Hawai’i’s recent regulation ordering innovative rate designs gives a strong signal to states still debating time-of-use, or TOU, rates that the energy transition requires new pricing approaches, rate design authorities said.

Hawai’i’s Advanced Rate Design proceeding also introduced a new approach to fixed charges based on its new and more limited definition of the fixed generation, transmission and other costs to serve customers.

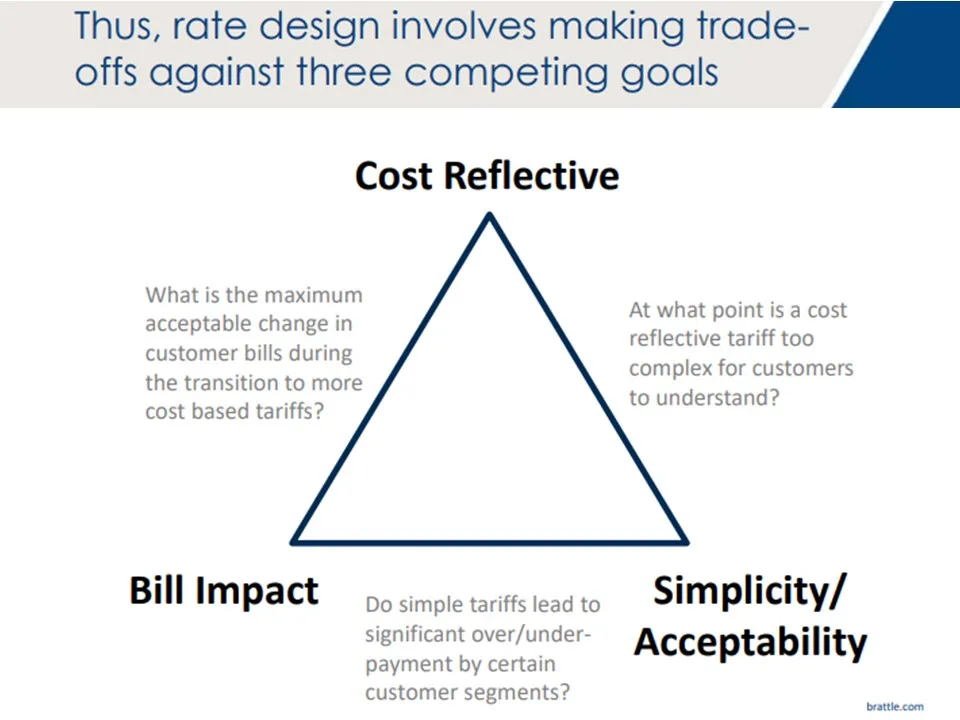

Many state policymakers are considering TOU rates that vary customers’ electricity bill prices based on times when system costs are higher or lower, regulatory analysts reported. These rates link customer usage with traditionally-defined costs to protect utility revenues and customer bills as power system loads and complexities grow, but they require a difficult balancing of customer and utility interests, they agreed.

TOU rates should be “the foundation” of regulatory responses to the energy transition’s cost and reliability challenges, responded former Hawai’i utilities commissioner Jennifer Potter, who oversaw the state’s Advanced Rate Design proceeding. Hawai’i’s “comprehensive process included multiple changes along with the new TOU rate price signals to allocate costs more efficiently,” she added.

Regulators across the country are realizing it is time for more advanced rate design.

“The strength of advanced rate designs like Hawai’i’s is they eliminate the basic lie to retail consumers that every kilowatt-hour costs the same regardless of the time of day or the season of the year,” said NRG Energy Vice President of Regulatory Affairs Travis Kavulla, the former Montana Public Service Commission chair and ex-president of the National Association of Regulatory Utility Commissioners.

Other states can learn much from Hawai’i’s step forward because none have taken rate reform as far, Kavulla, Potter, Hawai'ian Electric, the state’s dominant utility, and others agreed. But Hawai’i’s planned granular cost study, facilitated by an ongoing statewide smart meter deployment, still must prove to rate experts in other states that the new TOU rates, fixed charge framework, and new way of defining costs will allocate costs accurately, some insisted.

Rate design to align

For Q1 2023, the North Carolina Clean Energy Technology Center identified 21 proposed policy actions related to TOU-like rates and 34 significant proposed residential fixed charge increases, Associate Director, Policy and Markets Autumn Proudlove reported.

Increasingly dynamic loads, variable renewables, and smart technologies undermine justifications for traditional rate designs, said Regulatory Assistance Project, or RAP, Senior Associate Mark LeBel. The principle guiding reforms should be to align customer price signals and causes of system costs, he added. Peak period usage reductions do that, he added.

Based on Hawai'i-specific usage data, residential customers on default TOU rates with Hawai’i’s proposed price ratios are likely to reduce peak period usage by 3.3% to 5.8%, an April 2020 Brattle Group study found. Commercial customers on those rates would likely reduce peak consumption by 4% to 7.3%, Brattle added.

Hawai’i’s innovations

The Advanced Rate Design proceeding’s default three-tiered TOU rate with a substantial price differential is probably the first in the U.S., according to former Commissioner Potter, now consulting director, regulatory innovation, for Strategen Consulting.

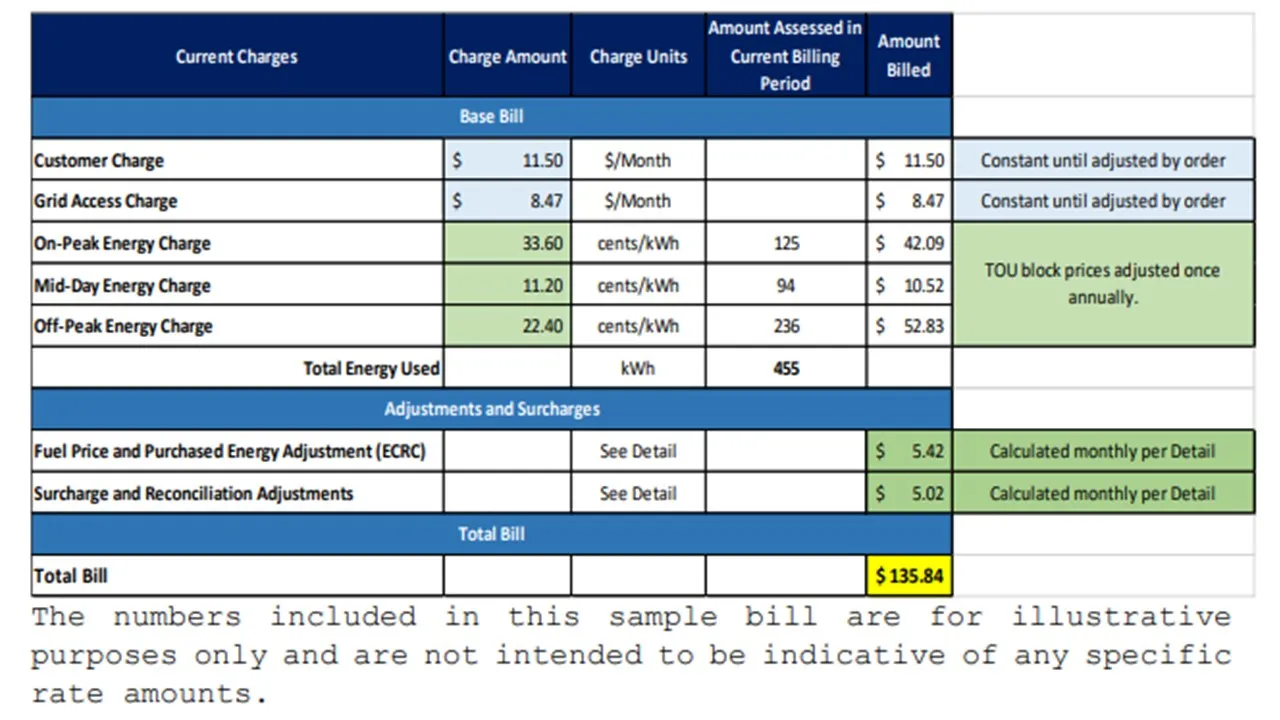

Specific prices will be determined by utility revenue requirements in future rate cases, she added. But the order requires time period prices to have a 1:2:3 ratio, with the evening 5 p.m. to 9 p.m. peak period priced three times as high as the 9 a.m. to 5 p.m. super off-peak period and the 9 p.m. to 9 a.m. off-peak period twice as high as the super off-peak period, Potter said.

The Advanced Rate Design decision “captures the necessary tradeoffs between longstanding ratemaking principles and technical, economic, and policy considerations,” the commission’s order said. It extends Hawai’i’s nation-leading ongoing work in grid modernization, performance-based regulation, and integrated grid planning, the order added.

The Advanced Rate Design proceeding’s combined TOU rates and innovative fixed charge reforms “is one of the easier, cheaper ways to increase system flexibility and peak reductions, even cheaper than energy efficiency,” Potter said.

The fixed charge innovations impose a narrower definition of fixed costs than Hawai’i has used, Potter said. The new grid access charge “covers only the costs to interconnect to the utility’s system, while the fixed customer charge covers only things like metering and billing, and all other costs are considered variable in the long run and will be recovered in TOU rates,” she added.

Together, the changes recover the utility’s fixed costs for residential customers without a demand charge or a minimum charge, though a commercial customer demand charge remains, Potter said.

Price and cost specifics will follow Hawai'ian Electric’s commission-ordered statewide advanced metering infrastructure, or AMI, deployment, Potter added. The AMI data will be used in the utility’s marginal cost of service study, which will replace Hawai’i’s longstanding cost of service approach to identifying and allocating system costs, she said.

The comprehensive Advanced Rate Design approach also provides “price signals both for customers who do and do not own distributed energy resources, like electric vehicles and rooftop solar,” Potter said. “And its flexibility allows next Advanced Rate Design iterations to be developed for new customer-owned resources that can meet peak load needs,” she added.

It is “critical” to also protect affordability, the order acknowledged. But that may require “a separate rate design option” for low- and moderate-income customers when the commission does its “iterative decision-making” on the Advanced Rate Design at three-year intervals, it added.

The order required Hawai'ian Electric to deliver a marketing and education plan by March 2023 “to help customers understand and use” the TOU rates “while minimizing rate shocks,” Potter said.

“The company has proposed, and the Commission has reviewed a two-track approach” for the plan, said Hawai'ian Electric Director, Pricing Division, Peter Young. One is “communications for customers selected” for a TOU study and the other is “communications that announce the TOU rates and offer customers the opportunity to volunteer” for the study, he added.

Implementation

In a 90-day “Ramp Up Period” through July 1, 2023, Hawai'ian Electric will develop a plan to study “the impacts and effectiveness of the rate design” during the “Roll Out Period” from July 1, 2023, to July 1, 2024.

The utility is also required to offer new “non-TOU rates” as well as an “opt out of the study” option allowing customers to remain on their existing rate schedule, the order said.

The statewide “Evolve Period” entailing full default implementation of the Advanced Rate Design will begin July 1, 2024, if the AMI rollout, the marginal cost study, and Hawai'ian Electric’s internal process updates are complete.

Hawai'ian Electric “is on target to implement TOU rates on July 1, 2023,” the utility’s Young said. “Revisions to billing systems are designed and being tested, communication messages have been designed and reviewed, dedicated customer service channels have been developed, and employees are being trained to respond to TOU inquiries,” he added.

The utility is also “on track” to meet the 2024 AMI deployment deadline and is providing the commission with “regular updates on our progress,” Young said. But the company has not completed a full marginal cost study “in many years” and doing one “will be a challenge,” while regulators and stakeholders continue to determine how study results “will be used in cost allocation and TOU rate design,” he added.

Hawai'ian Electric’s primary concern with the new rate design, expressed first in a March 2021 filing, remains potentially “significant bill impacts to customers” if they don’t respond to the TOU rate “per-kWh differentials,” Young said. The commission did, however, provide temporary bill protections during the July 2023 to July 2024 “test period” for learning to work with the rates, he acknowledged.

But there will be no “permanent bill protection,” the order said. A robust utility program to educate customers on how to respond successfully to TOU rates “is more beneficial” than protections that could “work against” customers’ willingness to respond to the price signal, it added.

Potter’s biggest concern is that the information technology deployment represents “no small technical challenge,” she said. Integrating all utility systems to obtain and manage data from customers’ AMI is “necessarily complex” and “may not happen as fast as the designs and plans require,” she acknowledged.

But “the worst-case scenario is if customers don't take action” and the peak usage reduction is inadequate to “this huge effort,” Potter said. To avoid misinterpretations, the commission asked Hawai'ian Electric to “not associate” the AMI and TOU rate rollouts, to distinguish the cause of “any cost increases or reliability constraints,” she added.

But Hawai'ian Electric’s work may not resolve a more complicated question about the Advanced Rate Design.

The marginal cost conundrum

More dynamic rate design elements that analysts said are missing from the Advanced Rate Design framework, like critical peak pricing to reward usage reductions during especially high demand periods, will follow incorporation of Hawai'ian Electric’s granular AMI data in its marginal cost study, Potter said.

But the marginal cost study may not be definitive, cautioned Independent Energy Producers Association Policy Director Scott Murtishaw. “In every rate case, there are analyses and competing testimony on what marginal costs are and how high they are,” he said.

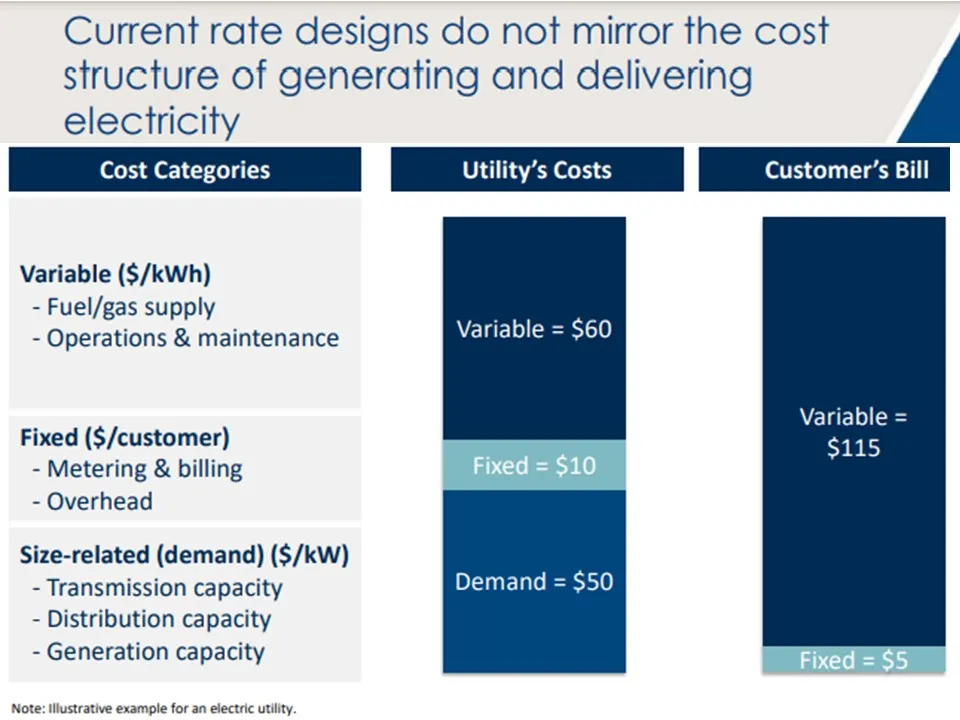

“Utilities frequently use a wider definition of fixed costs, that include some infrastructure expenditures,” RAP’s LeBel said. Hawai’i’s approach assumes that even generation and transmission infrastructure costs vary with loads, and times of customer usage change over the long term and should be accounted for in the TOU rates, he added.

There are important features of the Hawai’i rate design, but it assumes all costs to serve customers not in the grid access charge and the customer charge should be in the TOU charges, responded Natural Resources Defense Council California Technical Lead and Advisor, Climate & Clean Energy Program, Mohit Chhabra. The commission does not consider whether that allocates system costs equitably, he said.

New or upgraded infrastructure can impose costs for reasons other than customer usage, such as investments for power system build-outs to meet population growth, Chhabra said. Those costs were not caused by existing customers’ response to price signals, but Hawai’i’s approach does not differentiate between causes of system costs, which can result in imposing costs on the wrong customers, he added.

“It is not Hawai’i's job to completely resolve the fixed cost debate,” but approaches that use both the traditional wider range of costs and the new narrower range of costs “should, at a minimum, be considered in Hawai’i’s decision,” he insisted. The results of the marginal cost study “could lead to further consideration of what is or is not a fixed charge,” he added.

TOU elsewhere

Rate design across the U.S. has been a “blunt instrument,” said Energy and Environmental Economics Senior Partner Arne Olson, co-author of a March 2023 survey of state advanced rate design efforts. “Hawai’i is introducing a limited version of more precise and dynamic rates that approximate actual marginal costs but are easy to understand,” he said.

Colorado, California, Missouri and Michigan are different systems in different U.S. regions with different politics and resource mixes, but “are all shifting toward similarly dynamic retail rates,” Olson said. However, Hawai’i’s design may be the most definitive “interim step” so far toward the future with a design “to compensate flexible loads aligned with system avoided costs,” he added.

A Maryland TOU pilot’s substantial on-peak to off-peak price differential led to significant peak reductions but state regulators did not advance to default TOU rates, NRG Energy’s Kavulla said, citing his January 2023 paper on state efforts. California and Michigan have default TOU rates and Missouri and Colorado will implement them when their AMI deployments are complete, but their small price differentials impede substantial peak reductions, he added.

“Many utilities have optional TOU rates, but few have made them the default option,” added Jim Lazar, a fellow with the Institute for Energy Democracy at PACE University’s Energy and Climate Center, and who Potter said was instrumental in the Hawai’i rate design. “California regulators would do well to read this decision and capture the relevant elements,” he added.

“Gradual transition” is a respected ratemaking principle and many state regulators may be using TOU rates with small price differentials that lead to limited results to familiarize customers with the concept, Kavulla said. But “Hawai’i deserves a lot of credit for taking this major step because when policymakers impose default TOU rates, customers see them as the correct and normal choice,” he added.

Correction: We have updated this story to correct the time periods that are considered off-peak and super off-peak in Hawai'i. They are 9 p.m. to 9 a.m. and 9 a.m. to 5 p.m., respectively.

Correction: We have updated this story to conform to Industry Dive's style for the spelling of Hawai'i.