Vitamins are good for your health. They might be good for the planet too, if recent research from Harvard University pans out.

Using nature as inspiration, Harvard researchers have developed a chemical derived from vitamin B2 that expands the possibilities for redox flow batteries, they argue in a recent Nature Energy article. In a best case scenario, that new alloxazine class of chemicals could help lower costs and improve the economic viability of flow batteries.

Flow batteries have a lot of potential but have lagged behind the rapid spread of solid state batteries such as lithium-ion.

There are 2,536 MW of li-ion batteries in operation or in development around the world, including 735 MW in the United States, according to the Department of Energy’s energy storage database. The same database shows only 212 MW of flow batteries globally with 59 MW in the U.S. In addition, investors pulled funding for a leading flow battery developer, Imergy Power Systems, months after renewables developer SunEdison announced Chapter 11 bankruptcy protection.

Despite their small share of the market, flow batteries hold great promise, especially when it comes to buffering the intermittent supply of large scale wind and solar power projects.

“Large scale energy storage is an inevitable pathway to a carbon free future,” said Kiaxiang Lin, a Ph.D. student at Harvard and the lead author of the study.

And scale is where flow batteries have the potential to eventually outpace solid state batteries.

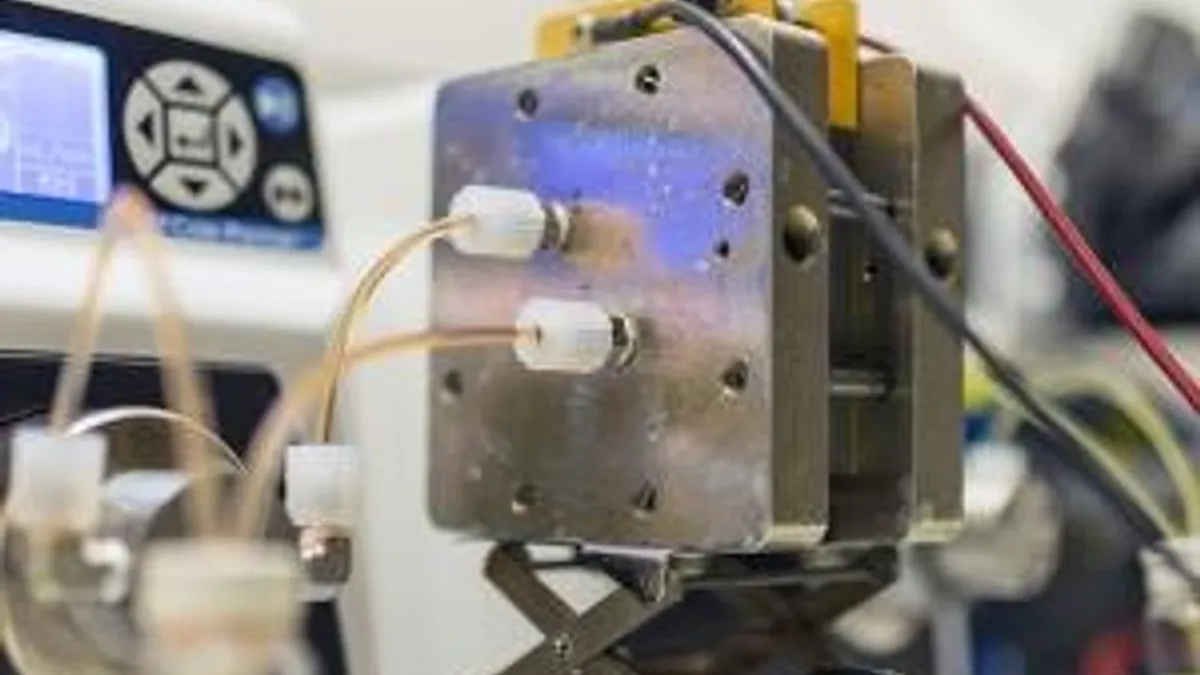

Flow batteries generate power by pumping electrolytes from storage tanks to a central stack of energy cells where the interchange between positive and negative electrolytes creates an electrical charge. Because the electrolytes can be returned to their respective storage tanks, flow batteries have a more flexible and resilient cycling characteristics than solid state batteries. They can withstand deeper discharge cycles and longer life cycles and can recharge very quickly.

When it comes to scale, though, it is the cells in the stack and the storage tanks that give flow batteries one of their biggest advantages.

Those two components can be independently tailored, giving flow batteries a great deal of design flexibility. The power capability can be moved up or down by changing the stack size to match the load or generating assets, and the energy capability can be made larger or smaller by changing the size of the tanks that store the electrolytes.

Scaling the flow

Flow batteries come in two broad categories, redox – short for reduction-oxidation, which is the chemical reaction in which electrons are gained and lost, respectively – and hybrid.

Redox flow batteries (RFB) involve the interchange of two electrolytes and involve chemical pairs such as iron-chromium and vanadium-vanadium (in two different states). Hybrid flow batteries, such as zinc-bromide batteries, use plating to attach zinc to the anode in the stack. Between them, vanadium and zinc-bromide batteries represent most of the flow batteries being deployed today.

Vanadium technology has proved to be very useful since it was first demonstrated in the 1980s by Maria Skyllas-Kazacos at the University of New South Wales, helping it to gain the lion’s share of the redox flow market.

But there is another class of redox flow batteries, organic redox batteries. “Organic” in this instance has nothing to do with farming or fertilizers, but refers to substances that contain carbon as distinct from substances that contain metals such as vanadium or iron.

There are several benefits of pursuing organic chemistries for redox batteries, such as safety and toxicity, but chief among those benefits is cost. The fact that the metals in inorganic redox batteries have to be mined and refined puts a floor on potential cost reductions. Organic chemicals are more widely available and usually simpler to manufacture, which lends them to greater potential cost reductions.

In addition, organics that are soluble in water also have an advantage over metallic combinations of lithium that can explode or catch fire and over vanadium that is dissolved in sulfuric acid.

In 2014, Harvard researchers developed an organic redox battery using a class of organic chemicals known as quinones. Quinones are found in fungi, bacteria, plants such as rhubarb and in vitamin K, where it serves to transport electrons. The specific chemical the researchers developed was 9,10-anthraquinone-2,7-disulphonic acid, more simply known as AQDS.

In early laboratory tests, the battery exhibited galvanic power densities of 1.0 watt/cm2, which is on par with existing commercial class flow batteries, and the energy cell was able to cycle about 800 times without degradation.

The researchers estimated that the cost of AQDS at $21/kWh and $6/kWh for the bromine solution used for the other electrolyte, calling it a “major” cost improvement over vanadium flow batteries with redox -active materials costing $81/kWh.

A step for energy storage

In 2015, the Harvard team took that research a step further. In the original formulation, the negative side electrolyte (negolyte) was AQDS dissolved in acid and the positive side electrolyte (posolyte) was a toxic and volatile bromine solution.

Combing through hundreds of quinone permutations in the search for an all-quinone RFB, they came up with an all-alkaline RFB that uses a version of anthraquinone for the negolyte and a food additive, ferrocyanide, in the posolyte.

“This is chemistry I’d be happy to put in my basement,” Michael J. Aziz, the Gene and Tracy Sykes Professor of Materials and Energy Technologies at the Harvard Paulson School of Engineering and Applied Sciences (SEAS), said at the time.

Because the chemistry is safer and noncorrosive, the battery components can be made of simpler and less expensive materials, such as plastics. The researchers also reported an increase in battery voltage of about 50% over our previous materials.

Also in 2015, researchers at Pacific Northwest National Laboratory developed another form of organic aqueous flow battery, one that uses methyl viologen, a chemical used in pesticides, and TEMPO, a chemical widely used as an industrial catalyst. They claim their formulation could cut costs to $180/kWh once the technology is fully developed, compared with vanadium-based batteries that cost about $450/kWh.

Meanwhile, Harvard researchers continued to look for new forms of quinones to improve their formulation. “I was looking for more backbone structures I could use, and I drew my inspiration from nature,” Lin said. He found a “sibling” of vitamin B2 (alloxazine 7/8-carboxylic acid).

“It could potentially be very cheap” to manufacture, Lin said, noting that not only is the source material abundant and readily available, it can be made in a single step in very high yields.

The formulation also exhibited an “open-circuit voltage approaching 1.2 volts and current efficiency and capacity retention exceeding 99.7% and 99.98% per cycle, respectively.”

While the alloxazine formulation could be seen as an advance – trading rhubarb for riboflavin – Lin is reluctant to compare the quinone (AQDS) and vitamin B2 derived (alloxazine) formulations. The goal, he said, is to “open the door to more promising chemistries.” He added that it is too early to judge whether the alloxazine formulation is scalable or not.

Aziz, who leads Harvard’s research efforts in organic flow batteries, generally agrees. “We don’t yet know whether the aza-aromatics or the quinones will be more advantageous commercially; it likely depends on the relative costs of manufacturing the chemicals at large scale and their relative long-term stability (calendar life),” he wrote in an email.

But it is already clear that there is a potential for organics to be much cheaper than the vanadium formulations with comparable performance, he said, and even “significantly cheaper than viologen and [at] higher performance, as far as we can tell at this time.”

In Aziz’s view, the aza-aromatics “give us additional shots” on the goal compared to having only quinones.

He said he is in the midst of writing proposals that make the case that his team has a “fighting chance of getting systems to market at less than $100/kWh of capacity.”

Aziz estimated that the quinone formulation is “maybe a year away from the first commercial product, and the aza-aromatic formulation is at least two years farther away.”

While flow batteries in general, and organic flow batteries, appear to have great potential it is worth noting that most of the flow battery project that are in operation or under development are still in the realm of demonstration projects. But, longer term, “they have great potential,” said Matt Roberts, executive director of the Energy Storage Association.

Roberts is wary, however, of using a single metric such as cost per kWh to gauge the potential of storage technologies.

“Target pricing is usually based on maximum penetration. In fact, storage can work within a wide range, from $100/kWh to $500/kWh, depending on the market.

Equal to the physical challenge of bringing down the costs of chemicals and components is the regulatory challenge of defining the role storage will play in the marketplace, Roberts argues.

Depending on the jurisdiction or venue, storage can be seen as generation or load. In some cases that can lead to a situation where a storage provider might be charged retail rates when charging a battery system and earn wholesale rates when selling. Under those circumstances, Roberts said it would be hard to make a storage project work, even at $0/kWh.