As utilities increasingly move away from coal fired generation, perhaps the biggest beneficiary of the shift has been natural gas. Growth in natural gas generation outpaced all other generation sources in the first half of 2014, according to the latest aggregated data from EIA, and is projected to continue its steady growth in 2015.

In that natural gas boom, few states have been as enthusiastic as Florida. As EIA data shows, the state added more than 1200 MW of natural gas capacity in the first half of 2014 alone, significantly more than any other state.

Florida Power and Light (FPL), Florida’s dominant electricity provider, says its increased use of natural gas is the right thing for its customers. Earlier this year, it entered uncharted territory as it asked regulators to approve direct investments in natural gas exploration and drilling — necessary, the utility says, to combat price volatility.

But now activists of every political stripe are speaking out against the increased reliance on gas. Conservatives, renewable industry advocates, scientists and an unprecedented coalition of environmentalists and tea partiers have come together to push for more solar energy and less emphasis on gas. Their pressure is setting up another utility showdown in the Sunshine State.

“FPL’s percentage of natural gas increased from 51.9% in 2007 to 67.4% in 2013,” said FPL Public Affairs Director Mark Bubriski. “Since 2001, FPL’s investments in natural gas energy have saved our customers more than $7.5 billion on fuel and prevented more than 85 million tons of carbon emissions…[and] enabled us to cut our use of foreign oil by more than 99%.”

FPL’s 2014 10-Year Site Plan projects the need for “approximately 1,000 megawatts of [additional] firm capacity” by mid-2019.

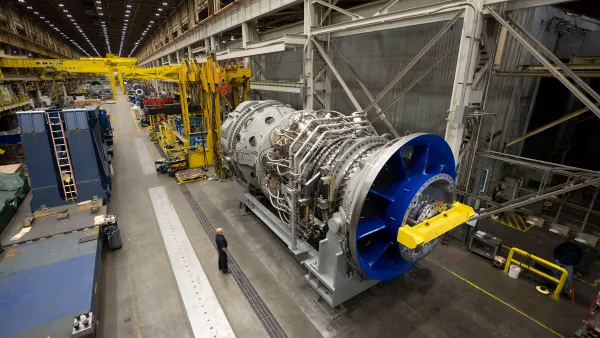

“The reality is that U.S.-produced natural gas is one of the lowest-cost options,” according to Bubriski. “High-efficiency natural gas centers that use about one-third the fuel per unit of energy…[are] projected to remain a prominent component of our fuel mix.”

FPL’s natural gas capacity makes it “well-positioned” to comply with the proposed Environmental Protection Agency (EPA) Clean Power Plan (CPP) because “our CO2 emissions rate is 35% lower than the national average,” Bubriski added.

Gas, emissions and price volatility

“FPL and other Florida utilities are moving away from coal and oil and towards lower carbon sources and that is a good thing,” said Union of Concerned Scientists (UCS) Senior Energy Analyst Jeff Deyette, co-author of the report, "The Natural Gas Gamble: A Risky Bet on America's Clean Energy Future."

Using natural gas for Clean Power Plan compliance is where the UCS study sees potential over-reliance on the resource.

“Florida is already at risk, with 68 percent of its total electricity generation coming from natural gas in 2012,” the study reports. If, in pursuit of mandated emissions cuts, Florida bumps its plants’ 52% capacity factor up to 70%, “it will depend on natural gas for 89% of its power.”

FPL investments in natural gas pipelines, Oklahoma exploration and production ventures, and new combined cycle facilities recently approved by Florida regulators will make meeting demand possible, the study says. “But they could also lock in additional carbon emissions and crowd out investments in new zero-carbon renewable and energy efficiency technologies.”

Bubriski called the UCS study’s assertions an “anti-utility attack.” Its claim that natural gas could reach 90% of Florida’s energy mix “is an attempt to intentionally mislead,” he argued.

“No legitimate entity would suggest such a wildly fictional scenario…[especially because] we’ve already announced plans to add more nuclear and solar, so we’re obviously not just adding natural gas.”

“This is not an anti-utility attack,” Deyette said. “We weren’t saying FPL is going to 90% natural gas. We were saying if it decided to comply with the Clean Power Plan entirely by maximizing its natural gas generators, it would be on a pathway to 90% natural gas.”

By displacing coal and oil, natural gas offers pollution and health benefits. As a more flexible fuel with faster ramping capabilities, it provides benefits to the grid and can help integrate renewables. And it has helped drive power prices down, Deyette said. But gas is still a fossil fuel that emits CO2 at the smokestack, and it comes with price volatility risks.

“In the modeling of a transition to a low carbon economy, the scenario that prioritized renewables and efficiency had lower costs, more emission reductions, and stronger price stability for electricity consumers,” Deyette said. “That is the path we should be going down. Natural gas will continue to be used over the next two decades or so to help balance variable renewables like wind and solar and make them more reliable.”

According to Deyette, Florida can get its emissions reductions with renewables and efficiency.

“Florida is the sunshine state and the cost of solar has come down and the technology has improved. It should be investing heavily," he said. "It should also be investing more aggressively in energy efficiency technologies. And there is no reason Florida can’t use transmission to import Texas and plains state wind like Alabama Power, Southern Power, and Gulf Power.”

The conspicuous lack of solar in the Sunshine State

“In the past few years, we’ve built three large-scale solar plants, including a PV plant that was the largest of its kind in the nation when it opened in 2009, and the world’s first solar-natural gas hybrid plant,” Bubriski pointed out.

FPL’s Site Plan announced “several community-based solar installations” as well as “plans to install commercial-scale arrays.” By the end of 2016, the company will complete three 74 MW utility-scale solar power plants, it also announced, increasing its present 110 MW installed solar capacity to 332 MW while keeping its typical customer bill “well below the national average.”

The just-announced 10-Year Site Plan from Duke Energy Florida, the state’s other major electricity provider, includes the addition of “up to 500 MW of utility-scale solar in Florida by 2024.”

Duke will begin construction of a 5 MW project in 2015 and intends to complete 35 MW of new solar capacity by 2018. “The new solar,” the utility announced, “will complement already planned investments” in a new combined-cycle natural gas plant, an upgrade to an existing combined-cycle plant, and the purchase of another existing plant.

FPL and other Florida utilities have, Deyette acknowledged, made positive strides by investing in solar. “But it is the state’s main domestic resource and they should be tripling down on it.”

On that point — that Florida should be investing even more heavily in solar — there appears to be agreement across the political spectrum. Representatives of the ad-hoc Green Tea Coalition, a loose alliance of greens and conservatives formed to support solar in 2013 in Georgia, created Floridians for Solar Choice early this year to demand policy supportive of rooftop solar.

The left-right alliance against natural gas

Over-reliance on natural gas is the result of “misguided state energy policy,” said Southern Alliance for Clean Energy (SACE) Florida Energy Policy Attorney George Cavros. “This is what you get: Utilities doubling down on natural gas.”

A ballot petition proposed by Floridians for Solar Choice is moving rapidly toward eligibility for the state’s 2016 ballot. It would legalize unregulated third party sales of solar energy-generated electricity for Florida that has jumpstarted residential and commercial-industrial solar markets from New England to the West Coast.

“Too much reliance on natural gas is risky for utility customers because the price is so volatile,” agreed Conservatives for Energy Freedom (CFEF) Director Debbie Dooley. “I find it deplorable that Florida utilities are not taking advantage of Florida’s biggest natural resource, the sun. This shows they are not looking out for ratepayers, but for their stockholders.”

Regulator-approved investments in combined cycle plants, pipelines, and fracking ventures allow utilities to earn guaranteed ratepayer-funded profits, Dooley pointed out. To minimize that risk, State Rep. Dwight Dudley (D), the ranking member on the Florida House’s Energy and Utilities Subcommittee, has introduced a bill that would prevent utilities like FPL from passing gas exploration costs onto their ratepayers. The bill is still under consideration.

When he introduced the measure, Dudley told Platts that he was concerned FPL wants ratepayers to "subsidize its investments in a highly speculative business," and called the PSC's decision to approve the gas exploration investments "a dangerous precedent."

"We have to make sure ratepayers aren't left holding the bag," he said at the time.

Dooley says that possiblity of ratepayer subsidies for the exploration is exactly why FPL proposed the idea in the first place.

“That is why they want to invest in the most expensive technology," she said. "Their profit margin is usually 10% to 11%. The investment in solar is minimal.”

“Less than one tenth of 1% of Florida’s electricity is generated with solar energy,” Cavros said. “We need a robust residential and commercial market. We have 9 million electricity customers and we have about 6,600 rooftop solar installations. New Jersey has 5 times that number with half the electricity customers, in a less sunny state.”

Dooley’s CFEF wants the utilities deregulated.

“They are taking advantage of the privileges they were given when they were allowed to form monopolies,” Dooley said. “You never put all your eggs in one basket. That is investment 101. And particularly when it comes to energy. But the Florida utilities will make more profit by investing in natural gas from out of state than in taking advantage of Florida’s natural resource, the sun.”

For Carvos, responsibility for the over reliance on natural gas and slow solar growth rests as much with the PSC as it does with the utilities themselves.

“Without leadership from the legislature, regulators, or the state’s largest power companies, you end up with bad policy and the power companies essentially run the show,” Cavros said. “It is the commission that regulates them. If it doesn’t hold them accountable, they will keep making resource decisions that maximize shareholder value.”

The nuclear option and the smart decision

Nuclear power is also important in FPL’s plan. A years-long, $3 billion upgrade of its nuclear units has been completed, it reports, “thanks to Florida’s nuclear cost recovery system.”

New units are “a critical component of the company’s long-term plans.” But Nuclear Regulatory Commission-imposed delays and changes to the cost recovery law are impeding progress.

“Given the scale of the climate crisis, we can’t take nuclear power off the table as a low carbon solution,” Deyette said. “But right now new nuclear can’t compete economically with new solar or new wind or energy efficiency. If the state wants to build nuclear, it should demonstrate that can be done cost-effectively.”

“The more capital expenditure, the larger the profit at the expense of utility customers,” Dooley said. “They socialize the costs but privatize the profits. In many cases, the utility customers are the ones left holding the bag. There is no incentive for utilities to make wise investments and there is every incentive for them to invest in projects that are costly.”

“Smart decisions today about investment in renewables and efficiency and the needed infrastructure, that is the path to focus on,” Deyette said. “That scenario has natural gas supplying as much as a quarter of the U.S. power generation in 2040. It isn’t going away. We just don’t want it to be a runaway train.”