms that are coming off their 10-year PPAs, but “that would not be our first choice,” he said.

Building a new project or helping a new project be built by signing a PPA with the developer represents “additionality.” It adds to the renewable energy being built and lessens the use of fossil fuels.

That is not to say that Walmart does not at times buy renewable energy credits (RECs) or credit clean energy purchased from the grid; the 25% milestone in Walmart’s global quest to reach 100% renewables includes renewable energy from the grid.

“We don’t just want to lean on RECs,” said Vanderhelm, but the company also adapts its strategy to the conditions where it operates. Walmart operates in 28 countries around the globe.

In Brazil well over 75% of Walmart’s renewable energy comes from the grid. In China, more than 75% of Walmart’s renewable target comes from projects, rather than the grid. In Mexico, Walmart said it is more than half way to its goal of powering its operations with 100% renewable energy, with 1,100 million kWh supplied from five renewable projects. If renewables from the grid are included, the company said it is at 60% of that goal.

In the Unites States, more than 75% of Walmart’s renewable energy does not come from the grid, but the company must still adapt to regulations that vary from region to region and state to state.

Step by step

Procuring renewables in the Southeast, for instance, is very different than procuring them in Texas or California. In jurisdictions dominated by traditional cost-of-service rate regulation, Vanderhelm said Walmart still prefers to pursue additionality.

In Alabama, for instance, Walmart has signed a long-term contract with Alabama Power for the majority of the RECs from a 72-MW solar farm being built near LaFayette in Chambers County. The RECs will be retired on Walmart’s behalf. Alabama Power, which signed a PPA for the energy and RECs from the plant with Origis Energy, the developer of the project, will sell the remaining RECs to other customers.

Regulated utilities often have concerns that customers who switch to renewables are leaving other customers to pay an unequal share or the cost of serving all customers. Vanderhelm said Walmart cannot ignore those concerns. “Utilities are a critical part of the ecosystem,” he said.

In those situations, Walmart works with the local utility to negotiate a PPA that works for all parties. “We do not want to unduly burden other rate payers,” he said. Lately, Vanderhelm said he has seen a “really significant shift” in utility attitudes toward renewable energy. “The dialogue has really changed.”

One of Walmart’s retail strategies is to use its market power to drive bargains with suppliers. That enables the company to offer customers low prices, which helps the company to grow sales. That strategy also applies to energy. Part of the company’s strategy is to use its buying power to drive the development of renewable energy.

In February 2014, Walmart struck a deal with Plug Power, ordering 1,738 fuel cells for use in its distribution centers. The order represented about 40% of Plug’s total existing installed base of 4,500 units and its single biggest order to date.

In recent years, Walmart has come under criticism from some organizations for greenwashing or inflating its green energy claims. Walmart, of course, disputes those charges.

But for all its growth in renewable energy, Walmart still has a long way to go. It is, after all, at only 25% of its global goal. Vanderhelm said the company does not publicize more specific data for the United States.

With Walmart’s enormous size, it could take a long time to get to its 100% renewable target. But with its buying power, the effect on renewable energy companies and the renewable energy market could be large. One thing seems sure though; the company is not going green without keeping an eye on costs.

Walmart will not reveal how much money it saves with its renewable energy strategy, but Vanderhelm said that “internally it is in the millions of dollars.”